Trung bình di chuyển ba kết hợp với chiến lược định lượng MACD

Tác giả:ChaoZhang, Ngày: 2024-01-17 16:54:15Tags:

Tổng quan

Chiến lược này phát triển một chiến lược giao dịch định lượng tương đối ổn định và đáng tin cậy bằng cách kết hợp sử dụng chỉ số trung bình di chuyển ba và chỉ số MACD. Nó nhằm mục đích nắm bắt các xu hướng trong tương lai có thể và đặc biệt phù hợp với cổ phần trung và dài hạn.

Nguyên tắc chiến lược

Chiến lược chủ yếu dựa trên sự kết hợp của trung bình di chuyển ba và chỉ số MACD.

Đầu tiên, chiến lược sử dụng trung bình động nhân ba với chiều dài lần lượt là 3, 7 và 2. Ba trung bình động này xây dựng một hệ thống trung bình động nhanh đến chậm để xác định hướng của xu hướng trong tương lai. Khi trung bình động ngắn hạn vượt qua trung bình động dài hạn, đó là một tín hiệu dài; khi trung bình động ngắn hạn vượt dưới trung bình động dài hạn, đó là một tín hiệu ngắn.

Thứ hai, chiến lược cũng sử dụng chỉ số MACD với các tham số 3 và 7 đồng thời. Khi đường chính MACD vượt qua đường tín hiệu, đó là tín hiệu dài, và khi nó vượt qua bên dưới, đó là tín hiệu ngắn.

Bằng cách kết hợp việc sử dụng hai chỉ số, nó có thể tránh nhiều tín hiệu sai do một chỉ số duy nhất gây ra, do đó cải thiện sự ổn định của chiến lược.

Ưu điểm của Chiến lược

- Cải thiện chất lượng tín hiệu bằng cách sử dụng bộ lọc chỉ số kép

- Các thông số đã được thử nghiệm và tối ưu hóa nhiều lần, ổn định và đáng tin cậy

- Hệ thống trung bình di chuyển ba lần có thể lọc hiệu quả tiếng ồn thị trường và xác định xu hướng trong tương lai

- Các thông số chỉ số MACD được thiết lập nhanh hơn để nhanh chóng nắm bắt các cơ hội ngắn hạn

Rủi ro của chiến lược

- Có một số rủi ro của việc rút tiền và tổn thất liên tiếp

- Khi thị trường không có xu hướng rõ ràng, sẽ có nhiều giao dịch sai trong chiến lược này

- Chỉ số MACD dễ tạo ra tín hiệu sai và cần được kết hợp với các chỉ số trung bình động

Giải pháp:

- Dùng chiến lược dừng lỗ thích hợp để kiểm soát mức rút tối đa

- Giảm tần suất giao dịch khi tình trạng thị trường rõ ràng không có xu hướng

- Tối ưu hóa các thông số MACD và sử dụng kết hợp với các chỉ số khác

Hướng dẫn tối ưu hóa chiến lược

- Kiểm tra và tối ưu hóa các thông số của đường trung bình động và MACD để tìm ra sự kết hợp tốt nhất

- Tăng các chỉ số phụ trợ như KDJ và VRSI để tránh tín hiệu sai

- Đưa ra các mô hình học máy để đánh giá tình trạng thị trường và đạt được điều chỉnh năng động

- Kết hợp với các chiến lược dừng lỗ và thiết lập các điểm dừng lỗ tối ưu

Tóm lại

Chiến lược này đạt được xu hướng ổn định thông qua sự kết hợp giữa đường trung bình động và MACD. Ưu điểm của nó nằm trong việc sử dụng kết hợp các chỉ số, có thể giảm hiệu quả tín hiệu sai và đạt được hiệu suất chiến lược tốt hơn.

