概述

移动平均线交叉策略是一种 momentum 策略,利用双移动平均线的交叉信号来判断趋势方向,产生买入和卖出信号。该策略使用 2 条简单移动平均线和 1 条指数移动平均线,根据它们的交叉情况判定多空,属于中短期交易策略。

策略原理

该策略使用 3 条移动平均线:

- EMA1: 一条较短周期的指数移动平均线,代表快线

- SMA1: 一条较长周期的简单移动平均线,代表慢线

- SMA2: 一条更长周期的简单移动平均线,判断趋势方向

策略以 EMA1, SMA1, SMA2 的大小关系来判断趋势:

- 上升趋势:EMA1 > SMA1 > SMA2

- 下降趋势:EMA1 < SMA1 < SMA2

进入信号:

- 多头进入:当快线上穿慢线时做多

- 空头进入:当快线下穿慢线时做空

退出信号:

- 多头退出:快线下穿慢线时平仓

- 空头退出:快线上穿慢线时平仓

该策略提供了多种参数配置,可以选择不同的移动平均线来判断进入和退出。

优势分析

该策略具有以下优势:

- capture momentum: 能够捕捉市场趋势的变化,momentum 策略

- flexible configuration: 提供多种移动平均线选择,可以灵活配置

- trend filtering: 使用长周期移动平均线来判断趋势方向,避免逆势交易

- risk management: 可配置止损和止盈,控制单笔交易风险

风险分析

该策略也存在以下风险:

- whipsaws: 在突破前有可能出现持续震荡导致多次假突破

- sensitive to MA parameters: 移动平均线参数设置不当可能导致过于频繁或不够敏感

- lagging: 移动平均线本质具有滞后性,可能错过突破最佳时点

- no fundamentals: 纯技术指标驱动,不考虑基本面

针对 whipsaws 风险,可以适当调整移动平均线周期;对参数敏感性风险,可以优化参数;对滞后性风险,可以结合其他先行指标优化。

优化方向

该策略可以从以下几个方面进行优化:

- 加入其他技术指标过滤,例如 RSI、布林带等,提高信号质量

- 优化移动平均线周期参数,寻找最优参数

- 加入机器学习模型判断趋势和信号可靠性

- 结合交易量,避免价格在低量情况下出现虚假突破

- 结合基本面因素,避免逆经济周期交易

总结

移动平均线交叉策略整体较为简单直接,通过快慢均线的交叉判定趋势方向和参与时机。该策略优势是可以捕捉momentum,灵活配置参数,但也存在一定的whipsaw风险、滞后风险等问题。通过引入其他指标进行过滤优化,该策略可以成为一个非常实用的量化交易策略。

