Estratégia de negociação de dupla direção baseada no RSI e na SuperTrend

Autora:ChaoZhang, Data: 2023-11-03 14:22:50Tags:

Resumo

Esta é uma estratégia de negociação bidirecional que utiliza de forma abrangente o indicador RSI e o indicador SuperTrend. A estratégia visa identificar a força e a fraqueza no mercado e fazer mudanças de posição oportunas quando a direção da tendência muda, a fim de obter retornos mais altos.

Princípio da estratégia

A estratégia baseia-se principalmente nos seguintes princípios:

-

Usar o indicador RSI para determinar a força e fraqueza atual do mercado.

-

Use o indicador SuperTrend como um filtro de tendência.

-

Quando o RSI dá um sinal forte, vá longo se o preço quebrar acima da faixa superior e feche a posição se quebrar abaixo da faixa inferior.

-

Quando o RSI dá um sinal fraco, vá curto se o preço quebrar abaixo da faixa inferior, e feche a posição se quebrar acima da faixa superior.

-

Captar pontos de virada através do monitoramento das transições do RSI entre longo e curto, e fazer a troca de posição em tempo hábil.

Implementação

-

Calcular os valores do RSI com comprimento 14, utilizando 50 como limiar de força/fraqueza.

-

Calcular SuperTrend com comprimento de 10 e multiplicador de 2.

-

Vá longo quando o RSI for acima de 50 e o preço quebrar acima da faixa superior da SuperTrend. vá curto quando o RSI cair abaixo de 50 e o preço quebrar abaixo da faixa inferior.

-

Quando já long, se o RSI ficar fraco e o preço cair abaixo da faixa superior, feche a posição longa.

-

Configurável para modos apenas longos ou apenas curtos.

Vantagens

Esta estratégia combina o seguimento da tendência e a análise de sobrecompra/supervenda e tem as seguintes vantagens:

-

Pode captar mudanças de tendência em tempo hábil e evitar entradas desnecessárias.

-

O RSI identifica efetivamente zonas de sobrecompra/supervenda para evitar a perseguição de altos e baixos.

-

A SuperTrend filtra bem o ruído do mercado e acompanha as tendências de médio e longo prazo.

-

A combinação de RSI e SuperTrend melhora a estabilidade.

-

A estratégia tem um grande espaço de ajuste de parâmetros para diferentes produtos e prazos.

-

Suporta os modos apenas longo/só curto para lidar com diferentes condições de mercado de forma flexível.

Riscos

Há também alguns riscos com esta estratégia:

-

O RSI pode gerar sinais falsos facilmente, exigindo confirmação de preço.

-

Parâmetros de SuperTendência ruins podem causar trocas perdidas ou perseguição.

-

O risco de divergência existe quando se combinam dois indicadores, sendo necessário ajustar os parâmetros para melhor correspondência.

-

A posição de stop loss pode ser tomada instantaneamente em situações de volatilidade extrema.

-

Evitar posições de inversão perto dos principais níveis de suporte/resistência.

Melhorias

A estratégia pode ser ainda melhorada nos seguintes aspectos:

-

Ajuste os parâmetros do RSI para encontrar o comprimento ideal para filtrar sinais falsos.

-

Otimizar os parâmetros da SuperTendência para uma melhor capacidade de rastreamento de tendências.

-

Teste diferentes combinações de parâmetros em diferentes produtos e prazos para encontrar o ideal.

-

Adicione outros indicadores como MACD, KDJ para melhorar a precisão do sinal.

-

Adicionar análise de suporte/resistência chave, Bandas de Bollinger, médias móveis etc. para qualificar os sinais de estratégia.

-

Otimizar a estratégia de stop loss para reduzir a interrupção, mantendo a eficácia.

Conclusão

Esta estratégia integra os pontos fortes do RSI e da SuperTrend para identificar efetivamente mudanças de tendência de médio prazo entre os mercados de touros e ursos. A estratégia é fácil de implementar com lógica clara e tem forte valor prático. Com ajuste de parâmetros, pode se adaptar a mais condições de mercado.

