A Super Tendência do Crodl

Autora:ChaoZhang, Data: 2022-05-13 17:38:34Tags:SMAEMASMMAWMAVWMA

Este indicador está usando a super tendência com 3 entradas diferentes como confirmação, bem como a 200 EMA que nos dará os dados para uma tendência ascendente ou descendente. Em seguida, procura o indicador de stocks para confirmar se há uma cruz abaixo de 30 para um longo e acima de 70 para um curto.

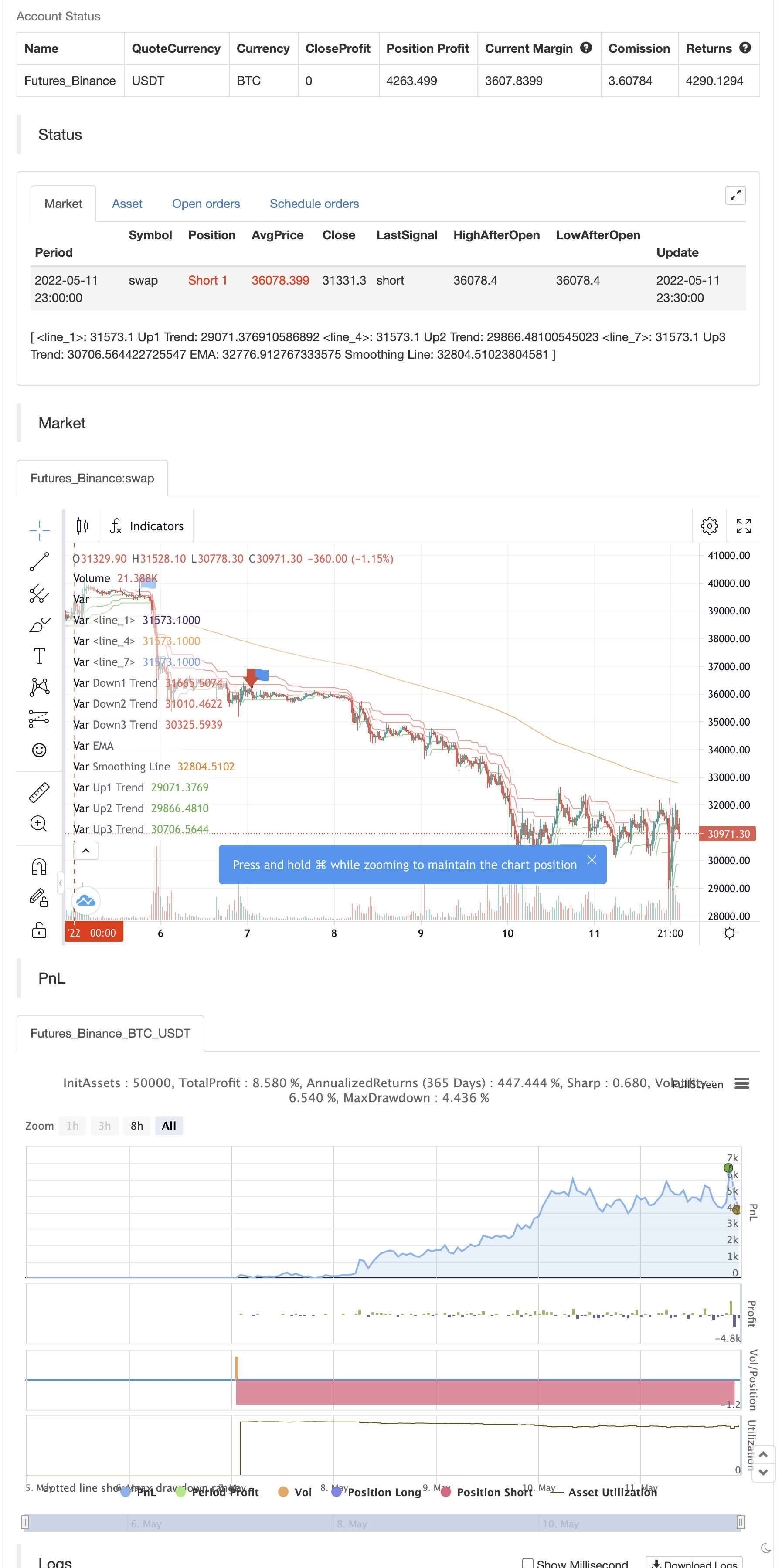

backtest

/*backtest

start: 2022-05-05 00:00:00

end: 2022-05-11 23:59:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// Visit Crodl.com for our Premium Indicators

// https://tradingbot.crodl.com to use our free tradingview bot to automate any indicator.

