Термостат Стратегия использования на крипто рынке MyLanguage

Автор:Доброта, Создано: 2020-08-21 19:19:20, Обновлено: 2023-10-10 21:15:32

Название стратегии: Усовершенствованная стратегия термостата

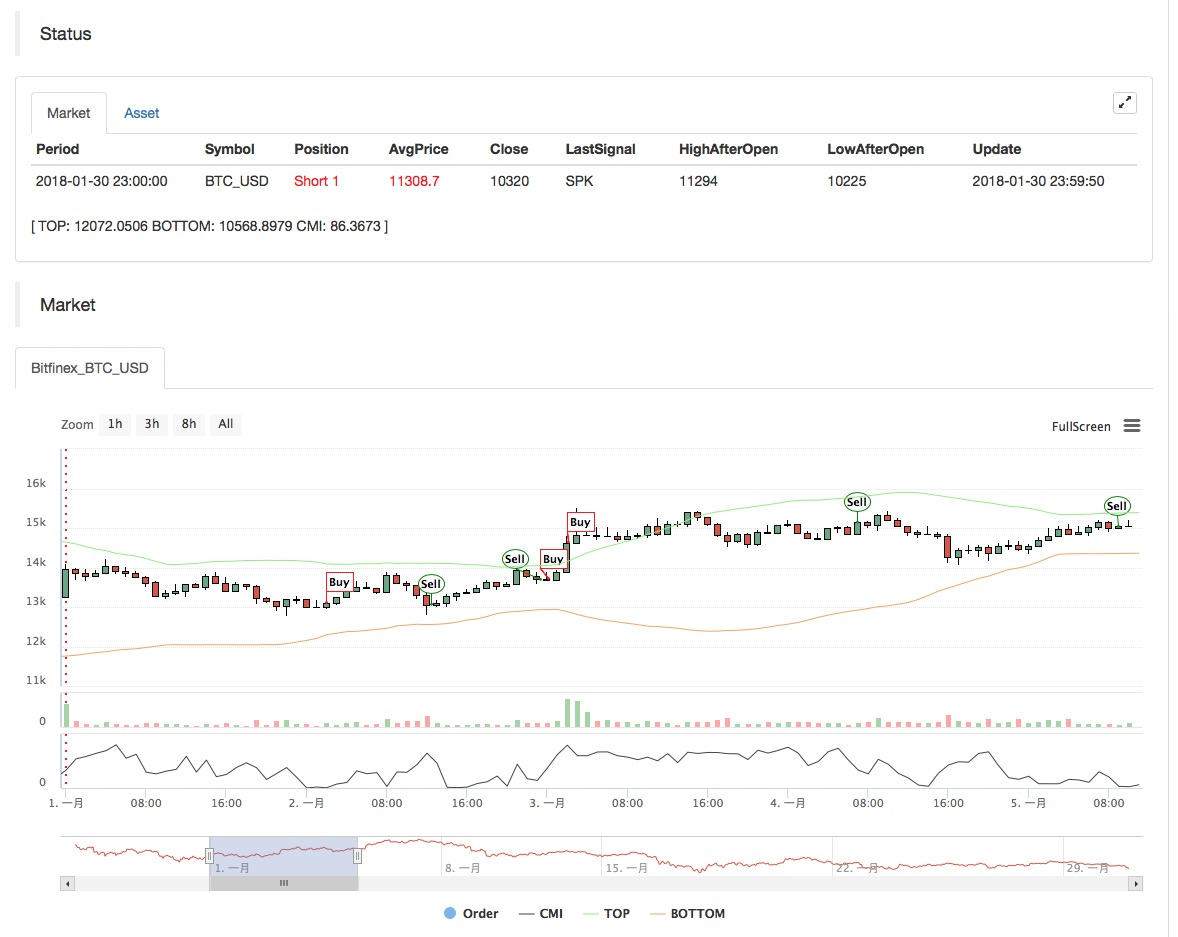

Цикл передачи данных: 1 час

Поддержка: Фьючерсы на товары, Фьючерсы на цифровую валюту, Спот на цифровую валюту

