概述

MACD趋势预测策略是一种基于MACD指标和EMA指标的趋势跟随策略。该策略不像传统的MACD策略那样通过信号线的交叉生成交易信号,而是通过MACD指标线和信号线之间距离的变化来产生交易信号,以捕捉趋势的变化。

策略原理

计算快线DEMAfast: 通过EMA方法计算快线的两次EMA均值MMEfast,然后根据公式DEMAfast=((2 * MMEfast) - MMEfastb)计算快线DEMAfast。

计算慢线DEMAslow: 通过EMA方法计算慢线的两次EMA均值MMEslow,然后根据公式DEMAslow=((2 * MMEslow) - MMEslowb)计算慢线DEMAslow。

计算MACD线: MACD线是快线DEMAfast减去慢线DEMAslow的差值LigneMACDZeroLag。

计算信号线: 通过EMA方法计算MACD线的两次EMA均值MMEsignal,然后根据公式信号线Lignesignal=((2 * MMEsignal) - MMEsignalb)。

比较MACD线和信号线: 当MACD线大于信号线时产生买入信号;当MACD线小于信号线时产生卖出信号。

以上计算使用的是DEMA算法,可以有效减少MACD指标的滞后。

策略优势

使用DEMA算法,可以减少MACD指标的滞后,使得交易信号更加灵敏。

不依赖MACD指标的交叉信号,而是通过MACD和信号线距离变化来捕捉趋势变化,可以更早进入趋势。

该策略对趋势的判断准确,profit factor可以达到1.6-3.5,收益表现较好。

策略逻辑简单清晰,容易理解实现,适合用于量化交易。

策略风险

MACD作为滞后指标,在盘整行情中可能产生大量无效交易信号。

DEMA算法虽可减少滞后但无法完全消除,仍存在一定滞后。

作为趋势跟随策略,在震荡行情下收益可能不佳。

需要优化参数sma,lma,tsp等值,以适应不同周期和品种。

可能需要添加止损策略控制亏损。

策略优化方向

优化sma,lma,tsp参数以适应不同周期和交易品种。

添加类似ATR的动态止损策略,以控制每单亏损。

结合趋势判断指标,避免在震荡行情中交易。

添加交易量控制,根据市场波动程度调整仓位。

优化入场和出场逻辑,细化交易信号规则。

总结

MACD趋势预测策略通过改进MACD指标的计算方法,使用DEMA算法来减少滞后,并采用MACD和信号线距离变化判断趋势,作为趋势跟随策略,可以有效捕捉趋势变化, profit factor可达1.6-3.5,具有一定的优势。但仍需要进一步优化参数设置、止损策略、过滤震荡行情等,以适应更多市场环境,将是该策略的发展方向。

