Estratégia de tendência quantitativa baseada em múltiplos factores

Autora:ChaoZhang, Data: 2024-01-12 11:09:40Tags:

Resumo

Esta estratégia considera de forma abrangente fatores como volume de negociação, volatilidade, posição de preço de fechamento, tendência, etc. para identificar oportunidades de negociação.

Princípio da estratégia

A ideia central desta estratégia é identificar pontos de entrada e saída combinando avanços anormais no volume de negociação, posição de fechamento, faixa de volatilidade e outros fatores.

Especificamente, a estratégia calcula o volume médio de negociação durante um período de tempo. Quando o volume de negociação do período atual mostra um avanço anormal significativo, pode indicar uma reversão de tendência. Além disso, se o preço de fechamento estiver perto do limite superior ou inferior da faixa de volatilidade, também implica uma possível reversão de tendência. Combinando o volume de negociação e a posição de fechamento, os pontos de entrada e saída potenciais podem ser julgados inicialmente.

Para verificar os sinais de negociação, esta estratégia também leva em consideração a faixa de volatilidade. Se a volatilidade atual atravessa o nível médio durante um período, ela forma a primeira condição dos sinais de negociação. Em seguida, se o preço de fechamento de uma barra alta cair na metade inferior da faixa de volatilidade com volume crescente, um sinal de venda é gerado. Pelo contrário, se o preço de fechamento de uma barra baixa estiver na metade superior da faixa de volatilidade com volume decrescente, então um sinal de compra é produzido.

Além disso, esta estratégia também utiliza a média móvel para determinar a tendência geral.

Ao integrar os indicadores acima referidos, esta estratégia pode identificar eficazmente os pontos de entrada e saída do mercado.

Vantagens

A maior vantagem desta estratégia é que leva em conta vários fatores para a tomada de decisão, tornando os sinais de negociação mais confiáveis.

- Detectar sinais de reversão da tendência precocemente por volume anormal de negociação.

- Determinar a tendência real por intervalo de volatilidade e posição de fechamento, evitando ruídos de curto prazo.

- Assegurar que a estratégia se alinha com a tendência principal, verificando a média móvel de médio e longo prazo.

- Reduzir as perdas verificando os sinais a partir de vários aspectos.

Riscos

Há também vários riscos desta estratégia:

- Complexo para otimizar parâmetros com múltiplos fatores.

- Incapaz de evitar completamente sinais falsos.

- O julgamento errado das principais tendências pode afetar negativamente o desempenho geral.

- Os parâmetros de volatilidade necessitam de ajustamentos em função dos diferentes ambientes de mercado.

Orientações de otimização

Principais aspectos em que esta estratégia pode ser otimizada:

- Usar modelos de aprendizagem de máquina para ajustar automaticamente parâmetros.

- Adicionar mecanismos de stop loss para controlar os riscos.

- Integrar mais fatores como fluxos de caixa para determinar as principais tendências.

- Parâmetro de volatilidade adaptativa de projeto.

Conclusão

Esta estratégia identifica as chances de negociação, levando em conta vários fatores. As vantagens estão em mecanismos de sinalização abrangentes e desempenho estável, enquanto os principais riscos vêm do ajuste de parâmetros e previsão de tendências principais imprecisas. Algumas técnicas como aprendizado de máquina podem ser aplicadas para uma otimização adicional no futuro.

