Compartilhamento lógico de estratégias de arbitragem de spread spot de várias bolsas

Autora:Inventor quantificado - sonho pequeno, Criado: 2022-07-12 17:20:06, Atualizado: 2024-12-02 21:43:21

Princípios da estratégia

Devido a razões de liquidez, quando há uma grande quantidade de esmagamento e puxa no mercado, inevitavelmente haverá grandes flutuações de preços, e uma diferença de preço instantânea será formada entre as bolsas, e a estratégia é capturar esses momentos em que os negócios rápidos são executados para completar o processo de comprar baixo e vender alto. Alguns clientes me perguntaram por que eu tenho que obter tantas trocas. Isso é inevitável. O que ganhamos é a diferença de preço instantânea entre as trocas. Quanto mais trocas, mais oportunidades para a diferença de preço formada após o crossover.

Lógica básica da estratégia

- Para obter simultaneamente informações de mercado de várias bolsas, estas devem ser obtidas simultaneamente para reduzir o atraso do mercado obtido.Plug-in simultâneo multi-exchange

- Combinar o pedido e a oferta de todas as ordens de troca para obter uma informação de ordem combinada, onde RealPrice é o preço após dedução da taxa de manipulação,

function createOrders(depths, askOrders, bidOrders) {

let asksIndex = 0;

let bidIndex = 0;

for (let i = 0; i < depths.length; i++) {

let exchangeTariff = getExchangeTariff(i);

let asks = depths[i].Asks;

let bids = depths[i].Bids;

for (let j = 0; j < Math.min(asks.length, bids.length, 20); j++) {

if (asks[j].Amount >= minTakerAmount) {

askOrders[asksIndex] = {

"Price": asks[j].Price,

"Amount": asks[j].Amount,

"Fee": asks[j].Price * exchangeTariff,

"RealPrice": asks[j].Price * (1 + exchangeTariff),

"Index": i,

};

asksIndex++;

}

if (bids[j].Amount >= minTakerAmount) {

bidOrders[bidIndex] = {

"Price": bids[j].Price,

"Amount": bids[j].Amount,

"Fee": bids[j].Price * exchangeTariff,

"RealPrice": bids[j].Price * (1 - exchangeTariff),

"Index": i,

};

bidIndex++;

}

}

}

askOrders.sort(function (a, b) {

return a.RealPrice - b.RealPrice;

});

bidOrders.sort(function (a, b) {

return b.RealPrice - a.RealPrice;

});

}

- Calcule o melhor spread de arbitragem a partir da informação combinada do mercado. Uma vez que estamos tomando a ordem, ou seja, comprar a partir do preço mais baixo pedir e vender a partir do preço mais alto de oferta, desde que bid.RealPrice > ask.RealPrice, há espaço para lucro

function getArbitrageOrders(askOrders, bidOrders) {

let ret = [];

for (let i = 0; i < askOrders.length; i++) {

for (let j = 0; j < bidOrders.length; j++) {

let bidOrder = bidOrders[j];

let askOrder = askOrders[i];

if (bidOrder.Index === askOrder.Index) {

continue

}

let minMigrateDiffPrice = ((askOrder.Price + bidOrder.Price) / 2 * minMigrateDiffPricePercent / 100);

if (bidOrder.RealPrice - askOrder.RealPrice > minMigrateDiffPrice) {

ret.push({

"Ask": askOrder,

"Bid": bidOrder,

})

}

}

}

if (ret.length === 0) {

ret.push({

"Ask": askOrders[0],

"Bid": bidOrders[0],

});

}

//Sort by best spread

ret.sort((a, b) => {

return (b.Bid.RealPrice - b.Ask.RealPrice) - (a.Bid.RealPrice - a.Ask.RealPrice);

});

return ret;

}

- Neste ponto, obtivemos as informações sobre o spread de arbitragem no mercado, por isso existem vários pontos de julgamento sobre como escolher se executar um comércio e quanto negociar:

- Ativos restantes correntes

- O tamanho do spread (se o spread for muito pequeno, apenas a quantidade de moeda será equilibrada e, se o spread for grande o suficiente, o número de transações será maximizado)

- Número de ordens pendentes

var askOrder = arbitrageOrder.Ask;

var bidOrder = arbitrageOrder.Bid;

var perAmountFee = arbitrageOrder.Ask.Fee + arbitrageOrder.Bid.Fee;

var minRealDiffPrice = (askOrder.Price + bidOrder.Price) / 2 * minDiffPricePercent / 100;

var minMigrateDiffPrice = ((askOrder.Price + bidOrder.Price) / 2 * minMigrateDiffPricePercent / 100);

var curRealDiffPrice = arbitrageOrder.Bid.RealPrice - arbitrageOrder.Ask.RealPrice;

var buyExchange = exchanges[arbitrageOrder.Ask.Index];

var sellExchange = exchanges[arbitrageOrder.Bid.Index];

var buySellAmount = 0;

if (curRealDiffPrice > minRealDiffPrice) {

buySellAmount = math.min(

bidOrder.Amount,

askOrder.Amount,

maxTakerAmount,

runningInfo.Accounts[bidOrder.Index].CurStocks,

runningInfo.Accounts[askOrder.Index].CurBalance / askOrder.Price

);

