حرکت پذیری اوسط کی بنیاد پر حکمت عملی کے بعد رجحان

جائزہ

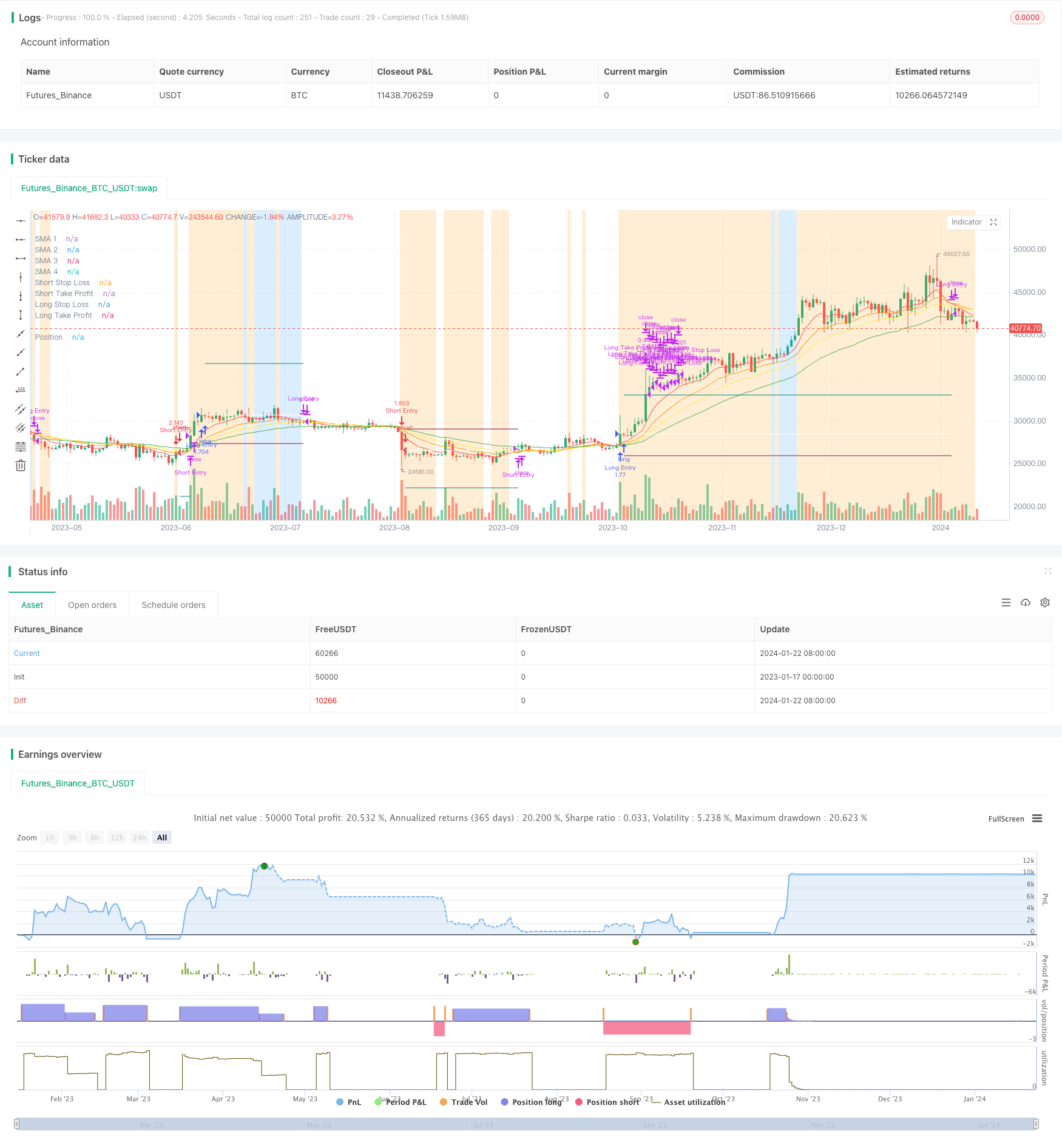

یہ حکمت عملی ایک سادہ رجحان کی پیروی کرنے والی حکمت عملی ہے جو ایک چلتی اوسط پر مبنی ہے۔ یہ مختلف ادوار کی چلتی اوسط کے بڑے بڑے تعلقات کا موازنہ کرکے موجودہ رجحان کی سمت کا فیصلہ کرتا ہے ، اور اس رجحان کی مدت کا فیصلہ کرتا ہے۔ جب قلیل مدتی اوسط نیچے سے اوپر کی طرف سے طویل مدتی اوسط کو عبور کرتا ہے تو زیادہ کام کرتا ہے ، اور جب قلیل مدتی اوسط اوپر سے نیچے کی طرف سے طویل مدتی اوسط کو عبور کرتا ہے تو خالی ہوجاتا ہے۔

حکمت عملی کا اصول

یہ حکمت عملی 4 مختلف ادوار کی متحرک اوسط کا استعمال کرتی ہے: 5 دن کی لائن ، 10 دن کی لائن ، 15 دن کی لائن اور 25 دن کی لائن۔ یہ 4 اوسط لائنیں MA1 ، MA2 ، MA3 اور MA4 کہلاتی ہیں۔ ان میں سے ، MA1 سب سے چھوٹا ہے ، اور MA4 سب سے لمبا ہے۔

جب MA1>MA2>MA3>MA4، اشارہ کرتا ہے کہ قیمت بڑھتی ہوئی رجحان میں ہے، اس وقت زیادہ ہے؛ جب MA1

زیادہ اور کم کرنے کے لئے پوزیشن کھولنے کی شرائط کو بھی اے ٹی آر اسٹاپ نقصان فلٹر کو پورا کرنے کی ضرورت ہے ، یعنی اے ٹی آر کی قیمت اے ٹی آر کی 40 سیکنڈ کی سادہ حرکت پذیر اوسط سے زیادہ ہے ، جس سے قیمت کے اتار چڑھاؤ کے بعد گھنٹوں میں غلط سگنل سے بچا جاسکتا ہے۔

