Ichimoku tendência seguindo estratégia

Autora:ChaoZhang, Data: 2023-12-11 15:00:29Tags:

Resumo

Esta estratégia foi concebida com base no indicador Ichimoku para a negociação de seguimento de tendências e de ruptura de equilíbrio, com o objetivo de capturar tendências de preços de médio a longo prazo para obter lucros constantes.

Estratégia lógica

A estratégia utiliza as cinco linhas de Ichimoku - Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B e Chikou Span para determinar a tendência de preços e os níveis de suporte / resistência.

- Quando o cruzamento entre Kijun-sen e Kijun-sen não é plano, um sinal de compra é acionado.

- Quando o cruzamento entre Kijun-sen e Kijun-sen não é plano, um sinal de venda é acionado.

- Quando o fechamento está acima da nuvem, a liquidez é boa para tomar posições.

- Quando o fechamento está abaixo da nuvem, a liquidez é baixa e deve-se evitar a tomada de posições.

- Quando o Chikou Span atravessa o fechamento, um sinal de compra é acionado.

- Quando o Chikou Span atravessa o fechamento, um sinal de venda é acionado.

Os sinais de negociação acima são combinados para determinar o calendário de entrada final.

Análise das vantagens

As vantagens desta estratégia incluem:

- Usar Ichimoku para determinar tendências pode filtrar o ruído do mercado e capturar tendências de médio a longo prazo.

- Incorporar a condição de nuvem evita a tomada de posições com baixa liquidez.

- O Chikou Span serve de confirmação para evitar uma fuga falsa.

- As regras são simples e claras para aplicação.

Análise de riscos

Os riscos desta estratégia incluem:

- A configuração inadequada dos parâmetros pode conduzir à perda de oportunidades comerciais.

- O julgamento da tendência pode atrasar-se quando a tendência muda, incapaz de cortar a perda a tempo.

- Risco de perda mais elevado para posições longas.

Estes riscos podem ser abordados através da otimização dos parâmetros, da combinação com outros indicadores para determinar a mudança de tendência e de um rigoroso stop loss.

Orientações de otimização

A estratégia pode ser melhorada a partir dos seguintes aspectos:

- Otimize os parâmetros do Ichimoku para encontrar a melhor combinação.

- Adicionar filtros de preço e volume para evitar desvios de tendência.

- Incorporar indicadores de volatilidade para identificar pontos de reversão.

- Adicionar modelos de aprendizagem de máquina para determinar o estado da tendência.

Resumo

Esta estratégia aproveita Ichimoku para determinar a tendência de preços e as condições de liquidez para seguir a tendência, o que pode efetivamente filtrar o ruído e capturar tendências de médio a longo prazo com reduções menores.