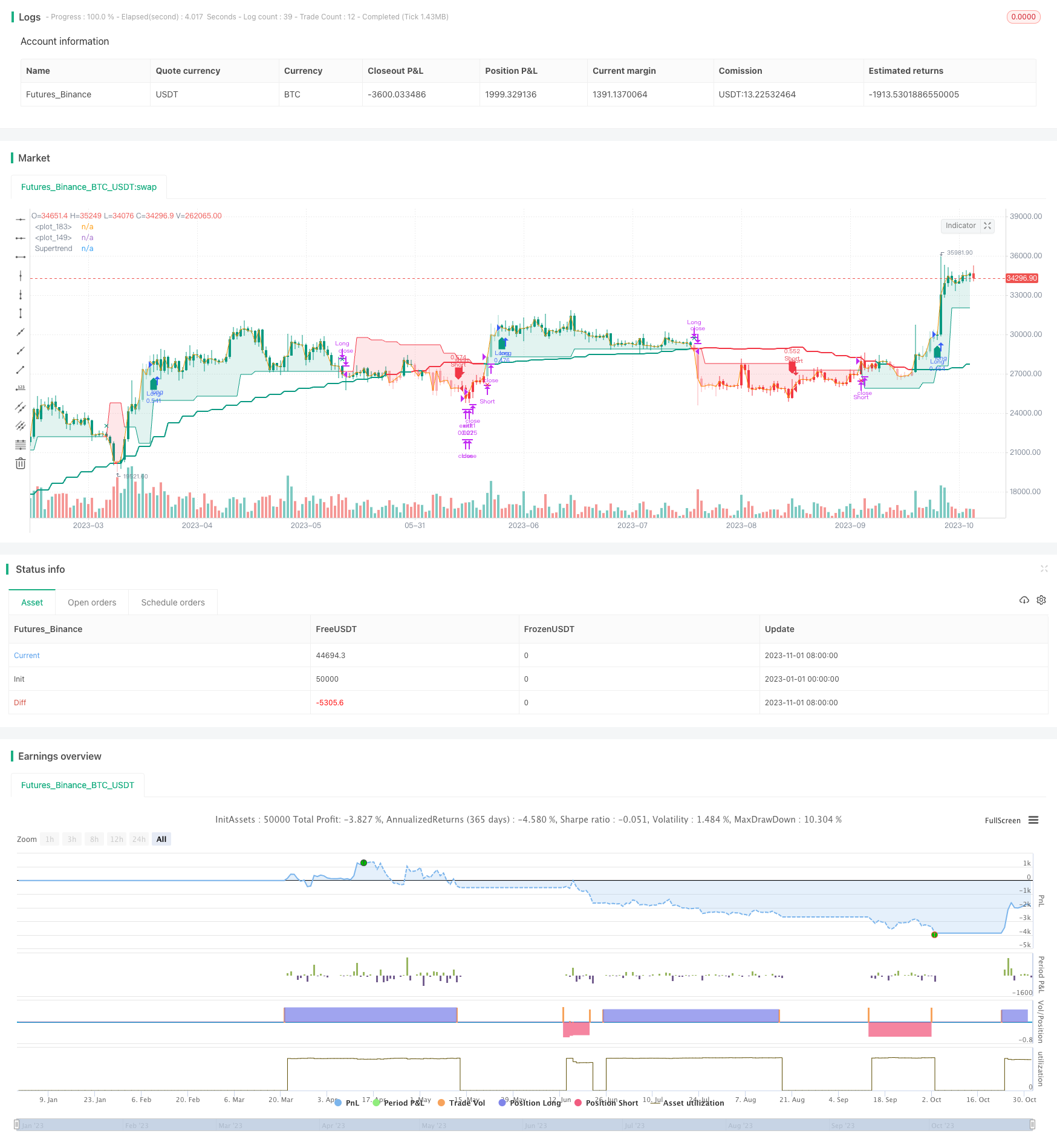

/*backtest

start: 2023-01-01 00:00:00

end: 2023-11-02 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

//Created by @CITIAlgo

// —————————————————————————————————————————————————————————————————————————————————————————————————————————

