Estratégia de negociação de curto prazo baseada na reversão da média móvel

Visão geral

A estratégia de linha média invertida é uma estratégia de negociação de linha curta baseada na inversão da linha média. Combina vários indicadores, como a faixa de Brin, o RSI e o CCI, para capturar mudanças nas condições de linha curta nos mercados financeiros e alcançar o objetivo de negociação de baixa e alta.

A estratégia é usada principalmente em variedades de alta liquidez, como índices de ações, divisas e metais preciosos. Ela busca maximizar o lucro de cada um, enquanto controla o risco-receita da negociação geral.

Princípio da estratégia

Use a faixa de Brin para determinar a área de desvalorização do preço. Considere o short quando o preço estiver perto da faixa de Brin e o long quando o preço estiver perto da faixa de Brin.

Em combinação com o indicador RSI para determinar se há excesso de compra ou venda. O indicador RSI pode identificar efetivamente o excesso de compra ou venda.

O indicador CCI é sensível a situações anormais e pode efetivamente capturar oportunidades de reversão de preços.

Os preços estão acima da média de 5 dias e abaixo da média de 5 dias. A posição da média representa a principal faixa de preços atual, e a relação entre a média e o preço reflete a mudança de tendência potencial.

Após a confirmação do sinal de entrada, o setor de liquidação rápida tira o lucro. De acordo com a situação de retirada, configure o stop loss para sair, para obter uma alta taxa de vitória.

Vantagens estratégicas

- Combinação de múltiplos indicadores para melhorar a precisão do sinal

A estratégia de linha de média inversa usa vários indicadores ao mesmo tempo, como a faixa de Brin, o RSI e o CCI. Estes indicadores são mais sensíveis às mudanças de preço, e a combinação pode melhorar a precisão do sinal e reduzir os sinais errados.

- Regras rígidas de entrada no mercado para evitar a queda

A estratégia exige que os sinais dos indicadores e os preços apareçam em sincronia, evitando que um único indicador induza a erro. Ao mesmo tempo, exige que os preços tenham sido claramente reversos, reduzindo o risco associado.

- Mecanismos eficientes de prevenção e controle de perdas individuais

A estratégia estabelece uma linha de parada mais rígida, independentemente de fazer mais curto prazo. Uma vez que o preço quebra a linha de parada na direção negativa, a estratégia é interrompida rapidamente, evitando grandes perdas individuais.

- O objetivo é maximizar o lucro de cada peça.

A estratégia define dois objetivos de stop-loss para obter ganhos em etapas. Ao mesmo tempo, o stop-loss de rastreamento é ajustado em pequenas etapas após o stop-loss, aumentando o espaço de ganho de cada um.

Análise de Riscos

- Os preços flutuaram e o stop loss foi desencadeado.

Em situações de forte flutuação de preços, a linha de parada pode ser rompida, causando prejuízos desnecessários. Isso geralmente ocorre em situações de flutuação anormal de preços causada por eventos importantes.

Pode-se responder a esse risco expandindo o limiar de perda, evitando, ao mesmo tempo, a operação durante um evento importante.

- Perseguição é violenta e irreversível

Quando a tendência é muito forte, os preços tendem a subir muito rápido e não conseguem reverter a tendência a tempo.

Nesse caso, deve-se esperar até que a tendência de aumento dos preços diminua de forma significativa para considerar a intervenção.

Direção de otimização

- Otimização de parâmetros de indicadores para melhorar a precisão do sinal

Pode testar os resultados de feedback sob diferentes combinações de parâmetros, selecionando o melhor parâmetro. Por exemplo, os parâmetros que podem otimizar o RSI, os parâmetros do CCI, etc.

- Indicadores de energia combinada para determinar o momento de uma verdadeira reversão

Pode ser adicionado um indicador de potência equivalente de volume de transação ou largura de banda de Brin. Isso pode evitar que o preço seja apenas um pequeno ajuste e gerar um sinal de erro.

- Optimizar a estratégia de stop loss para expandir o lucro individual

É possível testar diferentes pontos de stop loss para maximizar cada ganho. Ao mesmo tempo, é necessário equilibrar o risco para evitar que o stop loss seja facilmente acionado.

Resumir

A estratégia de linha de equilíbrio de reversão utiliza um conjunto de indicadores de discernimento, com características de precisão de sinal, especificações de operação e controle de risco. Ela é adequada para variedades de alta sensibilidade às mudanças no mercado, com forte liquidez, capaz de capturar oportunidades de reversão de preços entre a faixa de Bryn e a linha de equilíbrio crítica, para atingir o objetivo de negociação de baixa e alta.