策略源码

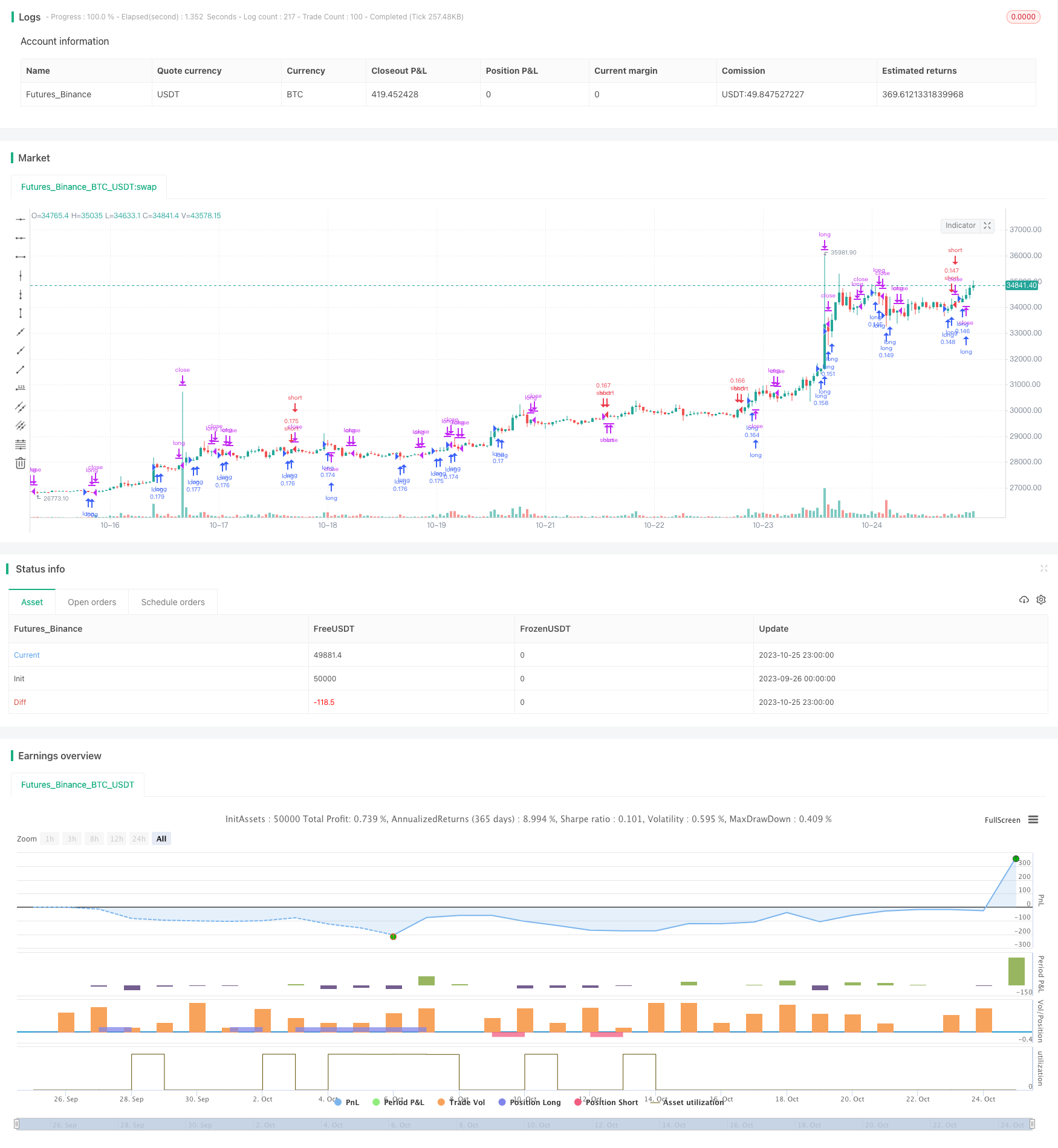

/*backtest

start: 2023-09-26 00:00:00

end: 2023-10-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Decam9

//@version=5

strategy(title = "Moving Average Crossover", shorttitle = "MA Crossover Strategy", overlay=true,

initial_capital = 100000,default_qty_type = strategy.percent_of_equity, default_qty_value = 10)

//Moving Average Inputs

EMA1 = input.int(title="Fast EMA", group = "Moving Averages:",

inline = "EMAs", defval=5, minval = 1)

isDynamicEMA = input.bool(title = "Dynamic Exponential Moving Average?", defval = true,

inline = "EMAs", group = "Moving Averages:", tooltip = "Changes the source of the MA based on trend")

SMA1 = input.int(title = "Slow SMA", group = "Moving Averages:",

inline = "SMAs", defval = 10, minval = 1)

isDynamicSMA = input.bool(title = "Dynamic Simple Moving Average?", defval = false,

inline = "SMAs", group = "Moving Averages:", tooltip = "Changes the source of the MA based on trend")

SMA2 = input.int(title="Trend Determining SMA", group = "Moving Averages:",

inline = "MAs", defval=13, minval = 1)

//Moving Averages

Trend = ta.sma(close, SMA2)

