Стратегия оптимизации перекрестного перемещения скользящей средней за несколько временных рамок

Автор:Чао Чжан, Дата: 2024-01-05 12:05:42Тэги:

Обзор

Эта стратегия основана на известном индикаторе CM_Ultimate_MA_MTF и переписана в торговую стратегию. Она может графизировать скользящие средние по нескольким временным рамкам и генерировать перекрестные сигналы между МА разных периодов. Стратегия также включает механизм остановки потери.

Логика стратегии

- Графика линий MA различных типов на основных графических временных рамках и более высоких временных рамках на основе конфигурации пользователя.

- Пройти длинный путь, когда более быстрый MA пересекает более медленный MA; пройти короткий путь, когда более быстрый MA пересекает более медленный MA.

- Добавьте к дальнейшему управлению рисками остановку потерь.

Анализ преимуществ

- Кроссоверы MA в разные временные рамки могут улучшить качество сигнала и уменьшить ложные сигналы.

- Комбинация различных типов МО использует сильные стороны отдельных индикаторов для лучшей стабильности.

- Следующая остановка помогает своевременно ограничить потери.

Анализ рисков

- Отставание от МО может привести к потере краткосрочных возможностей.

- Плохая оптимизация периодов MA может привести к чрезмерным ложным сигналам.

- Неправильное размещение стоп-лосса может привести к ненужному выходу.

Руководство по оптимизации

- Испытать комбинации параметров MA для поиска оптимальной настройки.

- Добавить другие показатели для фильтрации сигнала и улучшения качества.

- Оптимизировать стратегию стоп-лосса, чтобы соответствовать профилю рынка.

Заключение

Стратегия включает в себя анализ многочасовых рамок и подходы к остановке движущихся средних для улучшения качества сигнала и контроля рисков.

