Estratégia dinâmica de paralisação de perdas de Bollinger Bands

Autora:ChaoZhang, Data: 2024-02-01 10:48:52Tags:

Resumo

Esta estratégia utiliza os trilhos superiores e inferiores das Bandas de Bollinger para implementar o stop loss dinâmico. Vai curto quando o preço atravessa o trilho superior e vai longo quando o preço atravessa o trilho inferior. E define o stop loss dinâmico para rastrear o movimento do preço.

Princípio

O núcleo desta estratégia está nos trilhos superior e inferior das Bandas de Bollinger. O trilho do meio é a média móvel de n dias. O trilho superior é o trilho do meio + kdesvio padrão de n dias. O trilho inferior é o trilho do meio − kQuando o preço salta do trilho inferior, vá longo. Quando o preço cai de volta do trilho superior, vá curto. Ao mesmo tempo, a estratégia define um ponto de stop loss e o ajusta dinamicamente durante o movimento do preço para definir um ponto de lucro para implementar um controle de risco prudente.

Vantagens

- Utilize as bandas de Bollinger

de forte regressão para a característica do trilho médio para captar tendências de médio e longo prazo; - Sinais claros de comprimento e curto, fáceis de operar;

- Configurar um stop loss dinâmico para maximizar o bloqueio de lucros e controlar os riscos;

- Parâmetros ajustáveis para se adaptarem às diferentes condições do mercado.

Riscos e soluções

- As bandas de Bollinger podem gerar múltiplos sinais longos e curtos durante os mercados de faixa, fazendo com que os usuários fiquem presos em whipssaws.

- A solução é otimizar razoavelmente os parâmetros para diferentes produtos.

Orientações de otimização

- Otimizar os parâmetros da média móvel para adaptá-los às características do produto;

- Adicionar filtragem de tendências para evitar o mercado limitado por intervalo;

- Combinar com outros indicadores como condições de filtragem para melhorar a estabilidade da estratégia.

