概述

该策略是一个利用RSI指标判断趋势,配合MACD指标进行入市的趋势追踪型多头策略。该策略同时结合EMA均线作为趋势过滤器,以及紧急止损机制来控制风险。

策略原理

该策略主要依赖RSI指标判断趋势方向。当RSI指标上穿设定的RSI长线(默认21)时,认为行情可能反转为涨趋势。此时如果MACD已经处于下降趋势,那么可以判断目前处于反转点,是一个较好的做多时机。

另外,该策略还引入EMA均线(默认200周期)作为趋势过滤器。只有当价格高于EMA均线时才会考虑做多。这可以有效过滤趋势不明或者下降趋势中的假反转。

在止损方面,该策略同时设置了常规止损线和紧急止损线。当RSI下穿常规止损线(默认86)时平仓;如果价格大幅下挫,RSI下穿紧急止损线(默认73)时无条件平仓,以控制最大损失。

优势分析

- 使用RSI判断反转点,配合MACD滤除误入。

- 引入EMA均线判断大趋势。

- 同时使用常规止损和紧急止损,控制风险。

风险分析

- RSI反转信号可能出现误判。

- 大盘趋势变化时,EMA均线无法及时响应。

- 单一止损指标可能将获利交易截止。

优化方向

- 可以引入价量指标或者阳线/阴线比例作为辅助判断指标,提高入场准确率。

- 均线系统可以调整为动态追踪最近N日趋势。

- 增加移动止损或者统计止损,让止损更加灵活。

总结

本策略总体来说是一个较为传统的趋势追踪型多头策略。利用RSI识别反转点,MACD过滤误判,EMA判断大趋势,止损控制风险。该策略较为简单直观,容易理解,在判断行情反转上具有一定优势,可以作为量化交易的入门策略之一。但该策略可优化空间较大,后续可以从入场信号、趋势判断、止损机制等多个方面进行进一步完善。