Na prática, ainda é necessário prestar atenção à otimização dos parâmetros do indicador, combinando a quantidade com a capacidade do indicador de determinar o momento da verdadeira reversão. Além disso, é necessário fazer um bom gerenciamento de risco para lidar com a forte flutuação dos preços. Se aplicada corretamente, a estratégia pode obter um rendimento Alfa relativamente estável.

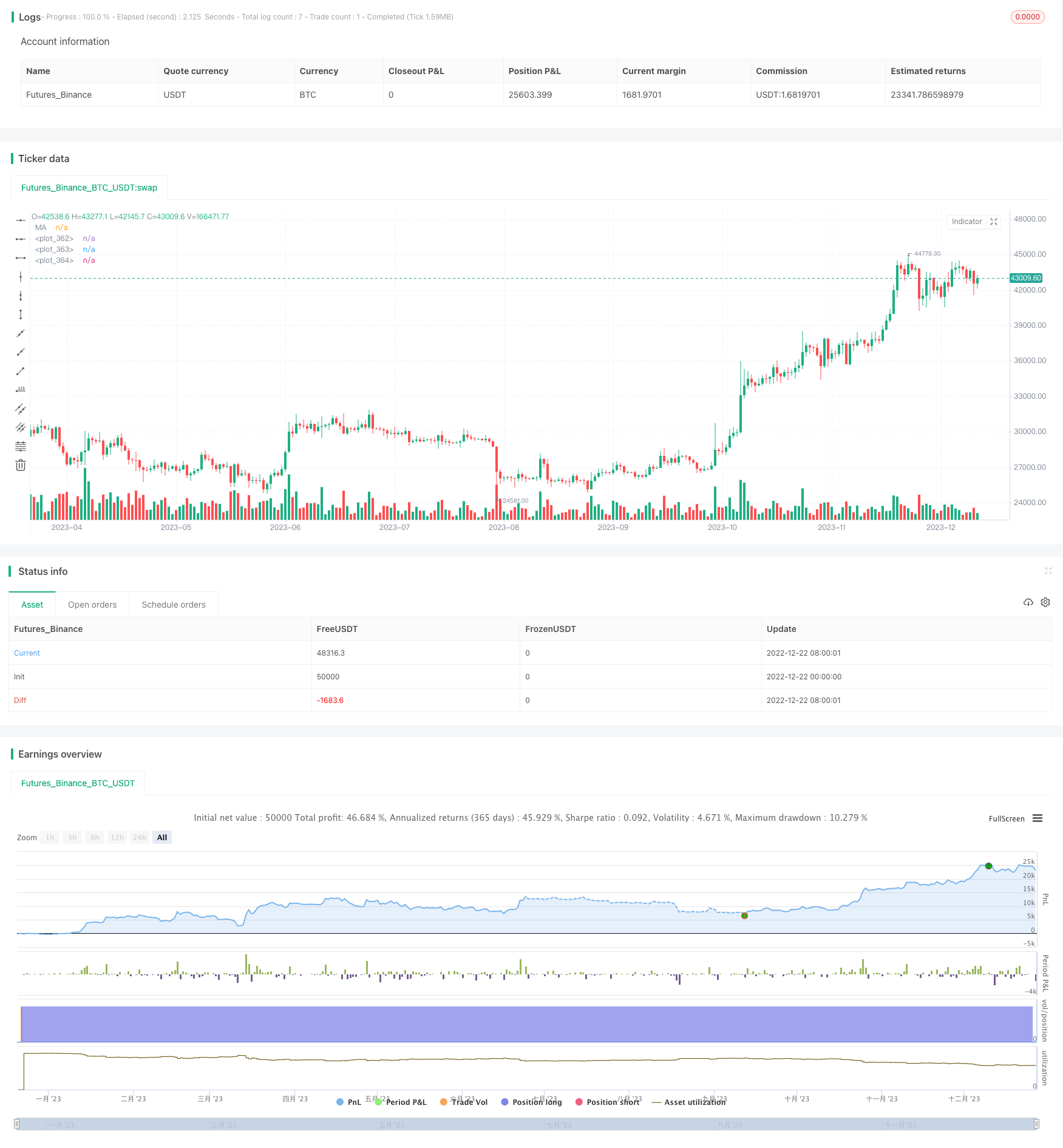

/*backtest

start: 2022-12-22 00:00:00

end: 2023-12-28 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sg1999

//@version=4

// >>>>>strategy name

strategy(title = "CCI-RSI MR", shorttitle = "CCI-RSI MR", overlay = true)