strategy('CITI Trends A with RSI Candles', shorttitle = "CITI Trends A" , overlay = true ,

initial_capital = 10000,

commission_value = 0.025,

default_qty_value = 25,

slippage = 1,

pyramiding = 0,

max_lines_count = 500,

max_labels_count = 500,

currency = currency.USD,

default_qty_type = strategy.percent_of_equity)

bullColor1 = #089981

bearColor1 = #f23645

bullColor2 = #3873e3

bearColor2 = #630ef5

neutralColor1 = #d5d5d5

//Base Settings

groupBase = "Base Settings ---------------------------------------"

Repaint_type = input.string('Non-Repainting', "Allow Repainting ?", options = ['Non-Repainting', 'Repainting'], inline ='repaint' , group = groupBase , tooltip = 'The default value is Non-Repainting. To learn more visit https://www.tradingview.com/pine-script-docs/en/v5/concepts/Repainting.html')

//Configure trade direction

tradeDirection = input.string("Both", title="Trade Direction", options=["Long", "Short", "Both"] , group=groupBase , inline = 'Type' )

longOK = tradeDirection == "Long" or tradeDirection == "Both"

shortOK = tradeDirection == "Short" or tradeDirection == "Both"

var bool PlotEntries = input.bool (true, "Show Entries" ,group=groupBase , inline = 'Signals' )

var bool PlotExits = input.bool (true, "Show Exits" , group=groupBase, inline = 'Signals' )

//Display Settings

groupDisplay = "Display Settings ------------------------------------"

MomBars = input.bool( true , title="Apply Bar Colors", inline = 'candles' , group=groupDisplay)

cbullColor = input.color( bullColor1 , 'Candle Colors' , inline = 'candles1a',group=groupDisplay)

cbearColor = input.color( bearColor1 , '' , inline = 'candles1a',group=groupDisplay)

//Candle & label Colors

Bullish_Bars = color.new( cbullColor , 0)

WBullish_Bars = color.new( cbullColor , 60)

Bearish_Bars = color.new( cbearColor , 0)

WBearish_Bars = color.new( cbearColor , 60)

lbullColor = input.color( bullColor1 , 'Long/Short Labels' , group=groupDisplay, inline = 'Signals1' )

lbearColor = input.color( bearColor1 , '' , group=groupDisplay, inline = 'Signals1' )

st_status = input.bool( true , title="Show Supertrend", inline = 'st' , group=groupDisplay)

st_bullColor = input.color( bullColor1 , '' , group=groupDisplay, inline = 'st' )

st_bearColor = input.color( bearColor1 , '' , group=groupDisplay, inline = 'st' )

//Build Your Signals Settings

groupEntry = " Trend & Signal Settings---------------------"

Entry1a = input.bool(true, title= "Entry", inline='entry1a', group=groupEntry)

Exit1a = input.bool(false, title= "Exit | Strong/Weak Momentum", inline='entry1a', group=groupEntry)

Entry1b = input.bool(false, title= 'Entry' , inline='entry1b', group=groupEntry)

Exit1b = input.bool(false, title= 'Exit | Bull/Bear Momentum' , inline='entry1b', group=groupEntry)

Entry3a = input.bool(false, title= "Filter", inline='entry3a', group=groupEntry)

Exit3a = input.bool(false, title= "Exit | MA ", inline='entry3a', group=groupEntry)

Entry4a = input.bool(false, title= "Filter | Disable RSI Ranges ", inline='entry4a', group=groupEntry)

Entry4b = input.bool(true, title= "Filter", inline='entry4b', group=groupEntry)

Exit4b = input.bool(true, title= "Exit | Supertrend ", inline='entry4b', group=groupEntry)

Entry4c = input.bool(true, title= "Filter | Disable Supertrend Ranges ", inline='entry4c', group=groupEntry)

