RSI Divergência com Pivot, BB, SMA, EMA, SMMA, WMA, VWMA

Autora:ChaoZhang, Data: 2022-05-12 17:17:05Tags:SMAEMASMMAWMAVWMABoll

RSI Divergências com pivots, BB, MA é um oscilador básico RSI com algumas características úteis, ele permite ao usuário exibir divergências, pivots e média móvel diretamente no indicador RSI.

As médias móveis que podem ser exibidas no oscilador RSI são: SMA EMA SMMA WMA VWMA Bandeiras de Bollinger

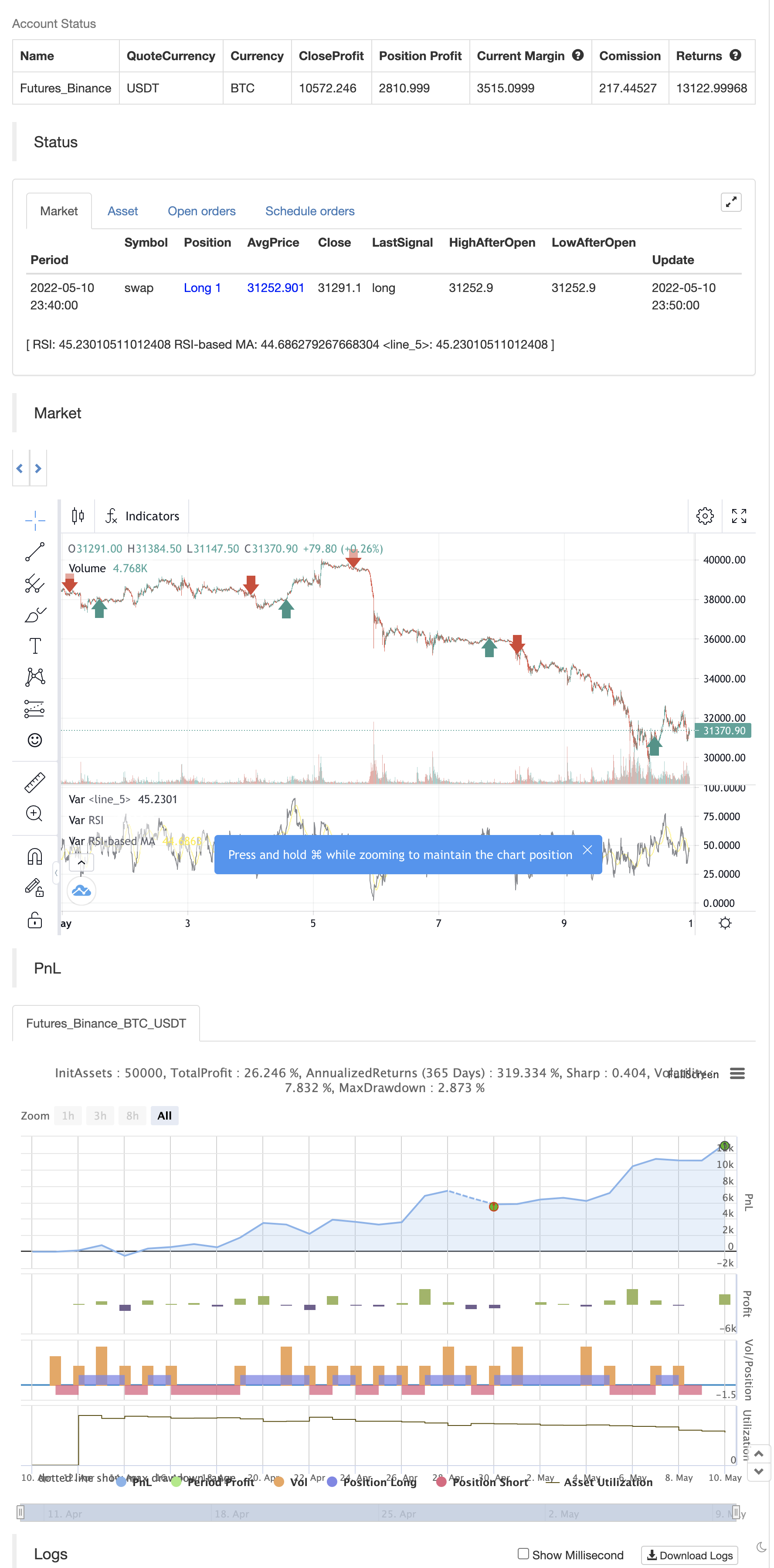

/*backtest

start: 2022-04-11 00:00:00

end: 2022-05-10 23:59:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

////////////////////////////////////////////////////////////////////////////////

// //

// ====== My Crypto Succubus ====== //

// ====== RSI Divergence with Pivot, BB, SMA, EMA, SMMA, WMA, VWMA ====== //

// //

////////////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////////////////