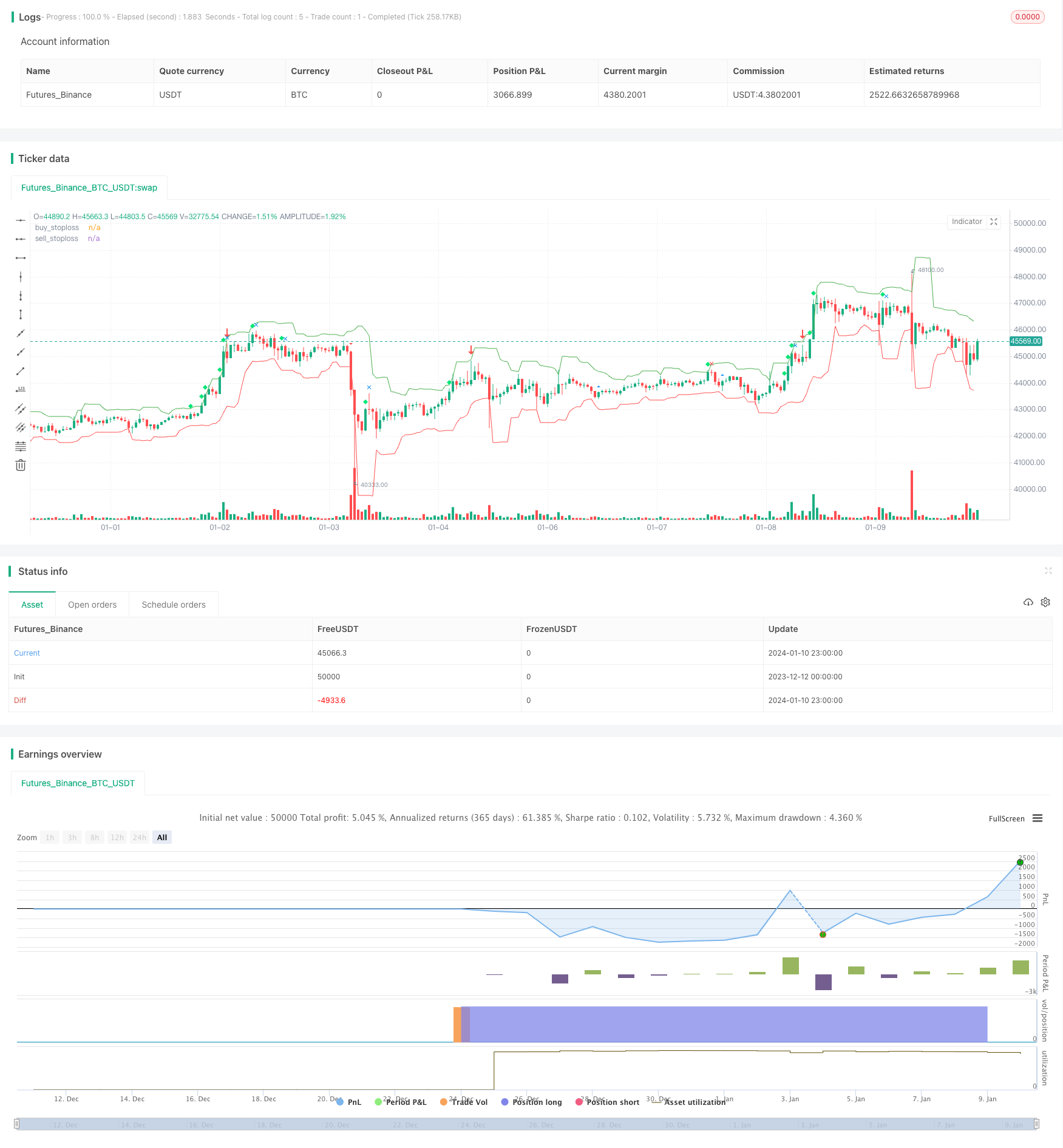

/*backtest

start: 2023-12-12 00:00:00

end: 2024-01-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("volume spread analysis ", overlay=true)

volavg = sma(volume,40)

c= close

l=low

h=high

v=volume

volmean = stdev(volavg,30)

volupband3 = volavg + 3*volmean

volupband2 = volavg + 2*volmean

volupband1 = volavg + 1*volmean

voldnband1 = volavg -1*volmean

voldnband2 = volavg -2*volmean

midprice = (high+low)/2

spread = (high-low)

avgspread = sma(spread,80)