// —————————————————————————————————————MTF FUNCTIONS

// —————————— PineCoders MTF Selection Framework functions

// ————— Converts current "timeframe.multiplier" plus the TF into minutes of type float.

f_resInMinutes() =>

_resInMinutes = timeframe.multiplier * (timeframe.isseconds ? 1. / 60. : timeframe.isminutes ? 1. : timeframe.isdaily ? 1440. : timeframe.isweekly ? 10080. : timeframe.ismonthly ? 43800. : na)

_resInMinutes

// Get current resolution in float minutes.

var ResInMinutes = f_resInMinutes()

// ————— Returns resolution of _resolution period in minutes.

f_tfResInMinutes(_res) =>

// _res: resolution of any TF (in "timeframe.period" string format).

request.security(syminfo.tickerid, _res, f_resInMinutes())

// ————— Returns a multiple of current resolution as a string in "timeframe.period" format usable with "security()".

f_multipleOfRes(_res, _mult) =>

// _res: current resolution in minutes, in the fractional format supplied by f_resInMinutes() companion function.

// _mult: Multiple of current TF to be calculated.

// Convert current float TF in minutes to target string TF in "timeframe.period" format.

_targetResInMin = _res * math.max(_mult, 1)

// Find best string to express the resolution.

_targetResInMin <= 0.083 ? '5S' : _targetResInMin <= 0.251 ? '15S' : _targetResInMin <= 0.501 ? '30S' : _targetResInMin <= 1440 ? str.tostring(math.round(_targetResInMin)) : _targetResInMin <= 43800 ? str.tostring(math.round(math.min(_targetResInMin / 1440, 365))) + 'D' : str.tostring(math.round(math.min(_targetResInMin / 43800, 12))) + 'M'

// ————— Converts current resolution

f_resInString(_res) =>

// _res: resolution of any TF (in "timeframe.period" string format).

_res == "1" ? "1m" :

_res == "3" ? "3m" :

_res == "5" ? "5m" :

_res == "15" ? "15m" :

_res == "30" ? "30m" :

_res == "45" ? "45m" :

_res == "60" ? "1h" :

_res == "120" ? "2h" :

_res == "180" ? "3h" :

_res == "240" ? "4h" :

_res == "1D" ? "D" :

_res == "1W" ? "W" :

_res == "1M" ? "M" : _res

//Set repaint security function

repaint_sw = Repaint_type == 'Non-Repainting' ? false : true

f_security(_symbol, _res, _src, _repaint) => request.security(_symbol, _res, _src[_repaint ? 0 : barstate.isrealtime ? 1 : 0] , barmerge.gaps_off, barmerge.lookahead_on)[_repaint ? 0 : barstate.isrealtime ? 0 : 1]

f_source(_res , source) => f_security(syminfo.tickerid , _res , source , repaint_sw )

Type1 = 'Auto Multiplied TF'

Type2 = 'Fixed TF'

//---------------------------------------------------------------------------

//RSI Settings // INPUTS

groupRange = "RSI Settings ----------------------------------"

TF1type = input.string( Type1, 'TF' , options=[Type1,Type2] , inline ='tf1' , group=groupRange)

setHTF1a = input.int( 4 , '' , inline ='tf1', group=groupRange)

setHTF1b = input.timeframe( 'D' , '' , inline ='tf1', group=groupRange)

// Get HTF from user-defined mode.

var TF1 = TF1type == Type1 ? f_multipleOfRes(ResInMinutes, setHTF1a) : setHTF1b

mLength = input.int( 14 , "RSI Length" ,inline='lines', group=groupRange)

BullLevel = input.int( 50 , "Bullish Level | Above 50 ",inline='lines1a', group=groupRange)

BearLevel = input.int( 50 , "Bearish Level | Below 50 ",inline='lines1b', group=groupRange)

ma_length = input.int( 21 , "MA Length" ,inline='ma', group=groupRange)

ma_status = input.bool( true , "Show MA" ,inline='ma1', group=groupRange)

ma_bullColor = input.color( bullColor1 , '' , inline='ma1', group=groupRange)

ma_bearColor = input.color( bearColor1 , '' , inline='ma1', group=groupRange)