Fast = ta.ema(isDynamicEMA ? (close > Trend ? low : high) : close, EMA1)

Slow = ta.sma(isDynamicSMA ? (close > Trend ? low : high) : close, SMA1)

//Allowed Entries

islong = input.bool(title = "Long", group = "Allowed Entries:",

inline = "Entries",defval = true)

isshort = input.bool(title = "Short", group = "Allowed Entries:",

inline = "Entries", defval= true)

//Entry Long Conditions

buycond = input.string(title="Buy when", group = "Entry Conditions:",

inline = "Conditions",defval="Fast-Slow Crossing",

options=["Fast-Slow Crossing", "Fast-Trend Crossing","Slow-Trend Crossing"])

intrendbuy = input.bool(title = "In trend", defval = true, group = "Entry Conditions:",

inline = "Conditions", tooltip = "In trend if price is above SMA 2")

//Entry Short Conditions

sellcond = input.string(title="Sell when", group = "Entry Conditions:",

inline = "Conditions2",defval="Fast-Slow Crossing",

options=["Fast-Slow Crossing", "Fast-Trend Crossing","Slow-Trend Crossing"])

intrendsell = input.bool(title = "In trend",defval = true, group = "Entry Conditions:",

inline = "Conditions2", tooltip = "In trend if price is below SMA 2?")

//Exit Long Conditions

closebuy = input.string(title="Close long when", group = "Exit Conditions:",

defval="Fast-Slow Crossing", options=["Fast-Slow Crossing", "Fast-Trend Crossing","Slow-Trend Crossing"])

//Exit Short Conditions

closeshort = input.string(title="Close short when", group = "Exit Conditions:",

defval="Fast-Slow Crossing", options=["Fast-Slow Crossing", "Fast-Trend Crossing","Slow-Trend Crossing"])

//Filters

filterlong =input.bool(title = "Long Entries", inline = 'linefilt', group = 'Apply Filters to',

defval = true)

filtershort =input.bool(title = "Short Entries", inline = 'linefilt', group = 'Apply Filters to',

defval = true)

filterend =input.bool(title = "Exits", inline = 'linefilt', group = 'Apply Filters to',

defval = true)

usevol =input.bool(title = "", inline = 'linefiltvol', group = 'Relative Volume Filter:',

defval = false)

rvol = input.int(title = "Volume >", inline = 'linefiltvol', group = 'Relative Volume Filter:',

defval = 1)

len_vol = input.int(title = "Avg. Volume Over Period", inline = 'linefiltvol', group = 'Relative Volume Filter:',

defval = 30, minval = 1,

tooltip="The current volume must be greater than N times the M-period average volume.")

useatr =input.bool(title = "", inline = 'linefiltatr', group = 'Volatility Filter:',

defval = false)

len_atr1 = input.int(title = "ATR", inline = 'linefiltatr', group = 'Volatility Filter:',

defval = 5, minval = 1)

len_atr2 = input.int(title = "> ATR", inline = 'linefiltatr', group = 'Volatility Filter:',

defval = 30, minval = 1,

tooltip="The N-period ATR must be greater than the M-period ATR.")

usersi =input.bool(title = "", inline = 'linersi', group = 'Overbought/Oversold Filter:',

defval = false)

rsitrhs1 = input.int(title = "", inline = 'linersi', group = 'Overbought/Oversold Filter:',

defval = 0, minval=0, maxval=100)

rsitrhs2 = input.int(title = "< RSI (14) <", inline = 'linersi', group = 'Overbought/Oversold Filter:',

defval = 100, minval=0, maxval=100,

tooltip="RSI(14) must be in the range between N and M.")

issl = input.bool(title = "SL", inline = 'linesl1', group = 'Stop Loss / Take Profit:',

defval = false)

slpercent = input.float(title = ", %", inline = 'linesl1', group = 'Stop Loss / Take Profit:',

defval = 10, minval=0.0)

istrailing = input.bool(title = "Trailing", inline = 'linesl1', group = 'Stop Loss / Take Profit:',

defval = false)

istp = input.bool(title = "TP", inline = 'linetp1', group = 'Stop Loss / Take Profit:',

defval = false)

tppercent = input.float(title = ", %", inline = 'linetp1', group = 'Stop Loss / Take Profit:',

defval = 20)