//@version=5

indicator("Crodl's Supertrend", overlay=true, timeframe="", timeframe_gaps=true)

atrPeriod1 = input(12, "ATR1 Length")

factor1 = input.float(3.0, "Factor1", step = 0.01)

[supertrend1, direction1] = ta.supertrend(factor1, atrPeriod1)

bodyMiddle1 = plot((open + close) / 2, display=display.none)

upTrend1 = plot(direction1 < 0 ? supertrend1 : na, "Up1 Trend", color = color.green, style=plot.style_linebr)

downTrend1 = plot(direction1 < 0? na : supertrend1, "Down1 Trend", color = color.red, style=plot.style_linebr)

atrPeriod2 = input(11, "ATR2 Length")

factor2 = input.float(2.0, "Factor2", step = 0.01)

[supertrend2, direction2] = ta.supertrend(factor2, atrPeriod2)

bodyMiddle2 = plot((open + close) / 2, display=display.none)

upTrend2 = plot(direction2 < 0 ? supertrend2 : na, "Up2 Trend", color = color.green, style=plot.style_linebr)

downTrend2 = plot(direction2 < 0? na : supertrend2, "Down2 Trend", color = color.red, style=plot.style_linebr)

atrPeriod3 = input(10, "ATR3 Length")

factor3 = input.float(1.0, "Factor3", step = 0.01)

[supertrend3, direction3] = ta.supertrend(factor3, atrPeriod3)

bodyMiddle3 = plot((open + close) / 2, display=display.none)

upTrend3 = plot(direction3 < 0 ? supertrend3 : na, "Up3 Trend", color = color.green, style=plot.style_linebr)

downTrend3 = plot(direction3 < 0? na : supertrend3, "Down3 Trend", color = color.red, style=plot.style_linebr)

len = input.int(200, minval=1, title="Length")

src = input(close, title="Source")

offset = input.int(title="Offset", defval=0, minval=-500, maxval=500)

out = ta.ema(src, len)

plot(out, title="EMA", color=color.white,linewidth=2, offset=offset)

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

typeMA = input.string(title = "Method", defval = "SMA", options=["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="Smoothing")

smoothingLength = input.int(title = "Length", defval = 5, minval = 1, maxval = 100, group="Smoothing")

smoothingLine = ma(out, smoothingLength, typeMA)

plot(smoothingLine, title="Smoothing Line", color=#f37f20, offset=offset, display=display.none)

//////

l = input(13, title='Length')

l_ma = input(7, title='MA Length')

t = math.sum(close > close[1] ? volume * (close - close[1]) : close < close[1] ? volume * (close - close[1]) : 0, l)

m = ta.sma(t, l_ma)

//////

periodK = input.int(14, title="%K Length", minval=1)

smoothK = input.int(1, title="%K Smoothing", minval=1)

periodD = input.int(3, title="%D Smoothing", minval=1)

k = ta.sma(ta.stoch(close, high, low, periodK), smoothK)

d = ta.sma(k, periodD)

stochbuy= float(k) < 30 and ta.crossover(k,d)

stochsell=float(k) > 70 and ta.crossover(d,k)

long =(( ((direction1 < 0 and direction2 < 0 ) or (direction2 < 0 and direction3 < 0 ) and (direction1 < 0 or direction3 < 0 ) )and open > out) and t > 0) and stochbuy

short=(( ((direction1 > 0 and direction2 > 0 ) or (direction2 > 0 and direction3 > 0 ) and (direction1 > 0 or direction3 > 0 ) )and open < out) and t < 0) and stochsell

plotshape(long, title = "Long Signal", location=location.belowbar, style=shape.labelup, color=color.green, textcolor=color.white, size=size.small, text="Long")

plotshape(short, title = "Short Signal", location=location.abovebar, style=shape.labeldown, color=color.red, textcolor=color.white, size=size.small, text="Short")

alertcondition(long, title='Long Signal', message=' Buy')

alertcondition(short, title='Short Signal', message=' Sell')

if long

strategy.entry("Enter Long", strategy.long)

else if short

strategy.entry("Enter Short", strategy.short)

Relacionado

- SSS

- O Brin Band avançou na estratégia de rastreamento de movimentos

- Estratégias de negociação de faixa de flutuação

- RSI Divergência com Pivot, BB, SMA, EMA, SMMA, WMA, VWMA

- Estratégias de quantificação de rastreamento de tração duplo equilátero

- Estratégias de rastreamento de tendências e filtragem de flutuação

- Estratégias de rastreamento de tendências de cruzamento de linhas homogêneas multicíclicas

- Estratégias de cruzamento de médias móveis de adaptação

- Estratégia R5.1 do OCC

- 2 Detecção da direção da média móvel de cores

Mais informações

- Bem-vindo ao mercado de ursos.

- Sidboss

- Pontos pivô altos e baixos Multi Time Frame

- Ghosts Tracking Trends é uma base de dados estratégica

- O Ghosts Trends está seguindo estratégias do banco de dados

- Estratégias de rastreamento de tendências de fantasmas

- Oscilador Arco-íris

- Exemplo de dimensionamento da posição da curva de capital

- Demonstração do KLineChart

- Estratégia de Supertendência Villa Dynamic Pivot

- RSI por zdmre

- FTL - Filtro de alcance X2 + EMA + UO

- BRAHMASTRA

- Bandas de Mobo

- SAR + 3SMMA com SL & TP

- SSS

- Modelo de alertas de lançamento lunar [indicador]

- HALFTREND + HEMA + SMA (estratégia de sinal falso)

- RSI Divergência com Pivot, BB, SMA, EMA, SMMA, WMA, VWMA

- RSI e BB e simultaneamente OverSold