// //

// My Crypto Succubus is a project based on the community and participatory //

// aspect, knowledge sharing is the core of the project, the act of sharing //

// is destined to get richer, either on the intellectual or the wealth //

// side, the ultimate goal of MCS is that every single one of our members //

// can reach the financial freedom we all deserve. //

// //

// ====== Join us on our Discord : https://discord.gg/TmW6RQeyXp ====== //

// //

////////////////////////////////////////////////////////////////////////////////

//@version=5

indicator(title="RSI Divergences with Pivots, BB, MA [My Crypto Succubus]", shorttitle="RSI Div, Pivot, BB, MA [My Crypto Succubus]", format=format.price, precision=2)

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"Bollinger Bands" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "Source", group="RSI Settings")

maTypeInput = input.string("SMA", title="MA Type", options=["SMA", "Bollinger Bands", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="MA Settings")

maLengthInput = input.int(14, title="MA Length", group="MA Settings")

bbMultInput = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev", group="MA Settings")

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ma(rsi, maLengthInput, maTypeInput)

isBB = maTypeInput == "Bollinger Bands"

plot(rsi, "RSI", color=#ffffff, linewidth=1)

plot(rsiMA, "RSI-based MA", color=color.yellow)

rsiUpperBand = hline(70, "RSI Upper Band", color=#787B86)

hline(50, "RSI Middle Band", color=color.new(#787B86, 50))

rsiLowerBand = hline(30, "RSI Lower Band", color=#787B86)

fill(rsiUpperBand, rsiLowerBand, color=color.rgb(178, 8, 120, 90), title="RSI Background Fill")

bbUpperBand = plot(isBB ? rsiMA + ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Upper Bollinger Band", color=color.green)

bbLowerBand = plot(isBB ? rsiMA - ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Lower Bollinger Band", color=color.green)

fill(bbUpperBand, bbLowerBand, color= isBB ? color.new(color.green, 90) : na, title="Bollinger Bands Background Fill")

///////////////////////////////////////////////////////////////////////////////////////////////////////

len = input.int(14, minval=1, title='RSI Length', group="RSI Settings")

ob = input.int(defval=70, title='Overbought', minval=0, maxval=100, group="RSI Settings")

os = input.int(defval=30, title='Oversold', minval=0, maxval=100, group="RSI Settings")

// RSI code

band1 = hline(ob)

band0 = hline(os)

plot(rsi, color=rsi > ob or rsi < os ? color.rgb(255, 0, 0, 0) : color.new(color.black, 100), linewidth=1)

fill(band1, band0, color=color.new(color.purple, 97))

// DIVS code

piv = input(false, 'Hide pivots?')

shrt = input(false, 'Shorter labels?')

hidel = input(true, 'Hide labels and color background')

xbars = input.int(defval=90, title='Div lookback period (bars)?', minval=1)

hb = math.abs(ta.highestbars(rsi, xbars)) // Finds bar with highest value in last X bars

lb = math.abs(ta.lowestbars(rsi, xbars)) // Finds bar with lowest value in last X bars

// Defining variable values, mandatory in Pine 3

max = float(na)

max_rsi = float(na)

min = float(na)

min_rsi = float(na)

pivoth = bool(na)

pivotl = bool(na)

divbear = bool(na)

divbull = bool(na)

// If bar with lowest / highest is current bar, use it's value

max := hb == 0 ? close : na(max[1]) ? close : max[1]

max_rsi := hb == 0 ? rsi : na(max_rsi[1]) ? rsi : max_rsi[1]

min := lb == 0 ? close : na(min[1]) ? close : min[1]

min_rsi := lb == 0 ? rsi : na(min_rsi[1]) ? rsi : min_rsi[1]

