A média móvel tripla combinada com a estratégia quantitativa MACD

Autora:ChaoZhang, Data: 2024-01-17 16:54:15Tags:

Resumo

Esta estratégia desenvolve uma estratégia de negociação quantitativa relativamente estável e fiável, combinando o uso do indicador de média móvel tripla e do indicador MACD.

Princípio da estratégia

A estratégia baseia-se principalmente na combinação da média móvel tripla e do indicador MACD.

Em primeiro lugar, a estratégia usa médias móveis exponenciais triplas com comprimentos de 3, 7 e 2 respectivamente. Estas três médias móveis constroem um sistema de média móvel rápida a lenta para determinar a direção das tendências futuras. Quando a média móvel de curto prazo cruza a média móvel de longo prazo, é um sinal longo; quando a média móvel de curto prazo cruza abaixo da média móvel de longo prazo, é um sinal curto.

Em segundo lugar, a estratégia também usa o indicador MACD com parâmetros de 3 e 7 simultaneamente.

Ao combinar a utilização de indicadores duplos, pode evitar múltiplos falsos sinais causados por um único indicador, melhorando assim a estabilidade da estratégia.

Vantagens da estratégia

- Melhoria da qualidade do sinal através da utilização de filtragem de indicadores duplos

- Os parâmetros foram testados e otimizados muitas vezes, estável e confiável

- O sistema de média móvel tripla pode filtrar eficazmente o ruído do mercado e determinar as tendências futuras

- Os parâmetros do indicador MACD são definidos mais rapidamente para captar rapidamente oportunidades de curto prazo

Riscos da Estratégia

- Existem certos riscos de utilização e perdas consecutivas

- Quando o mercado não tem uma tendência óbvia, haverá mais trocas falsas nesta estratégia

- O indicador MACD é propenso a gerar falsos sinais e precisa ser combinado com indicadores de média móvel

Soluções:

- Adotar uma estratégia de stop loss adequada para controlar a retirada máxima

- Reduzir a frequência de negociação quando o estado do mercado estiver claramente sem tendência

- Otimizar os parâmetros do MACD e utilizar em combinação com outros indicadores

Orientações para a otimização da estratégia

- Teste e otimize os parâmetros das médias móveis e do MACD para encontrar a melhor combinação

- Aumentar os indicadores auxiliares como KDJ e VRSI para evitar falsos sinais

- Introduzir modelos de aprendizagem de máquina para avaliar o estado do mercado e alcançar um ajuste dinâmico

- Combinar com estratégias de stop loss e definir pontos de stop loss ideais

Resumo

Esta estratégia alcança a captura de tendência estável através da combinação de médias móveis e MACD. Sua vantagem reside no uso combinado de indicadores, que podem efetivamente reduzir sinais falsos e obter um melhor desempenho da estratégia.