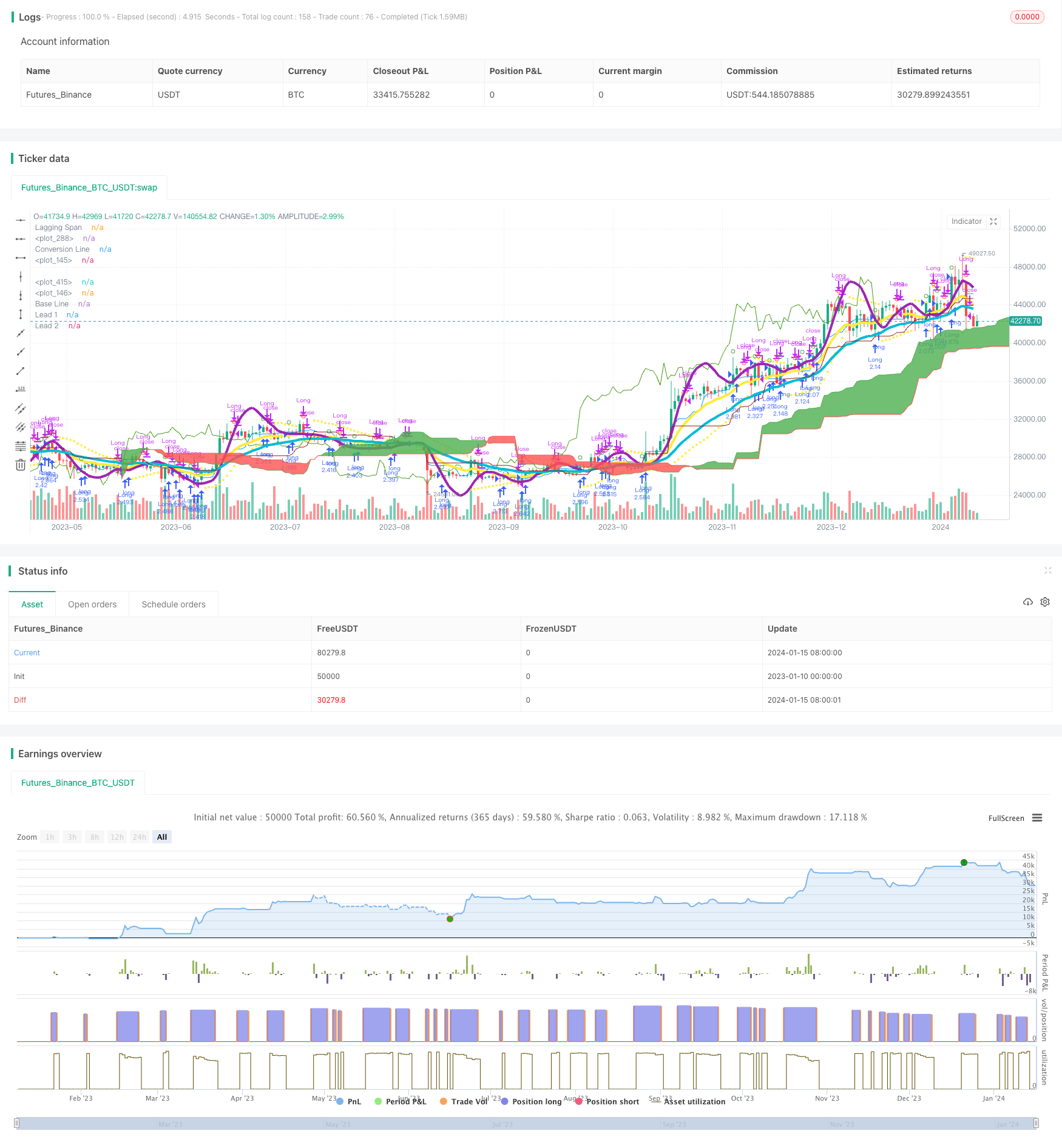

/*backtest

start: 2023-01-10 00:00:00

end: 2024-01-16 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Matt's MACD Algo v1", shorttitle="Matt's MACD Algo v1", overlay=true, pyramiding = 0, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, initial_capital=7000, calc_on_order_fills = true, commission_type=strategy.commission.percent, commission_value=0, currency = currency.USD)

//study("MFI Fresh", shorttitle="MFI Fresh", overlay=true)

//Risk Management Settings

//trategy.risk.max_drawdown(20, strategy.percent_of_equity)

//strategy.risk.max_intraday_loss(10, strategy.percent_of_equity)

//strategy.risk.max_cons_loss_days(3)

/////////////////

ts = input(title="Trailing Stop in cents", defval=50)/100

//Time Inputs

FromMonth = input(defval = 6, title = "From Month", minval = 1)