//--------------------------------------------------------------------------

//Momentum Calculations

f_momTF( _tf ) =>

_isShow = f_tfResInMinutes(_tf) >= f_resInMinutes()

close_ = f_source(_tf , close)

rsi_ = _isShow ? f_security(syminfo.tickerid , _tf, ta.rsi( close_, mLength) , repaint_sw) : na

ma = _isShow ? f_security(syminfo.tickerid , _tf, ta.vwma( hlc3 , ma_length ) , repaint_sw) : na

[rsi_ , ma]

[ rsi , ma ] = f_momTF(TF1)

ma_color = close > ma ? ma_bullColor : ma_bearColor

plot( ma_status ? ma : na , color = ma_color , linewidth = 2 , style = plot.style_line)

//---------------------------------------------------------------------------

//Supertrend Settings // INPUTS

groupST = "Supertrend Settings ----------------------------------"

TF2type = input.string( Type1, 'TF' , options=[Type1,Type2] , inline ='tf2' , group=groupST)

setHTF2a = input.int( 4 , '' , inline ='tf2', group=groupST)

setHTF2b = input.timeframe( 'D' , '' , inline ='tf2', group=groupST)

// Get HTF from user-defined mode.

var TF2 = TF2type == Type1 ? f_multipleOfRes(ResInMinutes, setHTF2a) : setHTF2b

stLength = input.int( 10 , "Supertrend Length" ,inline='lines', group=groupST)

stmult = input.int( 2 , "Mult" ,inline='lines', group=groupST)

stHighlights = input.bool( true , "Highlights",inline='lines1a', group=groupST)

f_st( _tf) =>

_isShow = f_tfResInMinutes(_tf) >= f_resInMinutes()

close_ = f_source(_tf , close)

atr= f_security(syminfo.tickerid , _tf, ta.atr(stLength) , repaint_sw)

Up=close_ -(stmult*atr)

Dn=close_ +(stmult*atr)

TrendUp = 0.0

TrendUp := close_[1]>TrendUp[1] ? math.max(Up,TrendUp[1]) : Up

TrendDown = 0.0

TrendDown := close_[1]<TrendDown[1]? math.min(Dn,TrendDown[1]) : Dn

Trend = 0.0

Trend := close_ > TrendDown[1] ? 1: close_< TrendUp[1]? -1: nz(Trend[1],1)

stLine = Trend==1? TrendUp: TrendDown

[Trend, stLine]

[Trend, stLine] = f_st( TF2 )

stTrend = close > stLine ? 1:-1

stplot = plot( st_status? stLine : na , color= stTrend ==1 ? st_bullColor : st_bearColor , linewidth=1 ,title ="Supertrend")

priceLineP = plot( close , color= na , linewidth=1 , display = display.none)

fill(priceLineP , stplot , color = stHighlights ? stTrend ==1 ? color.new(st_bullColor , 85) : color.new( st_bearColor , 85 ) : na )

//---------------------------------------------------------------------------

//Momentum BarColors

mom2a = rsi > BullLevel ? Bullish_Bars : WBullish_Bars

mom2b = rsi < BearLevel ? Bearish_Bars : WBearish_Bars

mom2_color = close > ma ? mom2a : mom2b

mom_color = MomBars ? mom2_color : na

barcolor(mom_color)

//-------------------------------------------------

//Momentum Strength & Values

momVal2a = rsi > BullLevel ? 2 : 1

momVal2b = rsi < BearLevel ? -2 : -1

momVal2 = close > ma ? momVal2a : momVal2b

momVal = momVal2

///==============================================================================================================

