Estratégia de rompimento de dupla confirmação

Visão geral

A estratégia combina um sinal de ruptura em um ciclo de 4 horas e um período de tempo solar, verificando a forma da linha K antes de emitir um sinal de negociação, permitindo uma estratégia de ruptura mais confiável.

Princípio da estratégia

A estratégia de dupla confirmação de ruptura identifica pontos de ruptura mais eficazes, considerando a consistência da tendência de curto e longo períodos, usando uma combinação de sinais de ruptura de curto e longo períodos. Concretamente, a estratégia calcula a média em períodos de 4 horas e dia, respectivamente, e gera um sinal de compra quando a média de curto período quebra a média de longo período, e a ruptura oposta gera um sinal de venda. Além disso, a estratégia também verifica a forma da linha K atual antes de emitir o sinal de negociação, evitando abrir posições na linha K do apsing.

Através do mecanismo de dupla confirmação e filtragem de linha K acima mencionado, pode-se evitar efetivamente o risco de perda de múltiplos cabeçalhos ou de cabeçalho vazio, melhorando a qualidade do sinal de negociação.

Análise de vantagens

A dupla quebra de ciclo de tempo melhora a qualidade do sinal. A combinação de 4 horas e diagrama permite que o sinal tenha a vantagem de acompanhar tendências de curto prazo e referenciar tendências de longo prazo.

Verificação de forma de K-linha, para evitar erros de sinal. Antes de emitir o sinal, a forma de verificação pode ser filtrada para evitar falhas de ruptura ou rupturas de inércia, para evitar perdas.

Optimização automática, flexibilidade e conveniência. Os parâmetros de ruptura e os parâmetros de ciclo da estratégia podem ser configurados de forma personalizada, permitindo que o usuário escolha a melhor combinação de parâmetros de acordo com diferentes variedades de negociação e mercados.

Análise de Riscos

A estratégia de dupla ruptura tem uma fraca capacidade de acompanhar o mercado em um período de forte queda. A estratégia pode perder o seu ponto de vantagem quando ocorrem situações agudas em períodos curtos e longos.

O mecanismo de verificação de forma K pode perder algumas oportunidades. Em casos extremos, a linha K geralmente é distorcida, e o mecanismo de verificação torna a estratégia conservadora e perde certas oportunidades.

Parâmetros inadequados também podem gerar sinais errados. O usuário precisa escolher o parâmetro de dupla ruptura e o parâmetro de linha K apropriados de acordo com a variedade específica. Parâmetros inadequados podem prejudicar o efeito da estratégia.

Os riscos acima mencionados podem ser melhorados e otimizados por meio de ajustes na combinação de parâmetros e configuração de condições de parada de perda.

Direção de otimização

Combinando os indicadores de taxa de flutuação para a segunda verificação de ruptura. Por exemplo, o sinal de ruptura emitido quando a Bollinger Bands se espremem, a qualidade será maior.

A adição de um módulo de parada de perda. A configuração adequada de parada de perda pode bloquear os lucros e evitar os riscos de forma proativa.

Optimizar os parâmetros de dupla ruptura. Os parâmetros podem ser ajustados com base nas características da variedade, como a taxa de flutuação diária e a taxa de flutuação diária.

Optimizar os parâmetros de verificação de linhas K. Verificação de linhas K em diferentes períodos e combinações de parâmetros, pode obter resultados mais estáveis.

Resumir

A estratégia de ruptura de dupla confirmação é uma estratégia de ruptura de linha curta recomendada, que permite um equilíbrio efetivo entre a eficiência financeira e a qualidade do sinal, através da combinação de mecanismos de verificação de dupla duração e forma de linha K. O usuário pode ajustar os parâmetros relevantes de acordo com suas próprias necessidades para obter melhores resultados.

