概述

本策略运用动量指标和均线的组合,识别市场趋势和回转点,在趋势发生转折的时候进行交易,属于趋势跟踪和逆势交易策略。主要由供需区、EMA均线、各类HH、LL、LH、HL多空区域标记、ATR止损等模块组成。

策略原理

1. 供需区辨识

根据K线高低点范围区分供需关系,红色区域为供过于求的供给区,绿色区域为求大于供的需求区。

2. EMA趋势判断

计算长度为200的EMA均线并绘制,通过价格与EMA的大小关系判断多空趋势,价格高于EMA视为上升趋势,价格低于EMA视为下降趋势。

3. 多空区域标记

根据最近2根K线高低点情况判断回转区域:

- HH区( Higher High区域) — 连续2根K线高点创新高

- LL区( Lower Low区域) — 连续2根K线低点创新低

- LH区(Lower High区域) — 最近1根K线高点创新高,次根K线高点反转,属回落高点

- HL区(Higher Low区域) — 最近1根K线低点创新低,次根K线低点反转,属回升低点

4. ATR 止损追踪

计算14周期的ATR值,乘以系数2成为本策略的止损位。

5. 入场与止损退出

监测价格与前一日Kline的高低点关系。当价格高于前一日的高点则产生多头信号;当价格低于前一日的低点则产生空头信号。入场信号延迟到第3根K线确认,避免冲击波动带来的错误信号。采用ATR 止损追踪方式,价格回撤超过止损线则主动止损退出当前信号。

优势分析

- 运用多种指标识别趋势与关键回转区域,提高获利概率。

- ATR止损方式能有效控制单笔损失风险。

- 延迟入场确定有效信号,减少错误交易概率。

风险分析

- 仅依赖技术指标,没有结合基本面信息,可能错过重要信息导致交易失败。

- ATR止损方式可能在大幅度行情中被突破从而造成亏损。

- 在震荡趋势中,EMA回转交易信号频繁,可能导致过度交易。

风险解决方法: 1. 结合重大经济数据与政策判断来决定操作。 2. 可适当扩大ATR 止损的系数,确保有足够空间。 3. 调整ATR 止损的周期参数,避免在震荡中过于敏感。

优化方向

- 结合其他技术指标如MACD、RSI等判断入场时机。

- 测试不同周期参数与系数参数的组合,寻找最优参数。

- 可考虑加入再突破过滤,避免信号被套。

- 运用机器学习等方法动态优化参数。

总结

本策略综合运用供需分析、趋势判断、回转识别和止损管理模块,能有效识别市场在关键区域转折的机会,是一套行之有效的趋势跟踪与逆势交易策略。同时也需要不断测试与优化,辅以人工经验判断,方能取得长期稳定收益。