Conclusão

Esta estratégia utiliza os atributos de regressão de Bollinger Bands

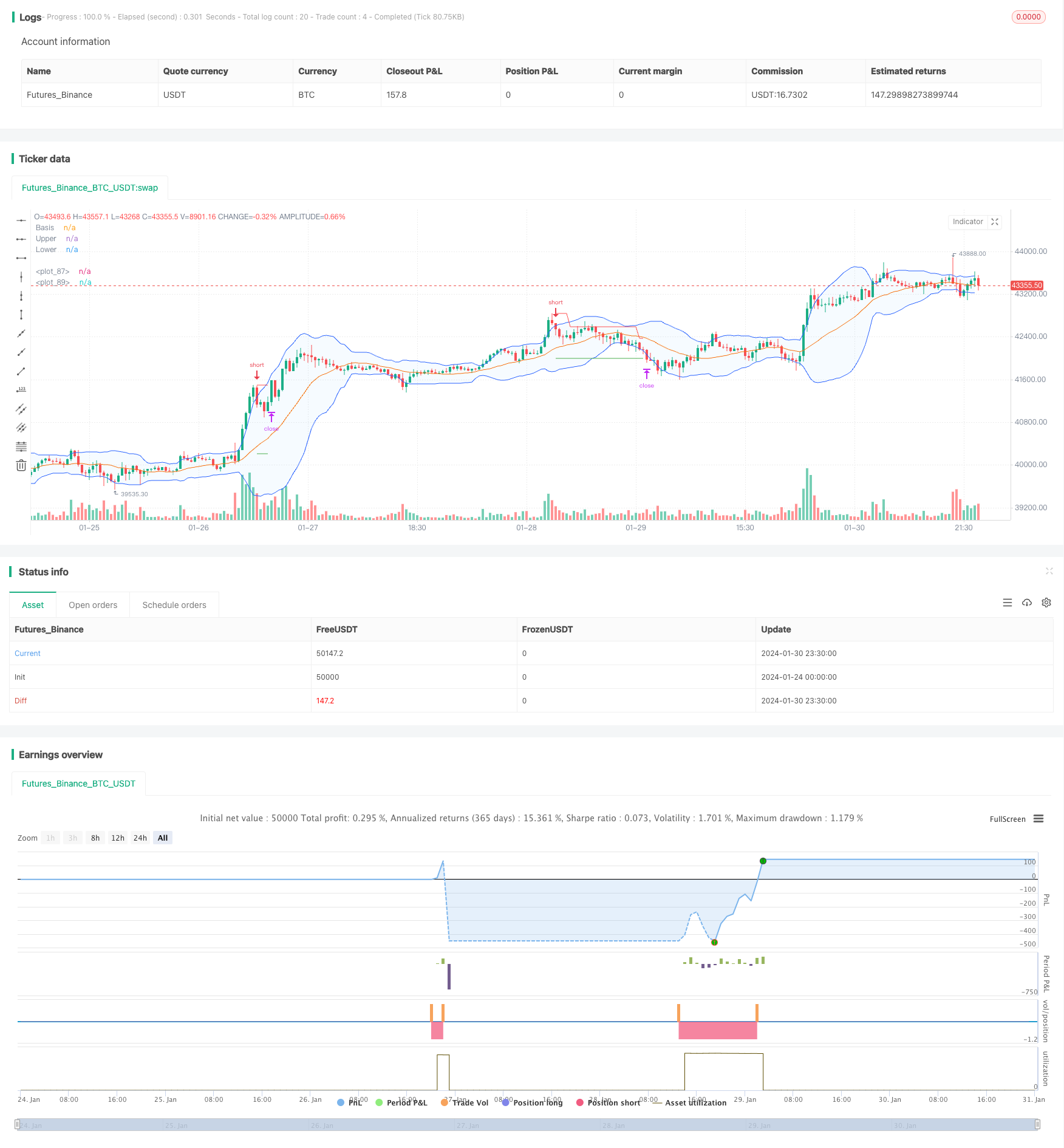

/*backtest

start: 2024-01-24 00:00:00

end: 2024-01-31 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(shorttitle="BB Strategy", title="Bollinger Bands Strategy", overlay=true)

length = input.int(20, minval=1, group = "Bollinger Bands")

maType = input.string("SMA", "Basis MA Type", options = ["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group = "Bollinger Bands")

src = input(close, title="Source", group = "Bollinger Bands")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev", group = "Bollinger Bands")

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

basis = ma(src, length, maType)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input.int(0, "Offset", minval = -500, maxval = 500, group = "Bollinger Bands")

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

lo = input.bool(true, "Long", group = "Strategy")

sh = input.bool(true, "Short", group = "Strategy")

x = input.float(3.0, "Target Multiplier (X)", group = "Strategy", minval = 1.0, step = 0.1)

token = input.string(defval = "", title = "Token", group = "AUTOMATION")

Buy_CE = '{"auth-token":"' + token + '","key":"Value1","value":"' + str.tostring(1) + '"}'

Buy_PE = '{"auth-token":"' + token + '","key":"Value1","value":"' + str.tostring(2) + '"}'

Exit_CE = '{"auth-token":"' + token + '","key":"Value1","value":"' + str.tostring(-1) + '"}'

Exit_PE = '{"auth-token":"' + token + '","key":"Value1","value":"' + str.tostring(-2) + '"}'

Exit_PE_CE = '{"auth-token":"' + token + '","key":"Value1","value":"' + str.tostring(2.5) + '"}'