FromDay = input(defval = 1, title = "From Day", minval = 1)

FromYear = input(defval = 2017, title = "From Year", minval = 1)

ToMonth = input(defval = 1, title = "To Month", minval = 1)

ToDay = input(defval = 1, title = "To Day", minval = 1)

ToYear = input(defval = 9999, title = "To Year", minval = 1)

//Time Variable

testPeriod() =>

(time > timestamp(FromYear, FromMonth, FromDay, 09, 30)) and (time < timestamp(ToYear, ToMonth, ToDay, 09, 29))

//MA On and MA Colors On? Inputs

switch1=input(false, title="Enable Bar Color?")

switch2=input(true, title="Enable Moving Averages?")

switch3=input(false, title="Enable Background Color?")

switch4=input(false, title="Enable Bolinger Bands?")

switch5=input(false, title="Enable Keltner Channel?")

////////////////////////////////Williams %R

R_length = input(14, minval=1)

R_overBought = input(title="%R Overbought", defval=80)

R_overSold = input(title="%R Oversold", defval=20)

R_upper = highest(R_length)

R_lower = lowest(R_length)

R_out = 100 * (close - R_upper) / (R_upper - R_lower)

WilliamsR_longEntry = crossover(R_out, R_overSold)

WilliamsR_shortEntry = crossunder(R_out, R_overBought)

//plot(R_out)

//R_band1 = hline(R_overSold)

//R_band0 = hline(R_overBought)

//fill(R_band1, R_band0)

////////////////////////////////RSI Variables

rsi_source = close

RSI_Length = input(title="RSI Length", defval=3)

RSI_overBought = input(title="RSI Overbought", defval=80)

RSI_overSold = input(title="RSI Oversold", defval=20)

up = rma(max(change(rsi_source), 0), RSI_Length)

down = rma(-min(change(rsi_source), 0), RSI_Length)

rsi = down == 0 ? 100 : up == 0 ? 0 : 100 - (100 / (1 + up / down))

RSI_longEntry = rsi > 50

//crossover(rsi, RSI_overSold)

RSI_shortEntry = rsi < 50

//crossunder(rsi, RSI_overBought)

//plot(rsi, color=purple)

//band1 = hline(RSI_overBought)

//band0 = hline(RSI_overSold)

//fill(band1, band0, color=purple, transp=90)

//////////////////////Commodity Channel Index

cci_length = input(20, minval=1)

cci_src = input(close, title="Source")

cci_ma = sma(cci_src, cci_length)

cci = (cci_src - cci_ma) / (0.015 * dev(cci_src, cci_length))

cci_longEntry = crossover(cci, -100)

cci_shortEntry = crossunder(cci, 100)

//plot(cci, color=olive)

//cci_band1 = hline(100, color=gray, linestyle=dashed)

//cci_band0 = hline(-100, color=gray, linestyle=dashed)

//fill(cci_band1, cci_band0, color=olive)

//MFI Inputs

MFI_length = input(title="MFI Length", defval=3)

MFI_overBought = input(title="MFI Overbought", defval=80)

MFI_overSold = input(title="MFI Oversold", defval=20)

//MFI Variables

rawMoneyFlow = hlc3 * volume

positiveMoneyFlow = 0.0

positiveMoneyFlow := hlc3 > hlc3[1] ? positiveMoneyFlow + rawMoneyFlow : positiveMoneyFlow

negativeMoneyFlow = 0.0

negativeMoneyFlow := hlc3 < hlc3[1] ? negativeMoneyFlow + rawMoneyFlow : negativeMoneyFlow

moneyFlowRatio = sma(positiveMoneyFlow, MFI_length) / sma(negativeMoneyFlow, MFI_length)

moneyFlowIndex = 100 - 100 / (1 + moneyFlowRatio)

MFI_longEntry = (crossover(moneyFlowIndex, MFI_overSold))

MFI_shortEntry = (crossunder(moneyFlowIndex, MFI_overBought))

///// MFI Plot for STUDY

//plot(moneyFlowIndex, color=#459915)

//MFI_OB=hline(MFI_overBought, title="Overbought", color=#c0c0c0)

//MFI_OS=hline(MFI_overSold, title="Oversold", color=#c0c0c0)

