RSI Divergence với Pivot, BB, SMA, EMA, SMMA, WMA, VWMA

Tác giả:ChaoZhang, Ngày: 2022-05-12 17:17:05Tags:SMAEMASMMAWMAVWMABoll

RSI Divergences with Pivots, BB, MA là một bộ dao động RSI cơ bản với một số tính năng hữu ích, nó cho phép người dùng hiển thị các chênh lệch, pivots và Moving Average trực tiếp trên Chỉ số RSI.

Đường trung bình động mà bạn có thể hiển thị trên dao động RSI là: SMA EMA SMMA WMA VWMA Bollinger Bands

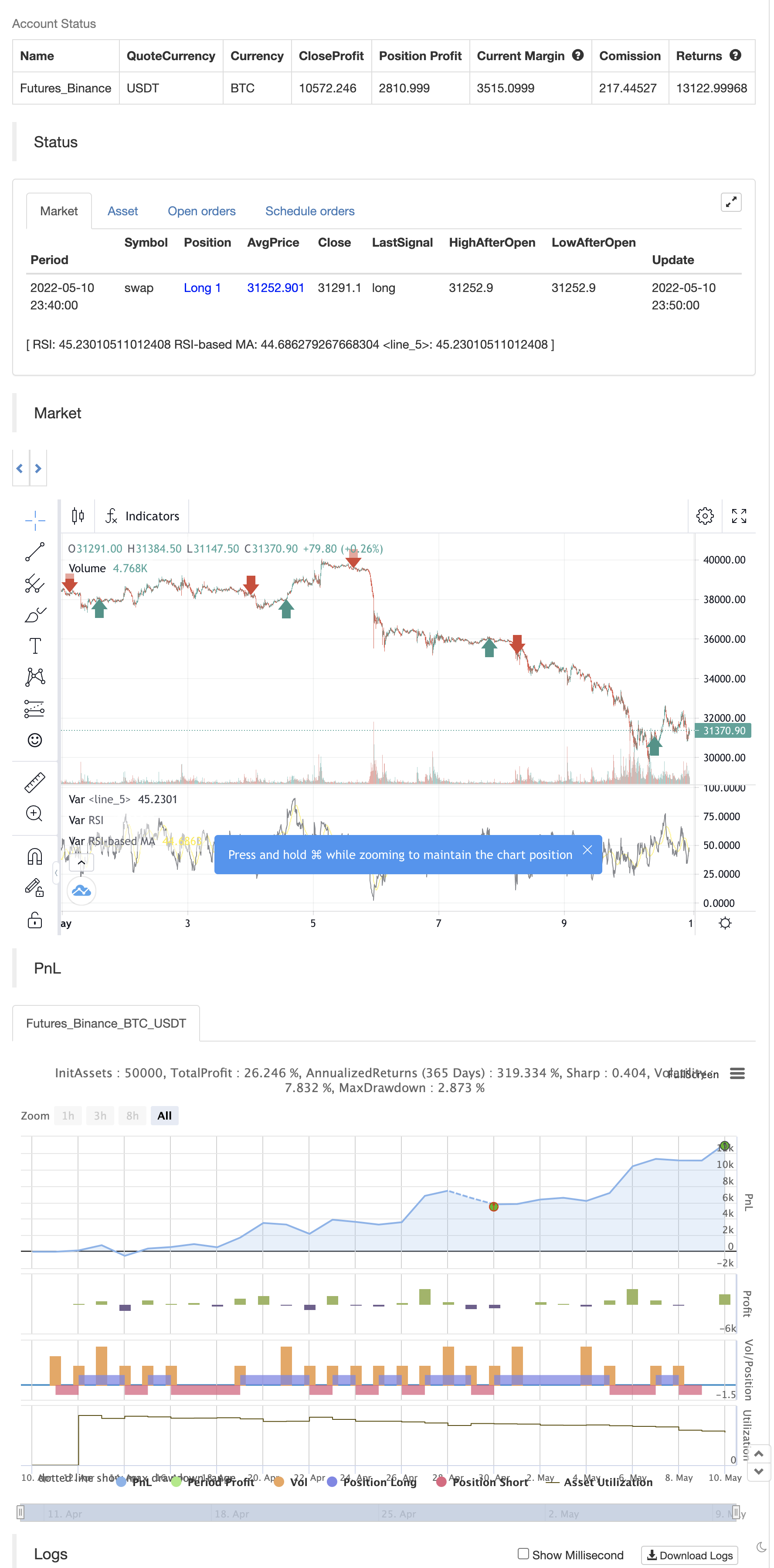

/*backtest

start: 2022-04-11 00:00:00

end: 2022-05-10 23:59:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

////////////////////////////////////////////////////////////////////////////////

// //

// ====== My Crypto Succubus ====== //

// ====== RSI Divergence with Pivot, BB, SMA, EMA, SMMA, WMA, VWMA ====== //

// //

////////////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////////////////