} else if (bidOrder.Index !== askOrder.Index) {

if (migrateCoinEx == -1) {

if (curRealDiffPrice > minMigrateDiffPrice && runningInfo.Accounts[bidOrder.Index].CurStocks - runningInfo.Accounts[askOrder.Index].CurStocks > maxAmountDeviation) {

buySellAmount = math.min(

bidOrder.Amount,

askOrder.Amount,

maxTakerAmount,

runningInfo.Accounts[bidOrder.Index].CurStocks,

runningInfo.Accounts[askOrder.Index].CurBalance / askOrder.Price,

runningInfo.Accounts[bidOrder.Index].CurStocks - ((runningInfo.Accounts[bidOrder.Index].CurStocks + runningInfo.Accounts[askOrder.Index].CurStocks) / 2)

);

if (buySellAmount >= minTakerAmount) {

Log("Start exchange balancing!");

}

}

} else if (migrateCoinEx == askOrder.Index) {

if (curRealDiffPrice > minMigrateDiffPrice && runningInfo.Accounts[bidOrder.Index].CurStocks > 0) {

buySellAmount = math.min(

bidOrder.Amount,

askOrder.Amount,

maxTakerAmount,

runningInfo.Accounts[bidOrder.Index].CurStocks,

runningInfo.Accounts[askOrder.Index].CurBalance / askOrder.Price

);

if (buySellAmount >= minTakerAmount) {

Log("Initiate currency migration:", exchanges[bidOrder.Index].GetName(), "-->", exchanges[askOrder.Index].GetName());

}

}

}

}

- Após calcular o número de ordens a serem colocadas, a transação pode ser executada.

var buyWait = buyExchange.Go("Buy", _N(askOrder.Price * (1.01), pricePrecision), buySellAmount);

var sellWait = sellExchange.Go("Sell", _N(bidOrder.Price * (0.99), pricePrecision), buySellAmount);

var startWaitTime = new Date().getTime()

Sleep(3000);

var buyOrder = buyWait.wait()

var sellOrder = sellWait.wait()

- Tudo o que resta é a lógica de calcular retornos, lidar com stop losses em ordens falhadas, e assim por diante.