اسٹریٹجک فوائد

یہ حکمت عملی مندرجہ ذیل فوائد رکھتی ہے:

- اس کے علاوہ، اس کے بارے میں سوچنے کے لئے آسان ہے، اور اسے لاگو کرنا آسان ہے.

- ایک حرکت پذیر اوسط کے ایک سے زیادہ سیٹ کا استعمال کرتے ہوئے رجحانات کی سمت کا تعین کرنے کے لئے قابل اعتماد ہے.

- اسٹاپ اسٹاپ نقصان کا تعین کریں تاکہ آپ ایک ہی تجارت میں زیادہ سے زیادہ نقصان کو مؤثر طریقے سے کنٹرول کرسکیں۔

- اے ٹی آر سٹاپ نقصان فلٹر قیمت کے اتار چڑھاؤ کے بعد گھنٹوں کے غلط سگنل کو روکتا ہے۔

خطرے کا تجزیہ

اس حکمت عملی میں مندرجہ ذیل خطرات بھی ہیں:

- اس کے علاوہ، یہ بھی کہا گیا ہے کہ یہ ایک غلط سگنل ہے جو بڑے پیمانے پر ہلکے بازاروں میں پیدا ہوتا ہے.

- پیرامیٹرز کی غلط ترتیب (مثلا اوسط مدت وغیرہ) سے حکمت عملی کا اثر خراب ہوسکتا ہے۔

- بنیادی اور اہم خبروں کی قیمتوں پر اثر و رسوخ پر غور نہیں کیا گیا ہے۔

ان خطرات کو کم کرنے کے لئے، آپ مناسب طریقے سے پیرامیٹرز کو بہتر بنا سکتے ہیں، یا پالیسی استحکام کو بہتر بنانے کے لئے دیگر فلٹر شرائط شامل کرسکتے ہیں.