// >>>>input variables

// 1. risk per trade as % of initial capital

risk_limit = input(title="Risk Limit (%)", type=input.float, minval=0.1, defval=2.0, step=0.1)

// 2. drawdown

Draw_down = input(title="Max Drawdown (x ATR)", type=input.float, minval=0.5, maxval=10, defval=2.0, step=0.1)

// 3. type of stop loss to be used

original_sl_type = input(title="SL Based on", defval="Close Price", options=["Close Price","Last Traded Price"])

// 4. entry signal validity for bollinger strategies

dist_from_signal= input(title="Entry distance from signal", type=input.integer, minval=1, maxval=20, defval=3, step=1)

// 5. multiple exit points

exit_1_pft_pct = input(title="1st exit when reward is", type=input.float, minval=0.5, maxval=100, defval=1.0, step=0.1)

exit_1_qty_pct = input(title="1st exit quantity %", type=input.float, minval=1, maxval=100, defval=100, step=5)

exit_2_pft_pct = input(title="2nd exit when reward is", type=input.float, minval=0.5, maxval=100, defval=1.5, step=0.1)

sl_trail_pct = input(title="Trailing SL compared to original SL", type=input.float, minval=0.5, maxval=100, defval=0.5, step=0.5)

//show signal bool

plotBB = input(title="Show BB", type=input.bool, defval=true)

plotSignals = input(title="Show Signals", type=input.bool, defval=true)

// 6. date range to be used for backtesting

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 1, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 1990, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2022, title = "Thru Year", type = input.integer, minval = 1970)

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true

// >>>>>strategy variables

//input variables

current_high = highest(high, 5) // swing high (5 period)

current_low = lowest(low, 5) // swing low (5 period)

current_ma = sma(close, 5) // Simple Moving average (5 period)

atr_length = atr(20) // ATR (20 period)

CCI = cci(close,20) // CCI (20 period)

RSI = rsi(close,14) // RSI (14 period)

RSI_5 = sma (RSI, 5) // Simple moving average of RSI (5 period)

// 1. for current candle

long_entry = false

short_entry = false

risk_reward_ok = false

sl_hit_flag = false

tsl_hit_flag = false

sl_cross = false

// 2. across candles

var RSI_short = false //short signal boolean

var RSI_long = false //long signal boolean

var cci_sell = false //sellsignal crossunder boolean

var cci_buy = false //buy signal crossover boolean

var bar_count_long = 0 // Number of bars after a long signal

var bar_count_short = 0 // Number of bars after a short signal

var candles_on_trade = 0

var entry_price = 0.00

var sl_price = 0.00

var qty = 0

var exit_1_qty = 0

var exit_2_qty = 0

var exit_1_price = 0.0

var exit_2_price = 0.0

var hold_high = 0.0 // variable used to calculate Trailing sl

var hold_low = 0.0 // variable used to calculate Trailing sl

var tsl_size = 0.0 // Trailing Stop loss size(xR)

var sl_size = 0.0 // Stop loss size (R)

var tsl_price = 0.0 //Trailing stoploss price

// >>>>>strategy conditions.

// Bollinger bands (2 std)

[mBB0,uBB0,lBB0] = bb(close,20,2)

uBB0_low= lowest(uBB0,3) // lowest among upper BB of past 3 periods

lBB0_high= highest(lBB0,3) //highest among upper BB of past 3 periods

//RSI and CCI may not necessarily crossunder on the same candle

t_sell_RSI = sum( crossunder(RSI,RSI_5)? 1 : 0, 2) == 1 // checks if crossunder has happened in the last 3 candles (including the current candle)

t_sell_CCI = sum( crossunder(CCI,100)? 1 : 0, 2) == 1 //and (CCI >50)

t_buy_RSI = sum( crossover(RSI,RSI_5)? 1 : 0, 2) == 1 //checks if crossover has happened in the last 3 candles (including the current candle)

t_buy_CCI = sum( crossover(CCI,-100) ? 1 : 0, 2) == 1 //and (CCI<-50)

// CONDITIONS FOR A SELL signal

if t_sell_RSI and t_sell_CCI and (current_high >= uBB0_low)

cci_sell := true

bar_count_short := 0

if cci_sell and strategy.position_size ==0

bar_count_short := bar_count_short + 1

if cci_sell and bar_count_short<= dist_from_signal and close <= current_ma and strategy.position_size ==0

