Стратегия торговли индексом импульса двойного переворота

Автор:Чао Чжан, Дата: 2024-02-06 09:29:34Тэги:

Обзор

Стратегия Dual Reversal Momentum Index сочетает в себе стратегию 123 Reversal и стратегию Relative Momentum Index (RMI).

Принцип стратегии

Стратегия состоит из двух частей:

-

123 Стратегия отмены

- Длинный, когда закрытие вчерашнего дня ниже, чем в предыдущие дни, и сегодняшнее закрытие выше, чем в предыдущие дни, и 9-дневный медленный K ниже 50

- Короткий, когда закрытие вчера выше, чем в предыдущие дни, и сегодняшнее закрытие ниже, чем в предыдущие дни, и 9-дневный Fast K выше 50

-

Стратегия относительного индекса импульса (RMI)

- RMI - это вариация RSI с добавлением импульсного компонента.

- Долгий, когда RMI ниже перекупленной линии; короткий, когда RMI выше перепроданной линии

Стратегия генерирует торговые сигналы только тогда, когда 123 Reversal и RMI дают выровненные двойные сигналы.

Анализ преимуществ

Преимущества этой стратегии включают:

- Улучшенная точность сигнала с двойными индикаторами

- Техники обратного отсчета, подходящие для рынков с ограниченным диапазоном

- Чувствительный показатель RMI для выявления поворотных точек сильных тенденций

Анализ рисков

Существуют также некоторые риски:

- Двойные фильтры могут упустить некоторые торговые возможности

- Сигналы обратного движения могут быть ошибочными.

- Неправильные настройки параметров RMI могут повлиять на эффективность

Эти риски могут быть уменьшены путем корректировки параметров, оптимизации расчетов показателей.

Руководство по оптимизации

Стратегия может быть дополнительно оптимизирована путем:

- Испытание различных комбинаций параметров для поиска оптимального

- Попытка использования различных комбинаций индикаторов обратного движения, например, KDJ, MACD

- Корректировка формулы RMI, чтобы сделать ее более чувствительной

- Добавление механизмов остановки потерь для контроля одиночных потерь

- Сочетание объема торговли для предотвращения ложных сигналов

Заключение

Стратегия двойного обратного импульса может эффективно улучшить точность торговых решений и уменьшить вероятность ошибочных сигналов с помощью двойного фильтрации сигналов и оптимизации параметров.