اصلاح کی سمت

اس حکمت عملی کو بہتر بنانے کے لیے:

- متحرک اوسط کے مختلف پیرامیٹرز کے مجموعے کو آزمائیں اور بہترین پیرامیٹرز تلاش کریں۔

- سگنل کی وشوسنییتا کا فیصلہ کرنے کے لئے دیگر تکنیکی اشارے فلٹرز جیسے MACD، KDJ وغیرہ شامل کریں۔

- ٹرانزیکشنز کو فلٹر کرنے میں اضافہ کریں ، صرف اس صورت میں تجارت کریں جب ٹرانزیکشنز کی مقدار زیادہ ہو۔

- مختلف قسم کے پیرامیٹرز کے فرق کے مطابق مختلف قسم کے پیرامیٹرز کو بہتر بنائیں۔

- مشین لرننگ الگورتھم کے فیصلے کے سگنل میں اضافہ کرنا۔

خلاصہ کریں۔

یہ حکمت عملی مجموعی طور پر ایک سادہ رجحان کی پیروی کرنے والی حکمت عملی ہے ، جس میں رجحان کی سمت کا اندازہ لگانے کے لئے متحرک اوسط کا استعمال کیا جاتا ہے ، اور معقول اسٹاپ نقصان کا تعین کرنے کے لئے خطرے کی سطح کو کنٹرول کیا جاتا ہے۔ حکمت عملی کو بہتر بنانے کے لئے بہت زیادہ گنجائش موجود ہے ، جس میں پیرامیٹرز کو ایڈجسٹ کرنے ، فلٹرز شامل کرنے وغیرہ کے ذریعہ حکمت عملی کی استحکام اور منافع بخش صلاحیت کو مزید بہتر بنایا جاسکتا ہے۔

/*backtest

start: 2023-01-17 00:00:00

end: 2024-01-23 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © fpemehd

// @version=5

// # ========================================================================= #

// # | STRATEGY |

// # ========================================================================= #

strategy(title = 'MA Simple Strategy with SL & TP & ATR Filters',

shorttitle = 'MA Strategy',

overlay = true,

pyramiding = 0,

default_qty_type = strategy.percent_of_equity,

default_qty_value = 100,

commission_type = strategy.commission.percent,

commission_value = 0.1,

initial_capital = 100000,

max_lines_count = 150,

max_labels_count = 300)

// # ========================================================================= #

// # Inputs

// # ========================================================================= #

// 1. Time

i_start = input (defval = timestamp("20 Jan 1990 00:00 +0900"), title = "Start Date", tooltip = "Choose Backtest Start Date", inline = "Start Date", group = "Time" )

i_end = input (defval = timestamp("20 Dec 2030 00:00 +0900"), title = "End Date", tooltip = "Choose Backtest End Date", inline = "End Date", group = "Time" )

c_timeCond = true

// 2. Inputs for direction: Long? Short? Both?

i_longEnabled = input.bool(defval = true , title = "Long?", tooltip = "Enable Long Position Trade?", inline = "Long / Short", group = "Long / Short" )

i_shortEnabled = input.bool(defval = true , title = "Short?", tooltip = "Enable Short Position Trade?", inline = "Long / Short", group = "Long / Short" )

// 3. Use Filters? What Filters?

i_ATRFilterOn = input.bool(defval = true , title = "ATR Filter On?", tooltip = "ATR Filter On?", inline = "ATR Filter", group = "Filters")

i_ATRSMALen = input.int(defval = 40 , title = "SMA Length for ATR SMA", minval = 1 , maxval = 100000 , step = 1 , tooltip = "ATR should be bigger than this", inline = "ATR Filter", group = "Filters")

// 3. Shared inputs for Long and Short

//// 3-1. Inputs for Stop Loss Type: normal? or trailing?

