概述

本策略基于MACD指标设计了一个可以控制每笔交易风险的长线交易策略。相比传统的做多做空翻转策略,本策略更加注重每笔交易的风险控制。策略通过计算目标止损价位和止盈价位,设定合理的仓位大小,限制每笔交易可能造成的最大损失。这可以有效控制回撤,获得长期稳定收益。

原理

本策略首先计算MACD指标的macd线和signal线。当macd线从下向上突破signal线时,判断为买入信号。为过滤假突破,策略要求barssince(crossover(macd_line, signal_line)) <= 5,即突破发生在最近5根K线内。同时要求macd线和signal线均低于0,表明目前处于超卖状态,以及收盘价高于wma均线,表明趋势向上。满足上述条件时,进行买入开仓。

对每笔交易,策略计算合理的止损价位和止盈价位。止损价位设定为最近3根K线的最低价。止盈价位设定为买入价格加上止损价位到买入价格距离的4倍。

关键的是,策略根据可承受的风险计算每笔交易的具体仓位。通过参数capital_risk设定每笔交易最大可承受的损失占总资金的百分比。然后根据止损幅度计算以美元计的仓位大小。再转换为合约数进行买入开仓。

每次交易风险控制在总资金的1%以内,可以有效控制回撤。同时,止盈位置较大,可以获得较高收益。

优势

- 风险控制先行,每笔交易风险可控

- 优化仓位大小,最大程度利用资金

- 止损策略可以有效控制回撤

- 合理止盈,获利潜力较大

风险及改进

- MACD指标存在滞后,可能错过快速变化的趋势

- 止损或止盈位置设定不当,可能使收益减少或风险扩大

- 交易频率可能过高,交易成本增加

可以考虑:

- 整合其他指标判断趋势,避免MACD滞后问题

- 优化止损止盈算法,使其更具弹性

- 适当放宽交易频率,降低交易成本

总结

本策略基于MACD指标判断趋势方向,以控制风险为先导,计算合理仓位进行交易。关键在于风险控制和仓位优化,可以获得长期稳定收益。但MACD指标存在一定缺陷,止损止盈机制也需进一步优化。如果进一步优化指标运用、止损止盈设定以及降低交易频率,会使策略更加强大。