//Long Trend Conditions

Entry1aL = Entry1a ? momVal == 2 : true

Entry1bL = Entry1b ? momVal == 1 or momVal == 2 : true

Entry3aL = Entry3a ? close > ma : true

Entry4aL = Entry4a ? rsi > BullLevel : true

Entry4bL = Entry4b ? close > stLine : true

Entry4cL = Entry4c ? stLine > stLine[1] : true

//------

noEntry = Entry1a == false and Entry1b == false and Entry3a == false and Entry4a == false and Entry4b == false and Entry4c == false ? false : true

noExit = Exit1a == false and Exit1b == false and Exit3a == false and Exit4b == false ? false : true

//------

EntryL = noEntry and Entry1aL and Entry1bL and Entry3aL and Entry4aL and Entry4bL and Entry4cL

Exit1aL = Exit1a ? momVal == 1 and momVal[1] == 2 : true

Exit1bL = Exit1b ? momVal == -1 or momVal == -2 : true

Exit3aL = Exit3a ? close < ma : true

Exit4bL = Exit4b ? close < stLine : true

ExitL = noExit and Exit1aL and Exit3aL and Exit1bL and Exit4bL

//Short Trend Conditions

Entry1aS = Entry1a ? momVal == -2 : true

Entry1bS = Entry1b ? momVal == -1 or momVal == -2 : true

Entry3aS = Entry3a ? close < ma : true

Entry4aS = Entry4a ? rsi < BearLevel : true

Entry4bS = Entry4b ? close < stLine : true

Entry4cS = Entry4c ? stLine < stLine[1] : true

EntryS = noEntry and Entry1aS and Entry1bS and Entry3aS and Entry4aS and Entry4bS and Entry4cS

Exit1aS = Exit1a ? momVal == -1 and momVal[1] == -2 : true

Exit1bS = Exit1b ? momVal == 1 or momVal == 2 : true

Exit3aS = Exit3a ? close > ma : true

Exit4bS = Exit4b ? close > stLine : true

ExitS = noExit and Exit1aS and Exit3aS and Exit1bS and Exit4bS

///==============================================================================================================

//Entry & exit conditions

isLong = false

isLong := nz(isLong[1], false)

isShort = false

isShort := nz(isShort[1], false)

goLong = not isLong and EntryL and not ExitL and longOK and barstate.isconfirmed

goShort = not isShort and EntryS and not ExitS and shortOK and barstate.isconfirmed

longExit = isLong and ExitL and barstate.isconfirmed

shortExit = isShort and ExitS and barstate.isconfirmed

if (goLong)

isLong := true

isShort := false

if (goShort)

isLong := false

isShort := true

if (longExit)

isLong := false

if (shortExit)

isShort := false

//------------------------------------------------------------------------------

// ——Backtester

grouptime = 'Step 5 - 📆 Time Filter 📆-------------'

startTime = input (group=grouptime, title="Start Timeㅤㅤ", defval=timestamp('UTC 01 Jan 2020 00:00'), inline="Start")

endTime = input (group=grouptime, title="End Time ㅤ ㅤ", defval=timestamp('UTC 31 Dec 2025 23:45'), inline="End")

dateRange = true

//------------------------------------------------------------------------------

// Risk Managment

grouprisk = 'Step 6 - Risk Management-------------'

takeprofit = input.bool(true,title = "TP Price %",group=grouprisk, inline="profit")

tppercent = input.float(1, '', group=grouprisk, inline="profit") / 100

q1 = input.int (5 , "Quantity %",group=grouprisk , inline="profit")

stoploss = input.bool(false,title = "SL Price %",group=grouprisk, inline="loss")

stoppercent = input.float(5, '', group=grouprisk, inline="loss") / 100

// Determine where you've entered and in what direction

longtp = strategy.position_avg_price * (1 + tppercent)

longStop = strategy.position_avg_price * (1 - stoppercent)

shorttp = strategy.position_avg_price * (1 - tppercent)

shortStop = strategy.position_avg_price * (1 + stoppercent)