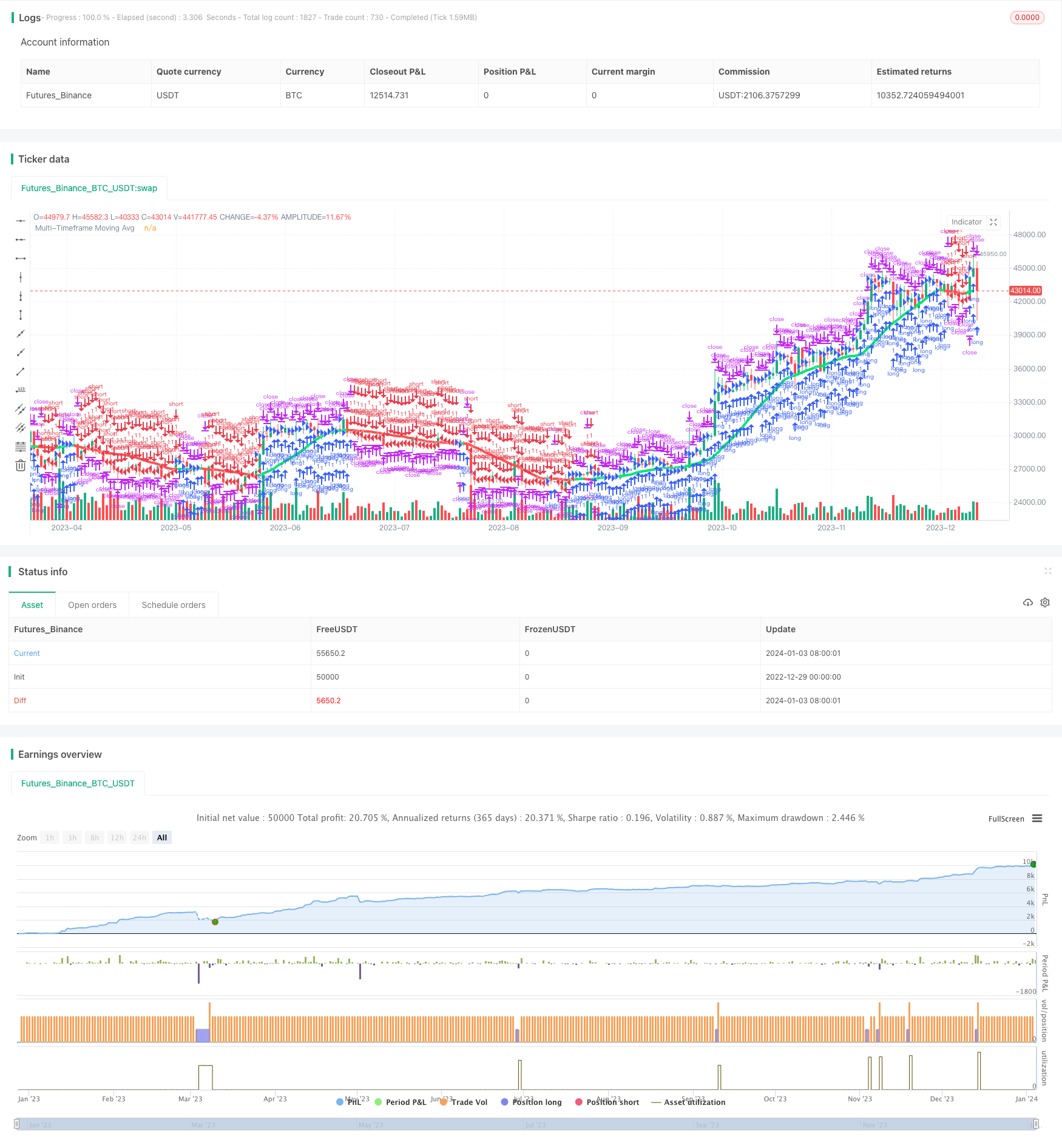

/*backtest

start: 2022-12-29 00:00:00

end: 2024-01-04 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title = "Ultimate Moving Average Strategy", shorttitle = "UMA Strategy", overlay = true)

//Created by user ChrisMoody 4-24-2014

//Converted to strategy by Virtual_Machinist 7-11-2018

//Plots The Majority of Moving Averages

//Defaults to Current Chart Time Frame --- But Can Be Changed to Higher Or Lower Time Frames

//2nd MA Capability with Show Crosses Feature

//inputs

src = close

useCurrentRes = input(true, title="Use Current Chart Resolution?")

resCustom = input(title="Use Different Timeframe? Uncheck Box Above", defval="D")

len = input(20, title="Moving Average Length - LookBack Period")

atype = input(1,minval=1,maxval=7,title="1=SMA, 2=EMA, 3=WMA, 4=HullMA, 5=VWMA, 6=RMA, 7=TEMA")

cc = input(true,title="Change Color Based On Direction?")

smoothe = input(2, minval=1, maxval=10, title="Color Smoothing - 1 = No Smoothing")

doma2 = input(false, title="Optional 2nd Moving Average")

len2 = input(50, title="Moving Average Length - Optional 2nd MA")

atype2 = input(1,minval=1,maxval=7,title="1=SMA, 2=EMA, 3=WMA, 4=HullMA, 5=VWMA, 6=RMA, 7=TEMA")

cc2 = input(true,title="Change Color Based On Direction 2nd MA?")

warn = input(false, title="***You Can Turn On The Show Dots Parameter Below Without Plotting 2nd MA to See Crosses***")

warn2 = input(false, title="***If Using Cross Feature W/O Plotting 2ndMA - Make Sure 2ndMA Parameters are Set Correctly***")

sd = input(false, title="Show Dots on Cross of Both MA's")

useStop = input(defval = true, title = "Use Trailing Stop?")

slPoints = input(defval = 200, title = "Stop Loss Trail Points", minval = 1)

slOffset = input(defval = 400, title = "Stop Loss Trail Offset", minval = 1)

res = useCurrentRes ? timeframe.period : resCustom

//hull ma definition

hullma = wma(2*wma(src, len/2)-wma(src, len), round(sqrt(len)))