avgspreadbar = spread > avgspread

widerangebar = spread>(1.5*avgspread)

narrowrangebar = spread<(0.7*avgspread)

lowvolume = volume<volume[1] and volume<volume[2]

upbar = close>close[1]

downbar = close<close[1]

highvolume = volume>volume[1] and volume[1]>volume[2]

closefactor = close-low

clsposition = spread/closefactor

closeposition = iff(closefactor==0,avgspread,clsposition)

vb = volume>volavg or volume>volume[1]

upclose = close>=((spread*0.7)+low)// close is above 70% of the bar

downclose = close<=((spread*0.3)+low)// close is below the 30% of the bar

aboveclose = close>((spread*0.5)+low)// close is between 50% and 70% of the bar

belowclose = close<((spread*0.5)+low)// close is between 50% and 30% of the bar

midclose = close>((spread*0.3)+low) and c<((spread*0.7)+l)// close is between 30% and 70% of the bar

verylowclose = closeposition>4//close is below 25% of the bar

veryhighclose = closeposition<1.35// close is above 80% of the bar

closepos = iff(close<=((spread*0.2)+low),1,iff(close<=((spread*0.4)+low),2,iff(close<=((spread*0.6)+low),3,iff(close<=((spread*0.8)+low),4,5))))

// 1 = downclose, 2 = belowclose, 3 = midclose, 4 = aboveclose, 5 = upclose

volpos = iff(volume>volavg*2,1,iff(volume>volavg*1.3,2,iff(volume>volavg,3,iff(volume<volavg and volume>volavg*0.7,4,5))))

//// 1 = very high, 2 = high, 3 = above average, 4 = less than average, 5 = low

freshgndhi = close > highestbars(h,5)

freshgndlo = close < lowestbars(l,5)

//========================trend estimation =========================

//jtrend=sma(close,5)

//trendlongterm = linreg(jtrend,40)

//trendmediumterm = linreg(jtrend,10)

//trendshortterm = linreg(jtrend,3)

//tls=linreg(jtrend,3)

minperiodsrwist = input(title="short term min periods", defval=2, minval=1)

maxperiodsrwist = input(title="short term max periods", defval=8, minval=1)

minperiodsrwilt = input(title="long term min periods", defval=10, minval=1)

maxperiodsrwilt = input(title="long term max periods", defval=40, minval=1)

rwhmins = (high - nz(low[minperiodsrwist])) / (atr(minperiodsrwist) * sqrt(minperiodsrwist))

rwhmaxs = (high - nz(low[maxperiodsrwist])) / (atr(maxperiodsrwist) * sqrt(maxperiodsrwist))

rwhs = max( rwhmins, rwhmaxs )

rwlmins = (nz(high[minperiodsrwist]) - low) / (atr(minperiodsrwist) * sqrt(minperiodsrwist))

rwlmaxs = (nz(high[maxperiodsrwist]) - low) / (atr(maxperiodsrwist) * sqrt(maxperiodsrwist))

rwls = max( rwlmins, rwlmaxs )

rwhminl = (high - nz(low[minperiodsrwilt])) / (atr(minperiodsrwilt) * sqrt(minperiodsrwilt))

rwhmaxl = (high - nz(low[maxperiodsrwilt])) / (atr(maxperiodsrwilt) * sqrt(maxperiodsrwilt))

rwhl = max( rwhminl, rwhmaxl )

rwlminl = (nz(high[minperiodsrwilt]) - low) / (atr(minperiodsrwilt) * sqrt(minperiodsrwilt))

rwlmaxl = (nz(high[maxperiodsrwilt]) - low) / (atr(maxperiodsrwilt) * sqrt(maxperiodsrwilt))

rwll = max( rwlminl, rwlmaxl )

ground = rwhs

sky = rwls

j = rwhs-rwls

k = rwhl-rwll

j2 = rwhl

k2 = rwll

ja = cross(j,1)