Exit_CE_PE = '{"auth-token":"' + token + '","key":"Value1","value":"' + str.tostring(1.5) + '"}'

long = high < lower

short = low > upper

var sl_b = 0.0

var tar_b = 0.0

var sl_s = 0.0

var tar_s = 0.0

var static_sl = 0.0

entry = strategy.opentrades.entry_price(strategy.opentrades - 1)

if long and lo and strategy.position_size == 0

strategy.entry("Long", strategy.long, alert_message = Buy_CE, stop = high)

strategy.exit("LX", "Long", profit = (math.abs(high - low) * x)/syminfo.mintick, stop = low, alert_message = Exit_CE)

sl_b := low

tar_b := high + (math.abs(high - low) * x)

static_sl := math.abs(low - high)

if short and sh and strategy.position_size == 0

strategy.entry("Short", strategy.short, alert_message = Buy_PE, stop = low)

strategy.exit("SX", "Short", profit = (math.abs(high - low) * x)/syminfo.mintick, stop = high, alert_message = Exit_PE)

sl_s := high

tar_s := low - (math.abs(high - low) * x)

static_sl := math.abs(high - low)

// if long and strategy.position_size < 0

// strategy.entry("Long", strategy.long, alert_message = Exit_PE_CE, stop = high)

// strategy.exit("LX", "Long", profit = (math.abs(high - low) * x)/syminfo.mintick, stop = low, alert_message = Exit_CE)

// sl_b := low

// tar_b := high + (math.abs(high - low) * x)

// if short and strategy.position_size > 0

// strategy.entry("Short", strategy.short, alert_message = Exit_CE_PE, stop = low)

// strategy.exit("SX", "Short", profit = (math.abs(high - low) * x)/syminfo.mintick, stop = high, alert_message = Exit_PE)

// sl_s := math.max(high[1], high)

// tar_s := low - (math.abs(high - low) * x)

if ta.change(dayofmonth) or (long[1] and not long[2])

strategy.cancel("Long")

if ta.change(dayofmonth) or (short[1] and not short[2])

strategy.cancel("Short")

var count = 1

if strategy.position_size != 0

if strategy.position_size > 0

if close > (entry + (static_sl * count))

strategy.exit("LX", "Long", limit = tar_b, stop = sl_b, alert_message = Exit_CE)

sl_b := entry + (static_sl * (count - 1))

count += 1

else

if close < (entry - (static_sl * count))

strategy.exit("SX", "Short", limit = tar_s, stop = sl_s, alert_message = Exit_PE)

sl_s := entry - (static_sl * (count - 1))

count += 1

// label.new(bar_index, high, str.tostring(static_sl))

if strategy.position_size == 0

count := 1

plot(strategy.position_size > 0 ? sl_b : na, "", color.red, style = plot.style_linebr)

plot(strategy.position_size < 0 ? sl_s : na, "", color.red, style = plot.style_linebr)

plot(strategy.position_size > 0 ? tar_b : na, "", color.green, style = plot.style_linebr)

plot(strategy.position_size < 0 ? tar_s : na, "", color.green, style = plot.style_linebr)

- Estratégia de RSI de média móvel e estocástica

- Tendência de Nuvem Ichimoku Seguindo Estratégia

- Estratégia de negociação a longo prazo baseada em bandas de Bollinger % B Indicador

- A estratégia de canal de média móvel tripla para minerar pacientemente informações valiosas a partir de linhas de velas

- Estratégia do enforcador Yin Yang

- Estratégia de percentual de perda de parada de atraso

- Tendência da média móvel tripla seguindo a estratégia

- Estratégia de negociação de média móvel de rastreamento de stop loss

- Tendência de reversão média do indicador duplo seguindo estratégia

- Canais de preços dinâmicos com estratégia de rastreamento de stop loss

- Reversão Breakout Combo Bandpass Estratégia

- Estratégia de cruzamento das médias móveis dinâmicas

- Tendência transversal da EMA na sequência da estratégia

- Estratégia de negociação a curto prazo baseada no RSI e no SMA

- Impulso de ruptura Estratégia de negociação intradiária

- KDJ Golden Cross Estratégia de entrada longa

- Estratégia de tempestade de ruptura em oportunidades ocultas

- Estratégia de acompanhamento do momento no intervalo de tempo

- Tendência de média móvel seguindo a estratégia

- Estratégia de Supertendência de Pivot em vários prazos