//TEMA definition

ema1 = ema(src, len)

ema2 = ema(ema1, len)

ema3 = ema(ema2, len)

tema = 3 * (ema1 - ema2) + ema3

avg = atype == 1 ? sma(src,len) : atype == 2 ? ema(src,len) : atype == 3 ? wma(src,len) : atype == 4 ? hullma : atype == 5 ? vwma(src, len) : atype == 6 ? rma(src,len) : tema

//2nd Ma - hull ma definition

hullma2 = wma(2*wma(src, len2/2)-wma(src, len2), round(sqrt(len2)))

//2nd MA TEMA definition

sema1 = ema(src, len2)

sema2 = ema(sema1, len2)

sema3 = ema(sema2, len2)

stema = 3 * (sema1 - sema2) + sema3

avg2 = atype2 == 1 ? sma(src,len2) : atype2 == 2 ? ema(src,len2) : atype2 == 3 ? wma(src,len2) : atype2 == 4 ? hullma2 : atype2 == 5 ? vwma(src, len2) : atype2 == 6 ? rma(src,len2) : tema

out = avg

out_two = avg2

out1 = request.security(syminfo.tickerid, res, out)

out2 = request.security(syminfo.tickerid, res, out_two)

ma_up = out1 >= out1[smoothe]

ma_down = out1 < out1[smoothe]

col = cc ? ma_up ? lime : ma_down ? red : aqua : aqua

col2 = cc2 ? ma_up ? lime : ma_down ? red : aqua : aqua

circleYPosition = out2

plot(out1, title="Multi-Timeframe Moving Avg", style=line, linewidth=4, color = col)

plot(doma2 and out2 ? out2 : na, title="2nd Multi-TimeFrame Moving Average", style=circles, linewidth=4, color=col2)

plot(sd and cross(out1, out2) ? circleYPosition : na,style=cross, linewidth=5, color=yellow)

// Strategy conditions

longCond = ma_up

shortCond = ma_down

// entries and base exit

strategy.entry("long", strategy.long, when = longCond)

strategy.entry("short", strategy.short, when = shortCond)

if (useStop)

strategy.exit("XL", from_entry = "long", trail_points = slPoints, trail_offset = slOffset)

strategy.exit("XS", from_entry = "short", trail_points = slPoints, trail_offset = slOffset)

// not sure needed, but just incase..

strategy.exit("XL", from_entry = "long", when = shortCond)

strategy.exit("XS", from_entry = "short", when = longCond)

Больше

- Стратегия соединения импульса обратного движения

- Количественная стратегия торговли, основанная на перекрестном использовании EMA

- Количественная стратегия торговли Ichimoku Cloud

- Тенденция вследствие стратегии торговли скользящими средними

- Тенденция, следующая за стратегией прорыва импульса

- Прорыв и стратегия ценового канала интеллектуальных полос Боллинджера

- Простой тренд после стратегии

- Долгая стратегия прорыва на основе строительства линии К

- Импульсная колеблющаяся средняя движущаяся стратегия торговли на основе буферизированных полос Боллинджера

- Стратегия выбора диапазона даты адаптивного обратного теста на основе двойного MA

- Стратегия отслеживания прорыва

- Адаптивная стратегия торговли на основе индикаторов импульса

- Автоматический тренд, основанный на ключевой точке и ретракции Фибоначчи, следующий за стратегией

- Тенденционная стратегия, основанная на EMA и MACD в течение всех временных рамок

- Многопоказательная стратегия обращения столкновения

- Стратегия обратной тенденции, основанная на перекрестном использовании EMA и SMA

- Стратегия охраны DMI DPO

- Наблюдение за трендом краткосрочная стратегия торговли

- Тенденция RSI после бычьей стратегии

- Стратегия комбинирования индекса РС и скользящей средней