概述

该策略基于相对强弱指数(RSI)指标设计,利用RSI指标的超买超卖原理进行双向突破操作。当RSI指标上穿设定的超买线时做多,当RSI指标下穿设定的超卖线时做空,属于典型的反转交易策略。

策略原理

根据用户输入设置计算RSI指标的参数,包括RSI周期长度、超买线阈值、超卖线阈值。

根据RSI曲线相对于超买线和超卖线的位置关系,判断所处的超买区还是超卖区。

当RSI指标从超卖区突破对应阈值线时,进行相反方向的开仓操作。例如从超买区突破超买线时,认为行情反转,此时开仓做多;从超卖区突破超卖线时,认为行情反转,此时开仓做空。

开仓后,设置止损止盈线。跟踪止损止盈情况,满足条件时进行平仓。

该策略还提供了利用EMA作为过滤器的可选功能。只有在RSI指标做多做空信号的同时,价格也要突破EMA才开仓。

策略还提供了只在特定交易时段交易的功能。用户可以设置只在某个时间段交易,超过时间后平仓离场。

优势分析

- 利用RSI指标的经典突破原理,回测效果较好。

- 可灵活设置超买超卖阈值,调整适合不同品种。

- 可选择是否使用EMA过滤信号,避免因小范围震荡而频繁开平仓。

- 支持止损止盈功能,可以提高策略稳定性。

- 支持设置特定交易时段,避免不适宜的时间段交易。

- 支持做多做空双向交易,可以充分利用行情双向波动。

风险分析

- RSI指标容易出现背离,仅凭RSI指标判断可能产生交易信号不准。需要结合趋势、均线等判断。

- 超买超卖阈值设定不当可能导致过于频繁或错过交易机会。

- 止损止盈设置不当可能造成策略过于激进或保守。

- EMA过滤器设置不当也可能错过交易机会或过滤掉有效信号。

风险解决:

- 优化RSI参数,调整适合不同品种的参数。

- 结合趋势指标等判断背离情况,避免错误信号。

- 测试和优化止损止盈参数,找到最佳参数。

- 测试和优化EMA参数,找到最佳过滤水平。

策略优化方向

该策略可以从以下几个方面进行优化:

优化RSI参数,寻找不同品种最佳参数组合。可以通过遍历回测找到最佳超买超卖阈值。

尝试不同的指标替代或结合RSI,形成更强势的判断信号。例如MACD,KD,布林带等。

优化止损止盈策略,提高策略稳定性。可以根据市场波动率设定游离止损,或者带有追踪止损功能的策略。

优化EMA过滤器参数或试验其他指标过滤器,进一步避免被套。

增加趋势判断模块,避免反向做空多头行情,或反向做多空头行情。

测试不同的交易时段参数,判断哪些时段适合该策略,哪些时段应避免。

总结

该RSI双向突破策略整体思路清晰,利用经典的RSI超买超卖原理进行反转交易。既可以抓取超买超卖区的反转机会,又可通过EMA过滤和止损止盈来控制风险。通过参数优化和模块优化空间较大,可以将其打造成较为稳定可靠的反转策略。值得进一步测试优化后实际应用。

