MyLanguage کی طرف سے کرپٹو مارکیٹ پر تھرمو اسٹریٹیجی کا استعمال

مصنف:نیکی, تخلیق: 2020-08-21 19:19:20, تازہ کاری: 2023-10-10 21:15:32

حکمت عملی کا نام: اپ گریڈ شدہ ترموسٹیٹ حکمت عملی

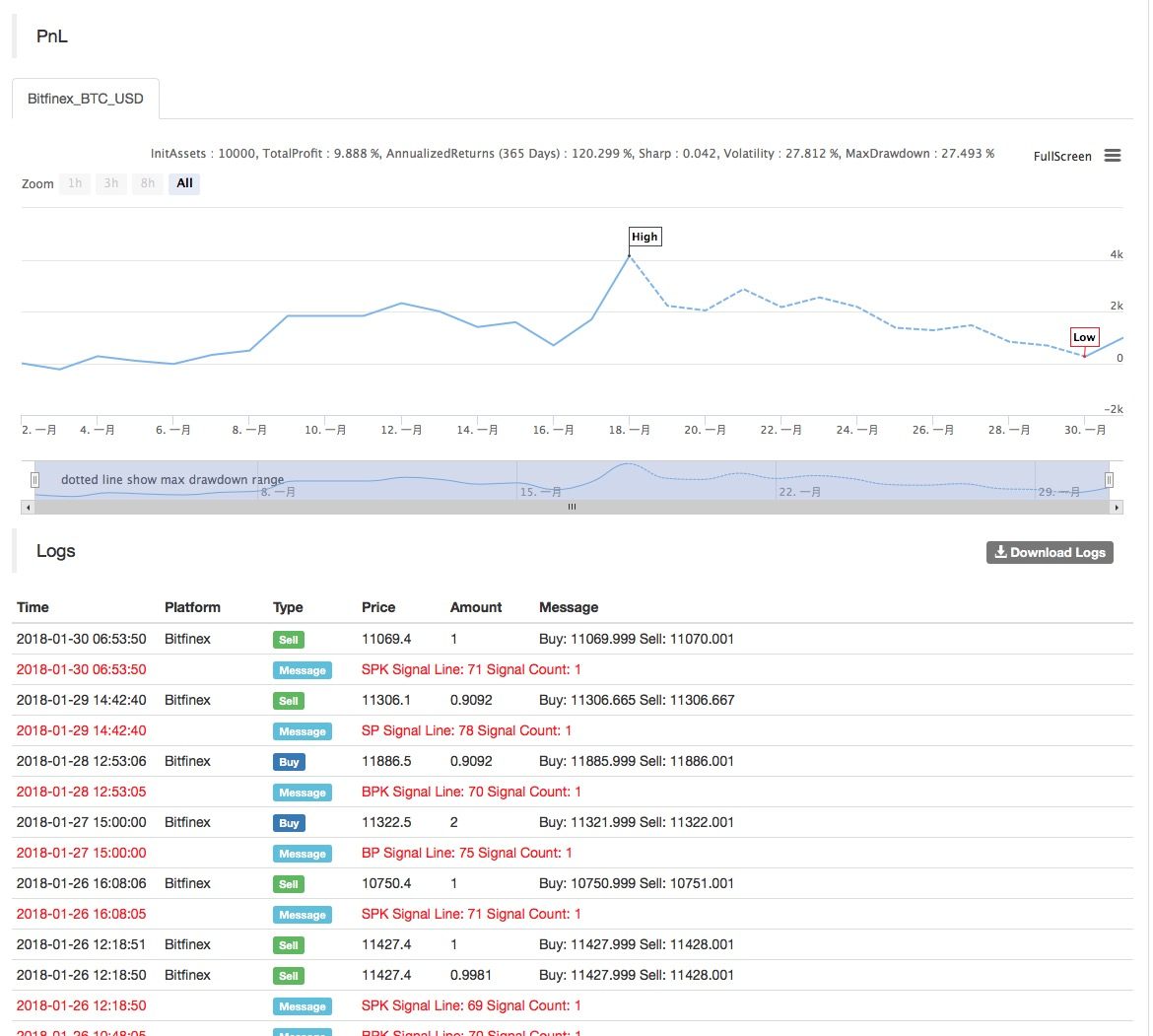

ڈیٹا سائیکل: 1H

سپورٹ: کموڈٹی فیوچر، ڈیجیٹل کرنسی فیوچر، ڈیجیٹل کرنسی اسپاٹ

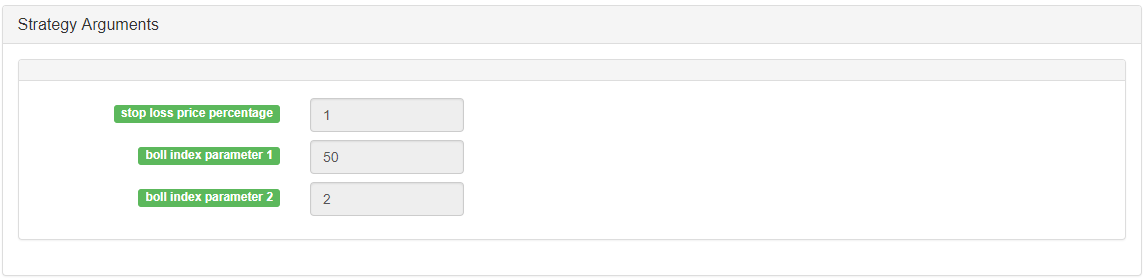

مرکزی چارٹ: اوپر ٹریک، فارمولا: TOP^^MAC+N_TMPTMP؛ / / بال کے اوپر ٹریک نچلی ٹریک، فارمولا: Bottom^^MAC-N_TMPTMP؛//boll کی نچلی ٹریک

ثانوی چارٹ: CMI، فارمولا: CMI: ABS ((C-REF ((C,N_CMI-1))/(HHV ((H,N_CMI) -LLV ((L,N_CMI)) * 100؛ //0-100 قدر جتنی زیادہ ہوگی ، رجحان اتنا ہی مضبوط ہوگا ، سی ایم آئی <20 نوسٹالیشن ہے ، سی ایم آئی>20 رجحان ہے

ماخذ کوڈ:

(*backtest

start: 2018-11-06 00:00:00

end: 2018-12-04 00:00:00

period: 1h

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

*)

MAC:=MA(CLOSE,N);

TMP:=STD(CLOSE,N);

TOP^^MAC+N_TMP*TMP;// upper track of boll

BOTTOM^^MAC-N_TMP*TMP;// lower track of boll

BBOLL:=C>MAC;

SBOLL:=C<MAC;

N_CMI:=30;

CMI:ABS(C-REF(C,N_CMI-1))/(HHV(H,N_CMI)-LLV(L,N_CMI))*100;

//0-100 the larger the value, the stronger the trend, CMI <20 is oscillation mode, CMI>20 is the trend

N_KD:=9;

M1:=3;

M2:=3;

RSV:=(CLOSE-LLV(LOW,N_KD))/(HHV(HIGH,N_KD)-LLV(LOW,N_KD))*100;

