概述

本策略基于LazyBear的压缩动量指标,加入了动量过滤器,改变了数据源,并增加了风险管理系统,可自定义回测时间段,旨在捕捉波动性压缩后的价格爆发。

策略原理

该策略使用布林带指标和Keltner通道指标计算价格通道,当价格突破通道时,视为波动性加大的信号。它结合了LazyBear的压缩动量指标,该指标使用线性回归方法判断价格动量方向。

策略加入了动量过滤器,只有当动量绝对值超过阈值时才会发出交易信号。当波动性压缩(通道内收紧),且动量过滤通过时,策略判断趋势方向,做多或做空。同时设置止损、止盈、追踪止损来控制风险。

优势分析

该策略集成了多种指标判断,比较全面;加入风险管理机制,可以限制单笔损失;在波动性压缩后能及时判断价格趋势方向;参数可自定义,适应性强。

风险分析

风险主要存在:虚假突破导致错误判断;参数设置不当,未能及时反转;止损被突破造成损失扩大。可以优化参数,调整风险管理参数,选择合适品种和交易时段来降低这些风险。

优化方向

可以考虑结合其他指标过滤信号,例如交易量指标;调整动量阈值更精确;设置回撤止损以进一步控制风险;测试更多品种数据效果。这些优化可以使策略更稳定和泛化。

总结

本策略较全面判断价格趋势和波动性,集成程度高,风险控制措施较完善,可根据优化方向做进一步改进,对捕捉波动性压缩后的价格爆发有很强的适应性。

策略源码

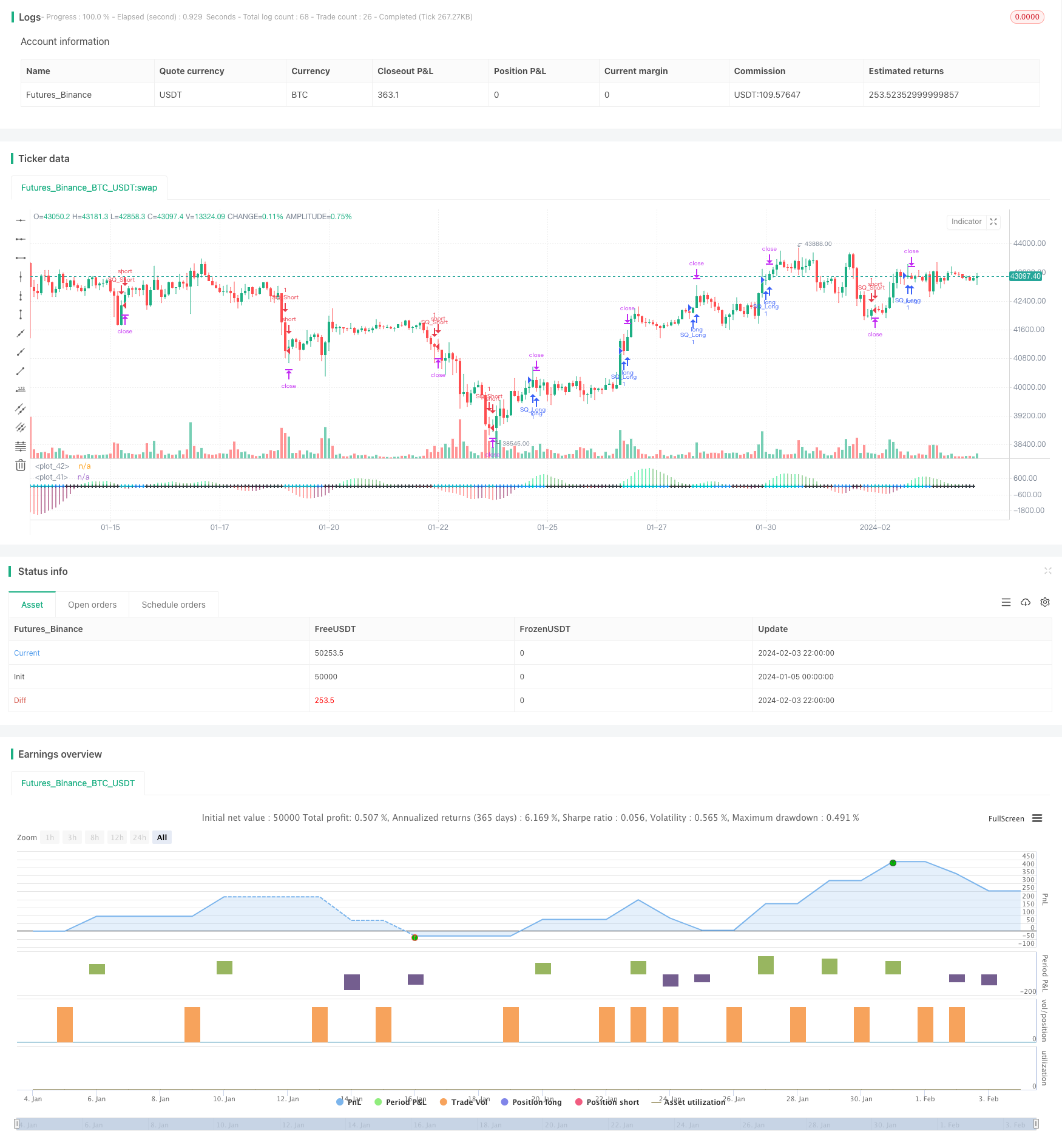

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 2h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// @version=4

// Strategy based on LazyBear Squeeze Momentum Indicator

// © Bitduke

// All scripts: https://www.tradingview.com/u/Bitduke/#published-scripts

strategy(shorttitle="SMS", title="Squeeze Momentum Strategy", overlay=false )

length = input(12, title="BB Length")

mult = input(2.0, title="BB MultFactor")

lengthKC = input(16, title="KC Length")

mult_kc = input(1.5, title="KC MultFactor")

//FILTERS

useMomAverage = input(false, title="Filter for Momenutum value", type=input.bool)

MomentumMin = input(20, title="Min for momentum")

// Calculate BB

src = ohlc4

ma_1 = sma(src, length)

ma_2 = sma(src, lengthKC)

range_ma = sma(high - low, lengthKC)

dev = mult * stdev(src, length)

upper_bb = ma_1 + dev

lower_bb = ma_1 - dev

upper_kc = ma_2 + range_ma * mult_kc

lower_kc = ma_2 - range_ma * mult_kc

sqz_on = lower_bb > lower_kc and upper_bb < upper_kc

sqz_off = lower_bb < lower_kc and upper_bb > upper_kc

no_sqz = sqz_on == false and sqz_off == false