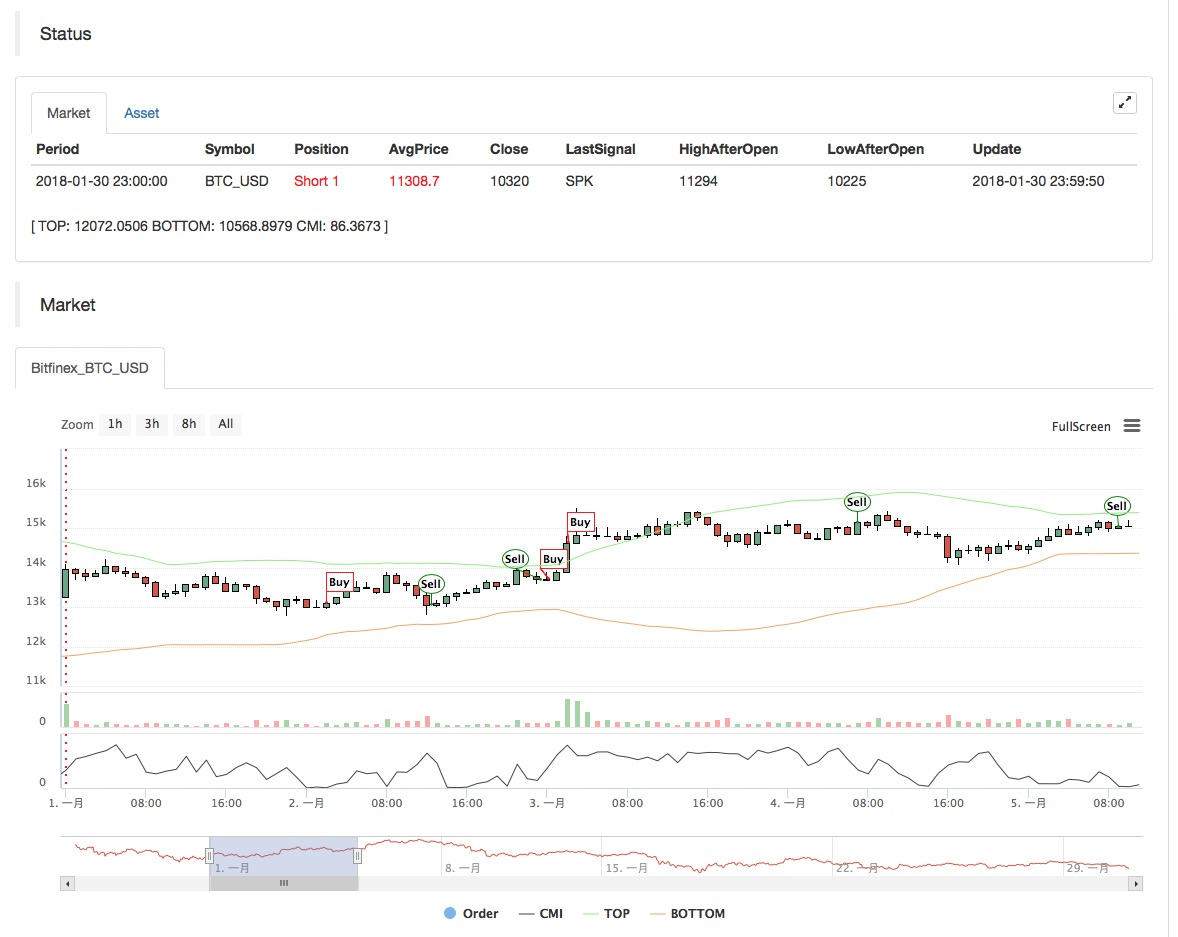

Основная диаграмма: верхняя дорожка, формула: TOP^^MAC+N_TMPTMP; / / верхняя дорожка пузыря Нижняя рельса, формула: BOTTOM^^MAC-N_TMPTMP;//нижняя рельса пузыря

Вторичная карта: CMI, формула: CMI: ABS ((C-REF ((C,N_CMI-1))/(HHV ((H,N_CMI) -LLV ((L,N_CMI)) *100; //0-100 чем больше значение, тем сильнее тренд, CMI <20 - колебание, CMI>20 - тренд

Источник:

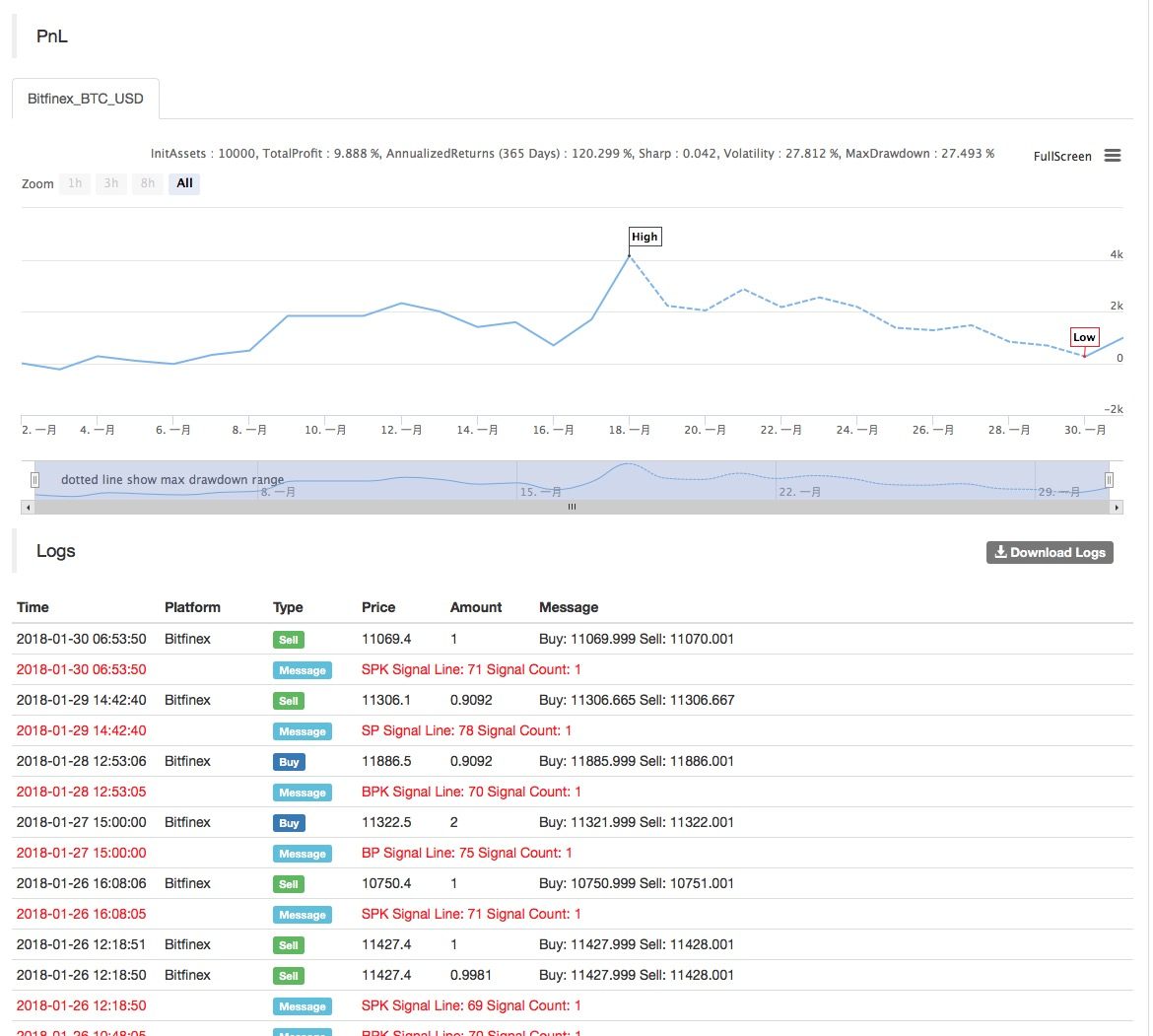

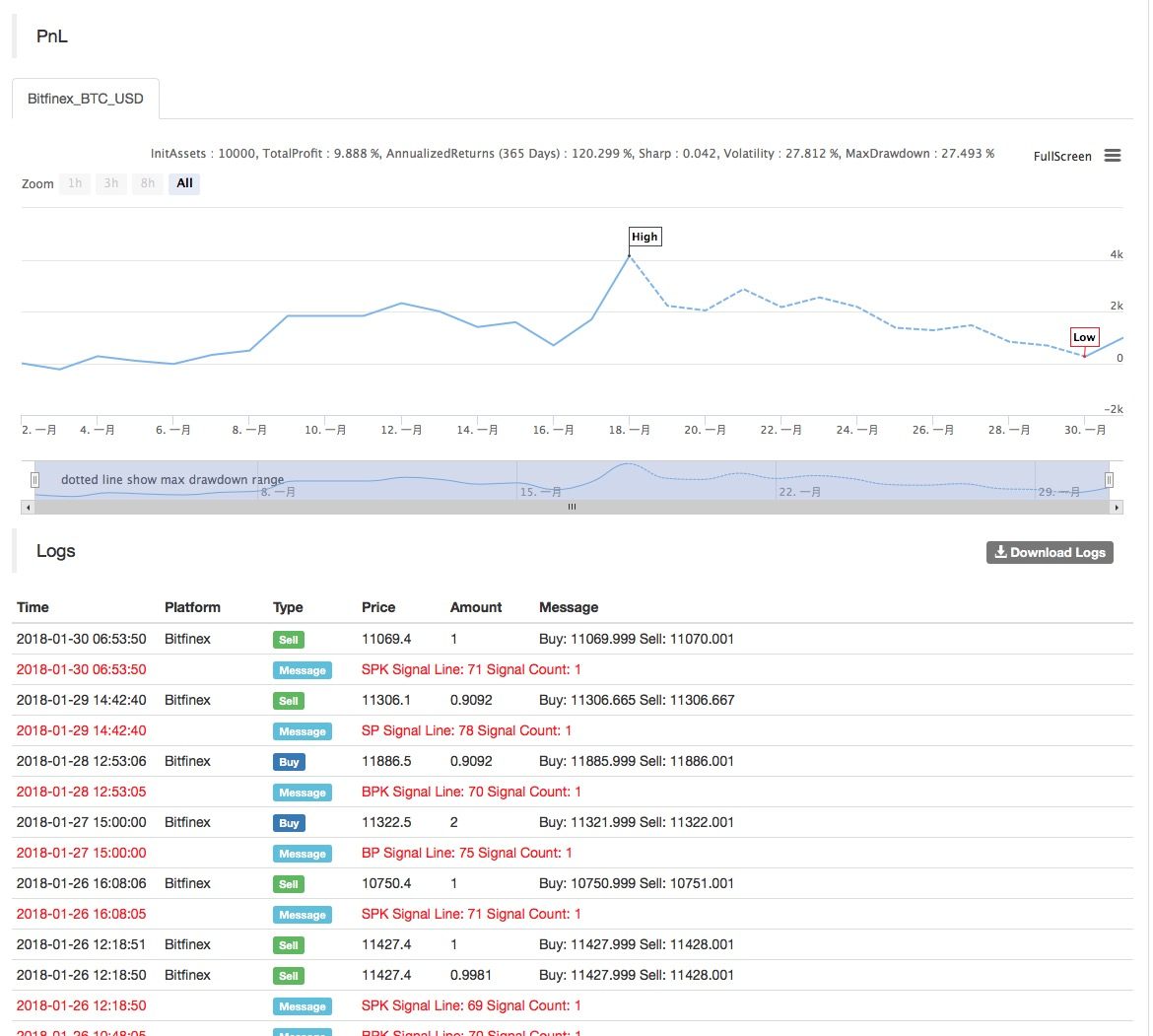

(*backtest

start: 2018-11-06 00:00:00

end: 2018-12-04 00:00:00

period: 1h

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

*)

MAC:=MA(CLOSE,N);

TMP:=STD(CLOSE,N);

TOP^^MAC+N_TMP*TMP;// upper track of boll

BOTTOM^^MAC-N_TMP*TMP;// lower track of boll

BBOLL:=C>MAC;

SBOLL:=C<MAC;