策略源码

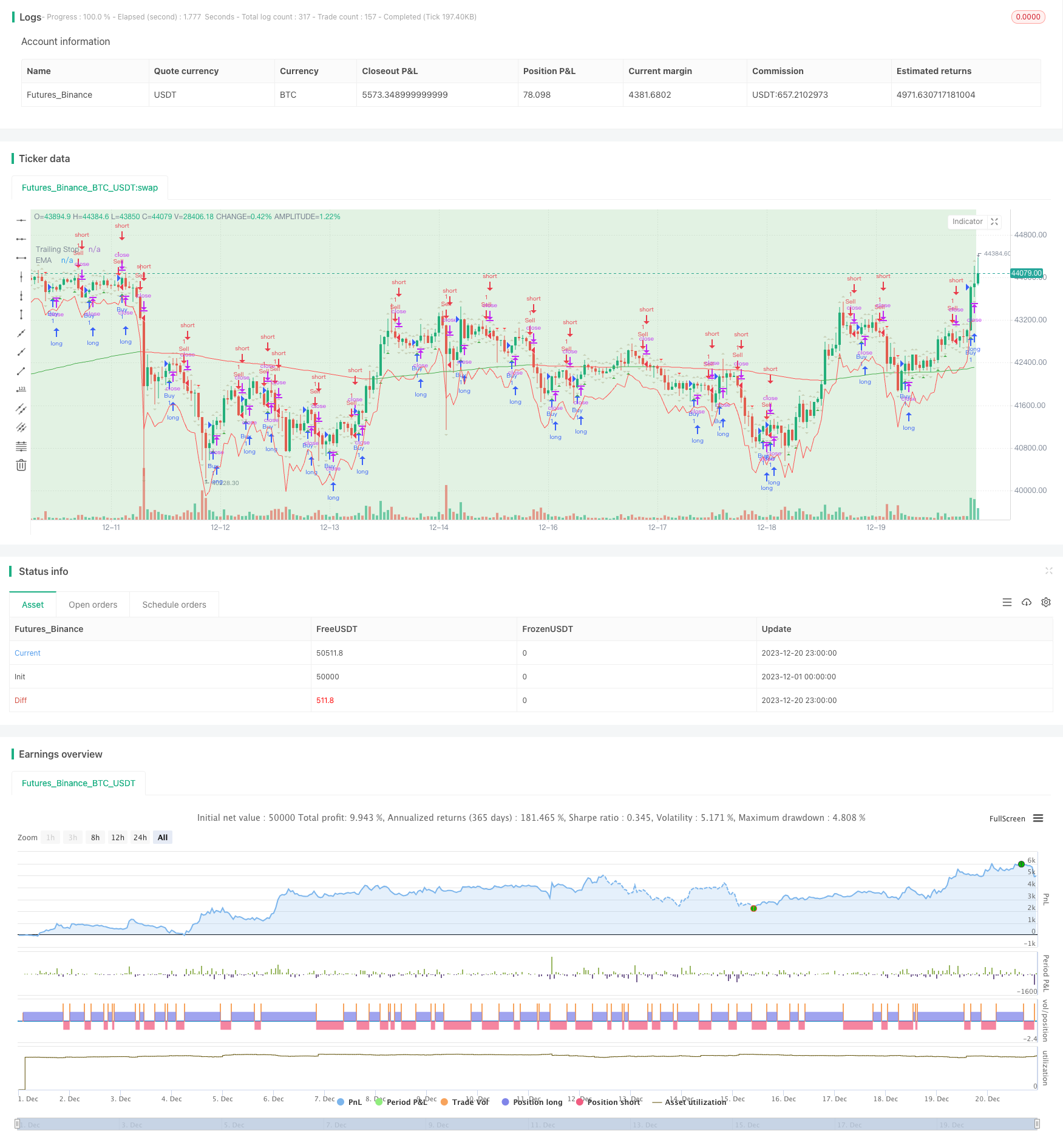

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-20 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Supply and Demand Zones with EMA and Trailing Stop", shorttitle="SD Zones", overlay=true)

showBuySignals = input(true, title="Show Buy Signals", group="Signals")

showSellSignals = input(true, title="Show Sell Signals", group="Signals")

showHLZone = input(true, title="Show HL Zone", group="Zones")

showLHZone = input(true, title="Show LH Zone", group="Zones")

showHHZone = input(true, title="Show HH Zone", group="Zones")

showLLZone = input(true, title="Show LL Zone", group="Zones")

emaLength = input(200, title="EMA Length", group="EMA Settings")

atrLength = input(14, title="ATR Length", group="Trailing Stop")

atrMultiplier = input(2, title="ATR Multiplier", group="Trailing Stop")

// Function to identify supply and demand zones

getZones(src, len, mult) =>

base = request.security(syminfo.tickerid, "D", close)

upper = request.security(syminfo.tickerid, "D", high)

lower = request.security(syminfo.tickerid, "D", low)

multiplier = request.security(syminfo.tickerid, "D", mult)

zonetype = base + multiplier * len

zone = src >= zonetype

[zone, upper, lower]

// Identify supply and demand zones

[supplyZone, _, _] = getZones(close, high[1] - low[1], 1)

[demandZone, _, _] = getZones(close, high[1] - low[1], -1)

// Plot supply and demand zones

bgcolor(supplyZone ? color.new(color.red, 80) : na)

bgcolor(demandZone ? color.new(color.green, 80) : na)

// EMA with Linear Weighted method

ema = ta.ema(close, emaLength)

// Color code EMA based on its relation to candles

emaColor = close > ema ? color.new(color.green, 0) : close < ema ? color.new(color.red, 0) : color.new(color.yellow, 0)

// Plot EMA

plot(ema, color=emaColor, title="EMA")

// Entry Signal Conditions after the third candle

longCondition = ta.crossover(close, high[1]) and (bar_index >= 2)

shortCondition = ta.crossunder(close, low[1]) and (bar_index >= 2)

// Trailing Stop using ATR

atrValue = ta.atr(atrLength)

trailStop = close - atrMultiplier * atrValue

// Strategy Entry and Exit

if (longCondition)

strategy.entry("Buy", strategy.long)

strategy.exit("TrailStop", from_entry="Buy", loss=trailStop)

if (shortCondition)

strategy.entry("Sell", strategy.short)

strategy.exit("TrailStop", from_entry="Sell", loss=trailStop)

// Plot Entry Signals

plotshape(series=showBuySignals ? longCondition : na, title="Buy Signal", color=color.new(color.green, 0), style=shape.triangleup, location=location.belowbar)

plotshape(series=showSellSignals ? shortCondition : na, title="Sell Signal", color=color.new(color.red, 0), style=shape.triangledown, location=location.abovebar)

// Plot Trailing Stop

plot(trailStop, color=color.new(color.red, 0), title="Trailing Stop")

// Plot HH, LL, LH, and HL zones

plotshape(series=showHHZone and ta.highest(high, 2)[1] and ta.highest(high, 2)[2] ? 1 : na, title="HH Zone", color=color.new(color.blue, 80), style=shape.triangleup, location=location.abovebar)

plotshape(series=showLLZone and ta.lowest(low, 2)[1] and ta.lowest(low, 2)[2] ? 1 : na, title="LL Zone", color=color.new(color.blue, 80), style=shape.triangledown, location=location.belowbar)

plotshape(series=showLHZone and ta.highest(high, 2)[1] and ta.lowest(low, 2)[2] ? 1 : na, title="LH Zone", color=color.new(color.orange, 80), style=shape.triangleup, location=location.abovebar)

plotshape(series=showHLZone and ta.lowest(low, 2)[1] and ta.highest(high, 2)[2] ? 1 : na, title="HL Zone", color=color.new(color.orange, 80), style=shape.triangledown, location=location.belowbar)