RSI_short := true

//conditions for a BUY signal

if t_buy_RSI and t_buy_CCI and (current_low <= lBB0_high) // or current_low_close <= lBB01_high)

cci_buy := true

bar_count_long := 0

if cci_buy and strategy.position_size ==0

bar_count_long := bar_count_long + 1

if cci_buy and bar_count_long<= dist_from_signal and close >= current_ma and strategy.position_size ==0

RSI_long := true

if RSI_long and RSI_short

RSI_long := false

RSI_short := false

// >>>>>entry and target specifications

if strategy.position_size == 0 and RSI_short

short_entry := true

entry_price := close

sl_price := current_high + syminfo.mintick // (swing high + one tick) is the stop loss

sl_size := abs(entry_price - sl_price)

candles_on_trade := 0

tsl_size := abs(entry_price - sl_price)*sl_trail_pct // Here sl_trail_pct is the multiple of R which is used to calculate TSL size

if strategy.position_size == 0 and RSI_long

long_entry := true

entry_price := close

sl_price := current_low - syminfo.mintick //(swing low - one tick) is the stop loss

candles_on_trade := 0

sl_size := abs(entry_price - sl_price)

tsl_size := abs(entry_price - sl_price)*sl_trail_pct // Here sl_trail_pct is the multiple of R which is used to calculate TSL size

if long_entry and short_entry

long_entry := false

short_entry := false

// >>>>risk evaluation criteria

//>>>>> quantity determination and exit point specifications.

if (long_entry or short_entry) and strategy.position_size == 0 // Based on our risk (R), no.of lots is calculated by considering a risk per trade limit formula

qty := round((strategy.equity) * (risk_limit/100)/(abs(entry_price - sl_price)*syminfo.pointvalue))

exit_1_qty := round(qty * (exit_1_qty_pct/100))

exit_2_qty := qty - (exit_1_qty)

if long_entry

exit_1_price := entry_price + (sl_size * exit_1_pft_pct)

exit_2_price := entry_price + (sl_size * exit_2_pft_pct)

if short_entry

exit_1_price := entry_price - (sl_size * exit_1_pft_pct)

exit_2_price := entry_price - (sl_size * exit_2_pft_pct)

// trail SL after 1st target is hit

if abs(strategy.position_size) == 0

hold_high := 0

hold_low := 0

if strategy.position_size > 0 and high > exit_1_price

if high > hold_high or hold_high == 0

hold_high := high

tsl_price := hold_high - tsl_size

if strategy.position_size < 0 and low < exit_1_price

if low < hold_low or hold_low == 0

hold_low := low

tsl_price := hold_low + tsl_size

//>>>> entry conditons

if long_entry and strategy.position_size == 0

strategy.cancel("BUY", window()) // add another window condition which considers day time (working hours)

strategy.order("BUY", strategy.long, qty, comment="BUY @ "+ tostring(entry_price),when=window())

if short_entry and strategy.position_size == 0

strategy.cancel("SELL", window()) // add another window condition which considers day time (working hours)

strategy.order("SELL", strategy.short, qty, comment="SELL @ "+ tostring(entry_price),when=window())

//>>>> exit conditons

tsl_hit_flag := false

//exit at tsl

if strategy.position_size > 0 and close < tsl_price and abs(strategy.position_size)!=qty

strategy.order("EXIT at TSL", strategy.short, abs(strategy.position_size), comment="EXIT TSL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

tsl_hit_flag := true

cci_sell := false

cci_buy := false

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at SL",true)

if strategy.position_size < 0 and close > tsl_price and abs(strategy.position_size)!=qty

strategy.order("EXIT at TSL", strategy.long, abs(strategy.position_size), comment="EXIT TSL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

tsl_hit_flag := true

cci_sell := false

cci_buy := false

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at SL",true)

//>>>>exit at sl

if strategy.position_size > 0 and original_sl_type == "Close Price" and close < sl_price and abs(strategy.position_size)==qty

strategy.cancel("EXIT at SL", true)

strategy.order("EXIT at SL", strategy.short, abs(strategy.position_size),stop= sl_price, comment="EXIT SL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

sl_hit_flag := true

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at TSL",true)

if strategy.position_size < 0 and original_sl_type == "Close Price" and close > sl_price and abs(strategy.position_size)==qty

strategy.cancel("EXIT at SL", true)

strategy.order("EXIT at SL", strategy.long, abs(strategy.position_size), stop = sl_price, comment="EXIT SL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

sl_hit_flag := true

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at TSL",true)