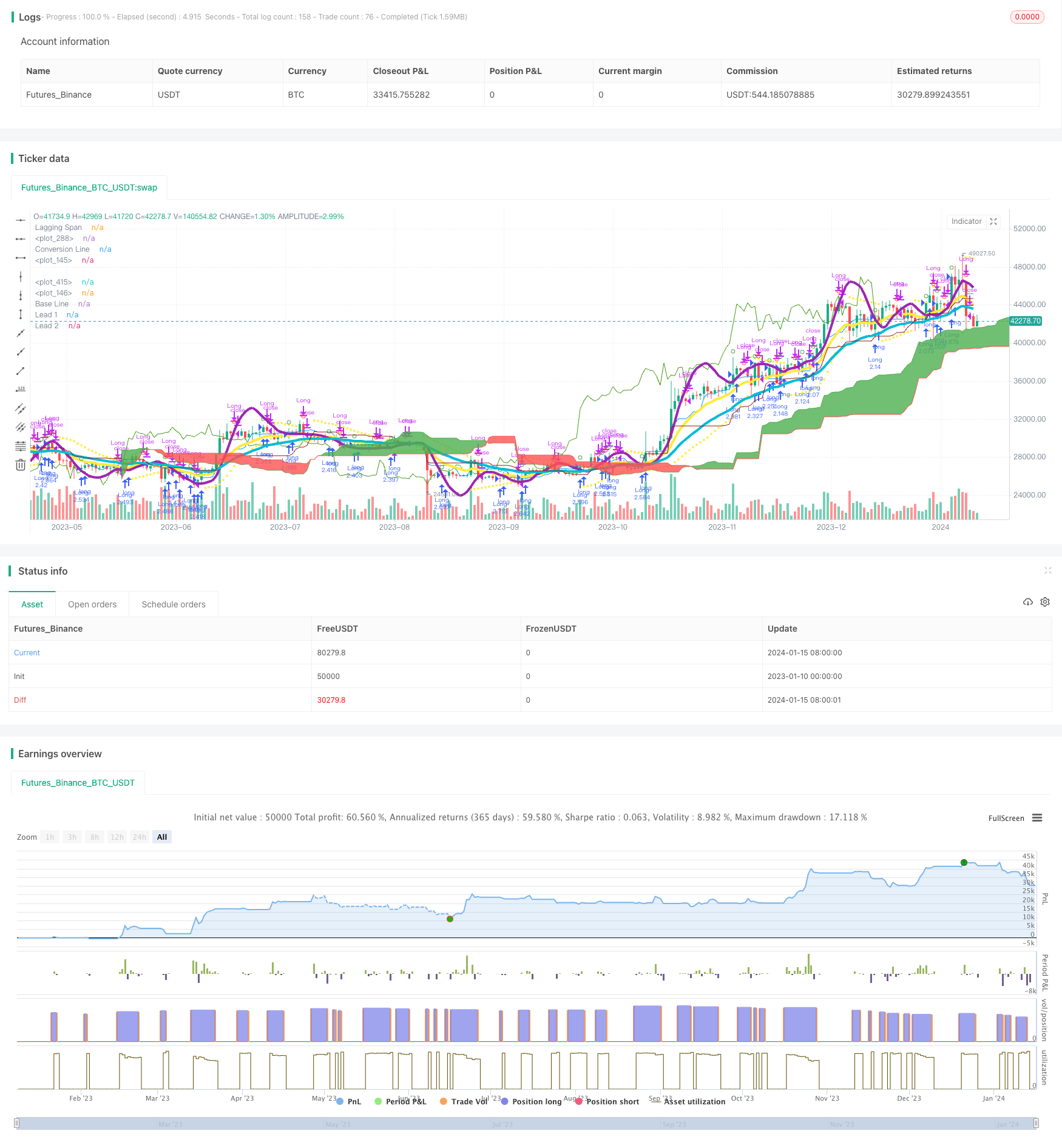

/*backtest

start: 2023-01-10 00:00:00

end: 2024-01-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Matt's MACD Algo v1", shorttitle="Matt's MACD Algo v1", overlay=true, pyramiding = 0, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=7000, calc_on_order_fills = true, commission_type=strategy.commission.percent, commission_value=0, currency = currency.USD)

//study("MFI Fresh", shorttitle="MFI Fresh", overlay=true)

//Risk Management Settings

//trategy.risk.max_drawdown(20, strategy.percent_of_equity)

//strategy.risk.max_intraday_loss(10, strategy.percent_of_equity)

//strategy.risk.max_cons_loss_days(3)

/////////////////

ts = input(title="Trailing Stop in cents", defval=50)/100

//Time Inputs

FromMonth = input(defval = 6, title = "From Month", minval = 1)

FromDay = input(defval = 1, title = "From Day", minval = 1)

FromYear = input(defval = 2017, title = "From Year", minval = 1)

ToMonth = input(defval = 1, title = "To Month", minval = 1)

ToDay = input(defval = 1, title = "To Day", minval = 1)

ToYear = input(defval = 9999, title = "To Year", minval = 1)

//Time Variable

testPeriod() =>

(time > timestamp(FromYear, FromMonth, FromDay, 09, 30)) and (time < timestamp(ToYear, ToMonth, ToDay, 09, 29))

//MA On and MA Colors On? Inputs

switch1=input(false, title="Enable Bar Color?")

switch2=input(true, title="Enable Moving Averages?")

switch3=input(false, title="Enable Background Color?")

switch4=input(false, title="Enable Bolinger Bands?")

switch5=input(false, title="Enable Keltner Channel?")