jb = cross(1,j)

jc = cross(-1,j)

jd = cross(j,-1)

j2a = cross(j2,1)

j2b = cross(1,j2)

k2a = cross(k2,1)

k2b = cross(1,k2)

upmajoron = j > 1 and ja[1]

upmajoroff = j < 1 and jb[1]

upminoron = j2 > 1 and j2a[1]

upminoroff = j2 < 1 and j2b[1]

dnmajoron = j < -1 and jc[1]

dnmajoroff = j > -1 and jd[1]

dnminoron = k2 > 1 and k2a[1]

dnminoroff = k2 < 1 and k2b[1]

upimd = iff(ground > 1, 1,0)

dnimd = iff(sky > 1, 1, 0)

upmajor = iff(j>1,1,iff(j<(-1),-1,0))

upminor = iff(j2>1,1,-1)

dnminor = iff(k2>1,1,-1)

//======================================================================|

Buy_stop = lowest(low[1],5) - atr(20)[1]

plot(Buy_stop, color=red, title="buy_stoploss")

Sell_stop = highest(high[1],5) + atr(20)[1]

plot(Sell_stop, color=green, title="sell_stoploss")

//======================================================================|

//upthrustbar = widerangebar and downclose and upimd==1 and high>high[1] //wrb and uhs and fresh ground

nut = widerangebar and downclose and freshgndhi and highvolume // new signal

bc = widerangebar and aboveclose and volume == highest(volume,60) and upmajor==1 // new signal

upthrustbar = widerangebar and (closepos==1 or closepos==2) and upminor>0 and high>high[1] and (upimd>0or upmajor>0) and volpos <4// after minor up trend

upthrustbartrue = widerangebar and closepos==1 and upmajor>0 and high>high[1] and volpos <4//occurs after a major uptrend

upthrustcond1 = upthrustbar[1] and downbar and not narrowrangebar

upthrustcond2 = upthrustbar[1] and downbar and volpos == 2

upthrustcond3 = upthrustbar and volpos ==1

toprevbar = volume[1]>volavg and upbar[1] and widerangebar[1] and downbar and downclose and widerangebar and upmajor>0 and high==highest(high,10)

pseudoupthrust = upbar[1] and high>high[1] and volume[1]>1.5*volavg and downbar and downclose and not upthrustbar

pseudoutcond = pseudoupthrust[1] and downbar and downclose and not upthrustbar

trendchange = upbar[1] and high==highest(high,5) and downbar and (downclose or midclose) and volume>volavg and upmajor>0 and upimd>0 and not widerangebar and not pseudoupthrust

nodemandbarut = upbar and narrowrangebar and lowvolume and closepos> 3 and ((upminor>0 and upimd>0)or (upminor<0 and upminor>0))//in a up market

nodemandbardt = upbar and narrowrangebar and lowvolume and closepos> 3 and (upminor<=0or upimd<=0)// in a down or sidewayss market

nosupplybar = downbar and narrowrangebar and lowvolume and closepos<3 and ((upminor<1 and upimd<1)or (upminor>0 and upimd<1))

lowvoltest = low==lowest(low,5) and upclose and lowvolume//lowvolume and l<low[1] and upclose

lowvoltest1 = low==lowest(low,5) and volume<volavg and low<low[1] and upclose and upminor>0 and upmajor>0// and widerangebar

lowvoltest2 = lowvoltest[1] and upbar and upclose

sellcond1 = (upthrustcond1 or upthrustcond2 or upthrustcond3)

sellcond2 = sellcond1[1]==0

sellcond = sellcond1 and sellcond2

strengthdown0 = upmajor<0 and volpos<4 and downbar[1] and upbar and closepos>3 and upminor<0 and upimd<=0// strength after a long down trend

strengthdown = volpos<4 and downbar[1] and upbar and closepos>3 and upimd<=00 and upminor<0// strength after a down trend