策略源码

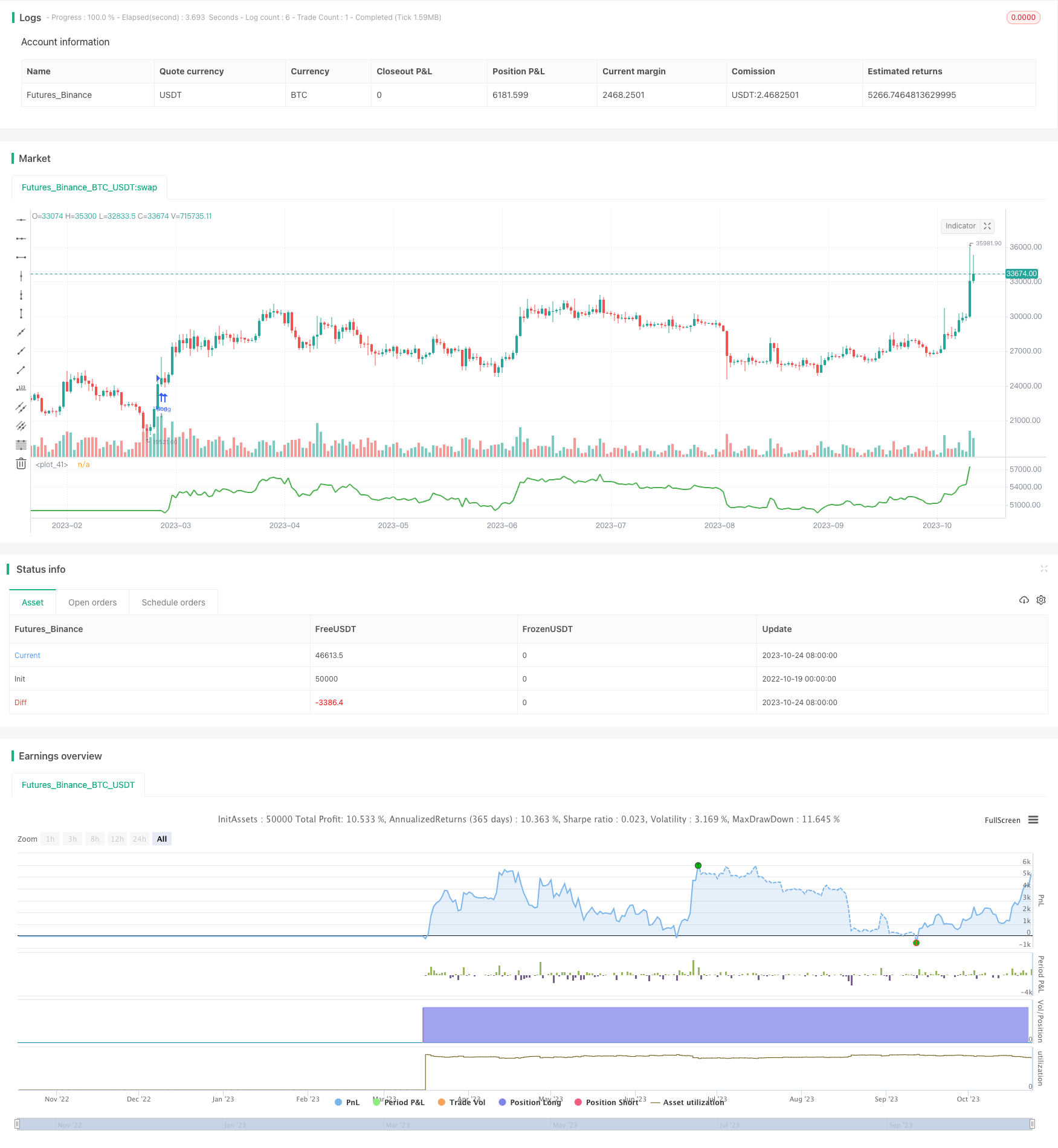

/*backtest

start: 2022-10-19 00:00:00

end: 2023-10-25 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy( "McDonalds ", shorttitle="Ur Lovin' It", initial_capital=10000, default_qty_type=strategy.cash, currency=currency.USD )

capital_risk = input( 1.0, "% capital risk per trade" ) / 100

r_exit = input( 4.0, "Take Profit in 'R'" )

wma_length = input( 150, 'WMA Bias Length' )

[macd_line, signal_line, hist ] = macd(close, 12, 26, 9)

w_line = wma( close, wma_length )

golong = barssince(crossover(macd_line, signal_line)) <= 5 and ( macd_line < 0 and signal_line < 0 ) and ( close > w_line ) and strategy.opentrades == 0

float stop = na

float tp = na

// For a stop, use a recent low

stop := golong ? lowest(low, 3)[1] : stop[1]

range = abs(close - stop)

tp := golong ? close + (r_exit * range) : tp[1]

// This is the bit that calculates how much size to use so we only lose 1% of the `strategy.equity`

how_much_willing_to_lose = strategy.equity * capital_risk

// Spread the risk across the stop range

position_size_in_usd = how_much_willing_to_lose / (range / close)

// Sized specified in base contract

position_size_in_contracts = position_size_in_usd / close

// Enter the position

if golong

strategy.entry("long", strategy.long, qty=position_size_in_contracts)

strategy.exit("long exit","long", stop=stop, limit=tp)

// experimental exit strategy

// hist_strength = hist >= 0 ? ( hist[1] < hist ? 'strong' : 'weak') : ( hist[1] < hist ? 'weak' : 'strong' )

// if hist < 0 and hist_strength == 'strong' and falling( hist, 8 )

// strategy.close("long")

plot( strategy.equity, color=strategy.equity > 10000 ? color.green : color.red, linewidth=2 )