//// If trailing, always trailing or trailing after take profit order executed?

i_useSLTP = input.bool(defval = true, title = "Enable SL & TP?", tooltip = "", inline = "Enable SL & TP & SL Type", group = "Shared Inputs")

i_tslEnabled = input.bool(defval = false , title = "Enable Trailing SL?", tooltip = "Enable Stop Loss & Take Profit? \n\Enable Trailing SL?", inline = "Enable SL & TP & SL Type", group = "Shared Inputs")

// i_tslAfterTP = input.bool(defval = true , title = "Enable Trailing SL after TP?", tooltip = "Enable Trailing SL after TP?", inline = "Trailing SL Execution", group = "Shared Inputs")

i_slType = input.string(defval = "ATR", title = "Stop Loss Type", options = ["Percent", "ATR"], tooltip = "Stop Loss based on %? ATR?", inline = "Stop Loss Type", group = "Shared Inputs")

i_slATRLen = input.int(defval = 14, title = "ATR Length", minval = 1 , maxval = 200 , step = 1, inline = "Stop Loss ATR", group = "Shared Inputs")

i_tpType = input.string(defval = "R:R", title = "Take Profit Type", options = ["Percent", "ATR", "R:R"], tooltip = "Take Profit based on %? ATR? R-R ratio?", inline = "Take Profit Type", group = "Shared Inputs")

//// 3-2. Inputs for Quantity

i_tpQuantityPerc = input.float(defval = 50, title = 'Take Profit Quantity %', minval = 0.0, maxval = 100, step = 1.0, tooltip = '% of position when tp target is met.', group = 'Shared Inputs')

// 4. Inputs for Long Stop Loss & Long Take Profit

i_slPercentLong = input.float(defval = 3, title = "SL Percent", tooltip = "", inline = "Percent > Long Stop Loss / Take Profit Percent", group = "Long Stop Loss / Take Profit")

i_tpPercentLong = input.float(defval = 3, title = "TP Percent", tooltip = "Long Stop Loss && Take Profit Percent?", inline = "Percent > Long Stop Loss / Take Profit Percent", group = "Long Stop Loss / Take Profit")

i_slATRMultLong = input.float(defval = 3, title = "SL ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "", inline = "Long Stop Loss / Take Profit ATR", group = "Long Stop Loss / Take Profit")

i_tpATRMultLong = input.float(defval = 3, title = "TP ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "ATR > Long Stop Loss && Take Profit ATR Multiplier? \n\Stop Loss = i_slATRMultLong * ATR (i_slATRLen) \n\Take Profit = i_tpATRMultLong * ATR (i_tpATRLen)", inline = "Long Stop Loss / Take Profit ATR", group = "Long Stop Loss / Take Profit")

i_tpRRratioLong = input.float(defval = 1.8, title = "R:R Ratio", minval = 0.1 , maxval = 200 , step = 0.1, tooltip = "R:R Ratio > Risk Reward Ratio? It will automatically set Take Profit % based on Stop Loss", inline = "R:R Ratio", group = "Long Stop Loss / Take Profit")

// 5. Inputs for Short Stop Loss & Short Take Profit

i_slPercentShort = input.float(defval = 3, title = "SL Percent", tooltip = "", inline = "Percent > Short Stop Loss / Take Profit Percent", group = "Short Stop Loss / Take Profit")

i_tpPercentShort = input.float(defval = 3, title = "TP Percent", tooltip = "Short Stop Loss && Take Profit Percent?", inline = "Percent > Short Stop Loss / Take Profit Percent", group = "Short Stop Loss / Take Profit")

i_slATRMultShort = input.float(defval = 3, title = "SL ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "", inline = "ATR > Short Stop Loss / Take Profit ATR", group = "Short Stop Loss / Take Profit")

i_tpATRMultShort = input.float(defval = 3, title = "TP ATR Multiplier", minval = 1 , maxval = 200 , step = 0.1, tooltip = "ATR > Short Stop Loss && Take Profit ATR Multiplier? \n\Stop Loss = i_slATRMultShort * ATR (i_slATRLen) \n\Take Profit = i_tpATRMultShort * ATR (i_tpATRLen)", inline = "ATR > Short Stop Loss / Take Profit ATR", group = "Short Stop Loss / Take Profit")

i_tpRRratioShort = input.float(defval = 1.8, title = "R:R Ratio", minval = 0.1 , maxval = 200 , step = 0.1, tooltip = "R:R Ratio > Risk Reward Ratio? It will automatically set Take Profit % based on Stop Loss", inline = "R:R Ratio", group = "Short Stop Loss / Take Profit")