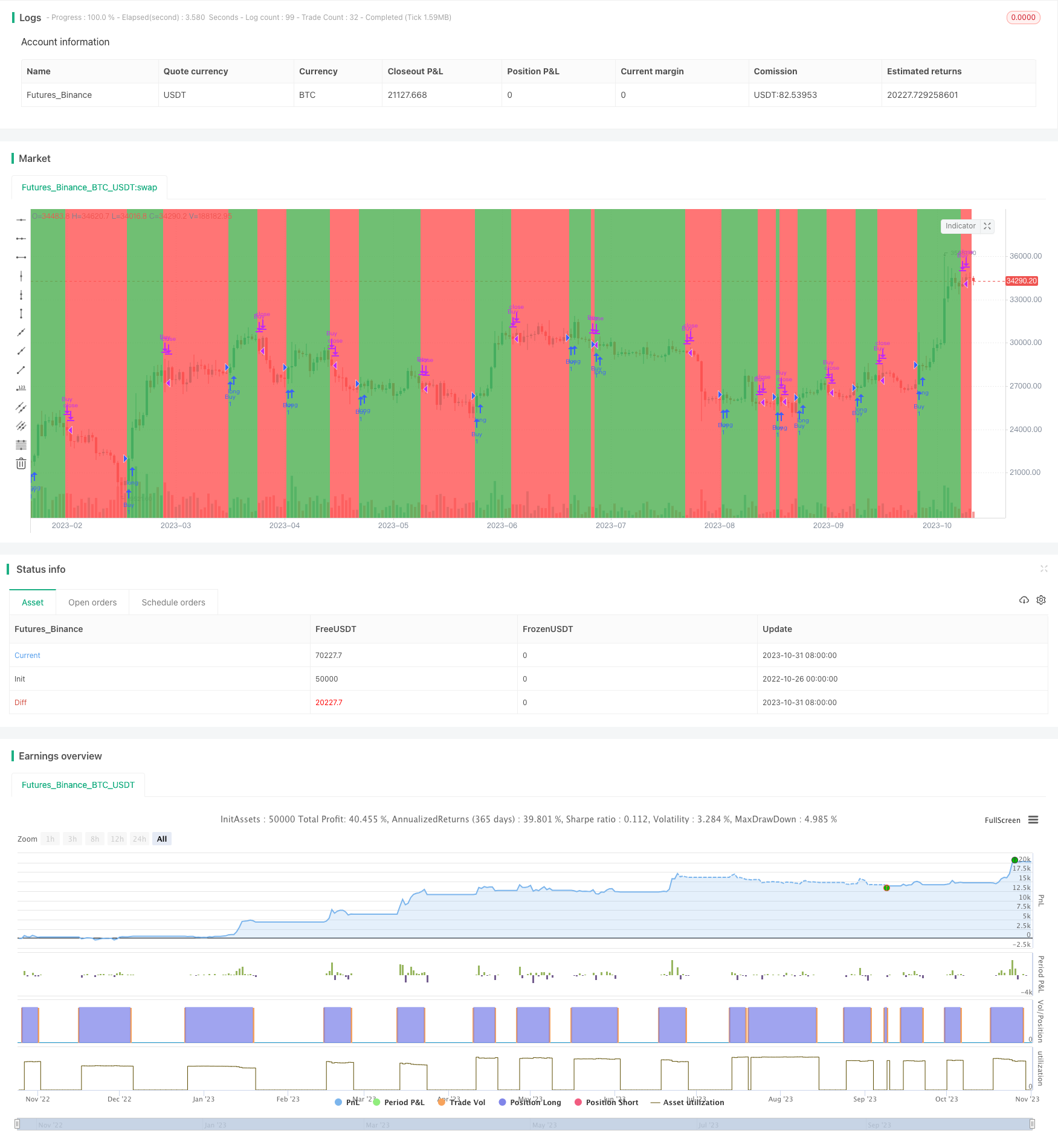

/*backtest

start: 2022-10-26 00:00:00

end: 2023-11-01 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © moritz1301

//@version=4

strategy("MACD Trendprediction Strategy V1", shorttitle="MACD TPS", overlay=true)

sma = input(12,title='DEMA Courte')

lma = input(26,title='DEMA Longue')

tsp = input(9,title='Signal')

dolignes = input(true,title="Lignes")

MMEslowa = ema(close,lma)

MMEslowb = ema(MMEslowa,lma)

DEMAslow = ((2 * MMEslowa) - MMEslowb )

MMEfasta = ema(close,sma)

MMEfastb = ema(MMEfasta,sma)

DEMAfast = ((2 * MMEfasta) - MMEfastb)

LigneMACDZeroLag = (DEMAfast - DEMAslow)

MMEsignala = ema(LigneMACDZeroLag, tsp)

MMEsignalb = ema(MMEsignala, tsp)

Lignesignal = ((2 * MMEsignala) - MMEsignalb )

MACDZeroLag = (LigneMACDZeroLag - Lignesignal)

bgcolor(LigneMACDZeroLag<Lignesignal ? color.red : color.green)

if (LigneMACDZeroLag>Lignesignal)

strategy.entry("Buy", strategy.long, comment="BUY")

if (LigneMACDZeroLag<Lignesignal)

strategy.close("Buy", strategy.long, comment="SELL")