概述

双线性BB口系统策略是一种典型的碰口交易策略。策略利用波动性指标布林带,通过双线口开仓,结合止盈止损管理资金,实现盈利。

原理

该策略主要基于布林带指标,布林带由均线、带宽决定。策略首先计算n周期的收盘价均线作为中轨,带宽为中轨的m倍标准差。然后分别绘制中轨上下各m个标准差的上轨和下轨。价格碰触上轨时看空,碰触下轨时看多。

具体来说,策略通过以下步骤实现:

输入参数:计算均线长度n,标准差倍数m

计算中轨:n周期收盘价的简单移动均线

计算上轨:中轨 + m * n周期收盘价标准差

计算下轨:中轨 - m * n周期收盘价标准差

画出中轨、上轨、下轨

当收盘价由下向上穿过中轨时,做多

当收盘价由上向下穿过中轨时,做空

设置止盈止损点,退出仓位

通过双线碰口进入场内,并设置止盈止损,可以有效控制风险,实现稳定盈利。

优势

该策略具有以下优势:

规则清晰,易于实现。

利用布林带指标,具有一定的科学依据。

双线口开仓,可以有效过滤震荡市场的假突破。

包含止盈止损机制,可以控制风险。

回测数据充足,具有真实可靠性。

参数优化空间大,可调整至最佳状态。

风险

该策略也存在一些风险:

布林带指标对参数敏感,不同参数可能导致结果差异较大。

双线口打开仓位频率可能过低,容易错过交易机会。

止盈止损点设置不当,可能过早止损或获利不足。

行情趋势变化时,布林带系统可能会产生较大亏损。

回测时间窗口较短,可能存在过拟合风险。

对应解决方法:

对参数进行优化,找到最优参数组合。

适当缩小布林带宽度,增加开仓频率。

根据不同市场调整止盈止损点,保证最佳结果。

增加趋势过滤,避免逆势交易。

增加回测时间长度,确保系统稳健性。

优化方向

该策略可以从以下几个方向进行优化:

优化参数,改进入场系统。可以通过更全面的参数优化,找到最佳的参数组合。

增加趋势判断。加入趋势判断指标,避免逆势开仓。

优化止盈止损。可以通过动态止盈止损、移动止损等方式优化盈亏管理。

结合其他指标过滤。加入MACD、KDJ等指标判断时机,过滤假突破。

增加机器学习模型。使用LSTM等深度学习模型进一步优化策略。

组合其他策略类型。与其他基础策略或高级策略组合,实施资金管理。

总结

双线性BB口系统策略整体表现良好,具有科学的指标运用、清晰的交易规则、灵活的参数设定等优点。通过不断优化参数、止盈止损、趋势判断等方面,可以进一步提升系统稳定性。此外,与其他策略和模式组合使用,也可以强化策略效果,创造更大价值。

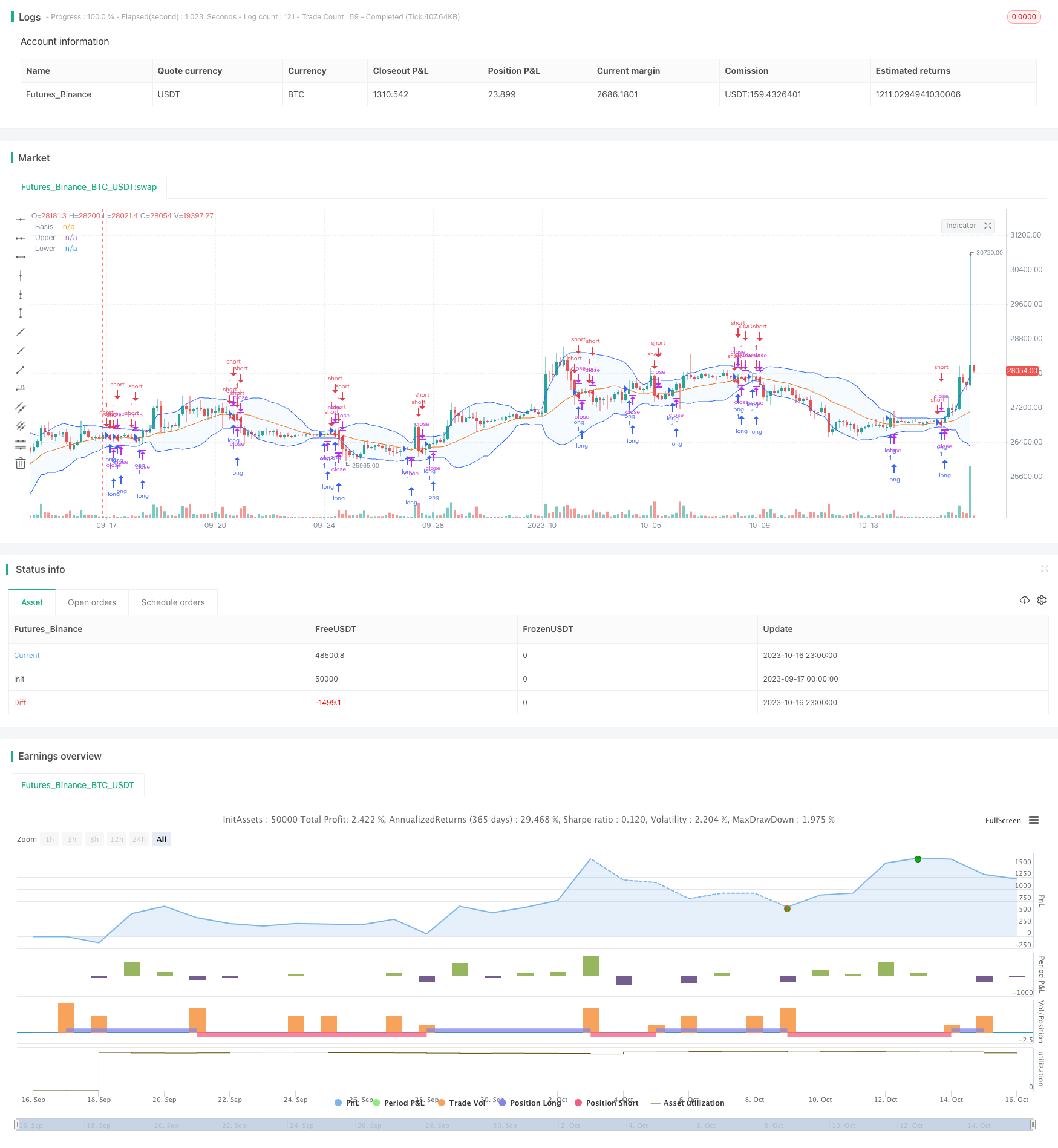

/*backtest

start: 2023-09-17 00:00:00

end: 2023-10-17 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("BB돌파", overlay=true)

length = input.int(20, minval=1)

src = input(close, title="Source")

mult = input.float(2.0, minval=0.001, maxval=50, title="StdDev")

basis = ta.sma(src, length)

dev = mult * ta.stdev(src, length)

upper = basis + dev

lower = basis - dev

offset = input.int(0, "Offset", minval = -500, maxval = 500)

plot(basis, "Basis", color=#FF6D00, offset = offset)

p1 = plot(upper, "Upper", color=#2962FF, offset = offset)

p2 = plot(lower, "Lower", color=#2962FF, offset = offset)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

long = ta.crossover(close,basis)

short = ta.crossunder(close,basis)

strategy.entry("long", strategy.long, when =long)

strategy.entry("short", strategy.short, when =short)