/*backtest

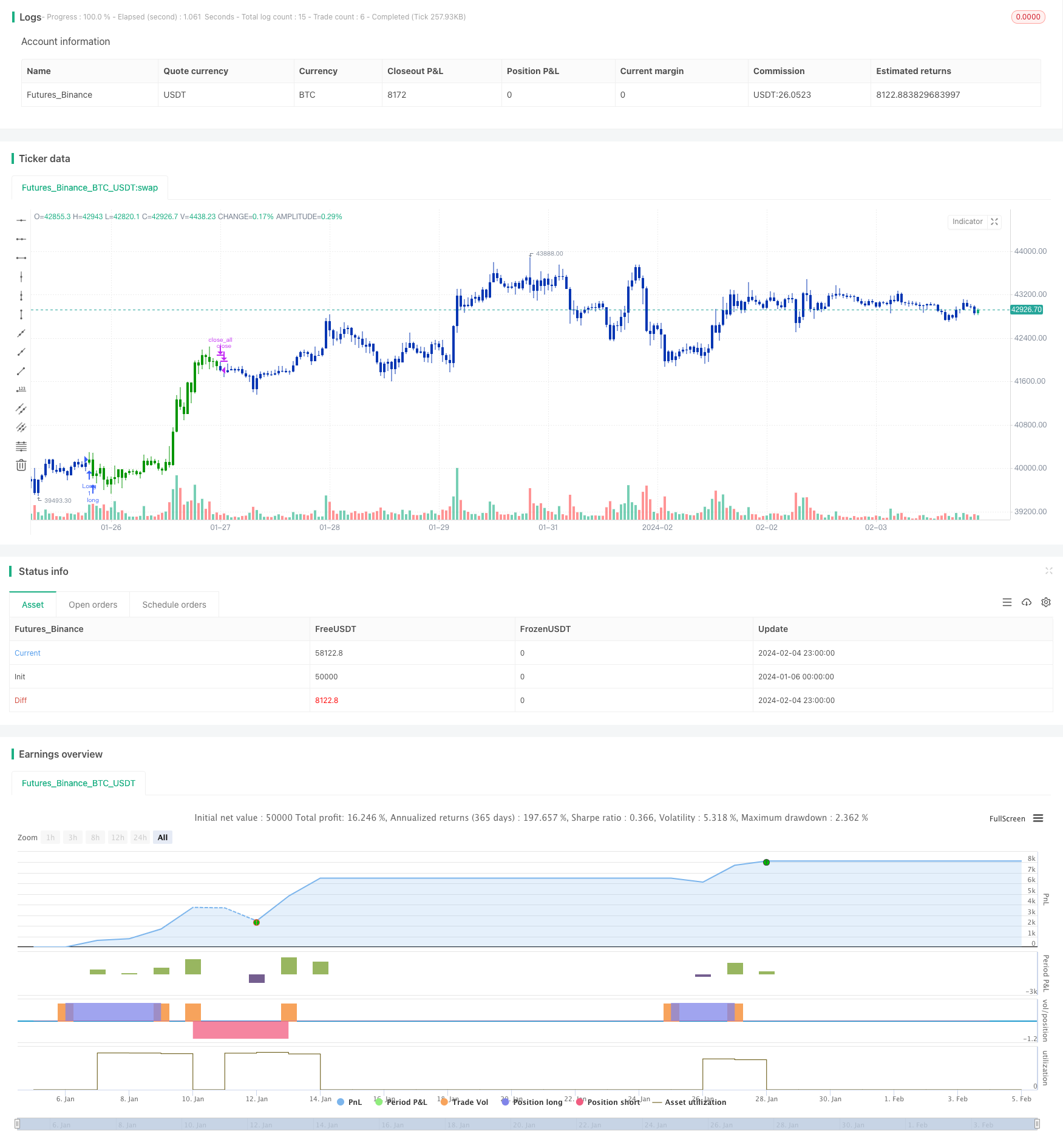

start: 2024-01-06 00:00:00

end: 2024-02-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 07/06/2021

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// The Relative Momentum Index (RMI) was developed by Roger Altman. Impressed

// with the Relative Strength Index's sensitivity to the number of look-back

// periods, yet frustrated with it's inconsistent oscillation between defined

// overbought and oversold levels, Mr. Altman added a momentum component to the RSI.

// As mentioned, the RMI is a variation of the RSI indicator. Instead of counting

// up and down days from close to close as the RSI does, the RMI counts up and down

// days from the close relative to the close x-days ago where x is not necessarily

// 1 as required by the RSI). So as the name of the indicator reflects, "momentum" is

// substituted for "strength".

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

RMI(Length,BuyZone, SellZone) =>

pos = 0.0

xMU = 0.0

xMD = 0.0

xPrice = close

xMom = xPrice - xPrice[Length]

xMU := iff(xMom >= 0, nz(xMU[1], 1) - (nz(xMU[1],1) / Length) + xMom, nz(xMU[1], 1))

xMD := iff(xMom <= 0, nz(xMD[1], 1) - (nz(xMD[1],1) / Length) + abs(xMom), nz(xMD[1], 0))

RM = xMU / xMD

nRes = 100 * (RM / (1+RM))

pos:= iff(nRes < BuyZone, 1,

iff(nRes > SellZone, -1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Relative Momentum Index", shorttitle="Combo", overlay = true)

line1 = input(true, "---- 123 Reversal ----")

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

line2 = input(true, "---- Relative Momentum Index ----")

LengthRMI = input(20, minval=1)

BuyZone = input(40, minval=1)

SellZone = input(70, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posRMI = RMI(LengthRMI,BuyZone, SellZone)

pos = iff(posReversal123 == 1 and posRMI == 1 , 1,

iff(posReversal123 == -1 and posRMI == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1 )

strategy.entry("Long", strategy.long)

if (possig == -1 )

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

Больше

- RSI и Bollinger Bands Fusion Trading Strategy для LTC

- Оптимизированная стратегия перекрестного перемещения среднего движущегося импульса

- Динамическая стратегия SMA-ATR

- Стратегия отслеживания обратного движения

- Стратегия арбитража с двойным обращением

- Кама и движущийся средний основанный на тренде после стратегии

- Ценовые каналы и движущийся средний по стратегии

- Динамическая стратегия среднего показателя позиций RSI

- Стратегия комбинации полос Боллинджера и RSI

- Динамическая двойная экспоненциальная стратегия торговли скользящей средней

- Стратегия ловца дна

- Стратегия полос Боллинджера с выбором диапазона дат

- Тенденция после стратегии остановки потерь на основе индикатора предупреждения о тренде

- Стратегия Брессерта с двойной сглаженной стохастической стратегией

- Кроссоверная тенденция стохастической и скользящей средних по количественной стратегии

- 5-дневная стратегия перемещения среднего канала в сочетании с концепцией пробега

- Стратегия отмены выхода с остановкой потери

- Стратегия EMA для прорыва в экономике

- Стратегия торговли Squeeze Momentum на основе индикатора LazyBear

- Camarilla Pivot Points Strategy на основе полос Боллинджера