////////////////////////////////Williams %R

R_length = input(14, minval=1)

R_overBought = input(title="%R Overbought", defval=80)

R_overSold = input(title="%R Oversold", defval=20)

R_upper = highest(R_length)

R_lower = lowest(R_length)

R_out = 100 * (close - R_upper) / (R_upper - R_lower)

WilliamsR_longEntry = crossover(R_out, R_overSold)

WilliamsR_shortEntry = crossunder(R_out, R_overBought)

//plot(R_out)

//R_band1 = hline(R_overSold)

//R_band0 = hline(R_overBought)

//fill(R_band1, R_band0)

////////////////////////////////RSI Variables

rsi_source = close

RSI_Length = input(title="RSI Length", defval=3)

RSI_overBought = input(title="RSI Overbought", defval=80)

RSI_overSold = input(title="RSI Oversold", defval=20)

up = rma(max(change(rsi_source), 0), RSI_Length)

down = rma(-min(change(rsi_source), 0), RSI_Length)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

RSI_longEntry = rsi > 50

//crossover(rsi, RSI_overSold)

RSI_shortEntry = rsi < 50

//crossunder(rsi, RSI_overBought)

//plot(rsi, color=purple)

//band1 = hline(RSI_overBought)

//band0 = hline(RSI_overSold)

//fill(band1, band0, color=purple, transp=90)

//////////////////////Commodity Channel Index

cci_length = input(20, minval=1)

cci_src = input(close, title="Source")

cci_ma = sma(cci_src, cci_length)

cci = (cci_src - cci_ma) / (0.015 * dev(cci_src, cci_length))

cci_longEntry = crossover(cci, -100)

cci_shortEntry = crossunder(cci, 100)

//plot(cci, color=olive)

//cci_band1 = hline(100, color=gray, linestyle=dashed)

//cci_band0 = hline(-100, color=gray, linestyle=dashed)

//fill(cci_band1, cci_band0, color=olive)

//MFI Inputs

MFI_length = input(title="MFI Length", defval=3)

MFI_overBought = input(title="MFI Overbought", defval=80)

MFI_overSold = input(title="MFI Oversold", defval=20)

//MFI Variables

rawMoneyFlow = hlc3 * volume

positiveMoneyFlow = 0.0

positiveMoneyFlow := hlc3 > hlc3[1] ? positiveMoneyFlow + rawMoneyFlow : positiveMoneyFlow

negativeMoneyFlow = 0.0

negativeMoneyFlow := hlc3 < hlc3[1] ? negativeMoneyFlow + rawMoneyFlow : negativeMoneyFlow

moneyFlowRatio = sma(positiveMoneyFlow, MFI_length) / sma(negativeMoneyFlow, MFI_length)

moneyFlowIndex = 100 - 100 / (1 + moneyFlowRatio)

MFI_longEntry = (crossover(moneyFlowIndex, MFI_overSold))

MFI_shortEntry = (crossunder(moneyFlowIndex, MFI_overBought))

///// MFI Plot for STUDY

//plot(moneyFlowIndex, color=#459915)

//MFI_OB=hline(MFI_overBought, title="Overbought", color=#c0c0c0)

//MFI_OS=hline(MFI_overSold, title="Oversold", color=#c0c0c0)

//fill(MFI_overBought, MFI_overSold, color=#9915ff, transp=90)

////VERY SLOW SMA

veryslowLength=input(50,minval=1, title="Very slow SMA")

veryslowSMA = sma(close, veryslowLength)