//>>>>>for ltp sl setting

if strategy.position_size > 0 and original_sl_type == "Last Traded Price" and abs(strategy.position_size) ==qty

strategy.order("EXIT at SL", strategy.short, abs(strategy.position_size),stop= sl_price, comment="EXIT SL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at TSL",true)

if strategy.position_size < 0 and original_sl_type == "Last Traded Price" and abs(strategy.position_size) ==qty

strategy.order("EXIT at SL", strategy.long, abs(strategy.position_size), stop = sl_price, comment="EXIT SL @ "+ tostring(close))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

strategy.cancel("EXIT 1", true)

strategy.cancel("EXIT 2", true)

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at TSL",true)

//>>>>>exit at target

if strategy.position_size > 0 and abs(strategy.position_size) == qty and not tsl_hit_flag

strategy.order("EXIT 1", strategy.short, exit_1_qty, limit=exit_1_price, comment="EXIT TG1 @ "+ tostring(exit_1_price))

strategy.cancel("Exit Drawd",true)

cci_sell := false

cci_buy := false

if strategy.position_size > 0 and abs(strategy.position_size) < qty and abs(strategy.position_size) != qty and not tsl_hit_flag

strategy.order("EXIT 2", strategy.short, exit_2_qty, limit=exit_2_price, comment="EXIT TG2 @ "+ tostring(exit_2_price))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at SL", true)

if strategy.position_size < 0 and abs(strategy.position_size) == qty and not tsl_hit_flag

strategy.order("EXIT 1", strategy.long, exit_1_qty, limit=exit_1_price, comment="EXIT TG1 @ "+ tostring(exit_1_price))

strategy.cancel("Exit Drawd",true)

cci_buy := false

cci_sell := false

if strategy.position_size < 0 and abs(strategy.position_size) < qty and abs(strategy.position_size) != qty

strategy.order("EXIT 2", strategy.long, exit_2_qty, limit=exit_2_price, comment="EXIT TG2 @ "+ tostring(exit_2_price))

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

strategy.cancel("Exit Drawd",true)

strategy.cancel("EXIT at SL", true)

//>>>>>>drawdown execution

if strategy.position_size < 0 and original_sl_type == "Close Price" and not tsl_hit_flag

strategy.cancel("Exit Drawd",true)

strategy.order("Exit Drawd", strategy.long, abs(strategy.position_size), stop= (entry_price + Draw_down*atr_length) ,comment="Drawdown exit S")

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

if strategy.position_size > 0 and original_sl_type == "Close Price" and not tsl_hit_flag and not sl_hit_flag

strategy.cancel("Exit Drawd",true)

strategy.order("Exit Drawd", strategy.short, abs(strategy.position_size), stop= (entry_price - Draw_down*atr_length) ,comment="Drawdown exit B")

RSI_short := false

RSI_long := false

bar_count_long := 0

bar_count_short := 0

cci_buy := false

cci_sell := false

//>>>>to add sl hit sign

if strategy.position_size != 0 and sl_hit_flag //For symbols on chart

sl_cross := true

//>>>>>cancel all pending orders if the trade is booked

strategy.cancel_all(strategy.position_size == 0 and not (long_entry or short_entry))

//>>>>plot indicators

p_mBB = plot(plotBB ? mBB0 : na, color=color.teal)

p_uBB = plot(plotBB ? uBB0 : na, color=color.teal, style=plot.style_stepline)

p_lBB = plot(plotBB ? lBB0 : na, color=color.teal, style=plot.style_stepline)

plot(sma(close,5), color=color.blue, title="MA")

//>>>>plot signals

plotshape(plotSignals and RSI_short, style=shape.triangledown, location=location.abovebar, color=color.red)

plotshape(plotSignals and RSI_long, style=shape.triangleup, location=location.belowbar, color=color.green)

plotshape(sl_cross, text= "Stoploss Hit",size= size.normal,style=shape.xcross , location=location.belowbar, color=color.red)

//>>>>plot signal high low

if strategy.position_size != 0

candles_on_trade := candles_on_trade + 1

if strategy.position_size != 0 and candles_on_trade == 1

line.new(x1=bar_index[1], y1=high[1], x2=bar_index[0], y2=high[1], color=color.black, width=2)

line.new(x1=bar_index[1], y1=low[1], x2=bar_index[0], y2=low[1], color=color.black, width=2)

//>>>>end of program