// Compare high of current bar being examined with previous bar's high

// If curr bar high is higher than the max bar high in the lookback window range

if close > max // we have a new high

max := close // change variable "max" to use current bar's high value

max

if rsi > max_rsi // we have a new high

max_rsi := rsi // change variable "max_rsi" to use current bar's RSI value

max_rsi

if close < min // we have a new low

min := close // change variable "min" to use current bar's low value

min

if rsi < min_rsi // we have a new low

min_rsi := rsi // change variable "min_rsi" to use current bar's RSI value

min_rsi

// Finds pivot point with at least 2 right candles with lower value

pivoth := max_rsi == max_rsi[2] and max_rsi[2] != max_rsi[3] ? true : na

pivotl := min_rsi == min_rsi[2] and min_rsi[2] != min_rsi[3] ? true : na

// Detects divergences between price and indicator with 1 candle delay so it filters out repeating divergences

if max[1] > max[2] and rsi[1] < max_rsi and rsi <= rsi[1]

divbear := true

divbear

if min[1] < min[2] and rsi[1] > min_rsi and rsi >= rsi[1]

divbull := true

divbull

// Alerts

alertcondition(divbear, title='Bear div', message='Bear div')

alertcondition(divbull, title='Bull div', message='Bull div')

alertcondition(pivoth, title='Pivot high', message='Pivot high')

alertcondition(pivotl, title='Pivot low', message='Pivot low')

// Plots divergences and pivots with offest

//l = divbear ? label.new(bar_index - 1, rsi[1] + 1, 'BEAR', color=color.red, textcolor=color.white, style=label.style_label_down, yloc=yloc.price, size=size.small) : divbull ? label.new(bar_index - 1, rsi[1] - 1, 'BULL', color=color.green, textcolor=color.white, style=label.style_label_up, yloc=yloc.price, size=size.small) : pivoth ? label.new(bar_index - 2, max_rsi + 1, 'PIVOT', color=color.blue, textcolor=color.white, style=label.style_label_down, yloc=yloc.price, size=size.small) : pivotl ? label.new(bar_index - 2, min_rsi - 1, 'PIVOT', color=color.blue, textcolor=color.white, style=label.style_label_up, yloc=yloc.price, size=size.small) : na

// Shorter labels

//if shrt

// label.set_text(l, na)

// Hides pivots or labels

//if piv and (pivoth or pivotl) or hidel

// label.delete(l)

// Colors indicator background

//bgcolor(hidel ? divbear ? color.new(color.red, 50) : divbull ? color.new(color.green, 50) : na : na, offset=-1, transp=90)

//bgcolor(hidel ? piv ? na : pivoth or pivotl ? color.new(color.blue, 50) : na : na, offset=-2, transp=90)

// Debug tools

// plot(max, color=blue, linewidth=2)

// plot(max_rsi, color=red, linewidth=2)

// plot(hb, color=orange, linewidth=2)

// plot(lb, color=purple, linewidth=1)

// plot(min_rsi, color=lime, linewidth=1)

// plot(min, color=black, linewidth=1)

////////////////////////////////////////////////////////////////////////////////

// //

// ====== My Crypto Succubus ====== //

// ====== RSI Divergence with Pivot, BB, SMA, EMA, SMMA, WMA, VWMA ====== //

// //

////////////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////////////////

// //

// My Crypto Succubus is a project based on the community and participatory //

// aspect, knowledge sharing is the core of the project, the act of sharing //

// is destined to get richer, either on the intellectual or the wealth //

// side, the ultimate goal of MCS is that every single one of our members //

// can reach the financial freedom we all deserve. //

// //

// ====== Join us on our Discord : https://discord.gg/TmW6RQeyXp ====== //

// //

////////////////////////////////////////////////////////////////////////////////

if divbear

strategy.entry("Enter Long", strategy.long)

else if divbull

strategy.entry("Enter Short", strategy.short)

Relacionado

- A Super Tendência do Crodl

- SSS

- O Brin Band avançou na estratégia de rastreamento de movimentos

- Estratégias de negociação de faixa de flutuação

- Estratégias de quantificação de rastreamento de tração duplo equilátero

- Estratégias de rastreamento de tendências de cruzamento de linhas homogêneas multicíclicas

- Estratégias de cruzamento de médias móveis de adaptação

- Estratégias de rastreamento de tendências e filtragem de flutuação

- Estratégia R5.1 do OCC

- 2 Detecção da direção da média móvel de cores

Mais informações

- Estratégia de Supertendência Villa Dynamic Pivot

- A Super Tendência do Crodl

- RSI por zdmre

- FTL - Filtro de alcance X2 + EMA + UO

- BRAHMASTRA

- Bandas de Mobo

- SAR + 3SMMA com SL & TP

- SSS

- Modelo de alertas de lançamento lunar [indicador]

- HALFTREND + HEMA + SMA (estratégia de sinal falso)

- RSI e BB e simultaneamente OverSold

- Velas de Heikin Ashi

- Combinação 2/20 EMA e Filtro de banda

- A ESSMA

- 3EMA

- Blocos de ordens pivotantes

- NMVOB-S

- EMA/SMA de cor média móvel

- Banda MAHL

- 3 Supertrend adicionar neste único script