概述

本策略通过设定简单的K线形态判断规则,实现对特斯拉4小时线的长仓突破交易。策略具有实现简单、逻辑清晰、容易理解等优点。

策略原理

策略的核心判断逻辑基于如下4条K线形态规则:

- 当前K线最低价低于开盘价

- 当前K线最低价低于上一根K线的最低价

- 当前K线收盘价高于开盘价

- 当前K线收盘价高于上一根K线的开盘价和收盘价

当同时满足以上4条规则时,进行做多方向的开仓操作。

此外,策略还设定了止损位和止盈位,当价格触发止盈或止损条件时,进行平仓操作。

优势分析

该策略具有以下一些优势:

- 使用的K线判断规则非常简单和直接,容易理解,也容易实践。

- 完全基于价格实体判断,没有使用过于复杂的技术指标,回测效果直接。

- 实现代码量很小,运行效率高,容易进行优化和改进。

- 可通过参数调整,自由设置止损止盈条件,控制风险。

风险分析

需要注意的风险主要有:

- 使用固定数量开仓,没有考虑仓位管理,可能存在超量交易的风险。

- 没有设置过滤器,在震荡行情中可能会产生过多无效交易。

- 回测数据不足,可能对策略效果判断产生偏差。

可通过如下方法减轻风险:

- 加入仓位管理模块,根据资金规模动态调整交易数量。

- 增加交易过滤条件,避免在震荡盘中无序开仓。

- 收集更多历史数据,扩大回测时间长度,提高结果可靠性。

优化方向

该策略可优化的方向包括:

- 增加仓位管理模块,根据资金使用比例确定交易规模。

- 设计止损止盈追踪机制,实现弹性出场。

- 增加交易过滤模块,避免无效交易。

- 利用机器学习方法自动优化参数。

- 支持多品种套利交易。

总结

本策略通过简单的K线形态判断规则实现做多突破交易,虽然存在一定改进空间,但从简单性和直接性考量,该策略是一个非常适合初学者理解和使用的长仓策略。通过不断优化,可以使策略效果更加出色。

策略源码

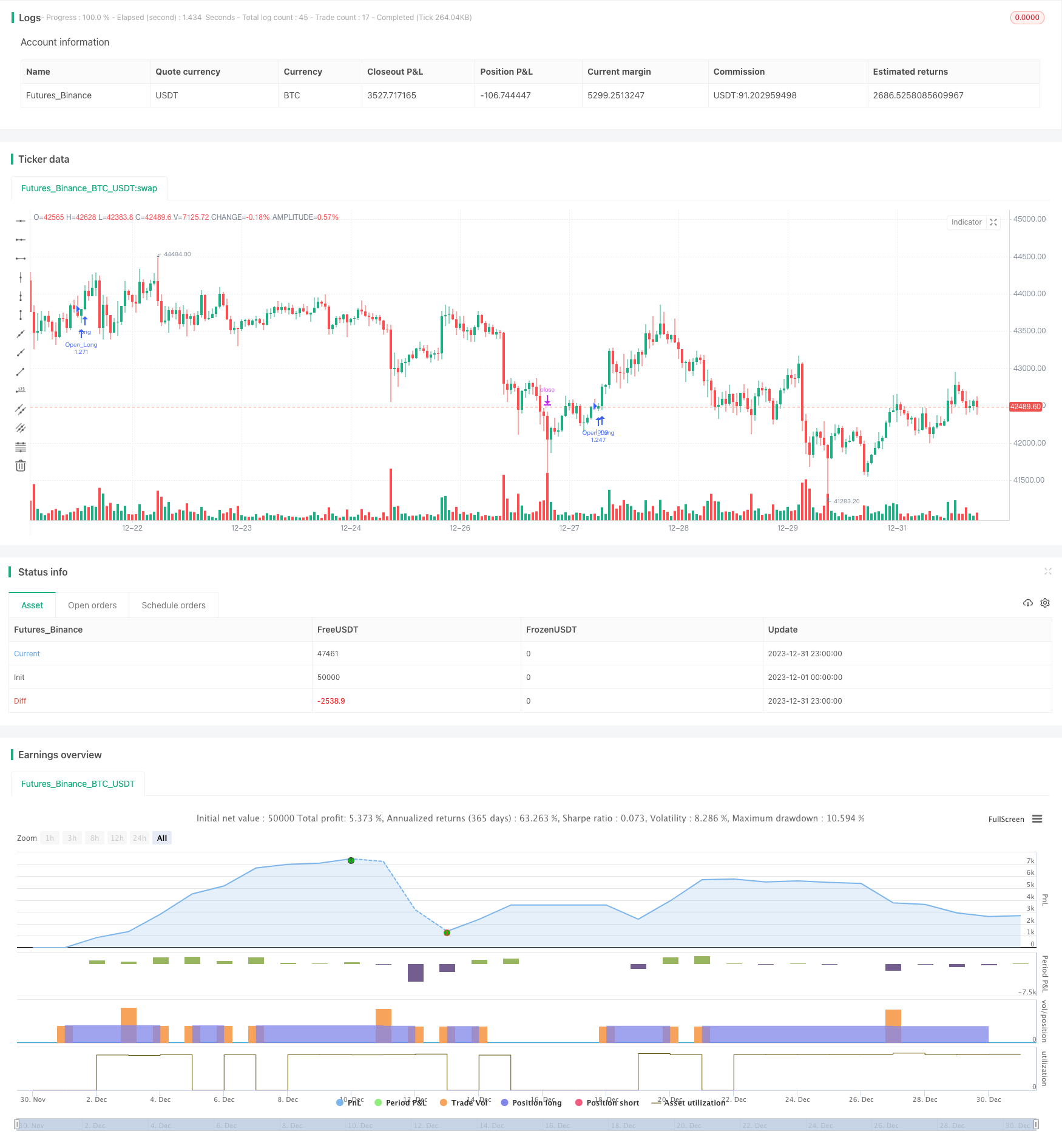

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © TheQuantScience

//@version=5

strategy("SimpleBarPattern_LongOnly", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, currency = currency.EUR, initial_capital = 1000, commission_type = strategy.commission.percent, commission_value = 0.03)

// Make input options that configure backtest date range

startDate = input.int(title="Start Date",

defval=1, minval=1, maxval=31)

startMonth = input.int(title="Start Month",

defval=1, minval=1, maxval=12)

startYear = input.int(title="Start Year",

defval=2017, minval=1800, maxval=2100)

endDate = input.int(title="End Date",

defval=8, minval=1, maxval=31)

endMonth = input.int(title="End Month",

defval=3, minval=1, maxval=12)

endYear = input.int(title="End Year",

defval=2022, minval=1800, maxval=2100)

// Look if the close time of the current bar

// Falls inside the date range

inDateRange = true

// Setting Conditions

ConditionA = low < open

ConditionB = low < low[1]

ConditionC = close > open

ConditionD = close > open[1] and close > close[1]

FirstCondition = ConditionA and ConditionB

SecondCondition = ConditionC and ConditionD

IsLong = FirstCondition and SecondCondition

TakeProfit_long = input(4.00)

StopLoss_long = input(4.00)

Profit = TakeProfit_long*close/100/syminfo.mintick

Loss = StopLoss_long*close/100/syminfo.mintick

EntryCondition = IsLong and inDateRange

// Trade Entry&Exit Condition

if EntryCondition and strategy.opentrades == 0

strategy.entry(id = 'Open_Long', direction = strategy.long)

strategy.exit(id = "Close_Long", from_entry = 'Open_Long', profit = Profit, loss = Loss)