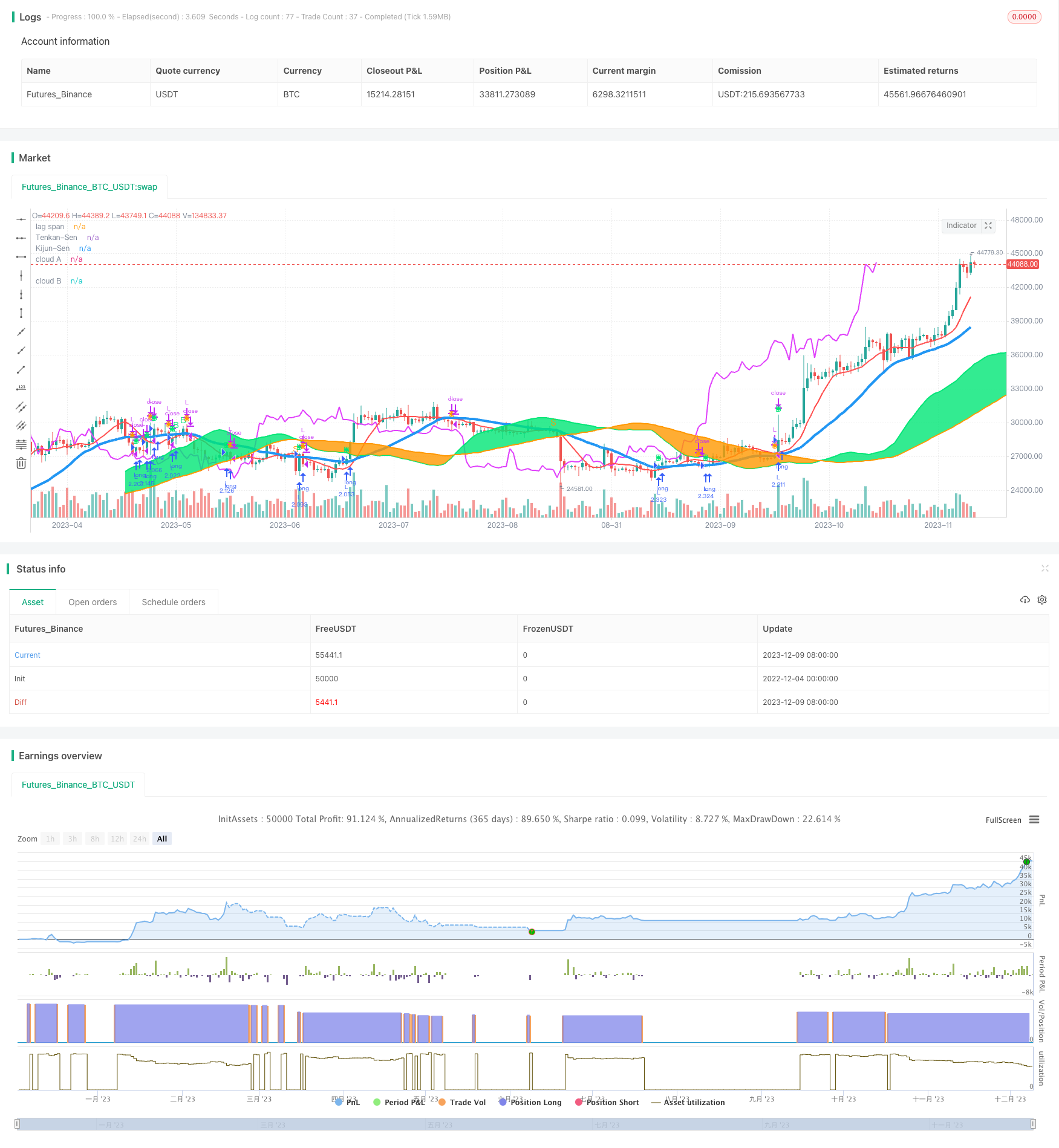

/*backtest

start: 2022-12-04 00:00:00

end: 2023-12-10 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("My Ichimoku Strat", overlay=true,default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=1000, currency=currency.EUR)

// === BACKTEST RANGE ===

FromMonth = input(defval = 1, title = "From Month", minval = 1)

FromDay = input(defval = 1, title = "From Day", minval = 1)

FromYear = input(defval = 2017, title = "From Year", minval = 2014)

ToMonth = input(defval = 1, title = "To Month", minval = 1)

ToDay = input(defval = 1, title = "To Day", minval = 1)

ToYear = input(defval = 9999, title = "To Year", minval = 2014)

// === SERIES SETUP ===

//**** Inputs *******

KijunSenLag = input(6,title="KijunSen Lag",minval=1)

//Kijun-sen

//Support resistance line, buy signal when price crosses it

KijunSen = sma((high+low)/2,26)

buy2 = crossover(close,KijunSen) and (rising(KijunSen,KijunSenLag) or falling(KijunSen,KijunSenLag))

sell2= crossunder(close,KijunSen) and (rising(KijunSen,KijunSenLag) or falling(KijunSen,KijunSenLag))

//Tenkan-Sen

TenkanSen = sma((high+low)/2,9)