val = linreg(src - avg(avg(highest(hl2, lengthKC), lowest(low, lengthKC)), sma(hl2, lengthKC)), lengthKC, 0)

bcolor = iff(val > 0, iff(val > nz(val[1]), color.lime, color.green), iff(val < nz(val[1]), color.red, color.maroon))

scolor = no_sqz ? color.blue : sqz_on ? color.black : color.aqua

plot(val, color=bcolor, style=plot.style_histogram, linewidth=4)

plot(0, color=scolor, style=plot.style_cross, linewidth=2)

//LOGIC

//momentum filter

filterMom = useMomAverage ? abs(val) > MomentumMin / 100000 ? true : false : true

//standard condition

longCondition = scolor[1] != color.aqua and scolor == color.aqua and bcolor == color.lime and filterMom

exitLongCondition = bcolor == color.green

shortCondition = scolor[1] != color.aqua and scolor == color.aqua and bcolor == color.red and filterMom

exitShortCondition = bcolor == color.maroon

// Risk Management Sysyem

stop_loss = input(defval = 600, title="Stop Loss", minval = 0)

take_profit = input(defval = 1000, title="Take Profit", minval = 0)

trailing_stop = input(defval = 20, title="Trailing Stop", minval = 0)

// If the zero value is set for stop loss, take profit or trailing stop, then the function is disabled

s_loss = stop_loss >= 1 ? stop_loss : na

tk_profit = take_profit >= 1 ? take_profit : na

tr_stop = trailing_stop >= 1 ? trailing_stop : na

//STRATEGY

strategy.entry("SQ_Long", strategy.long, when=longCondition)

strategy.exit("Exit Long", from_entry = "SQ_Long", profit = take_profit, trail_points = trailing_stop, loss = s_loss)

strategy.close("SQ_Long", exitLongCondition)

strategy.entry("SQ_Short", strategy.short, when=shortCondition)

strategy.exit("Exit Short", from_entry = "SQ_Short", profit = take_profit, trail_points = trailing_stop, loss = s_loss )

strategy.close("SQ_Short", when=exitShortCondition)