//MACD Inputs

source = input(close, title="MACD source")

fastLength = input(title="MACD Fast Length", defval=12)

fastLength2 = input(title="MACD Fast Length #2", defval=3)

slowLength = input(title="MACD Slow Length", defval=26)

slowLength2 = input(title="MACD Slow Length #2", defval=7)

MACD_fastsignalSmoothing = input(title="Signal Smoothing", defval=7)

MACD_slowsignalSmoothing = input(title="Signal Smoothing", defval=12)

MACD_fastsignalSmoothing2 = input(title="Signal Smoothing #2", defval=5)

MACD_slowsignalSmoothing2 = input(title="Signal Smoothing #2", defval=9)

MACD_percentthreshold = input(title="MACD % Threshold", defval=-0.0030, step=0.0001)

//MACD variables

fastEMA = ema(source, fastLength)

fastEMA2 = ema(source, fastLength2)

slowEMA = ema(source, slowLength)

slowEMA2 = ema(source, slowLength2)

MACD_Line = fastEMA - slowEMA

MACD_Line2 = fastEMA2 - slowEMA2

MACD_fastsignalLine = ema(MACD_Line, MACD_fastsignalSmoothing)

MACD_slowsignalLine = ema(MACD_Line, MACD_slowsignalSmoothing)

MACD_fastsignalLine2 = ema(MACD_Line2, MACD_fastsignalSmoothing2)

MACD_slowsignalLine2 = ema(MACD_Line2, MACD_slowsignalSmoothing2)

fasthist = MACD_Line - MACD_slowsignalLine

MACD_Histogram2 = MACD_Line2 - MACD_fastsignalLine2

minimum = close * MACD_percentthreshold

SMA = sma(MACD_Line, 10)

// MACD and veryslowSMA Plot for STRATEGY

Fast=plot(switch2?fastEMA:na,color=yellow, linewidth=4)

Slow=plot(switch2?slowEMA:na,color=aqua, linewidth=4)

//VerySlow=plot(switch2?veryslowSMA:na,color=purple,linewidth=4)

//fill(Fast,VerySlow,color=gray)

/////// MACD Plots for STUDY

//plot(fasthist, color=fasthist>0 and fasthist[0]>fasthist[1]?#00ff00:fasthist<=0 and fasthist[0]<fasthist[1]?#f72e2e:fasthist>0 and fasthist[0]<fasthist[1]?#008000:fasthist<0 and fasthist[0]>fasthist[1]?#7f0000:white, style=histogram)

//plot(slowhist, color=slowhist>0 and slowhist[0]>slowhist[1]?#00ff00:slowhist<=0 and slowhist[0]<slowhist[1]?#f72e2e:slowhist>0 and slowhist[0]<slowhist[1]?#008000:slowhist<0 and slowhist[0]>slowhist[1]?#7f0000:white, style=histogram)

//plot(MACD_Line, color=yellow, title="MACD Line")

//plot(MACD_fastsignalSmoothing, color=green, title="Fast Signal Line")

//plot(MACD_slowsignalSmoothing, color=red, title="Slow Signal Line")

//plot(MACD_Line2, color=aqua, title="MACD Line 2")

//plot(MACD_fastsignalSmoothing2, color=orange, title="Fast Signal Line 2")

//plot(MACD_slowsignalSmoothing2, color=white, title="Slow Signal Line 2")

//plot(minimum, color=white, title="% Threshold")

//plot(fasthist, color=fasthist>0 and fasthist[0]>fasthist[1]?#00ff00:fasthist<=0 and fasthist[0]<fasthist[1]?#f72e2e:fasthist>0 and fasthist[0]<fasthist[1]?#008000:fasthist<0 and fasthist[0]>fasthist[1]?#7f0000:white, style=histogram)

//plot(MACD_Histogram2, color=MACD_Histogram2>0?blue:MACD_Histogram2<0?orange:white, style=histogram)

//plot(SMA, color=white, title="SMA")

//MACD Entry Conditions

MACD_longEntry2 = (crossover(MACD_Histogram2, 0))

MACD_shortEntry2 = (crossunder(MACD_Histogram2, 0))