//fill(MFI_overBought, MFI_overSold, color=#9915ff, transp=90)

////VERY SLOW SMA

veryslowLength=input(50,minval=1, title="Very slow SMA")

veryslowSMA = sma(close, veryslowLength)

//MACD Inputs

source = input(close, title="MACD source")

fastLength = input(title="MACD Fast Length", defval=12)

fastLength2 = input(title="MACD Fast Length #2", defval=3)

slowLength = input(title="MACD Slow Length", defval=26)

slowLength2 = input(title="MACD Slow Length #2", defval=7)

MACD_fastsignalSmoothing = input(title="Signal Smoothing", defval=7)

MACD_slowsignalSmoothing = input(title="Signal Smoothing", defval=12)

MACD_fastsignalSmoothing2 = input(title="Signal Smoothing #2", defval=5)

MACD_slowsignalSmoothing2 = input(title="Signal Smoothing #2", defval=9)

MACD_percentthreshold = input(title="MACD % Threshold", defval=-0.0030, step=0.0001)

//MACD variables

fastEMA = ema(source, fastLength)

fastEMA2 = ema(source, fastLength2)

slowEMA = ema(source, slowLength)

slowEMA2 = ema(source, slowLength2)

MACD_Line = fastEMA - slowEMA

MACD_Line2 = fastEMA2 - slowEMA2

MACD_fastsignalLine = ema(MACD_Line, MACD_fastsignalSmoothing)

MACD_slowsignalLine = ema(MACD_Line, MACD_slowsignalSmoothing)

MACD_fastsignalLine2 = ema(MACD_Line2, MACD_fastsignalSmoothing2)

MACD_slowsignalLine2 = ema(MACD_Line2, MACD_slowsignalSmoothing2)

fasthist = MACD_Line - MACD_slowsignalLine

MACD_Histogram2 = MACD_Line2 - MACD_fastsignalLine2

minimum = close * MACD_percentthreshold

SMA = sma(MACD_Line, 10)

// MACD and veryslowSMA Plot for STRATEGY

Fast=plot(switch2?fastEMA:na,color=yellow, linewidth=4)

Slow=plot(switch2?slowEMA:na,color=aqua, linewidth=4)

//VerySlow=plot(switch2?veryslowSMA:na,color=purple,linewidth=4)

//fill(Fast,VerySlow,color=gray)

/////// MACD Plots for STUDY

//plot(fasthist, color=fasthist>0 and fasthist[0]>fasthist[1]?#00ff00:fasthist<=0 and fasthist[0]<fasthist[1]?#f72e2e:fasthist>0 and fasthist[0]<fasthist[1]?#008000:fasthist<0 and fasthist[0]>fasthist[1]?#7f0000:white, style=histogram)

//plot(slowhist, color=slowhist>0 and slowhist[0]>slowhist[1]?#00ff00:slowhist<=0 and slowhist[0]<slowhist[1]?#f72e2e:slowhist>0 and slowhist[0]<slowhist[1]?#008000:slowhist<0 and slowhist[0]>slowhist[1]?#7f0000:white, style=histogram)

//plot(MACD_Line, color=yellow, title="MACD Line")

//plot(MACD_fastsignalSmoothing, color=green, title="Fast Signal Line")

//plot(MACD_slowsignalSmoothing, color=red, title="Slow Signal Line")

//plot(MACD_Line2, color=aqua, title="MACD Line 2")

//plot(MACD_fastsignalSmoothing2, color=orange, title="Fast Signal Line 2")

//plot(MACD_slowsignalSmoothing2, color=white, title="Slow Signal Line 2")

//plot(minimum, color=white, title="% Threshold")

//plot(fasthist, color=fasthist>0 and fasthist[0]>fasthist[1]?#00ff00:fasthist<=0 and fasthist[0]<fasthist[1]?#f72e2e:fasthist>0 and fasthist[0]<fasthist[1]?#008000:fasthist<0 and fasthist[0]>fasthist[1]?#7f0000:white, style=histogram)

//plot(MACD_Histogram2, color=MACD_Histogram2>0?blue:MACD_Histogram2<0?orange:white, style=histogram)

//plot(SMA, color=white, title="SMA")