strengthdown1 = upmajor<0 and volume>(volavg*1.5) and downbar[1] and upbar and closepos>3 and upminor<0 and upimd<=0//strength after downtrend . high volume

strengthdown2 = upimd<=0 and volume[1]<volavg and upbar and veryhighclose and volpos<4

buycond1 = strengthdown or strengthdown1

buycond = upbar and buycond1[1]

stopvolume = low==lowest(low,5) and (upclose or midclose) and v>1.5*volavg and upmajor<0

revupthrust = upmajor<0 and upbar and upclose and volume>volume[1] and volume>volavg and widerangebar and downbar[1] and downclose[1] and upminor<0

effortup = high>high[1] and low>low[1] and close>close[1] and close>=((high-low)*0.7+low) and spread>avgspread and volpos<4//and open<=((high-low)*0.3+low)

effortupfail = effortup[1] and (upthrustbar or upthrustcond1 or upthrustcond2 or upthrustcond3 or (downbar and avgspreadbar))

effortdown = high<high[1] and low<low[1] and close<close[1] and close<=((high-low)*0.25+low) and widerangebar and volume>volume[1]//o>=((high-low)*0.75+

effortdownfail = effortdown[1] and ((upbar and avgspreadbar)or revupthrust or buycond1)

upflag = (sellcond or buycond or effortup or effortupfail or stopvolume or effortdown or effortdownfail or revupthrust or nodemandbardt or nodemandbarut or nosupplybar or lowvoltest or lowvoltest1 or lowvoltest2 or bc)

bullbar = (volume>volavg or volume>volume[1]) and closeposition <2 and upbar and not upflag

bearbar = vb and downclose and downbar and spread>avgspread and not upflag

buy = (upbar and revupthrust[1])or lowvoltest2

burely = strengthdown1 and stopvolume[1]or (upbar and revupthrust[1])or lowvoltest2

//buy = effortup and lowvoltest2[1]

//sell = upthrustbartrue

sell = effortup[1] and effortupfail and upthrustcond3 and upthrustbartrue and toprevbar

strategy.entry("simpleBuy", strategy.long, when= (upbar and revupthrust[1])or lowvoltest2 )

strategy.close("simpleBuy",when=upthrustbartrue )

//strategy.entry("simpleSell", strategy.short,when= upthrustbartrue )

//strategy.close("simpleSell",when= (upbar and revupthrust[1])or lowvoltest2)

//|============================================================================================|

//data = close >= open

//plotshape(true, style=shape.flag, color=data ? green : red)

plotshape((upthrustbar or upthrustbartrue) ,title="upthrustbaro" ,style=shape.arrowdown ,size=size.huge,color=red )

//plotshape(toprevbar ,title="toprevbar" ,style=shape.flag ,size=size.small,color=blue )

//plotshape((pseudoupthrust) ,title="(pseudoupthrus" ,style=shape.circle ,size=size.small,color=blue )

//plotshape((upthrustcond1 or upthrustcond2) ,title="upthrustcond1" ,style=shape.triangleup ,size=size.small,color=red )

plotshape(trendchange ,title="trendchange" ,style=shape.xcross ,size=size.small,color=red )

//plotshape((nodemandbardt) ,title="(nodemandbardt" ,style=shape.square ,size=size.small,color=orange )

//plotshape(nosupplybar ,title="nosupplybar" ,style=shape.cross ,size=size.small,color=blue)

plotshape(revupthrust ,title="revupthrust" ,style=shape.arrowup ,size=size.huge,color=green )

//plotshape((upthrustbar or upthrustbartrue) ,title="upthrustbaro" ,style=shape.cross ,size=size.small,color=red )

//plotshape((upthrustcond1 or upthrustcond2) ,title="upthrustcond1" ,style=shape.triangledown ,size=size.small,color=white )

//plotshape((pseudoupthrust) ,title="(pseudoupthrus" ,style=shape.arrowup ,size=size.small,color=blue )