MACD_longEntry = (crossover(fasthist, 0))

MACD_shortEntry = (crossunder(fasthist, 0))

// Colors

//MAtrendcolor = change(veryslowSMA) > 0 ? green : red

//trendcolor = fastEMA > slowEMA and change(veryslowSMA) > 0 and close > slowEMA ? green : fastEMA < slowEMA and change(veryslowSMA) < 0 and close < slowEMA ? red : yellow

//bartrendcolor = close > fastEMA and close > slowEMA and close > veryslowSMA and change(slowEMA) > 0 ? green : close < fastEMA and close < slowEMA and close < veryslowSMA and change(slowEMA) < 0 ? red : yellow

//backgroundcolor = slowEMA > veryslowSMA and MACD_longEntry and MACD_Line > 0 and fastEMA > slowEMA and close[slowLength] > veryslowSMA ? green : slowEMA < veryslowSMA and MACD_shortEntry and MACD_Line < 0 and fastEMA < slowEMA and close[slowLength] < veryslowSMA ? red : na

//barcolor(switch1?bartrendcolor:na)

// Conditional Bar Colors

//backgroundcolor = (MACD_longEntry ? green : MACD_shortEntry ? red : na)

//bgcolor(switch3?backgroundcolor:na,transp=80)

////BOLLINGER BAND Conditions

bb_source = close

bb_length = input(20, minval=1)

bb_mult = input(1.86, minval=0.001, maxval=50)

bb_basis = ema(bb_source, bb_length)

bb_dev = bb_mult * stdev(bb_source, bb_length)

bb_upper = bb_basis + bb_dev

bb_lower = bb_basis - bb_dev

bb_longEntry = crossover(bb_source, bb_lower)

bb_shortEntry = crossunder(bb_source, bb_upper)

plot(switch4?bb_basis:na, color=red, linewidth=4)

p1=plot(switch4?bb_upper:na)

p2=plot(switch4?bb_lower:na)

fill(p1,p2, color=aqua, transp=95)

////KELTNER CHANNEL Inputs/Variables/Plots

KC_useTrueRange = input(true)

KC_length = input(20, minval=1)

KC_mult = input(3.0)

KC_source = input(close, title="Source")

KC_ma = ema(KC_source, KC_length)

KC_range = KC_useTrueRange ? tr : high - low

KC_rangema = ema(KC_range, KC_length)

KC_upper = KC_ma + KC_rangema * KC_mult

KC_lower = KC_ma - KC_rangema * KC_mult

KC_longEntry = crossover(KC_source, KC_lower)

KC_shortEntry = crossunder(KC_source, KC_upper)

plot(switch5?KC_ma:na, color=red, title="Basis")

KC_u = plot(switch5?KC_upper:na, color=red, title="Upper")

KC_l = plot(switch5?KC_lower:na, color=red, title="Lower")

fill(KC_u, KC_l, color=red)

///////////////////ADX

//len = input(title="ADX Length", type=integer, defval=14)

//th = input(title="ADX threshold", type=integer, defval=20)

//TrueRange = max(max(high-low, abs(high-nz(close[1]))), abs(low-nz(close[1])))

//DirectionalMovementPlus = high-nz(high[1]) > nz(low[1])-low ? max(high-nz(high[1]), 0): 0

//DirectionalMovementMinus = nz(low[1])-low > high-nz(high[1]) ? max(nz(low[1])-low, 0): 0

//SmoothedTrueRange = nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1])/len) + TrueRange

//SmoothedDirectionalMovementPlus = nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1])/len) + DirectionalMovementPlus

//SmoothedDirectionalMovementMinus = nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1])/len) + DirectionalMovementMinus

//DIPlus = sma(SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100, len)

//DIMinus = sma(SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100, len)

//DX = abs(DIPlus-DIMinus) / (DIPlus+DIMinus)*100

//ADX = sma(DX, len)

///

//ADX_longEntry = crossover(DIPlus, DIMinus) //or (DIPlus > DIMinus and DIPlus > th and ADX > th)