//MACD Entry Conditions

MACD_longEntry2 = (crossover(MACD_Histogram2, 0))

MACD_shortEntry2 = (crossunder(MACD_Histogram2, 0))

MACD_longEntry = (crossover(fasthist, 0))

MACD_shortEntry = (crossunder(fasthist, 0))

// Colors

//MAtrendcolor = change(veryslowSMA) > 0 ? green : red

//trendcolor = fastEMA > slowEMA and change(veryslowSMA) > 0 and close > slowEMA ? green : fastEMA < slowEMA and change(veryslowSMA) < 0 and close < slowEMA ? red : yellow

//bartrendcolor = close > fastEMA and close > slowEMA and close > veryslowSMA and change(slowEMA) > 0 ? green : close < fastEMA and close < slowEMA and close < veryslowSMA and change(slowEMA) < 0 ? red : yellow

//backgroundcolor = slowEMA > veryslowSMA and MACD_longEntry and MACD_Line > 0 and fastEMA > slowEMA and close[slowLength] > veryslowSMA ? green : slowEMA < veryslowSMA and MACD_shortEntry and MACD_Line < 0 and fastEMA < slowEMA and close[slowLength] < veryslowSMA ? red : na

//barcolor(switch1?bartrendcolor:na)

// Conditional Bar Colors

//backgroundcolor = (MACD_longEntry ? green : MACD_shortEntry ? red : na)

//bgcolor(switch3?backgroundcolor:na,transp=80)

////BOLLINGER BAND Conditions

bb_source = close

bb_length = input(20, minval=1)

bb_mult = input(1.86, minval=0.001, maxval=50)

bb_basis = ema(bb_source, bb_length)

bb_dev = bb_mult * stdev(bb_source, bb_length)

bb_upper = bb_basis + bb_dev

bb_lower = bb_basis - bb_dev

bb_longEntry = crossover(bb_source, bb_lower)

bb_shortEntry = crossunder(bb_source, bb_upper)

plot(switch4?bb_basis:na, color=red, linewidth=4)

p1=plot(switch4?bb_upper:na)

p2=plot(switch4?bb_lower:na)

fill(p1,p2, color=aqua, transp=95)

////KELTNER CHANNEL Inputs/Variables/Plots

KC_useTrueRange = input(true)

KC_length = input(20, minval=1)

KC_mult = input(3.0)

KC_source = input(close, title="Source")

KC_ma = ema(KC_source, KC_length)

KC_range = KC_useTrueRange ? tr : high - low

KC_rangema = ema(KC_range, KC_length)

KC_upper = KC_ma + KC_rangema * KC_mult

KC_lower = KC_ma - KC_rangema * KC_mult

KC_longEntry = crossover(KC_source, KC_lower)

KC_shortEntry = crossunder(KC_source, KC_upper)

plot(switch5?KC_ma:na, color=red, title="Basis")

KC_u = plot(switch5?KC_upper:na, color=red, title="Upper")

KC_l = plot(switch5?KC_lower:na, color=red, title="Lower")

fill(KC_u, KC_l, color=red)

///////////////////ADX

//len = input(title="ADX Length", type=integer, defval=14)

//th = input(title="ADX threshold", type=integer, defval=20)

//TrueRange = max(max(high-low, abs(high-nz(close[1]))), abs(low-nz(close[1])))

//DirectionalMovementPlus = high-nz(high[1]) > nz(low[1])-low ? max(high-nz(high[1]), 0): 0

//DirectionalMovementMinus = nz(low[1])-low > high-nz(high[1]) ? max(nz(low[1])-low, 0): 0

//SmoothedTrueRange = nz(SmoothedTrueRange[1]) - (nz(SmoothedTrueRange[1])/len) + TrueRange

//SmoothedDirectionalMovementPlus = nz(SmoothedDirectionalMovementPlus[1]) - (nz(SmoothedDirectionalMovementPlus[1])/len) + DirectionalMovementPlus

//SmoothedDirectionalMovementMinus = nz(SmoothedDirectionalMovementMinus[1]) - (nz(SmoothedDirectionalMovementMinus[1])/len) + DirectionalMovementMinus

//DIPlus = sma(SmoothedDirectionalMovementPlus / SmoothedTrueRange * 100, len)