//plotshape(nodemandbarut ,title="nodemandbarut" ,style=shape.labelup ,size=size.small,color=orange )

//plotshape(nodemandbarut ,title="nodemandbarut" ,style=shape.labeldown ,size=size.small,color=yellow )

//plotshape(nodemandbardt ,title="nodemandbardt" ,style=shape.diamond ,size=size.small,color=yellow )

//plotshape(nosupplybar ,title="nosupplybar" ,style=shape.xcross ,size=size.small,color=blue )

plotshape(lowvoltest ,title="lowvoltest" ,style=shape.triangleup ,size=size.small,color=blue )

//plotshape(lowvoltest2 ,title="lowvoltest2" ,style=shape.triangledown ,size=size.small,color=yellow )

//plotshape(strengthdown ,title="strengthdown" ,style=shape.flag ,size=size.small,color=green)

//plotshape(strengthdown ,title="strengthdown" ,style=shape.circle ,size=size.small,color=lime )

//plotshape(strengthdown2 ,title="strengthdown2" ,style=shape.arrowup ,size=size.small,color=silver )

//plotshape(strengthdown2 ,title="strengthdown2" ,style=shape.arrowdown ,size=size.small,color=red )

//plotshape(stopvolume ,title="stopvolume" ,style=shape.labelup ,size=size.small,color=green )

//plotshape(stopvolume ,title="stopvolume" ,style=shape.labeldown ,size=size.small,color=yellow )

plotshape(effortup ,title="effortup" ,style=shape.diamond ,size=size.small,color=lime )

plotshape(effortupfail ,title="effortupfail" ,style=shape.xcross ,size=size.small,color=blue )

//plotshape(effortupfail ,title="effortupfail" ,style=shape.cross ,size=size.small,color=white )

plotshape(effortdown ,title="effortdown" ,style=shape.triangledown ,size=size.small,color=red )

plotshape(effortdownfail ,title="effortdownfail" ,style=shape.xcross ,size=size.small,color=green )

//plotshape(effortdownfail ,title="effortdownfail" ,style=shape.flag ,size=size.small,color=white )

//plotshape(buycond ,title="buycond" ,style=shape.circle ,size=size.small,color=green )

//plotshape(sellcond ,title="sellcond" ,style=shape.arrowup ,size=size.small,color=orange )

//plotshape((nut) ,title="(nut)" ,style=shape.arrowdown ,size=size.small,color=lime )

//plotshape((bc ) ,title="(bc" ,style=shape.labelup ,size=size.small,color=red )

//plotshape(buy ,title="buy" ,style=shape.labeldown ,size=size.small,color=white )

- Estratégia de negociação de poder de touro

- Estratégia de acompanhamento da média móvel diária para o valor do ouro

- Média móvel de vários prazos combinada com as horas de negociação Estratégia quantitativa de negociação

- Estratégia de negociação multi-tempo baseada no MACD

- Estratégia de rastreamento da potência do urso

- Tendência de seguir uma estratégia de negociação baseada em múltiplos indicadores

- Estratégia de Swing Trading com cruzamento da EMA 20/50

- Estratégia optimizada de rastreamento de tendências dinâmicas

- Estratégia de média móvel dupla combinada com indicador estocástico

- Estratégia de acompanhamento da tendência baseada na média móvel e na faixa real da média

- Estratégia de negociação baseada em derivados

- Estratégia MACD Long Only

- Estratégia de tendência cruzada da média móvel

- Estratégia de negociação quantitativa baseada no crossover da SMA

- Estratégia de Stop Loss

- Estratégia de suporte e resistência com ruptura de volume e perda de parada de arrasto

- Mudança de estratégia de stop loss baseada em pontos take profit e stop loss

- Percentagem de estratégia de stop loss

- Estratégia de combinação de dupla média móvel de cruzamento e balanço de potência de "bull bear"

- Estratégia simples do titular