//Conditions for Crossing

fscrossup = ta.crossover(Fast,Slow)

fscrossdw = ta.crossunder(Fast,Slow)

ftcrossup = ta.crossover(Fast,Trend)

ftcrossdw = ta.crossunder(Fast,Trend)

stcrossup = ta.crossover(Slow,Trend)

stcrossdw = ta.crossunder(Slow,Trend)

//Defining in trend

uptrend = Fast >= Slow and Slow >= Trend

downtrend = Fast <= Slow and Slow <= Trend

justCrossed = ta.cross(Fast,Slow) or ta.cross(Slow,Trend)

//Entry Signals

crosslong = if intrendbuy

(buycond =="Fast-Slow Crossing" and uptrend ? fscrossup:(buycond =="Fast-Trend Crossing" and uptrend ? ftcrossup:(buycond == "Slow-Trend Crossing" and uptrend ? stcrossup : na)))

else

(buycond =="Fast-Slow Crossing"?fscrossup:(buycond=="Fast-Trend Crossing"?ftcrossup:stcrossup))

crossshort = if intrendsell

(sellcond =="Fast-Slow Crossing" and downtrend ? fscrossdw:(sellcond =="Fast-Trend Crossing" and downtrend ? ftcrossdw:(sellcond == "Slow-Trend Crossing" and downtrend ? stcrossdw : na)))

else

(sellcond =="Fast-Slow Crossing"?fscrossdw:(buycond=="Fast-Trend Crossing"?ftcrossdw:stcrossdw))

crossexitlong = (closebuy =="Fast-Slow Crossing"?fscrossdw:(closebuy=="Fast-Trend Crossing"?ftcrossdw:stcrossdw))

crossexitshort = (closeshort =="Fast-Slow Crossing"?fscrossup:(closeshort=="Fast-Trend Crossing"?ftcrossup:stcrossup))

// Filters

rsifilter = usersi?(ta.rsi(close,14) > rsitrhs1 and ta.rsi(close,14) < rsitrhs2):true

volatilityfilter = useatr?(ta.atr(len_atr1) > ta.atr(len_atr2)):true

volumefilter = usevol?(volume > rvol*ta.sma(volume,len_vol)):true

totalfilter = volatilityfilter and volumefilter and rsifilter

//Filtered signals

golong = crosslong and islong and (filterlong?totalfilter:true)

goshort = crossshort and isshort and (filtershort?totalfilter:true)

endlong = crossexitlong and (filterend?totalfilter:true)

endshort = crossexitshort and (filterend?totalfilter:true)

// Entry price and TP

startprice = ta.valuewhen(condition=golong or goshort, source=close, occurrence=0)

pm = golong?1:goshort?-1:1/math.sign(strategy.position_size)

takeprofit = startprice*(1+pm*tppercent*0.01)

// fixed stop loss

stoploss = startprice * (1-pm*slpercent*0.01)

// trailing stop loss

if istrailing and strategy.position_size>0

stoploss := math.max(close*(1 - slpercent*0.01),stoploss[1])

else if istrailing and strategy.position_size<0

stoploss := math.min(close*(1 + slpercent*0.01),stoploss[1])

if golong and islong

strategy.entry("long", strategy.long )

if goshort and isshort

strategy.entry("short", strategy.short)

if endlong

strategy.close("long")

if endshort

strategy.close("short")

// Exit via SL or TP

strategy.exit(id="sl/tp long", from_entry="long", stop=issl?stoploss:na,

limit=istp?takeprofit:na)

strategy.exit(id="sl/tp short",from_entry="short",stop=issl?stoploss:na,

limit=istp?takeprofit:na)