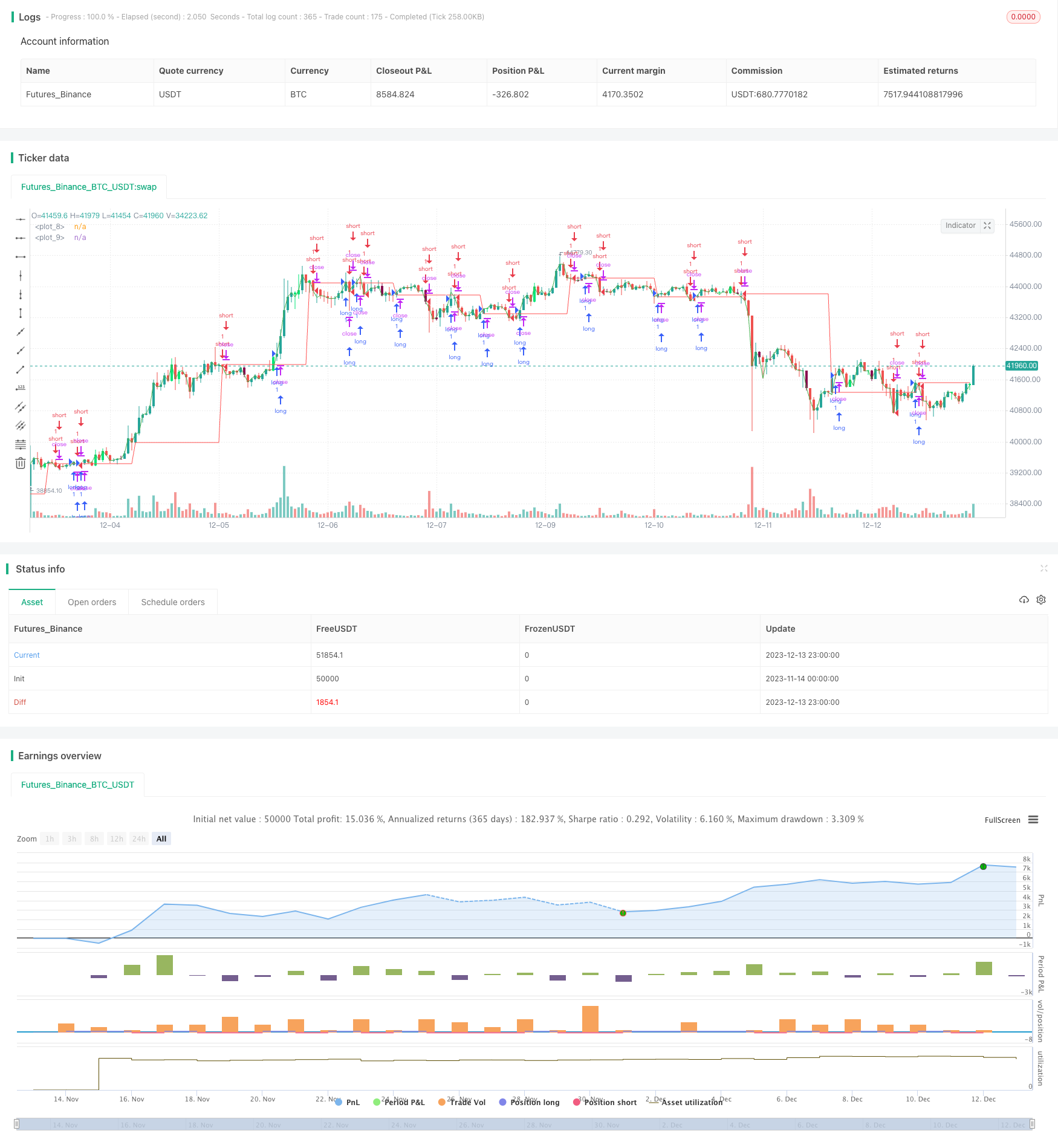

/*backtest

start: 2023-11-14 00:00:00

end: 2023-12-14 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy("breakout ", overlay=true)

tim=input('1440')

sim=input('370')

out1 = request.security(syminfo.tickerid, tim, open)

out2 = request.security(syminfo.tickerid, sim, close)

plot(out1,color=red)

plot(out2,color=green)

length = input(20, title="BB Length")

mult = input(2.0,title="BB MultFactor")

lengthKC=input(20, title="KC Length")

multKC = input(1.5, title="KC MultFactor")

useTrueRange = input(true, title="Use TrueRange (KC)", type=bool)