// 6. Inputs for logic

i_MAType = input.string(defval = "RMA", title = "MA Type", options = ["SMA", "EMA", "WMA", "HMA", "RMA", "VWMA", "SWMA", "ALMA", "VWAP"], tooltip = "Choose MA Type", inline = "MA Type", group = 'Strategy')

i_MA1Len = input.int(defval = 5, title = 'MA 1 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_MA2Len = input.int(defval = 10, title = 'MA 2 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_MA3Len = input.int(defval = 15, title = 'MA 3 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_MA4Len = input.int(defval = 25, title = 'MA 4 Length', minval = 1, inline = 'MA Length', group = 'Strategy')

i_ALMAOffset = input.float(defval = 0.7 , title = "ALMA Offset Value", tooltip = "The Value of ALMA offset", inline = "ALMA Input", group = 'Strategy')

i_ALMASigma = input.float(defval = 7 , title = "ALMA Sigma Value", tooltip = "The Value of ALMA sigma", inline = "ALMA Input", group = 'Strategy')

// # ========================================================================= #

// # Entry, Close Logic

// # ========================================================================= #

bool i_ATRFilter = ta.atr(length = i_slATRLen) >= ta.sma(source = ta.atr(length = i_slATRLen), length = i_ATRSMALen) ? true : false

// calculate Technical Indicators for the Logic

getMAValue (source, length, almaOffset, almaSigma) =>

switch i_MAType

'SMA' => ta.sma(source = source, length = length)

'EMA' => ta.ema(source = source, length = length)

'WMA' => ta.wma(source = source, length = length)

'HMA' => ta.hma(source = source, length = length)

'RMA' => ta.rma(source = source, length = length)

'SWMA' => ta.swma(source = source)

'ALMA' => ta.alma(series = source, length = length, offset = almaOffset, sigma = almaSigma)

'VWMA' => ta.vwma(source = source, length = length)

'VWAP' => ta.vwap(source = source)

=> na

float c_MA1 = getMAValue(close, i_MA1Len, i_ALMAOffset, i_ALMASigma)

float c_MA2 = getMAValue(close, i_MA2Len, i_ALMAOffset, i_ALMASigma)

float c_MA3 = getMAValue(close, i_MA3Len, i_ALMAOffset, i_ALMASigma)

float c_MA4 = getMAValue(close, i_MA4Len, i_ALMAOffset, i_ALMASigma)

// Logic: 정배열 될 떄 들어가

var ma1Color = color.new(color.red, 0)

plot(series = c_MA1, title = 'SMA 1', color = ma1Color, linewidth = 1, style = plot.style_line)

var ma2Color = color.new(color.orange, 0)

plot(series = c_MA2, title = 'SMA 2', color = ma2Color, linewidth = 1, style = plot.style_line)

var ma3Color = color.new(color.yellow, 0)

plot(series = c_MA3, title = 'SMA 3', color = ma3Color, linewidth = 1, style = plot.style_line)

var ma4Color = color.new(color.green, 0)

plot(series = c_MA4, title = 'SMA 4', color = ma4Color, linewidth = 1, style = plot.style_line)

bool openLongCond = (c_MA1 >= c_MA2 and c_MA2 >= c_MA3 and c_MA3 >= c_MA4)

bool openShortCond = (c_MA1 <= c_MA2 and c_MA2 <= c_MA3 and c_MA3 <= c_MA4)

bool openLong = i_longEnabled and openLongCond and (not i_ATRFilterOn or i_ATRFilter)

bool openShort = i_shortEnabled and openShortCond and (not i_ATRFilterOn or i_ATRFilter)

openLongCondColor = openLongCond ? color.new(color = color.blue, transp = 80) : na

bgcolor(color = openLongCondColor)