//(1)closing price - the lowest of cycle N, (2)the highest of cycle N - the lowest of cycle N, (1)/(2)

K:=SMA(RSV,M1,1);//MA of RSV

D:=SMA(K,M2,1);//MA of K

MIND:=30;

BKD:=K>D AND D<MIND;

SKD:=K<D AND D>100-MIND;

//oscillation mode

BUYPK1:=CMI < 20 AND BKD;//if it's oscillation, buy to cover and buy long immediately

SELLPK1:=CMI < 20 AND SKD;//if it's oscillation, sell to close long position and sell short to open position immediately

//Disposal of the original oscillating position under the trend mode

SELLY1:=REF(CMI,BARSBK) < 20 AND C>BKPRICE*(1+0.01*STOPLOSS*3) AND K<D;//if it's oscillation, long position take profit

BUYY1:=REF(CMI,BARSSK) < 20 AND C<SKPRICE*(1-0.01*STOPLOSS*3) AND K>D;//if it's oscillation, short position take profit

//trend mode

BUYPK2:=CMI >= 20 AND C > TOP;//if it's trend, buy to cover and buy long immediately

SELLPK2:=CMI >= 20 AND C < BOTTOM;//if it's trend, sell to close long position and sell short to open position immediately

//Disposal of the original oscillating position under the trend mode

SELLY2:=REF(CMI,BARSBK) >= 20 AND C>BKPRICE*(1+0.01*STOPLOSS*3) AND SBOLL;//if it's trend, long position take profit

BUYY2:=REF(CMI,BARSSK) >= 20 AND C<SKPRICE*(1-0.01*STOPLOSS*3) AND BBOLL;//if it's trend, short position take profit