QTYMethod = input.string ('EQUITY', 'Order Size', group=grouprisk, inline=' ', options=['NONE', 'EQUITY', 'SIZE', 'CONTRACTS'])

useNetProfit = input.bool (true, 'Use Net Profit', group=grouprisk, inline=' ', tooltip='Use Net Profit- On/Off the use of profit in the following trades. *Only works if the type is EQUITY')

riskPerc = input.int (30, '🇪🇶🇺🇮🇹🇾 %', group=grouprisk, inline='.', minval=1, maxval=100)

riskSize = input.int (10000, '🇸🇮🇿🇪', group=grouprisk, inline='.', minval=1)

riskCntr = input.int (1, '🇨🇴🇳🇹🇷🇦🇨🇹🇸', group=grouprisk, inline='.', minval=1, tooltip='Order Size: \nNone- Use the default position size settings in Tab "Properties". \nEquity% - per trade from the initial capital. \nSize- Fixed size amount of trade. \nContracts- The fixed amount of the deal in contracts. \n')

// —————— Order Size

eqty = switch QTYMethod

'NONE' => na

'EQUITY' => riskPerc / close

'SIZE' => riskSize / close

'CONTRACTS' => riskCntr

//-----------------------------------------------------------------------------

// —————— Trade variables

entry = strategy.position_avg_price

sizePos = strategy.position_size

inLong = sizePos > 0

inShort = sizePos < 0

inTrade = inLong or inShort

inPos = (inLong and not inShort[1]) or (inShort and not inLong[1])

var ID = 'TradeID'

var tpPrice = float(na)

var slPrice = float(na)

///==============================================================================================================

// ALERTS

groupalerts = 'Step 7 - Alerts & Bot Trading Settings-------------'

broker = input.string('Binance', "Broker", options=['Binance', 'Alpaca', 'Kucoin', '3Commas'], group=groupalerts, tooltip = 'Choose which type you are using to send the correct Json Alert message for entry and exit alerts.')

my_sym = input("FTMM/USDT", "Ticker", group = 'Cloud Function Server', tooltip = 'Only used with Alerts to fix ticker ID in json message. Some exchanges use the forward slash and some do not.')

my_pass = input('Passphrase', "Passphrase" , group = 'Cloud Function Server', tooltip = 'Only enter your Passphrase and nothing else goes here. Only needed when using a Cloud Function Server.')

i_alert_3CID_txt = input('Bot ID', "Bot ID", group =groupalerts, tooltip = 'Only enter your 3Commas Bot ID and nothing else goes here.')

i_alert_3CET_txt = input('Bot Email Token', title = 'Bot Email Token', group =groupalerts , tooltip = 'Only enter your 3Commas Bot Email Token and nothing else goes here.')

Alert='{"passphrase": "'+str.tostring(my_pass)+'","symbol": "'+ str.tostring(my_sym) +'","type":"market", "side":"{{strategy.order.action}}","amount":"{{strategy.order.contracts}}","price": "' + str.tostring(close) + '"}'

//---------------------------------------------------------------------------------

// JSON alert message used for 3Commas Bots

C3_EntryAlert ='{"message_type": "bot", "bot_id": ' + i_alert_3CID_txt + ', "email_token": "' + i_alert_3CET_txt + '", "delay_seconds": 0 }'

C3_ExitAlert ='{"action": "close_at_market_price_all", "message_type": "bot", "bot_id": ' + i_alert_3CID_txt + ', "email_token": "' + i_alert_3CET_txt + '", "delay_seconds": 0}'

//---------------------------------------------------------------------------------

// JSON alert message used for setting up a Google Cloud Function Server works when using Alpaca Exchange