策略源码

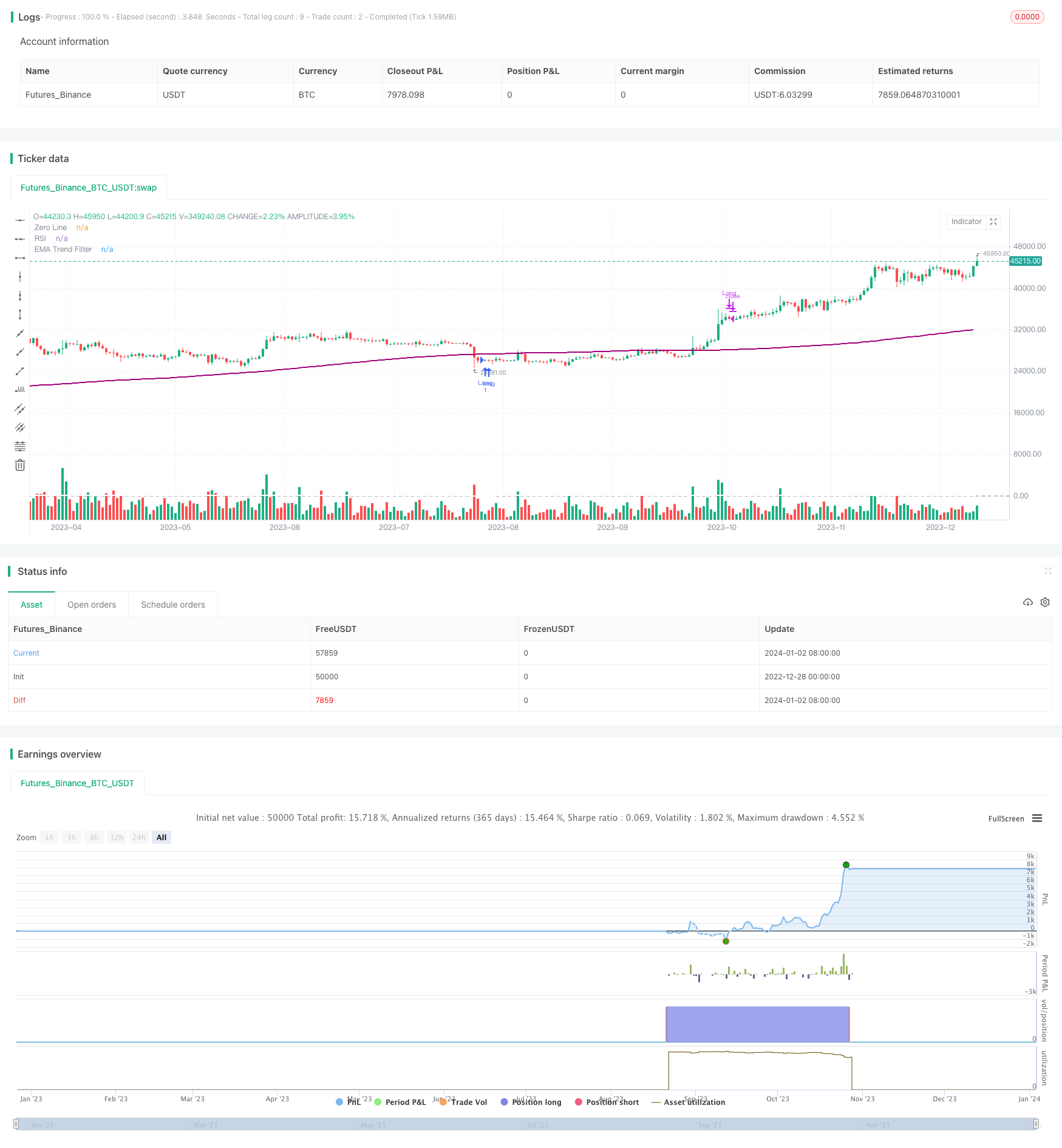

/*backtest

start: 2022-12-28 00:00:00

end: 2024-01-03 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © dravitch

//@version=4

strategy("RSI - BULL RUN (Improved)", overlay=true)

// Input

UseEmergency = input(true, "Use Emergency Exit?")

RSIlong = input(21, "RSI Long Cross")

RSIcloseLong = input(86, "RSI Close Long Position")

EmergencycloseLong = input(73, "RSI Emergency Close Long Position")

UseEMAFilter = input(true, "Use EMA Trend Filter")

EMAlength = input(200, "EMA Length for Trend Filter") // Utiliser 200 pour SMMA

// RSI

rsiValue = rsi(close, 14)

// MACD

[macdLine, signalLine, _] = macd(close, 12, 26, 9)

// EMA Trend Filter

emaTrend = sma(close, EMAlength) // Utiliser sma pour la SMMA (Simple Moving Average)

// Conditions pour les trades longs

trendUp = close > emaTrend

trendDown = close < emaTrend

longCondition = crossover(rsiValue, RSIlong) and trendDown or crossunder(macdLine, signalLine) and crossover(rsiValue, RSIlong)

longCloseCondition = crossunder(rsiValue, RSIcloseLong) and trendUp

emergencyLongCondition = crossunder(rsiValue, EmergencycloseLong)

// Plots

plot(rsiValue, color=color.white, linewidth=2, title="RSI")

// Strategy

if (longCondition)

strategy.entry("Long", strategy.long, alert_message='RSI Long Cross: LONG')

if (longCloseCondition)

strategy.close("Long", alert_message='RSI Close Long Position')

if (emergencyLongCondition and UseEmergency)

strategy.close("Long", alert_message='RSI Emergency Close Long')

// Plot EMA Trend Filter in a separate pane

plot(emaTrend, color=color.rgb(163, 0, 122), title="EMA Trend Filter", linewidth=2, style=plot.style_line, transp=0)

hline(0, "Zero Line", color=color.gray)