//Senkou Span A

SenkouSpanA = (KijunSen + TenkanSen)/2

//Senkou Span B

SenkouSpanB = sma((high+low)/2,52)

//Cloud conditions : ignore buy if price is under the cloud

// Huge cloud means safe support and resistance. Little cloud means danger.

buy3 = close > SenkouSpanA and close > SenkouSpanB

sell3 = close < SenkouSpanA and close < SenkouSpanB

//Chikou Span

//Buy signal : crossover(ChikouSpan,close)

//Sell Signal : crossunder(ChikouSpan,close)

ChikouSpan = close

buy1=crossover(ChikouSpan,close[26])

sell1=crossunder(ChikouSpan,close[26])

plotshape(buy1,style=shape.diamond,color=lime,size=size.small)

plotshape(sell1,style=shape.diamond,color=orange,size=size.small)

//Alerts

buyCompteur = -1

buyCompteur := nz(buyCompteur[1],-1)

buyCompteur := buy2 or buy3 ? 1 : buyCompteur

buyCompteur := buyCompteur > 0 ? buyCompteur + 1 : buyCompteur

buyCompteur := sell2 or sell3 ? -1 : buyCompteur

sellCompteur = -1

sellCompteur := nz(sellCompteur[1],-1)

sellCompteur := sell2 or sell3 ? 1 : sellCompteur

sellCompteur := sellCompteur > 0 ? sellCompteur + 1 : sellCompteur

sellCompteur := buy2 or buy3 ? -1 : sellCompteur

sell= sell2 and sell3 or (sell1 and buyCompteur <= 8)

buy=buy2 and buy3 or (buy1 and sellCompteur <=8)

plotchar(buy,char='B',size=size.small,color=lime)

plotchar(sell,char='S',size=size.small,color=orange)

//plots

plot(KijunSen,title="Kijun-Sen",color=blue,linewidth=4)

plot(TenkanSen,title="Tenkan-Sen",color=red,linewidth=2)

cloudA = plot(SenkouSpanA,title="cloud A", color=lime,offset=26,linewidth=2)

cloudB = plot(SenkouSpanB,title="cloud B", color=orange,offset=26,linewidth=2)

plot(ChikouSpan,title="lag span",color=fuchsia, linewidth=2,offset=-26)

//plot()

fill(cloudA,cloudB,color=SenkouSpanA>SenkouSpanB?lime:orange)

//plot(close,color=silver,linewidth=4)

// === ALERTS ===

strategy.entry("L", strategy.long, when=(buy and (time > timestamp(FromYear, FromMonth, FromDay, 00, 00)) and (time < timestamp(ToYear, ToMonth, ToDay, 23, 59))))

strategy.close("L", when=(sell and (time < timestamp(ToYear, ToMonth, ToDay, 23, 59))))

- ADX、RSI Indicadores de Impulso Estratégia

- Estratégia da EMA com ATR Stop Loss

- Estratégia de busca e busca baseada em canais internos de preços

- A EMA e a SuperTrend combinaram uma estratégia de tendência

- Tendência dinâmica na sequência da estratégia

- Estratégia de negociação quantitativa de reversão média do canal ATR

- Estratégia de cruzamento de média móvel dupla

- Estratégia de ruptura dentro da faixa de barras

- Estratégia de acompanhamento da tendência da média móvel dupla de banda de Bollinger

- Tendência média móvel na sequência da estratégia de negociação

- Tendência do MACD Seguindo a Estratégia

- Estratégia de negociação quantitativa da Octa-EMA e da Ichimoku Cloud

- A estratégia de faixa de média móvel suave

- Estratégia de negociação de caixa de alta baixa de 52 semanas

- Estratégia de negociação de oscilação entre médias móveis

- Estratégia de ruptura do RSI

- Estratégia dinâmica ATR de tração de paragem de perdas

- Estratégia de negociação de ruptura de volatilidade

- Estratégia de acompanhamento da tendência de reversão do ímpeto

- Estratégia de RSI de intervalo estocástico sobrevendido e sobrecomprado