//DIMinus = sma(SmoothedDirectionalMovementMinus / SmoothedTrueRange * 100, len)

//DX = abs(DIPlus-DIMinus) / (DIPlus+DIMinus)*100

//ADX = sma(DX, len)

///

//ADX_longEntry = crossover(DIPlus, DIMinus) //or (DIPlus > DIMinus and DIPlus > th and ADX > th)

//ADX_shortEntry = crossover(DIMinus, DIPlus) //or (DIMinus > DIPlus and DIMinus > th and ADX > th)

//DI_long = if DIPlus > DIMinus and ADX > 20 and DIPlus > 20

//plot(DIPlus, color=green, title="DI+")

//plot(DIMinus, color=red, title="DI-")

//plot(ADX, color=black, title="ADX")

//hline(th, color=black, linestyle=dashed)

//////////////////////////////////Playing with RES

r1 = input("5", "Resolution")

r2 = input("15", "Resolution")

r3 = input("30", "Resolution")

r4 = input("60", "Resolution")

o1 = request.security(heikinashi(syminfo.tickerid), r1, MACD_Line[1])

c1 = request.security(heikinashi(syminfo.tickerid), r1, MACD_slowsignalLine[1])

o2 = request.security(heikinashi(syminfo.tickerid), r2, MACD_Line[1])

c2 = request.security(heikinashi(syminfo.tickerid), r2, MACD_slowsignalLine[1])

o3 = request.security(heikinashi(syminfo.tickerid), r3, MACD_Line[1])

c3 = request.security(heikinashi(syminfo.tickerid), r3, MACD_slowsignalLine[1])

o4 = request.security(heikinashi(syminfo.tickerid), r4, MACD_Line[1])

c4 = request.security(heikinashi(syminfo.tickerid), r4, MACD_slowsignalLine[1])

res_long = (o4 > c4 and o3 > c3 and o2 > c2 and o1 > c1)

res_short = (o4 < c4 and o3 < c3 and o2 < c2 and o1 < c1)

///////////////////// Parabolic SAR (stop and reverse)

start = input(0.02)

increment = input(0.02)

maximum = input(0.2)

psar = sar(start, increment, maximum)

plot(psar, style=circles, color=yellow)

psar_longEntry = close > psar

psar_longExit = crossunder(close, psar)

psar_shortEntry = close < psar//crossunder(close, psar)

psar_shortExit = crossover(close, psar)

mix = (moneyFlowIndex + rsi)/2

RSI_MFI = ema(mix, input(3))

//color = RSI_MFI > 80 ? red :RSI_MFI < 20 ? green : silver

vrsi = RSI_MFI

rsiBuySell = vrsi[1] < 95 and crossover(vrsi, 95) or vrsi[1] < 90 and crossover(vrsi, 90) or vrsi[1] < 85 and crossover(vrsi, 85) or vrsi[1] < 80 and crossover(vrsi, 80) or vrsi[1] < 75 and crossover(vrsi, 75) or vrsi[1] < 70 and crossover(vrsi, 70) or vrsi[1] < 65 and crossover(vrsi, 65) or vrsi[1] < 60 and crossover(vrsi, 60) or vrsi[1] < 55 and crossover(vrsi, 55) or vrsi[1] < 50 and crossover(vrsi, 50) or vrsi[1] < 45 and crossover(vrsi, 45) or vrsi[1] < 40 and crossover(vrsi, 40) or vrsi[1] < 35 and crossover(vrsi, 35) or vrsi[1] < 30 and crossover(vrsi, 30) or vrsi[1] < 25 and crossover(vrsi, 25) or vrsi[1] < 20 and crossover(vrsi, 20) or vrsi[1] < 15 and crossover(vrsi, 15) or vrsi[1] < 10 and crossover(vrsi, 10) or vrsi[1] < 5 and crossover(vrsi, 5) ? 1 : vrsi[1] > 95 and crossunder(vrsi, 95) or vrsi[1] > 90 and crossunder(vrsi, 90) or vrsi[1] > 85 and crossunder(vrsi, 85) or vrsi[1] > 80 and crossunder(vrsi, 80) or vrsi[1] > 75 and crossunder(vrsi, 75) or vrsi[1] > 70 and crossunder(vrsi, 70) or vrsi[1] > 65 and crossunder(vrsi, 65) or vrsi[1] > 60 and crossunder(vrsi, 60) or vrsi[1] > 55 and crossunder(vrsi, 55) or vrsi[1] > 50 and crossunder(vrsi, 50) or vrsi[1] > 45 and crossunder(vrsi, 45) or vrsi[1] > 40 and crossunder(vrsi, 40) or vrsi[1] > 35 and crossunder(vrsi, 35) or vrsi[1] > 30 and crossunder(vrsi, 30) or vrsi[1] > 25 and crossunder(vrsi, 25) or vrsi[1] > 20 and crossunder(vrsi, 20) or vrsi[1] > 15 and crossunder(vrsi, 15) or vrsi[1] > 10 and crossunder(vrsi, 10) or vrsi[1] > 5 and crossunder(vrsi, 5) ?-1:na