//ADX_shortEntry = crossover(DIMinus, DIPlus) //or (DIMinus > DIPlus and DIMinus > th and ADX > th)

//DI_long = if DIPlus > DIMinus and ADX > 20 and DIPlus > 20

//plot(DIPlus, color=green, title="DI+")

//plot(DIMinus, color=red, title="DI-")

//plot(ADX, color=black, title="ADX")

//hline(th, color=black, linestyle=dashed)

//////////////////////////////////Playing with RES

r1 = input("5", "Resolution")

r2 = input("15", "Resolution")

r3 = input("30", "Resolution")

r4 = input("60", "Resolution")

o1 = request.security(heikinashi(syminfo.tickerid), r1, MACD_Line[1])

c1 = request.security(heikinashi(syminfo.tickerid), r1, MACD_slowsignalLine[1])

o2 = request.security(heikinashi(syminfo.tickerid), r2, MACD_Line[1])

c2 = request.security(heikinashi(syminfo.tickerid), r2, MACD_slowsignalLine[1])

o3 = request.security(heikinashi(syminfo.tickerid), r3, MACD_Line[1])

c3 = request.security(heikinashi(syminfo.tickerid), r3, MACD_slowsignalLine[1])

o4 = request.security(heikinashi(syminfo.tickerid), r4, MACD_Line[1])

c4 = request.security(heikinashi(syminfo.tickerid), r4, MACD_slowsignalLine[1])

res_long = (o4 > c4 and o3 > c3 and o2 > c2 and o1 > c1)

res_short = (o4 < c4 and o3 < c3 and o2 < c2 and o1 < c1)

///////////////////// Parabolic SAR (stop and reverse)

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

psar = sar(start, increment, maximum)

plot(psar, style=circles, color=yellow)

psar_longEntry = close > psar

psar_longExit = crossunder(close, psar)

psar_shortEntry = close < psar//crossunder(close, psar)

psar_shortExit = crossover(close, psar)

mix = (moneyFlowIndex + rsi)/2

RSI_MFI = ema(mix, input(3))

//color = RSI_MFI > 80 ? red :RSI_MFI < 20 ? green : silver

vrsi = RSI_MFI

rsiBuySell = vrsi[1] < 95 and crossover(vrsi, 95) or vrsi[1] < 90 and crossover(vrsi, 90) or vrsi[1] < 85 and crossover(vrsi, 85) or vrsi[1] < 80 and crossover(vrsi, 80) or vrsi[1] < 75 and crossover(vrsi, 75) or vrsi[1] < 70 and crossover(vrsi, 70) or vrsi[1] < 65 and crossover(vrsi, 65) or vrsi[1] < 60 and crossover(vrsi, 60) or vrsi[1] < 55 and crossover(vrsi, 55) or vrsi[1] < 50 and crossover(vrsi, 50) or vrsi[1] < 45 and crossover(vrsi, 45) or vrsi[1] < 40 and crossover(vrsi, 40) or vrsi[1] < 35 and crossover(vrsi, 35) or vrsi[1] < 30 and crossover(vrsi, 30) or vrsi[1] < 25 and crossover(vrsi, 25) or vrsi[1] < 20 and crossover(vrsi, 20) or vrsi[1] < 15 and crossover(vrsi, 15) or vrsi[1] < 10 and crossover(vrsi, 10) or vrsi[1] < 5 and crossover(vrsi, 5) ? 1 : vrsi[1] > 95 and crossunder(vrsi, 95) or vrsi[1] > 90 and crossunder(vrsi, 90) or vrsi[1] > 85 and crossunder(vrsi, 85) or vrsi[1] > 80 and crossunder(vrsi, 80) or vrsi[1] > 75 and crossunder(vrsi, 75) or vrsi[1] > 70 and crossunder(vrsi, 70) or vrsi[1] > 65 and crossunder(vrsi, 65) or vrsi[1] > 60 and crossunder(vrsi, 60) or vrsi[1] > 55 and crossunder(vrsi, 55) or vrsi[1] > 50 and crossunder(vrsi, 50) or vrsi[1] > 45 and crossunder(vrsi, 45) or vrsi[1] > 40 and crossunder(vrsi, 40) or vrsi[1] > 35 and crossunder(vrsi, 35) or vrsi[1] > 30 and crossunder(vrsi, 30) or vrsi[1] > 25 and crossunder(vrsi, 25) or vrsi[1] > 20 and crossunder(vrsi, 20) or vrsi[1] > 15 and crossunder(vrsi, 15) or vrsi[1] > 10 and crossunder(vrsi, 10) or vrsi[1] > 5 and crossunder(vrsi, 5) ?-1:na

