Tendência de vários prazos seguindo estratégia

Autora:ChaoZhangTags:

Resumo

Estratégia lógica

O núcleo desta estratégia é determinar se o preço está em uma tendência de alta ou baixa com base no indicador de tendência selecionado pelo usuário. A estratégia primeiro calcula mais de 20 médias móveis e linhas de regressão. Estes indicadores incluem os indicadores técnicos comuns na biblioteca padrão da linguagem de scripting Pine, bem como alguns indicadores personalizados escritos pela comunidade de codificadores Pine. A estratégia então consulta o valor atual de um indicador selecionado e o compara ao valor anterior. Se o valor atual for maior que o valor anterior, a tendência é alta. Se o valor atual for menor que o valor anterior, a tendência é baixa. Finalmente, a estratégia determina se deve entrar em uma posição longa com base na direção da tendência.

Análise dos prós

Análise de riscos

Oportunidades de melhoria

Conclusão

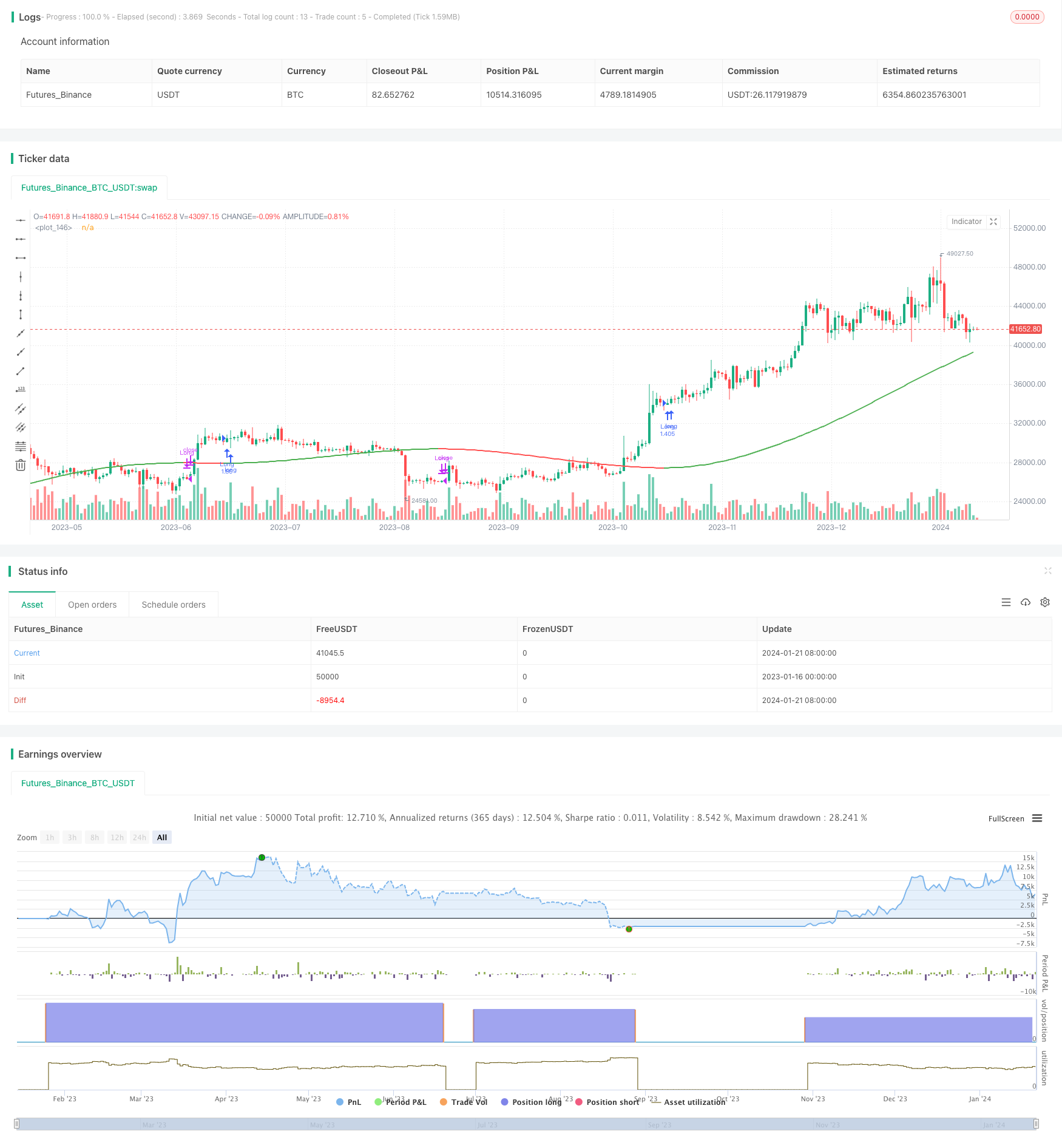

/*backtest

start: 2023-01-16 00:00:00

end: 2024-01-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// @version=5

// Author = TradeAutomation

strategy(title="Multi MA Trend Following Strategy Template", shorttitle="Multi Trend", process_orders_on_close=true, overlay=true, commission_type=strategy.commission.cash_per_order, commission_value=1, slippage = 0, margin_short = 75, margin_long = 75, initial_capital = 100000000, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Backtest Date Range Inputs //