// Calculate BB

source = close

basis = sma(source, length)

dev = multKC * stdev(source, length)

upperBB = basis + dev

lowerBB = basis - dev

// Calculate KC

ma = sma(source, lengthKC)

range1 = useTrueRange ? tr : (high - low)

rangema = sma(range1, lengthKC)

upperKC = ma + rangema * multKC

lowerKC = ma - rangema * multKC

sqzOn = (lowerBB > lowerKC) and (upperBB < upperKC)

sqzOff = (lowerBB < lowerKC) and (upperBB > upperKC)

noSqz = (sqzOn == false) and (sqzOff == false)

val = linreg(source - avg(avg(highest(high, lengthKC), lowest(low, lengthKC)),sma(close,lengthKC)),lengthKC,0)

bcolor = iff( val > 0,iff( val > nz(val[1]), lime, green),iff( val < nz(val[1]), red, maroon))

scolor = noSqz ? blue : sqzOn ? black : gray

//plot(val, color=bcolor, style=histogram, linewidth=4)

//plot(0, color=scolor, style=cross, linewidth=2)

// this section based on Almost Zero Lag EMA [LazyBear]

// Fast MA - type, length

matype = input(defval="HullMA", title="Fast MA Type: SMA, EMA, WMA, VWMA, SMMA, DEMA, TEMA, HullMA, TMA, ZEMA ( case sensitive )")

malength = input(defval=20, title="Moving Average Length", minval=1)

src = input(close,title="Moving average Source")

// Returns MA input selection variant, default to SMA if blank or typo.

variant(type, src, len) =>

v1 = sma(src, len) // Simple

v2 = ema(src, len) // Exponential

v3 = wma(src, len) // Weighted

v4 = vwma(src, len) // Volume Weighted

v5 = na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len // Smoothed

v6 = 2 * v2 - ema(v2, len) // Double Exponential

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v8 = wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) // Hull

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2) // Zero Lag Exponential

v11 = sma(sma(src,len),len) // Trianglular

// return variant, defaults to SMA if input invalid.

type=="EMA"?v2 : type=="WMA"?v3 : type=="VWMA"?v4 : type=="SMMA"?v5 : type=="DEMA"?v6 : type=="TEMA"?v7 : type=="HullMA"?v8 : type=="ZEMA"?v10 : type=="TMA"?v11 : v1

// Calculate selected MA and get direction of trend from it.

zlema= variant(matype,src,malength)

col = zlema > zlema[1] ? green : red

up = zlema > zlema[1] ? 1 : 0

down = zlema < zlema[1] ? 1 : 0

//plot(zlema,color=col, style=line, linewidth=4, transp=0)

// Find all Fractals.

// This section based on [RS]Fractal Levels by RicardoSantos

hidefractals = input(false)

hidelevels = input(false)

topfractal = high[2] > high[1] and high[2] > high and high[2] > high[3] and high[2] > high[4]

botfractal = low[2] < low[1] and low[2] < low and low[2] < low[3] and low[2] < low[4]

//plotshape(hidefractals ? na : topfractal, color=green, transp=0, style=shape.triangleup, location=location.abovebar, offset=-2, size=size.tiny)

//plotshape(hidefractals ? na : botfractal, color=red, transp=0, style=shape.triangledown, location=location.belowbar, offset=-2, size=size.tiny)

topfractals = topfractal ? high[2] : topfractals[1]

botfractals = botfractal ? low[2] : botfractals[1]

topfcolor = topfractals != topfractals[1] ? na : green

botfcolor = botfractals != botfractals[1] ? na : red

//plot(hidelevels ? na : topfractals, color=topfcolor, transp=0, linewidth=2)

//plot(hidelevels ? na : botfractals, color=botfcolor, transp=0, linewidth=2)

//

// This section based on Candlestick Patterns With EMA by rmwaddelljr

//

ufb = input(false, title="Use Fractal S/R Cross Patterns")

udc = input(true, title="Use Dark Cloud Cover Patterns" )

upl = input(true, title="Use Piecing Line Patterns" )

ube = input(true, title="Use Engulfing Candle Patterns" )

ubh = input(true, title="Use Harami Candle Patterns" )

upb = input(true, title="Use Defined PinBar Patterns")

pctP = input(66, minval=1, maxval=99, title="Directional PBars, % of Range of Candle the Long Wick Has To Be")

// This section based on CM_Price-Action-Bars by ChrisMoody

// Change the pin bar calculation, so can be used for market direction.