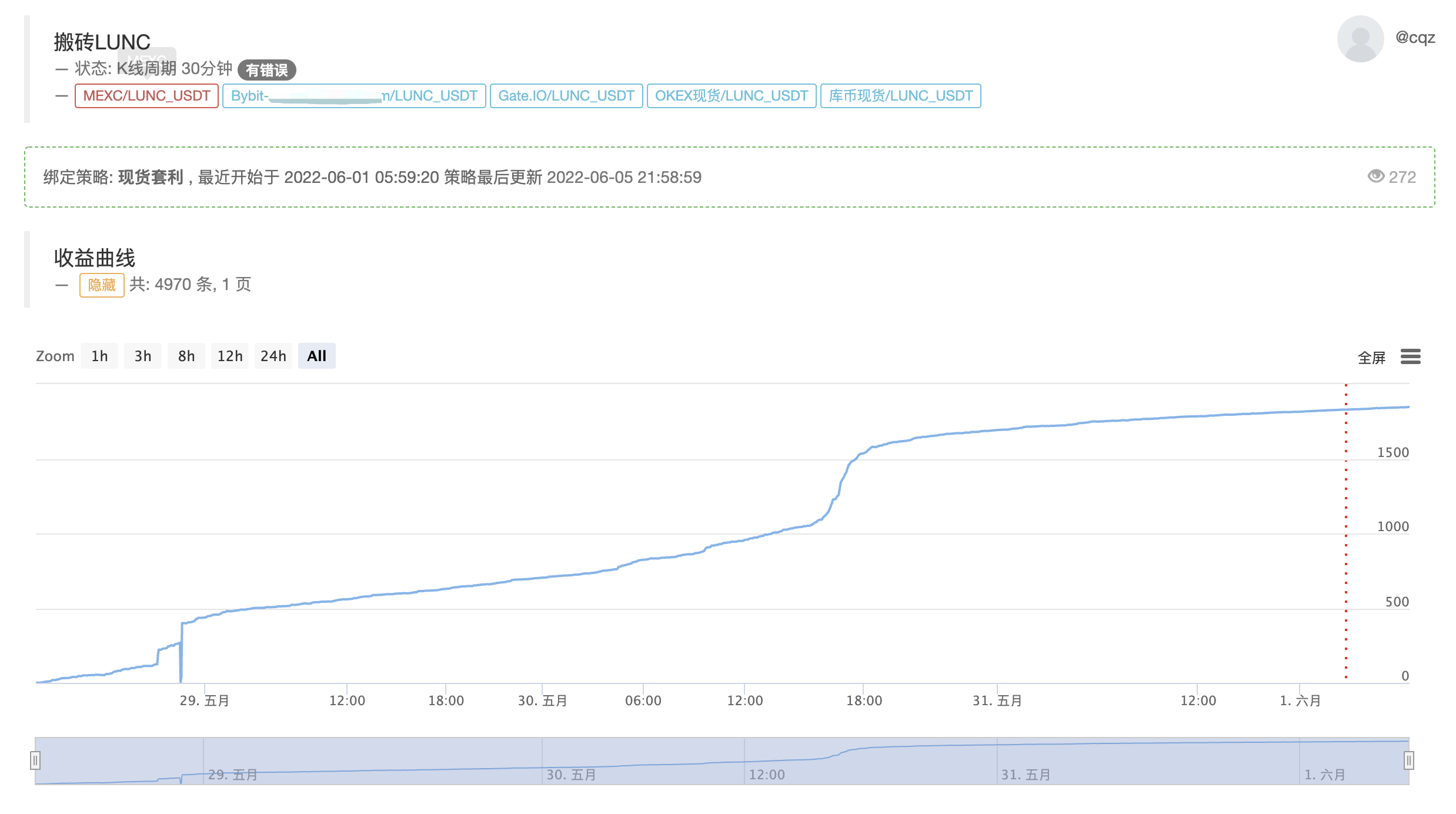

Os lucros reais da estratégia

A exibição atual do bot real, a lógica do núcleo permanece inalterada, otimizada para suportar várias moedas

https://www.fmz.com/robot/464965

Por último, bem-vindos à comunicação de intercâmbio quantitativo Laoqiu:https://t.me/laoqiu_arbitrage

Relacionado

- Prática quantitativa das bolsas DEX (2) -- Guia do utilizador do hiperlíquido

- Práticas de quantificação da DEX Exchange ((2) -- Guia de uso do Hyperliquid

- Prática quantitativa das bolsas DEX (1) -- dYdX v4 Guia do utilizador

- Introdução à arbitragem de lead-lag em criptomoedas (3)

- Práticas de quantificação da DEX exchange ((1) -- dYdX v4 Guia de uso

- Introdução ao conjunto de Lead-Lag na moeda digital (3)

- Introdução à arbitragem de lead-lag em criptomoedas (2)

- Introdução ao suporte de Lead-Lag na moeda digital (2)

- Discussão sobre a recepção de sinais externos da plataforma FMZ: uma solução completa para receber sinais com serviço HTTP em estratégia

- Discussão da recepção de sinais externos da plataforma FMZ: estratégias para o sistema completo de recepção de sinais do serviço HTTP embutido

- Introdução à arbitragem de lead-lag em criptomoedas (1)

Mais informações

- Negociação quantitativa de criptomoedas para iniciantes - aproximando-o da negociação quantitativa de criptomoedas (6)

- Visão geral e arquitetura da interface principal da plataforma de negociação quântica FMZ

- Projeto de estratégia Martingale para futuros de criptomoedas

- Negociação Quantitativa de Criptomoedas para iniciantes - Levá-lo mais perto da Criptomoeda Quantitativa (5)

- Negociação quantitativa de criptomoedas para iniciantes - aproximando-o da negociação quantitativa de criptomoedas (4)

- Negociação Quantitativa de Criptomoedas para iniciantes - Levá-lo mais perto da Criptomoeda Quantitativa (3)

- Negociação Quantitativa de Criptomoedas para iniciantes - Levá-lo mais perto de Criptomoeda Quantitativa (2)

- Negociação Quantitativa de Criptomoedas para iniciantes - Levá-lo mais perto de Criptomoeda Quantitativa (1)

- Projeto de estratégia de cobertura spot de criptomoedas (2)

- Exemplo de contrato de acesso ao protocolo geral na FMZ

- Módulo de visualização para construir estratégias de negociação - em profundidade

- Use a função KLineChart para facilitar o desenho de estratégias

- Usar a função KlineChart para simplificar o desenho de gráficos de estratégias

- Múltiplos mercados compartilham estratégias lógicas de desfalque de preços no momento

- Backtesting de estratégia JavaScript é depurado no DevTools do navegador Chrome

- Debug da política JavaScript no navegador Chrome

- Modulo de visualização para construir estratégias de negociação - aprofundamento

- Estratégias de equilíbrio sustentável adequadas para a repetição dos mercados de ursos

- Se você ainda não escreveu uma estratégia com a linguagem Pine, que é tão fácil de aprender, eu...

- Explicação pormenorizada das estratégias de equilíbrio e rede