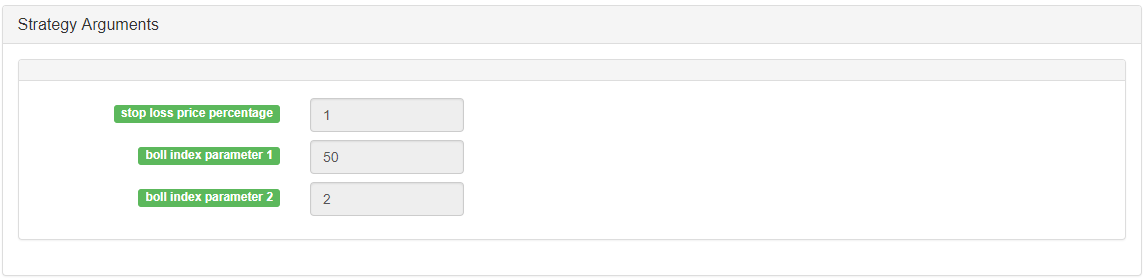

N_CMI:=30;

CMI:ABS(C-REF(C,N_CMI-1))/(HHV(H,N_CMI)-LLV(L,N_CMI))*100;

//0-100 the larger the value, the stronger the trend, CMI <20 is oscillation mode, CMI>20 is the trend

N_KD:=9;

M1:=3;

M2:=3;

RSV:=(CLOSE-LLV(LOW,N_KD))/(HHV(HIGH,N_KD)-LLV(LOW,N_KD))*100;

//(1)closing price - the lowest of cycle N, (2)the highest of cycle N - the lowest of cycle N, (1)/(2)