SELLS2:=REF(CMI,BARSBK) >= 20 AND C<BKPRICE*(1-0.01*STOPLOSS) AND SBOLL;//if it's trend, long position stop loss

BUYS2:=REF(CMI,BARSSK) >= 20 AND C>SKPRICE*(1+0.01*STOPLOSS) AND BBOLL;//if it's trend, short position stop loss

IF BARPOS>N THEN BEGIN

BUYPK1,BPK;

SELLPK1,SPK;

BUYPK2,BPK;

SELLPK2,SPK;

END

BUYY1,BP(SKVOL);

BUYY2,BP(SKVOL);

BUYS2,BP(SKVOL);

SELLY1,SP(BKVOL);

SELLY2,SP(BKVOL);

SELLS2,SP(BKVOL);

ماخذ کوڈ:https://www.fmz.com/strategy/129086

متعلقہ مواد

- ڈی ای ایکس ایکسچینجز کی مقداری مشق (2) -- ہائپر لیکویڈ صارف گائیڈ

- ڈی ای ایکس ایکسچینج کی مقدار سازی کی مشقیں ((2) -- Hyperliquid استعمال کرنے کا رہنما

- ڈی ای ایکس ایکسچینجز کی مقداری مشق (1) -- ڈی وائی ڈی ایکس وی 4 صارف گائیڈ

- کریپٹوکرنسی میں لیڈ لیگ ثالثی کا تعارف (3)

- ڈی ای ایکس ایکسچینج کی کوانٹیٹیشن پریکٹس ((1) -- dYdX v4 استعمال کرنے کا رہنما

- ڈیجیٹل کرنسیوں میں لیڈ لیگ سوٹ کا تعارف (3)

- کریپٹوکرنسی میں لیڈ لیگ اربیٹریج کا تعارف (2)

- ڈیجیٹل کرنسیوں میں لیڈ لیگ سوٹ کا تعارف ((2)

- ایف ایم زیڈ پلیٹ فارم کی بیرونی سگنل وصولی پر بحث: حکمت عملی میں بلٹ ان ایچ ٹی پی سروس کے ساتھ سگنل وصول کرنے کے لئے ایک مکمل حل

- ایف ایم زیڈ پلیٹ فارم کے بیرونی سگنل وصول کرنے کا جائزہ: حکمت عملی بلٹ میں HTTP سروس سگنل وصول کرنے کا مکمل نظام

- کریپٹوکرنسی میں لیڈ لیگ اربیٹریج کا تعارف (1)

مزید معلومات

- مقداری لین دین میں سرور کا استعمال

- [ہزاروں فوجوں کی جنگ] کرنسی اور کرنسی کے تبادلے کی شرح تقریبا حکمت عملی 3 تتلیوں کے طور پر ہیجنگ

- توازن کی حکمت عملی (تعلیم کی حکمت عملی)

- RSI2 فیوچر میں استعمال ہونے والی اوسط ریورسنگ کی حکمت عملی

- فیوچر اور کریپٹوکرنسی API وضاحت

- ایک نیم خودکار مقداری تجارتی آلہ کو فوری طور پر نافذ کریں

- ارون اشارے کا تعارف

- ڈیجیٹل کرنسی آپشنز کی حکمت عملی کے بیک ٹیسٹنگ پر ابتدائی مطالعہ

- مقداری تجارت اور موضوعی تجارت کے درمیان فرق

- اے ٹی آر چینل کی حکمت عملی کرپٹو مارکیٹ پر لاگو

- hans123 اندرونی دن کی کامیابی کی حکمت عملی

- ڈیجیٹل کرنسیوں کے اختیارات کی حکمت عملی کی پہلی جانچ پڑتال

- TradingViewWebHook الارم براہ راست FMZ روبوٹ سے منسلک

- تجارتی حکمت عملی میں الارم گھڑی شامل کریں

- سی ++ کا استعمال کرتے ہوئے اوکیکس مستقبل کے معاہدے کی ہیجنگ کی حکمت عملی

- فنڈز کے فعال بہاؤ پر مبنی تجارتی حکمت عملی

- دستی ٹریڈنگ کی سہولت کے لئے ٹریڈنگ ٹرمینل پلگ ان کا استعمال کریں

- مقداری ٹائپنگ ریٹ ٹریڈنگ کی حکمت عملی

- توازن کی حکمت عملی اور گرڈ کی حکمت عملی

- کثیر روبوٹ مارکیٹ کوٹس شیئرنگ حل