StartTime = input(defval=timestamp('01 Jan 2019 05:00 +0000'), group="Date Rangte", title='Start Time')

EndTime = input(defval=timestamp('01 Jan 2099 00:00 +0000'), group="Date Range", title='End Time')

InDateRange = true

// Trend Selector //

TrendSelectorInput = input.string(title="Trend Selector", defval="JMA", group="Core Settings", options=["ALMA", "DEMA", "EMA", "HMA", "JMA", "KAMA", "Linear Regression (LSMA)", "RMA", "SMA", "SMMA", "Source", "SuperTrend", "TEMA", "TMA", "VAMA", "VIDYA", "VMA", "VWMA", "WMA", "WWMA", "ZLEMA"], tooltip="Select your moving average")

src = input.source(close, "Source", group="Core Settings", tooltip="This is the price source being used for the moving averages to calculate based on")

length = input.int(200, "MA Length", group="Core Settings", tooltip="This is the amount of historical bars being used for the moving averages to calculate based on")

LineWidth = input.int(2, "Line Width", group="Core Settings", tooltip="This is the width of the line plotted that represents the selected trend")

// Individual Moving Average / Regression Setting //

AlmaOffset = input.float(0.85, "ALMA Offset", group="Individual MA Settings", tooltip="This only applies when ALMA is selected")

AlmaSigma = input.float(6, "ALMA Sigma", group="Individual MA Settings", tooltip="This only applies when ALMA is selected")

ATRFactor = input.float(3, "ATR Multiplier For SuperTrend", group="Individual MA Settings", tooltip="This only applies when SuperTrend is selected")

ATRLength = input.int(12, "ATR Length For SuperTrend", group="Individual MA Settings", tooltip="This only applies when SuperTrend is selected")

JMApower = input.int(2, "JMA Power Parameter", group="Individual MA Settings", tooltip="This only applies when JMA is selected")

KamaAlpha = input.float(3, "KAMA's Alpha", minval=1,step=0.5, group="Individual MA Settings", tooltip="This only applies when KAMA is selected")

LinRegOffset = input.int(0, "Linear Regression Offset", group="Individual MA Settings", tooltip="This only applies when Linear Regression is selected")

VAMALookback =input.int(12, "VAMA Volatility lookback", group="Individual MA Settings", tooltip="This only applies when VAMA is selected")

// Trend Indicators in Library //

ALMA = ta.alma(src, length, AlmaOffset, AlmaSigma)

EMA = ta.ema(src, length)

HMA = ta.hma(src, length)

LinReg = ta.linreg(src, length, LinRegOffset)

RMA = ta.rma(src, length)

SMA = ta.sma(src, length)

VWMA = ta.vwma(src, length)

WMA = ta.wma(src, length)

// Additional Trend Indicators Written and/or Open Sourced //

//DEMA

de1 = ta.ema(src, length)

de2 = ta.ema(de1, length)

DEMA = 2 * de1 - de2

//JMA [Capissmo]

beta = 0.45*(length-1)/(0.45*(length-1)+2)

alpha = math.pow(beta, JMApower)

L0=0.0, L1=0.0, L2=0.0, L3=0.0, JMA=0.0

L0 := (1-alpha)*src + alpha*nz(L0[1])

L1 := (src - L0[0])*(1-beta) + beta*nz(L1[1])

L2 := L0[0] + L1[0]

L3 := (L2[0] - nz(JMA[1]))*((1-alpha)*(1-alpha)) + (alpha*alpha)*nz(L3[1])

JMA := nz(JMA[1]) + L3[0]

//KAMA

var KAMA = 0.0

fastAlpha = 2.0 / (KamaAlpha + 1)

slowAlpha = 2.0 / 31

momentum = math.abs(ta.change(src, length))

volatility = math.sum(math.abs(ta.change(src)), length)

efficiencyRatio = volatility != 0 ? momentum / volatility : 0

smoothingConstant = math.pow((efficiencyRatio * (fastAlpha - slowAlpha)) + slowAlpha, 2)

KAMA := nz(KAMA[1], src) + smoothingConstant * (src - nz(KAMA[1], src))

//SMMA

var SMMA = 0.0

SMMA := na(SMMA[1]) ? ta.sma(src, length) : (SMMA[1] * (length - 1) + src) / length

//SuperTrend

ATR = ta.atr(ATRLength)

Signal = ATRFactor*ATR

var SuperTrend = 0.0

SuperTrend := if src>SuperTrend[1] and src[1]>SuperTrend[1]

math.max(SuperTrend[1], src-Signal)

else if src<SuperTrend[1] and src[1]<SuperTrend[1]

math.min(SuperTrend[1], src+Signal)

else if src>SuperTrend[1]

src-Signal

else

src+Signal

//TEMA

t1 = ta.ema(src, length)

t2 = ta.ema(t1, length)

t3 = ta.ema(t2, length)

TEMA = 3 * (t1 - t2) + t3

//TMA

TMA = ta.sma(ta.sma(src, math.ceil(length / 2)), math.floor(length / 2) + 1)