urpb= input(false, title="Use CM Price Action Reversal Pin Bars")

usb = input(false, title="Use CM Price Action Shaved Bars")

uob = input(false, title="Use CM Price Action Outside Bars")

uib = input(false, title="Use CM Price Action Inside Bars")

pctRP = input(72, minval=1, maxval=99, title="CM Reversal PBars, % of Range of Candle the Long Wick Has To Be")

pctS = input(5, minval=1, maxval=99, title="CM Shaved Bars, % of Range it Has To Close On The Lows or Highs")

pblb =input(6,minval=1,title="CM Reversal Pin Bar Lookback Length")

//

stnd = input(true, title="Alert Only Patterns Following Trend")

//

// Get MACD for Alert Filtering

umacd = input(true,title="Alert Only Patterns Confirmed by MACD")

fastMA = input(title="MACD Fast MA Length", defval = 12, minval = 2)

slowMA = input(title="MACD Slow MA Length", defval = 26, minval = 7)

signal = input(title="MACD Signal Length",defval=9,minval=1)

//

sgb = input(false, title="Check Box To Turn Bars Gray")

salc = input(true, title="Show Alert condition Dot")

//

[currMacd,_,_] = macd(close[0], fastMA, slowMA, signal)

[prevMacd,_,_] = macd(close[1], fastMA, slowMA, signal)

plotColor = currMacd > 0 ? currMacd > prevMacd ? green : red : currMacd < prevMacd ? red : green

// Show alert on this bar?

sbarUp = (not umacd or plotColor == green) and (not stnd or up)

sbarDn = (not umacd or plotColor == red) and (not stnd or down)

//PBar Percentages

pctCp = pctP * .01

//Shaved Bars Percentages

pctCs = pctS * .01

pctSPO = pctCs

//ma50 = sma(close,50)

range = high - low

///Reversal PinBars

pctCRp = pctRP * .01

pctCRPO = 1 - pctCRp

//

//pBarRUp= upb and open<close and open > high - (range * pctCRPO) and close > high - (range * pctCRPO) and low <= lowest(pblb) ? 1 : 0

//pBarRDn = upb and open>close and open < high - (range * pctCRp) and close < high-(range * pctCRp) and high >= highest(pblb) ? 1 : 0

pBarRUp = urpb and open > high - (range * pctCRPO) and close > high - (range * pctCRPO) and low <= lowest(pblb) ? 1 : 0

pBarRDn = urpb and open < high - (range * pctCRp) and close < high-(range * pctCRp) and high >= highest(pblb) ? 1 : 0

//Shaved Bars filter to the MA50 line

sBarUp = usb and (close >= (high - (range * pctCs))) // and close>ma50

sBarDown = usb and (close <= (low + (range * pctCs))) // and close<ma50

//Inside Bars

insideBarUp = uib and (high < high[1] and low > low[1])

insideBarDn = uib and (high < high[1] and low > low[1])

outsideBarUp= uob and (high > high[1] and low < low[1])

outsideBarDn= uob and (high > high[1] and low < low[1])

// PinBars representing possible change in trend direction

barcolor(pBarRUp ? green : na)

barcolor(pBarRDn ? red : na)

//Shaved Bars

barcolor(sBarDown ? fuchsia : na)

barcolor(sBarUp ? aqua : na)

//Inside and Outside Bars

barcolor((insideBarUp or insideBarDn)? yellow : na )

barcolor((outsideBarUp or outsideBarDn) ? orange : na )

//Long shadow PinBars supporting market direction

///PinBars Long Upper Shadow represent selling pressure

pBarDn = upb and open < high - (range * pctCp) and close < high - (range * pctCp)

//plotshape(pBarDn and (not pBarRUp and not pBarRDn), title= "Bearish Pin Bar", color=red, style=shape.arrowdown, text="Bearish\nPinBar")

///PinBars with Long Lower Shadow represent buying pressure

pBarUp = upb and open > low + (range * pctCp) and close > low + (range * pctCp)

//plotshape(pBarUp and (not pBarRUp and not pBarRDn), title= "Bullish Pin Bar", location=location.belowbar, color=green, style=shape.arrowup, text="Bullish\nPinBar")

dcc = udc and (close[1]>open[1] and abs(close[1]-open[1])/range[1]>=0.7 and close<open and abs(close-open)/range>=0.7 and open>=close[1] and close>open[1] and close<((open[1]+close[1])/2))