//////////////////////////////////Entry Conditions

//

MA1 = ema(hlc3, input(3))

MA2 = wma(MA1, input(7))

MA3 = ema(MA2, input(2))

MA4 = wma(MA3, input(1))

buy = close > MA4 or hlc3[1] < MA4 and hlc3 > MA4 and rsiBuySell == 1

sell = close < MA4 or hlc3[1] > MA4 and hlc3 < MA4 and rsiBuySell == -1

p=14

CO=close-open

HL=high-low

value1 = (CO + 2*CO[1] + 2*CO[2] + CO[3])/6

value2 = (HL + 2*HL[1] + 2*HL[2] + HL[3])/6

num=sum(value1,p)

denom=sum(value2,p)

RVI=denom!=0?num/denom:0

RVIsig=(RVI+ 2*RVI[1] + 2*RVI[2] + RVI[3])/6

//plot(RVI,color=white,style=line,linewidth=1)

//plot(RVIsig,color=orange,style=line,linewidth=1)

Tenkan_periods = input(9, minval=1, title="Conversion Line Periods"),

Kijun_periods = input(26, minval=1, title="Base Line Periods")

Senkou_Span_B_Length = input(50, minval=1, title="Lagging Span 2 Periods"),

Chikou_Span_Length = input(25, minval=1, title="Displacement")

donchian(len) => avg(lowest(len), highest(len))

Tenkan_sen = donchian(Tenkan_periods)

Kijun_sen = donchian(Kijun_periods)

Senkou_Span_A = avg(Tenkan_sen, Kijun_sen)

Senkou_Span_B = donchian(Senkou_Span_B_Length)

plot(Tenkan_sen, color=#0496ff, title="Conversion Line")

plot(Kijun_sen, color=#991515, title="Base Line")

plot(close, offset = -Chikou_Span_Length, color=#459915, title="Lagging Span")

p3 = plot(Senkou_Span_A, offset = Chikou_Span_Length, color=green,

title="Lead 1")

p4 = plot(Senkou_Span_B, offset = Chikou_Span_Length, color=red,

title="Lead 2")

fill(p3, p4, color = Senkou_Span_A > Senkou_Span_B ? green : red, transp=50)

Ichimoku_longEntry = Senkou_Span_B < Senkou_Span_A

Ichimoku_shortEntry = Senkou_Span_A < Senkou_Span_B

len9 = input(9, minval=1, title="Length")

srce = input(hlc3, title="Source")

ema9 = ema(srce, len9)

sma50 = sma(ema9, 80)

sma30 = vwma(sma50, 26)

ema930 = ema(sma30, 9)

//plot(ema930, color=blue, title="MA", linewidth=5, transp=0)

SMA100 = sma(input(ohlc4), input(10))

Lookback = SMA100[input(7)]

sma300 = SMA100 + (SMA100 - Lookback)

//if Ichimoku_longEntry

longEntry = (MACD_longEntry2) //or Stoch_longEntry// or buy //or cci_longEntry or bb_longEntry or psar_shortExit //or //// // KC_longEntry// or WilliamsR_longEntry// // // or RSI_longEntry// // or or MFI_longEntry// or crossover(close,psar) //(o4 < c4 and o3 < c3 and o2 < c2 and o1 < c1)

//if Ichimoku_shortEntry

shortEntry = (MACD_shortEntry2) //or Stoch_shortEntry// or sell//or cci_shortEntry or bb_shortEntry or psar_longExit// // //or KC_shortEntry// or WilliamsR_shortEntry// //or cci_shortEntry // // or or MFI_shortEntry// or crossunder(close,psar)// (o4 < c4 and o3 < c3 and o2 < c2 and o1 < c1)

//longExit = shortEntry or psar_longExit // if not (ADX > th and )

//shortExit = longEntry or psar_shortExit // if not (ADX > th and )

////psar for trailing stops or some other measure? we must have a good trailing stop.