//////////////////////////////////Entry Conditions

//

MA1 = ema(hlc3, input(3))

MA2 = wma(MA1, input(7))

MA3 = ema(MA2, input(2))

MA4 = wma(MA3, input(1))

buy = close > MA4 or hlc3[1] < MA4 and hlc3 > MA4 and rsiBuySell == 1

sell = close < MA4 or hlc3[1] > MA4 and hlc3 < MA4 and rsiBuySell == -1

p=14

CO=close-open

HL=high-low

value1 = (CO + 2*CO[1] + 2*CO[2] + CO[3])/6

value2 = (HL + 2*HL[1] + 2*HL[2] + HL[3])/6

num=sum(value1,p)

denom=sum(value2,p)

RVI=denom!=0?num/denom:0

RVIsig=(RVI+ 2*RVI[1] + 2*RVI[2] + RVI[3])/6

//plot(RVI,color=white,style=line,linewidth=1)

//plot(RVIsig,color=orange,style=line,linewidth=1)

Tenkan_periods = input(9, minval=1, title="Conversion Line Periods"),

Kijun_periods = input(26, minval=1, title="Base Line Periods")

Senkou_Span_B_Length = input(50, minval=1, title="Lagging Span 2 Periods"),

Chikou_Span_Length = input(25, minval=1, title="Displacement")

donchian(len) => avg(lowest(len), highest(len))

Tenkan_sen = donchian(Tenkan_periods)

Kijun_sen = donchian(Kijun_periods)

Senkou_Span_A = avg(Tenkan_sen, Kijun_sen)

Senkou_Span_B = donchian(Senkou_Span_B_Length)

plot(Tenkan_sen, color=#0496ff, title="Conversion Line")

plot(Kijun_sen, color=#991515, title="Base Line")

plot(close, offset = -Chikou_Span_Length, color=#459915, title="Lagging Span")

p3 = plot(Senkou_Span_A, offset = Chikou_Span_Length, color=green,

title="Lead 1")

p4 = plot(Senkou_Span_B, offset = Chikou_Span_Length, color=red,

title="Lead 2")

fill(p3, p4, color = Senkou_Span_A > Senkou_Span_B ? green : red, transp=50)

Ichimoku_longEntry = Senkou_Span_B < Senkou_Span_A

Ichimoku_shortEntry = Senkou_Span_A < Senkou_Span_B

len9 = input(9, minval=1, title="Length")

srce = input(hlc3, title="Source")

ema9 = ema(srce, len9)

sma50 = sma(ema9, 80)

sma30 = vwma(sma50, 26)

ema930 = ema(sma30, 9)

//plot(ema930, color=blue, title="MA", linewidth=5, transp=0)

SMA100 = sma(input(ohlc4), input(10))

Lookback = SMA100[input(7)]

sma300 = SMA100 + (SMA100 - Lookback)

//if Ichimoku_longEntry

longEntry = (MACD_longEntry2) //or Stoch_longEntry// or buy //or cci_longEntry or bb_longEntry or psar_shortExit //or //// // KC_longEntry// or WilliamsR_longEntry// // // or RSI_longEntry// // or or MFI_longEntry// or crossover(close,psar) //(o4 < c4 and o3 < c3 and o2 < c2 and o1 < c1)

//if Ichimoku_shortEntry

shortEntry = (MACD_shortEntry2) //or Stoch_shortEntry// or sell//or cci_shortEntry or bb_shortEntry or psar_longExit// // //or KC_shortEntry// or WilliamsR_shortEntry// //or cci_shortEntry // // or or MFI_shortEntry// or crossunder(close,psar)// (o4 < c4 and o3 < c3 and o2 < c2 and o1 < c1)

//longExit = shortEntry or psar_longExit // if not (ADX > th and )

//shortExit = longEntry or psar_shortExit // if not (ADX > th and )

////psar for trailing stops or some other measure? we must have a good trailing stop.