// //

// My Crypto Succubus is a project based on the community and participatory //

// aspect, knowledge sharing is the core of the project, the act of sharing //

// is destined to get richer, either on the intellectual or the wealth //

// side, the ultimate goal of MCS is that every single one of our members //

// can reach the financial freedom we all deserve. //

// //

// ====== Join us on our Discord : https://discord.gg/TmW6RQeyXp ====== //

// //

////////////////////////////////////////////////////////////////////////////////

//@version=5

indicator(title="RSI Divergences with Pivots, BB, MA [My Crypto Succubus]", shorttitle="RSI Div, Pivot, BB, MA [My Crypto Succubus]", format=format.price, precision=2)

ma(source, length, type) =>

switch type

"SMA" => ta.sma(source, length)

"Bollinger Bands" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

rsiLengthInput = input.int(14, minval=1, title="RSI Length", group="RSI Settings")

rsiSourceInput = input.source(close, "Source", group="RSI Settings")

maTypeInput = input.string("SMA", title="MA Type", options=["SMA", "Bollinger Bands", "EMA", "SMMA (RMA)", "WMA", "VWMA"], group="MA Settings")

maLengthInput = input.int(14, title="MA Length", group="MA Settings")

bbMultInput = input.float(2.0, minval=0.001, maxval=50, title="BB StdDev", group="MA Settings")

up = ta.rma(math.max(ta.change(rsiSourceInput), 0), rsiLengthInput)

down = ta.rma(-math.min(ta.change(rsiSourceInput), 0), rsiLengthInput)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

rsiMA = ma(rsi, maLengthInput, maTypeInput)

isBB = maTypeInput == "Bollinger Bands"

plot(rsi, "RSI", color=#ffffff, linewidth=1)

plot(rsiMA, "RSI-based MA", color=color.yellow)

rsiUpperBand = hline(70, "RSI Upper Band", color=#787B86)

hline(50, "RSI Middle Band", color=color.new(#787B86, 50))

rsiLowerBand = hline(30, "RSI Lower Band", color=#787B86)

fill(rsiUpperBand, rsiLowerBand, color=color.rgb(178, 8, 120, 90), title="RSI Background Fill")

bbUpperBand = plot(isBB ? rsiMA + ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Upper Bollinger Band", color=color.green)

bbLowerBand = plot(isBB ? rsiMA - ta.stdev(rsi, maLengthInput) * bbMultInput : na, title = "Lower Bollinger Band", color=color.green)

fill(bbUpperBand, bbLowerBand, color= isBB ? color.new(color.green, 90) : na, title="Bollinger Bands Background Fill")

///////////////////////////////////////////////////////////////////////////////////////////////////////

len = input.int(14, minval=1, title='RSI Length', group="RSI Settings")

ob = input.int(defval=70, title='Overbought', minval=0, maxval=100, group="RSI Settings")

os = input.int(defval=30, title='Oversold', minval=0, maxval=100, group="RSI Settings")

// RSI code

band1 = hline(ob)

band0 = hline(os)

plot(rsi, color=rsi > ob or rsi < os ? color.rgb(255, 0, 0, 0) : color.new(color.black, 100), linewidth=1)

fill(band1, band0, color=color.new(color.purple, 97))

// DIVS code

piv = input(false, 'Hide pivots?')

shrt = input(false, 'Shorter labels?')

hidel = input(true, 'Hide labels and color background')

xbars = input.int(defval=90, title='Div lookback period (bars)?', minval=1)

hb = math.abs(ta.highestbars(rsi, xbars)) // Finds bar with highest value in last X bars

lb = math.abs(ta.lowestbars(rsi, xbars)) // Finds bar with lowest value in last X bars

// Defining variable values, mandatory in Pine 3

max = float(na)

max_rsi = float(na)

min = float(na)

min_rsi = float(na)

pivoth = bool(na)

pivotl = bool(na)

divbear = bool(na)

divbull = bool(na)

// If bar with lowest / highest is current bar, use it's value

max := hb == 0 ? close : na(max[1]) ? close : max[1]

max_rsi := hb == 0 ? rsi : na(max_rsi[1]) ? rsi : max_rsi[1]

min := lb == 0 ? close : na(min[1]) ? close : min[1]

min_rsi := lb == 0 ? rsi : na(min_rsi[1]) ? rsi : min_rsi[1]