///////////////////////////////Strategy Execution

if testPeriod()

strategy.entry("Long", strategy.long, when=longEntry)

strategy.close("Long", when=shortEntry)

//if testPeriod()

// strategy.entry("Long", strategy.long, when=longEntry)

// strategy.exit("Exit Long", "Long", when=shortEntry)

//else

// strategy.cancel("Long")

//if testPeriod()

// strategy.entry("Short", strategy.short, when=shortEntry)

// strategy.exit("Exit Short", "Short", when=longEntry)

//else

// strategy.cancel("Long")

//Other Plots and Alerts

plotshape(MACD_longEntry2, title= "3,7 Long Open", color=green, style=shape.circle)

plotshape(MACD_shortEntry2, title= "3,7 Short Open", color=red, style=shape.circle)

//plotshape(Stoch_longEntry, title= "Stoch Long Open", color=aqua, style=shape.circle)

//plotshape(Stoch_shortEntry, title= "Stoch Short Open", color=orange, style=shape.circle)

//plotshape(buy, title= "RES Long Open", color=green, location=location.belowbar, style=shape.circle)

///plotshape(sell, title= "RES Short Open", color=red, location=location.belowbar, style=shape.circle)

//plotshape(MACD_longEntry, title= "12,26 Long Open", color=green, style=shape.arrowup, size=size.normal, location=location.belowbar)

//plotshape(MACD_shortEntry, title= "12,26 Short Open", color=red, style=shape.arrowdown, size=size.normal, location=location.abovebar)

//plotshape(MACD_longEntry, title= "12,26 Long Open", color=green, style=shape.diamond, size=size.tiny, location=location.belowbar)

//plotshape(MACD_shortEntry, title= "12,26 Short Open", color=red, style=shape.diamond, size=size.tiny, location=location.abovebar)

//plotchar(longCondition, location=bottom char="L", color=green)

//plotchar(shortCondition, char="S", color=red)

//alertcondition(longCondition, title="MFI+MACD Long", message="(MFI crossOver 30) or MACD+")

//alertcondition(shortCondition, title="MFI+MACD Short", message="(MFI crossUnder 70) or MACD-")

plot(sma300, color=purple, linewidth=4)

- Giá trung bình đô la sau chiến lược giảm

- Triple Indicators Sentiment Driven Breakout Strategy - Chiến lược đột phá dựa trên tình cảm

- Chiến lược đảo ngược xu hướng dựa trên đường trung bình động, mô hình giá và khối lượng

- Chiến lược trung bình di chuyển kép

- Chiến lược giao dịch chéo giữa động lực chuyển động trung bình

- Chiến lược Chữ thập vàng trung bình di chuyển kép

- Chiến lược xu hướng Bollinger Bands Momentum Wave

- Chiến lược giao dịch động lực ngược

- Chiến lược chỉ số PB trung bình băng thông

- RSI & Chiến lược giao dịch 5 phút Fibonacci

- Tối ưu hóa Dynamic Breakout

- Đơn vị xác định chéo đường cơ sở ATR Volatility & HMA Trend Bias Mean Reversal Strategy

- Phạm vi biến động và Chiến lược giao dịch xu hướng chứng khoán đa khung thời gian của VWAP

- Đổi ngược giá với chiến lược thu thập chéo

- Chiến lược chu kỳ mạng Stochastic Ehlers

- Sự đột phá của giá cao thấp hàng ngày dựa trên các mức Fibonacci

- Chiến lược SuperTrend được cải thiện

- Chiến lược giao dịch định lượng tích hợp MACD, RSI và RVOL

- Chiến lược theo dõi chuyển đổi động lực

- Xu hướng sau chiến lược dựa trên EMA và SMA Crossover