//plotshape(dcc, title="Dark Cloud Cover",text='DarkCloud\nCover',color=red, style=shape.arrowdown,location=location.abovebar)

ts = timestamp(2021,8,1,8,18)

pln= upl and (close[1]<open[1] and abs(open[1]-close[1])/range[1]>=0.7 and close>open and abs(close-open)/range>=0.7 and open<=close[1] and close<open[1] and close>((open[1]+close[1])/2))

//plotshape(pln, title="Piercieng Line",text="Piercing\nLine",color=green, style=shape.arrowup,location=location.belowbar)

beh = ubh and (close[1] > open[1] and open > close and open <= close[1] and low >= open[1] and open - close < close[1] - open[1] and (high < high[1] and low > low[1]))

//plotshape(beh and not dcc, title= "Bearish Harami", color=red, style=shape.arrowdown, text="Bear\nHarami")

blh = ubh and (open[1] > close[1] and close > open and close <= open[1] and high <= open[1] and close - open < open[1] - close[1] and (high < high[1] and low > low[1]))

//plotshape(blh and not pln, title= "Bullish Harami", location=location.belowbar, color=green, style=shape.arrowup, text="Bull\nHarami")

bee = ube and (close[1] > open[1] and close < open and close<=low[1] and open>= close[1])

//plotshape(bee, title= "Bearish Engulfing", color=red, style=shape.arrowdown, text="Bearish\nEngulf")

ble = ube and (close[1] < open[1] and close > open and close >= high[1] and open<=close[1])

//plotshape(ble, title= "Bullish Engulfing", location=location.belowbar, color=green, style=shape.arrowup, text="Bullish\nEngulf")

blfr = ufb and crossover(close,topfractals)

//plotshape(blfr and not ble and not blh and not sBarUp, title= "Bullish Fractal Cross", location=location.belowbar, color=green, style=shape.arrowup, text="Fractal\nCross")

befr = ufb and crossunder(close,botfractals)

//plotshape(befr and not bee and not beh and not sBarDown, title= "Bearish Fractal Cross", color=red, style=shape.arrowdown, text="Fractal\nCross")

//

//

bcolorDn = sbarDn and not(pBarRDn or pBarRUp or sBarDown or insideBarDn or outsideBarDn) and (beh or bee or dcc or befr or pBarDn)

bcolorUp = sbarUp and not(pBarRDn or pBarRUp or sBarUp or insideBarUp or outsideBarUp) and (blh or ble or pln or blfr or pBarUp)

barcolor(bcolorDn ? maroon : na)

barcolor(bcolorUp ? lime : na)

//

barcolor(sgb and close ? gray : na)

bullcnd = pBarUp or pln or blh or ble or blfr

bearcnd = pBarDn or dcc or beh or bee or befr

if(true )

longCondition = crossover(out2,out1)

if(longCondition or close > out1 and bullcnd and strategy.position_size == 0)

strategy.entry("long", strategy.long)

//if (pBarRUp) // and bullcnd) //and strategy.position_size == 0)

// strategy.entry("long", strategy.long)

shortCondition = crossunder(out2,out1)

if (shortCondition or close < out1 and bearcnd and strategy.position_size == 0)

strategy.entry("short", strategy.short)

//

barAlertDn = (sbarDn and (befr or bee or beh or pBarDn or dcc)) or (sbarDn and (insideBarDn or outsideBarDn or sBarDown)) or pBarRDn

barAlertUp = (sbarUp and (blfr or ble or blh or pBarUp or pln)) or (sbarUp and (insideBarUp or outsideBarUp or sBarUp)) or pBarRUp

barAlert = barAlertDn or barAlertUp

alertcondition(barAlert,title="CDLTRD Alert", message="CDLTRD Bar Alert")

// show only when alert condition is met and bar closed.

//plotshape(salc and barAlert[1],title= "Alert Indicator Closed", location=location.bottom, color=barAlertDn[1]?red:green, transp=0, style=shape.circle,offset=-1)

//EOF

//if (pBarRDn) //and bearcnd//and strategy.position_size == 0)

// strategy.entry("short", strategy.short)

//strategy.close("long", when = exit)

//strategy.close("short", when = exit2)

//exit3 = sqzOn and sqzOn[1] and sqzOn[2] and sqzOn[3] and sqzOn[4] and sqzOn[5] and sqzOn[6]

//strategy.close("long", when = exit3)

//strategy.close("short", when = exit3)

//else

// alertcondition(condition = time > t, message = "Time exceeded")