// Compare high of current bar being examined with previous bar's high

// If curr bar high is higher than the max bar high in the lookback window range

if close > max // we have a new high

max := close // change variable "max" to use current bar's high value

max

if rsi > max_rsi // we have a new high

max_rsi := rsi // change variable "max_rsi" to use current bar's RSI value

max_rsi

if close < min // we have a new low

min := close // change variable "min" to use current bar's low value

min

if rsi < min_rsi // we have a new low

min_rsi := rsi // change variable "min_rsi" to use current bar's RSI value

min_rsi

// Finds pivot point with at least 2 right candles with lower value

pivoth := max_rsi == max_rsi[2] and max_rsi[2] != max_rsi[3] ? true : na

pivotl := min_rsi == min_rsi[2] and min_rsi[2] != min_rsi[3] ? true : na

// Detects divergences between price and indicator with 1 candle delay so it filters out repeating divergences

if max[1] > max[2] and rsi[1] < max_rsi and rsi <= rsi[1]

divbear := true

divbear

if min[1] < min[2] and rsi[1] > min_rsi and rsi >= rsi[1]

divbull := true

divbull

// Alerts

alertcondition(divbear, title='Bear div', message='Bear div')

alertcondition(divbull, title='Bull div', message='Bull div')

alertcondition(pivoth, title='Pivot high', message='Pivot high')

alertcondition(pivotl, title='Pivot low', message='Pivot low')

// Plots divergences and pivots with offest

//l = divbear ? label.new(bar_index - 1, rsi[1] + 1, 'BEAR', color=color.red, textcolor=color.white, style=label.style_label_down, yloc=yloc.price, size=size.small) : divbull ? label.new(bar_index - 1, rsi[1] - 1, 'BULL', color=color.green, textcolor=color.white, style=label.style_label_up, yloc=yloc.price, size=size.small) : pivoth ? label.new(bar_index - 2, max_rsi + 1, 'PIVOT', color=color.blue, textcolor=color.white, style=label.style_label_down, yloc=yloc.price, size=size.small) : pivotl ? label.new(bar_index - 2, min_rsi - 1, 'PIVOT', color=color.blue, textcolor=color.white, style=label.style_label_up, yloc=yloc.price, size=size.small) : na

// Shorter labels

//if shrt

// label.set_text(l, na)

// Hides pivots or labels

//if piv and (pivoth or pivotl) or hidel

// label.delete(l)

// Colors indicator background

//bgcolor(hidel ? divbear ? color.new(color.red, 50) : divbull ? color.new(color.green, 50) : na : na, offset=-1, transp=90)

//bgcolor(hidel ? piv ? na : pivoth or pivotl ? color.new(color.blue, 50) : na : na, offset=-2, transp=90)

// Debug tools

// plot(max, color=blue, linewidth=2)

// plot(max_rsi, color=red, linewidth=2)

// plot(hb, color=orange, linewidth=2)

// plot(lb, color=purple, linewidth=1)

// plot(min_rsi, color=lime, linewidth=1)

// plot(min, color=black, linewidth=1)

////////////////////////////////////////////////////////////////////////////////

// //

// ====== My Crypto Succubus ====== //

// ====== RSI Divergence with Pivot, BB, SMA, EMA, SMMA, WMA, VWMA ====== //

// //

////////////////////////////////////////////////////////////////////////////////

////////////////////////////////////////////////////////////////////////////////

// //

// My Crypto Succubus is a project based on the community and participatory //

// aspect, knowledge sharing is the core of the project, the act of sharing //

// is destined to get richer, either on the intellectual or the wealth //

// side, the ultimate goal of MCS is that every single one of our members //

// can reach the financial freedom we all deserve. //

// //

// ====== Join us on our Discord : https://discord.gg/TmW6RQeyXp ====== //

// //

////////////////////////////////////////////////////////////////////////////////

if divbear

strategy.entry("Enter Long", strategy.long)

else if divbull

strategy.entry("Enter Short", strategy.short)

Nội dung liên quan

- Crodl's Supertrend

- SSS

- Brin Band đột phá chiến lược theo dõi giao dịch

- Chiến lược giao dịch dây chuyền biến động đa tầng

- Chiến lược định lượng theo dõi động lượng chéo hai đường thẳng

- Chiến lược theo dõi xu hướng chéo đa chu kỳ

- Chiến lược giao thoa trung bình di động thích nghi

- Chiến lược theo dõi xu hướng và lọc tỷ lệ biến động

- Chiến lược của OCC R5.1

- 2 Phát hiện hướng màu trung bình chuyển động

Nhiều hơn nữa

- Chiến lược siêu xu hướng Villa Dynamic Pivot

- Crodl's Supertrend

- RSI của zdmre

- FTL - Range Filter X2 + EMA + UO

- BRAHMASTRA

- Nhóm nhạc Mobo

- SAR + 3SMMA với SL & TP

- SSS

- Mô hình cảnh báo phóng mặt trăng [Dấu hiệu]

- HALFTREND + HEMA + SMA (Chiến lược tín hiệu sai)

- RSI và BB và đồng thời OverSold

- Quay nến Heikin Ashi

- Combo 2/20 EMA & Bandpass Filter

- ESSMA

- 3EMA

- Các khối thứ tự trục trục

- NMVOB-S

- Đường trung bình chuyển động màu EMA/SMA

- Nhóm MAHL

- 3 Tăng siêu xu hướng trong kịch bản duy nhất này