ATRFilterColor = i_ATRFilter ? color.new(color = color.orange, transp = 80) : na

bgcolor(color = ATRFilterColor)

bool enterLong = openLong and not (strategy.opentrades.size(strategy.opentrades-1) > 0)

bool enterShort = openShort and not (strategy.opentrades.size(strategy.opentrades-1) < 0)

bool closeLong = i_longEnabled and (c_MA1[1] >= c_MA2[1] and c_MA2[1] >= c_MA3[1] and c_MA3[1] >= c_MA4[1]) and not (c_MA1 >= c_MA2 and c_MA2 >= c_MA3 and c_MA3 >= c_MA4)

bool closeShort = i_shortEnabled and (c_MA1[1] <= c_MA2[1] and c_MA2[1] <= c_MA3[1] and c_MA3[1] <= c_MA4[1]) and not (c_MA1 <= c_MA2 and c_MA2 <= c_MA3 and c_MA3 <= c_MA4)

// # ========================================================================= #

// # Position, Status Conrtol

// # ========================================================================= #

// longisActive: New Long || Already Long && not closeLong, short is the same

bool longIsActive = enterLong or strategy.opentrades.size(strategy.opentrades - 1) > 0 and not closeLong

bool shortIsActive = enterShort or strategy.opentrades.size(strategy.opentrades - 1) < 0 and not closeShort

// before longTPExecution: no trailing SL && after longTPExecution: trailing SL starts

// longTPExecution qunatity should be less than 100%

bool longTPExecuted = false

bool shortTPExecuted = false

// # ========================================================================= #

// # Long Stop Loss Logic

// # ========================================================================= #

float openAtr = ta.valuewhen(enterLong or enterShort, ta.atr(i_slATRLen), 0)

f_getLongSL (source) =>

switch i_slType

'Percent' => source * (1 - (i_slPercentLong/100))

'ATR' => source - i_slATRMultLong * openAtr

=> na

var float c_longSLPrice = na

c_longSLPrice := if (longIsActive)

if (enterLong)

f_getLongSL(close)

else

c_stopPrice = f_getLongSL(i_tslEnabled ? high : strategy.opentrades.entry_price(trade_num = strategy.opentrades - 1))

math.max(c_stopPrice, nz(c_longSLPrice[1]))

else

na

// # ========================================================================= #

// # Short Stop Loss Logic

// # ========================================================================= #

f_getShortSL (source) =>

switch i_slType

'Percent' => source * (1 + (i_slPercentShort)/100)

'ATR' => source + i_slATRMultShort * openAtr

=> na

var float c_shortSLPrice = na

c_shortSLPrice := if (shortIsActive)

if (enterShort)

f_getShortSL (close)

else

c_stopPrice = f_getShortSL(i_tslEnabled ? low : strategy.opentrades.entry_price(strategy.opentrades - 1))

math.min(c_stopPrice, nz(c_shortSLPrice[1], 999999.9))

else

na

// # ========================================================================= #

// # Long Take Profit Logic

// # ========================================================================= #

f_getLongTP () =>

switch i_tpType

'Percent' => close * (1 + (i_tpPercentLong/100))

'ATR' => close + i_tpATRMultLong * openAtr

'R:R' => close + i_tpRRratioLong * (close - f_getLongSL(close))

=> na

var float c_longTPPrice = na

c_longTPPrice := if (longIsActive and not longTPExecuted)

if (enterLong)

f_getLongTP()

else

nz(c_longTPPrice[1], f_getLongTP())

else

na

longTPExecuted := strategy.opentrades.size(strategy.opentrades - 1) > 0 and (longTPExecuted[1] or strategy.opentrades.size(strategy.opentrades - 1) < strategy.opentrades.size(strategy.opentrades - 1)[1] or strategy.opentrades.size(strategy.opentrades - 1)[1] == 0 and high >= c_longTPPrice)

// # ========================================================================= #

// # Short Take Profit Logic

// # ========================================================================= #

f_getShortTP () =>

switch i_tpType

'Percent' => close * (1 - (i_tpPercentShort/100))

'ATR' => close - i_tpATRMultShort * openAtr

'R:R' => close - i_tpRRratioShort * (close - f_getLongSL(close))