K:=SMA(RSV,M1,1);//MA of RSV

D:=SMA(K,M2,1);//MA of K

MIND:=30;

BKD:=K>D AND D<MIND;

SKD:=K<D AND D>100-MIND;

//oscillation mode

BUYPK1:=CMI < 20 AND BKD;//if it's oscillation, buy to cover and buy long immediately

SELLPK1:=CMI < 20 AND SKD;//if it's oscillation, sell to close long position and sell short to open position immediately

//Disposal of the original oscillating position under the trend mode

SELLY1:=REF(CMI,BARSBK) < 20 AND C>BKPRICE*(1+0.01*STOPLOSS*3) AND K<D;//if it's oscillation, long position take profit

BUYY1:=REF(CMI,BARSSK) < 20 AND C<SKPRICE*(1-0.01*STOPLOSS*3) AND K>D;//if it's oscillation, short position take profit

//trend mode

BUYPK2:=CMI >= 20 AND C > TOP;//if it's trend, buy to cover and buy long immediately

SELLPK2:=CMI >= 20 AND C < BOTTOM;//if it's trend, sell to close long position and sell short to open position immediately

//Disposal of the original oscillating position under the trend mode

SELLY2:=REF(CMI,BARSBK) >= 20 AND C>BKPRICE*(1+0.01*STOPLOSS*3) AND SBOLL;//if it's trend, long position take profit

BUYY2:=REF(CMI,BARSSK) >= 20 AND C<SKPRICE*(1-0.01*STOPLOSS*3) AND BBOLL;//if it's trend, short position take profit

SELLS2:=REF(CMI,BARSBK) >= 20 AND C<BKPRICE*(1-0.01*STOPLOSS) AND SBOLL;//if it's trend, long position stop loss

BUYS2:=REF(CMI,BARSSK) >= 20 AND C>SKPRICE*(1+0.01*STOPLOSS) AND BBOLL;//if it's trend, short position stop loss

IF BARPOS>N THEN BEGIN

BUYPK1,BPK;

SELLPK1,SPK;

BUYPK2,BPK;

SELLPK2,SPK;

END

BUYY1,BP(SKVOL);

BUYY2,BP(SKVOL);

BUYS2,BP(SKVOL);

SELLY1,SP(BKVOL);

SELLY2,SP(BKVOL);

SELLS2,SP(BKVOL);

Источник:https://www.fmz.com/strategy/129086

Содержание

- Количественная практика DEX-бирж (2) -- Гипержидкое руководство пользователя

- ДЕКС (DEX Exchange) Количественная практика ((2) -- Гиперликвид (Hyperliquid)

- Количественная практика обмена DEX (1) -- руководство пользователя dYdX v4

- Введение в арбитраж с задержкой свинца в криптовалюте (3)

- DEX обмены количественные практики ((1) -- dYdX v4 Руководство пользователя

- Презентация о своде Lead-Lag в цифровой валюте (3)

- Введение в арбитраж с задержкой свинца в криптовалюте (2)

- Презентация о своде Lead-Lag в цифровой валюте (2)

- Обсуждение по внешнему приему сигналов платформы FMZ: полное решение для приема сигналов с встроенным сервисом Http в стратегии

- Обзор приема внешних сигналов на платформе FMZ: стратегию полного решения приема сигналов встроенного сервиса HTTP

- Введение в арбитраж с задержкой свинца в криптовалюте (1)

Больше информации

- Использование серверов в количественных сделках

- [Война Тысячелетий] Биткоин обменный коэффициент приблизительная стратегия 3 бабочка хеджирование

- Стратегия сбалансированного обучения

- RSI2 Средняя стратегия реверсии с использованием фьючерсов

- Фьючерсы и криптовалюты API объяснение

- Быстро внедрить полуавтоматический инструмент количественной торговли

- Введение индикатора Aroon

- Предварительное исследование по тестированию стратегии опционов на цифровую валюту

- Разница между количественной торговлей и субъективной торговлей

- Стратегия ATR Channel реализована на крипторынке

- hans123 Стратегия прорыва внутридневного использования

- Стратегия опционов на цифровые валюты

- Тревога TradingViewWebHook напрямую подключена к роботу FMZ

- Добавьте будильник к торговой стратегии

- Стратегия хеджирования фьючерсных контрактов OKEX с использованием C++

- Стратегия торговли, основанная на активном потоке средств

- Использование плагина торгового терминала для облегчения ручной торговли

- Стратегия торговли количественными ставками типографии

- Стратегия баланса и стратегия сети

- Решение для совместного использования котировок на рынке с использованием нескольких роботов