///////////////////////////////Strategy Execution

if testPeriod()

strategy.entry("Long", strategy.long, when=longEntry)

strategy.close("Long", when=shortEntry)

//if testPeriod()

// strategy.entry("Long", strategy.long, when=longEntry)

// strategy.exit("Exit Long", "Long", when=shortEntry)

//else

// strategy.cancel("Long")

//if testPeriod()

// strategy.entry("Short", strategy.short, when=shortEntry)

// strategy.exit("Exit Short", "Short", when=longEntry)

//else

// strategy.cancel("Long")

//Other Plots and Alerts

plotshape(MACD_longEntry2, title= "3,7 Long Open", color=green, style=shape.circle)

plotshape(MACD_shortEntry2, title= "3,7 Short Open", color=red, style=shape.circle)

//plotshape(Stoch_longEntry, title= "Stoch Long Open", color=aqua, style=shape.circle)

//plotshape(Stoch_shortEntry, title= "Stoch Short Open", color=orange, style=shape.circle)

//plotshape(buy, title= "RES Long Open", color=green, location=location.belowbar, style=shape.circle)

///plotshape(sell, title= "RES Short Open", color=red, location=location.belowbar, style=shape.circle)

//plotshape(MACD_longEntry, title= "12,26 Long Open", color=green, style=shape.arrowup, size=size.normal, location=location.belowbar)

//plotshape(MACD_shortEntry, title= "12,26 Short Open", color=red, style=shape.arrowdown, size=size.normal, location=location.abovebar)

//plotshape(MACD_longEntry, title= "12,26 Long Open", color=green, style=shape.diamond, size=size.tiny, location=location.belowbar)

//plotshape(MACD_shortEntry, title= "12,26 Short Open", color=red, style=shape.diamond, size=size.tiny, location=location.abovebar)

//plotchar(longCondition, location=bottom char="L", color=green)

//plotchar(shortCondition, char="S", color=red)

//alertcondition(longCondition, title="MFI+MACD Long", message="(MFI crossOver 30) or MACD+")

//alertcondition(shortCondition, title="MFI+MACD Short", message="(MFI crossUnder 70) or MACD-")

plot(sma300, color=purple, linewidth=4)

- A média do custo em dólar após a estratégia de tendência de baixa

- Estratégia de ruptura baseada em sentimentos

- Uma estratégia de inversão de tendência baseada em médias móveis, padrões de preços e volume

- Estratégia de média móvel dupla

- Estratégia de negociação cruzada de média móvel de impulso

- Estratégia de dupla média móvel da Cruz de Ouro

- Estratégia de tendência da onda de impulso Bollinger Bands

- Estratégia de negociação de impulso inverso

- Estratégia do indicador PB de banda média

- RSI & Fibonacci Estratégia de negociação de 5 minutos

- Optimização de ruptura de impulso

- Valor de mercado da posição em risco da instituição

- As bandas de volatilidade e a estratégia de negociação de tendências de ações VWAP

- Reversão de preços com estratégia de captura cruzada

- Estratégia do Ciclo Cibernético Estocástico de Ehlers

- Percussão de preço alto-baixo diário baseado em níveis de Fibonacci

- Melhoria da estratégia SuperTrend

- Estratégia quantitativa de negociação que integra MACD, RSI e RVOL

- Estratégia de acompanhamento da inversão do ímpeto

- Tendência de seguir uma estratégia baseada no cruzamento da EMA e da SMA