=> na

var float c_shortTPPrice = na

c_shortTPPrice := if (shortIsActive and not shortTPExecuted)

if (enterShort)

f_getShortTP()

else

nz(c_shortTPPrice[1], f_getShortTP())

else

na

shortTPExecuted := strategy.opentrades.size(strategy.opentrades - 1) < 0 and (shortTPExecuted[1] or strategy.opentrades.size(strategy.opentrades - 1) > strategy.opentrades.size(strategy.opentrades - 1)[1] or strategy.opentrades.size(strategy.opentrades - 1)[1] == 0 and low <= c_shortTPPrice)

// # ========================================================================= #

// # Make Orders

// # ========================================================================= #

if (c_timeCond)

if (enterLong)

strategy.entry(id = "Long Entry", direction = strategy.long , comment = 'Long(' + syminfo.ticker + '): Started', alert_message = 'Long(' + syminfo.ticker + '): Started')

if (enterShort)

strategy.entry(id = "Short Entry", direction = strategy.short , comment = 'Short(' + syminfo.ticker + '): Started', alert_message = 'Short(' + syminfo.ticker + '): Started')

if (closeLong)

strategy.close(id = 'Long Entry', comment = 'Close Long', alert_message = 'Long: Closed at market price')

if (closeShort)

strategy.close(id = 'Short Entry', comment = 'Close Short', alert_message = 'Short: Closed at market price')

if (longIsActive and i_useSLTP)

strategy.exit(id = 'Long Take Profit / Stop Loss', from_entry = 'Long Entry', qty_percent = i_tpQuantityPerc, limit = c_longTPPrice, stop = c_longSLPrice, alert_message = 'Long(' + syminfo.ticker + '): Take Profit or Stop Loss executed')

strategy.exit(id = 'Long Stop Loss', from_entry = 'Long Entry', stop = c_longSLPrice, alert_message = 'Long(' + syminfo.ticker + '): Stop Loss executed')

if (shortIsActive and i_useSLTP)

strategy.exit(id = 'Short Take Profit / Stop Loss', from_entry = 'Short Entry', qty_percent = i_tpQuantityPerc, limit = c_shortTPPrice, stop = c_shortSLPrice, alert_message = 'Short(' + syminfo.ticker + '): Take Profit or Stop Loss executed')

strategy.exit(id = 'Short Stop Loss', from_entry = 'Short Entry', stop = c_shortSLPrice, alert_message = 'Short(' + syminfo.ticker + '): Stop Loss executed')

// # ========================================================================= #

// # Plot

// # ========================================================================= #

var posColor = color.new(color.white, 0)

plot(series = strategy.opentrades.entry_price(strategy.opentrades - 1), title = 'Position', color = posColor, linewidth = 1, style = plot.style_linebr)

var stopLossColor = color.new(color.maroon, 0)

plot(series = c_longSLPrice, title = 'Long Stop Loss', color = stopLossColor, linewidth = 1, style = plot.style_linebr, offset = 1)

plot(series = c_shortSLPrice, title = 'Short Stop Loss', color = stopLossColor, linewidth = 1, style = plot.style_linebr, offset = 1)

longTPExecutedColor = longTPExecuted ? color.new(color = color.green, transp = 80) : na

//bgcolor(color = longTPExecutedColor)

shortTPExecutedColor = shortTPExecuted ? color.new(color = color.red, transp = 80) : na

//bgcolor(color = shortTPExecutedColor)

// isPositionOpenedColor = strategy.opentrades.size(strategy.opentrades-1) != 0 ? color.new(color = color.yellow, transp = 90) : na

// bgcolor(color = isPositionOpenedColor)

var takeProfitColor = color.new(color.teal, 0)

plot(series = c_longTPPrice, title = 'Long Take Profit', color = takeProfitColor, linewidth = 1, style = plot.style_linebr, offset = 1)

plot(series = c_shortTPPrice, title = 'Short Take Profit', color = takeProfitColor, linewidth = 1, style = plot.style_linebr, offset = 1)