概述

这是一个基于两个不同时间周期的指数移动平均线交叉做多空的自动交易策略。它使用简单的技术指标,非常适合新手学习和实践。

原理

该策略使用两个指数移动平均线,一个是大时间周期的均线,一个是当前周期的均线。当当前周期的均线上穿大周期的均线时,做多;当当前周期的均线下穿大周期的均线时,做空。

具体来说,策略首先定义两个均线参数:

- tf - 大时间周期,默认为日线

- len - 均线周期长度,默认为3

然后分别计算出两个EMA:

- ma1 - 大周期日线上的3日EMA

- ma2 - 当前周期的3日EMA

最后,进入交易逻辑:

- 当ma2 > ma1时,做多

- 当ma2 < ma1时,做空

这样,通过不同时间周期均线的交叉来判断趋势方向,进行自动交易。

优势

该策略具有以下优势:

- 原理简单,容易理解和实现,非常适合新手学习。

- 顺势交易,遵循趋势,可以获得较好的盈利。

- 采用指数移动平均线,对价格变化更敏感,可以及时捕捉趋势转折。

- 不同周期均线组合,可以发挥各自的优势,提高系统稳定性。

- 无需过多参数,容易测试和优化,实盘运作方便。

风险

该策略也存在一些风险:

- 跟踪趋势性不强,可能因震荡市场而被套牢。

- 双均线交叉存在时滞,可能错过部分机会。

- 无法有效过滤两均线交叉乱序的情况。

- 仅基于简单均线,对复杂市场难以适应。

可以通过设置止损,优化参数组合,或加入其它指标等方式来降低风险。

优化方向

该策略可以从以下几个方面进行优化:

- 测试不同的大周期均线参数,找出最佳组合。

- 增加成交量指标过滤,避免虚假信号。

- 结合趋势指标,提高持仓力度和操作效率。

- 设置自适应止损点,以控制单笔损失。

- 优化仓位管理,根据市场调整仓位大小。

- 加入机器学习模型,使策略更智能化。

总结

该指数移动平均交叉策略运用简单指标捕捉趋势,适合新手学习实践。优化空间较大,可以引入更多技术指标和模型进行改进,开发出具有更强效果的量化交易策略。

策略源码

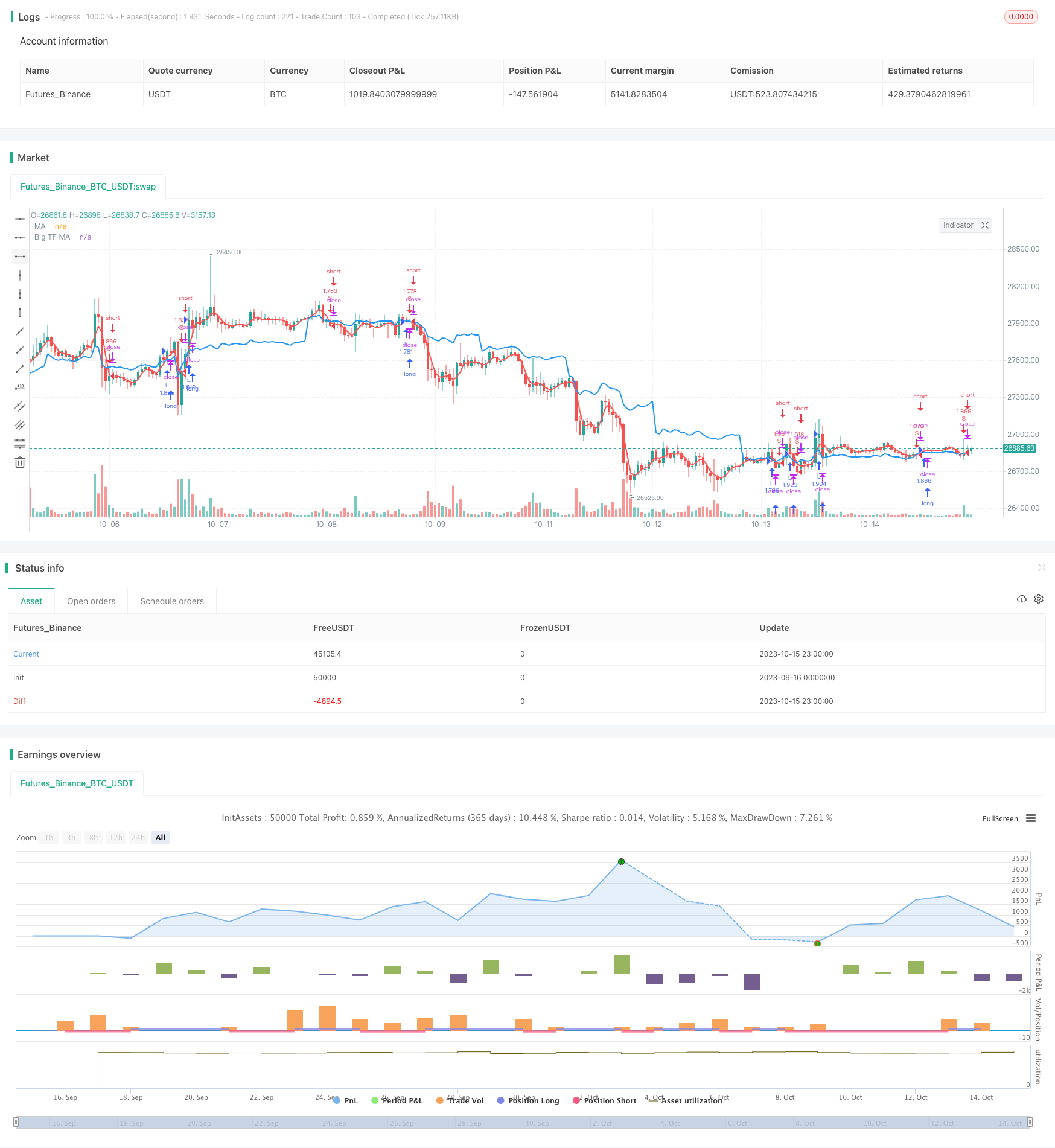

/*backtest

start: 2023-09-16 00:00:00

end: 2023-10-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Noro's Singapore Strategy", shorttitle = "Singapore str", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Lot")

tf = input("D", title = "Big Timeframe")

len = input(3, minval = 1, title = "MA length")

src = input(close, title = "MA Source")

fromyear = input(1900, defval = 1900, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//MAs

ma1 = request.security(syminfo.tickerid, tf, sma(src, len))

ma2 = sma(src, len)

plot(ma1, linewidth = 2, color = blue, title = "Big TF MA")

plot(ma2, linewidth = 2, color = red, title = "MA")

//Trading

size = strategy.position_size

lot = 0.0

lot := size != size[1] ? strategy.equity / close * capital / 100 : lot[1]

if ma2 > ma1

strategy.entry("L", strategy.long, needlong ? lot : 0, when = (time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

if ma2 < ma1

strategy.entry("S", strategy.short, needshort ? lot : 0, when = (time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

if time > timestamp(toyear, tomonth, today, 23, 59)

strategy.close_all()