Alert_Alpaca = '{"symbol": "{{ticker}}", "quantity": "{{strategy.order.contracts}}", "side": "{{strategy.order.action}}", "order_type": "market", "time_in_force": "gtc", "passphrase": "' + str.tostring(my_pass) + '"}'

entryAlert = broker == 'Binance' ? Alert : broker == 'Alpaca' ? Alert_Alpaca : broker == 'Kucoin' ? Alert : C3_EntryAlert

exitAlert = broker == 'Binance' ? Alert : broker == 'Alpaca' ? Alert_Alpaca : broker == 'Kucoin' ? Alert : C3_ExitAlert

strategy.initial_capital = 50000

// —————— Entry's

goLongEntry = goLong and dateRange and barstate.isconfirmed

goShortEntry = goShort and dateRange and barstate.isconfirmed

eqty(qty) => QTYMethod=='EQUITY' ? qty / 100 * (strategy.initial_capital + (useNetProfit ? strategy.netprofit : 0)) : QTYMethod=='SIZE' ? qty / syminfo.pointvalue : qty

if goLongEntry

ID := 'Long'

strategy.entry(ID, strategy.long, qty=eqty(eqty), comment=ID, alert_message = entryAlert)

if goShortEntry

ID := 'Short'

strategy.entry(ID, strategy.short, qty=eqty(eqty), comment=ID, alert_message = entryAlert)

// —————— Exit's

qty(perc) => math.abs(sizePos*perc/100)

if longExit

strategy.close("Long",comment='X', alert_message= exitAlert)

strategy.exit ("exit1", from_entry="Long", limit=takeprofit ? longtp : na, stop=stoploss ? longStop : na, comment_profit='TP', comment_loss='SL', qty_percent=q1)

strategy.exit ("exit2", from_entry="Long", stop=stoploss ? longStop : na, comment_loss='SL')

if shortExit

strategy.close("Short",comment='X', alert_message= exitAlert)

strategy.exit ("exit1", from_entry="Short", limit=takeprofit ? shorttp : na, stop=stoploss ? shortStop : na, comment_profit='TP', comment_loss='SL', qty_percent=q1)

strategy.exit ("exit2", from_entry="Short", stop=stoploss ? shortStop : na, comment_loss='SL')

///==============================================================================================================

//Style- Plots on Chart

posH = high + 2 * stLine

posL = low - 2 * stLine

plotshape( goLong and PlotEntries ? posL : na ,'Long Entry Signals' , text= '' , location=location.belowbar, style=shape.labelup , size=size.small , color=lbullColor , textcolor = color.white )

plotshape( longExit and PlotExits ? posH : na ,'Long Exit' , location=location.abovebar, style= shape.xcross , size=size.small, color=lbullColor )

plotshape( goShort and PlotEntries ? posH : na ,'Short Entry Signals' , text= '' , location=location.abovebar, style=shape.labeldown , size=size.small , color=lbearColor , textcolor = color.white )

plotshape( shortExit and PlotExits ? posL : na ,'Short Exit' , location=location.belowbar, style=shape.xcross , size=size.small , color=lbearColor )

///==============================================================================================================

// Alerts

alertcondition( goLong , 'Long Entry Alerts', 'Long Alerts')

alertcondition( goShort , 'Short Entry Alerts', 'Short Alerts')

- Júpiter e Saturno Momentum MA Crossover Filtrado Estratégia

- Estratégia além das nuvens

- Estratégia de negociação de sombra

- Estratégia de rastreamento da média móvel de ruptura da tendência

- Estratégia de acompanhamento da tendência baseada no oscilador de volume

- Tendência seguindo uma estratégia de longo prazo baseada na SuperTendência e na Transformação Fisher

- Estratégia de negociação de reversão de dupla cruz de ouro

- Fibonacci retira o script de estratégia de negociação

- RSI-BB - Estratégia de ruptura do momento

- Estratégia de perda de parada fixa de faixa de ruptura

- EMA 13 48 Tendência Seguindo estratégia

- Estratégia Williams de acumulação/distribuição (Williams AD)

- Estratégia do índice de ímpeto relativo

- Sistema de acompanhamento de tendências de caixa dupla

- Estratégia de Martingale com gama de média móvel alargada para negociação de ações

- Estratégia de equilíbrio touro e urso

- Estratégia de Comércio de Dual Rail de Oma e Apollo

- Estratégia de cruzamento de média móvel dupla

- Estratégia de acompanhamento de tendências de sinal duplo

- Tendência na sequência da estratégia SMA