//VAMA

mid=ta.ema(src,length)

dev=src-mid

vol_up=ta.highest(dev,VAMALookback)

vol_down=ta.lowest(dev,VAMALookback)

VAMA = mid+math.avg(vol_up,vol_down)

//VIDYA [KivancOzbilgic]

var VIDYA=0.0

VMAalpha=2/(length+1)

ud1=src>src[1] ? src-src[1] : 0

dd1=src<src[1] ? src[1]-src : 0

UD=math.sum(ud1,9)

DD=math.sum(dd1,9)

CMO=nz((UD-DD)/(UD+DD))

VIDYA := na(VIDYA[1]) ? ta.sma(src, length) : nz(VMAalpha*math.abs(CMO)*src)+(1-VMAalpha*math.abs(CMO))*nz(VIDYA[1])

//VMA [LazyBear]

sc = 1/length

pdm = math.max((src - src[1]), 0)

mdm = math.max((src[1] - src), 0)

var pdmS = 0.0

var mdmS = 0.0

pdmS := ((1 - sc)*nz(pdmS[1]) + sc*pdm)

mdmS := ((1 - sc)*nz(mdmS[1]) + sc*mdm)

s = pdmS + mdmS

pdi = pdmS/s

mdi = mdmS/s

var pdiS = 0.0

var mdiS = 0.0

pdiS := ((1 - sc)*nz(pdiS[1]) + sc*pdi)

mdiS := ((1 - sc)*nz(mdiS[1]) + sc*mdi)

d = math.abs(pdiS - mdiS)

s1 = pdiS + mdiS

var iS = 0.0

iS := ((1 - sc)*nz(iS[1]) + sc*d/s1)

hhv = ta.highest(iS, length)

llv = ta.lowest(iS, length)

d1 = hhv - llv

vi = (iS - llv)/d1

var VMA=0.0

VMA := sc*vi*src + (1 - sc*vi)*nz(VMA[1])

//WWMA

var WWMA=0.0

WWMA := (1/length)*src + (1-(1/length))*nz(WWMA[1])

//Zero Lag EMA

EMA1 = ta.ema(src,length)

EMA2 = ta.ema(EMA1,length)

Diff = EMA1 - EMA2

ZLEMA = EMA1 + Diff

// Trend Mapping and Plotting //

Trend = TrendSelectorInput == "ALMA" ? ALMA : TrendSelectorInput == "DEMA" ? DEMA : TrendSelectorInput == "EMA" ? EMA : TrendSelectorInput == "HMA" ? HMA : TrendSelectorInput == "JMA" ? JMA : TrendSelectorInput == "KAMA" ? KAMA : TrendSelectorInput == "Linear Regression (LSMA)" ? LinReg : TrendSelectorInput == "RMA" ? RMA : TrendSelectorInput == "SMA" ? SMA : TrendSelectorInput == "SMMA" ? SMMA : TrendSelectorInput == "Source" ? src : TrendSelectorInput == "SuperTrend" ? SuperTrend : TrendSelectorInput == "TEMA" ? TEMA : TrendSelectorInput == "TMA" ? TMA : TrendSelectorInput == "VAMA" ? VAMA : TrendSelectorInput == "VIDYA" ? VIDYA : TrendSelectorInput == "VMA" ? VMA : TrendSelectorInput == "VWMA" ? VWMA : TrendSelectorInput == "WMA" ? WMA : TrendSelectorInput == "WWMA" ? WWMA : TrendSelectorInput == "ZLEMA" ? ZLEMA : SMA

plot(Trend, color=(Trend>Trend[1]) ? color.green : (Trend<Trend[1]) ? color.red : (Trend==Trend[1]) ? color.gray : color.black, linewidth=LineWidth)

// Entry & Exit Functions //

if (InDateRange)

strategy.entry("Long", strategy.long, when = ta.crossover(Trend, Trend[1]))

strategy.close("Long", when = ta.crossunder(Trend, Trend[1]))

if (not InDateRange)

strategy.close_all()

- Tendência após estratégia de negociação baseada no MACD e no RSI

- Uma estratégia de negociação quantitativa de ruptura do canal ATR

- A taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa de variação da taxa.

- Estratégia de cobertura de tendências baseada em indicadores da ETI e HMACCI

- Algoritmo de média móvel dupla de cruz de ouro

- Cruz de Ouro Cruz da Morte Estratégia multifatorial a longo prazo

- RSI Divergência Estratégia de negociação

- Estratégia de negociação de redes dinâmicas

- Uma estratégia de linha de vantagem de confirmação de média móvel dupla

- Crypto RSI Mini-Sniper Tendência de Resposta Rápida Seguindo a Estratégia

- Esta estratégia é uma estratégia de impulso baseada em linhas médias móveis

- Estratégia de negociação de inversão do momento da oferta e da procura

- Estratégia de negociação do oscilador de momento dinâmico

- Tendência de seguir uma estratégia baseada na média móvel

- Estratégia de rastreamento de tendências

- Estratégia de negociação de ETF de rastreamento da tendência de inversão do RSI

- Segurança de transações