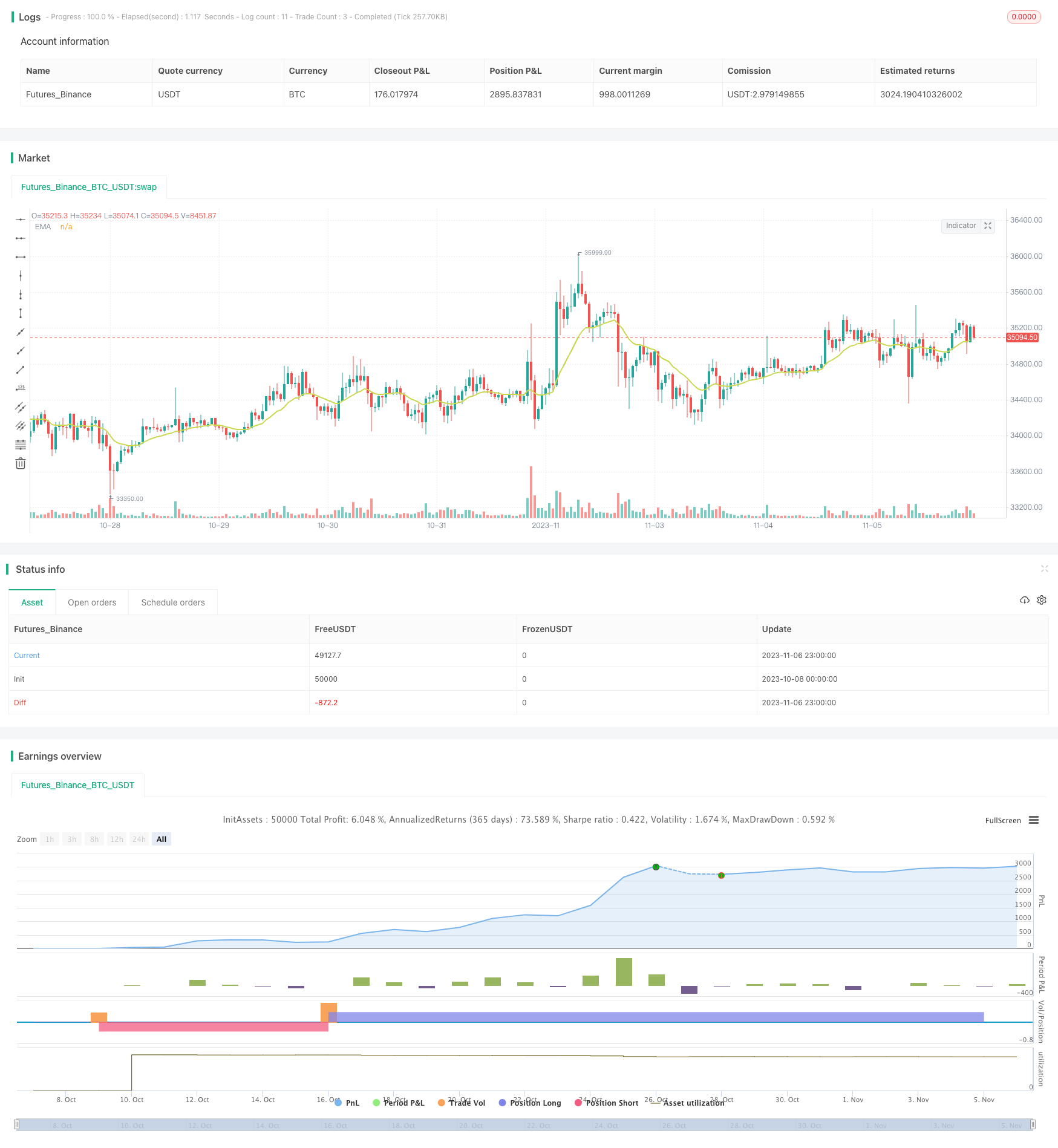

/*backtest

start: 2023-10-08 00:00:00

end: 2023-11-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © REV0LUTI0N

//@version=4

strategy("RSI Strategy", overlay=true, initial_capital = 10000, default_qty_value = 10000, default_qty_type = strategy.cash)

// Strategy Backtesting

startDate = input(timestamp("2021-10-01T00:00:00"), type = input.time, title='Backtesting Start Date')

finishDate = input(timestamp("9999-12-31T00:00:00"), type = input.time, title='Backtesting End Date')

time_cond = true

// Strategy

Length = input(12, minval=1)

src = input(close, title="Source")

overbought = input(70, minval=1)

oversold = input(30, minval=1)

xRSI = rsi(src, Length)

rsinormal = input(true, title="Overbought Go Long & Oversold Go Short")

rsiflipped = input(false, title="Overbought Go Short & Oversold Go Long")

// EMA Filter

noemafilter = input(true, title="No EMA Filter")

useemafilter = input(false, title="Use EMA Filter")

ema_length = input(defval=15, minval=1, title="EMA Length")

emasrc = input(close, title="Source")

ema = ema(emasrc, ema_length)

plot(ema, "EMA", style=plot.style_linebr, color=#cad850, linewidth=2)

//Time Restriction Settings

startendtime = input("", title='Time Frame To Enter Trades')

enableclose = input(false, title='Enable Close Trade At End Of Time Frame')

timetobuy = (time(timeframe.period, startendtime))

timetoclose = na(time(timeframe.period, startendtime))

// Stop Loss & Take Profit % Based

enablesl = input(false, title='Enable Stop Loss')

enabletp = input(false, title='Enable Take Profit')

stopTick = input(5.0, title='Stop Loss %', type=input.float, step=0.1) / 100

takeTick = input(10.0, title='Take Profit %', type=input.float, step=0.1) / 100

longStop = strategy.position_avg_price * (1 - stopTick)

shortStop = strategy.position_avg_price * (1 + stopTick)

shortTake = strategy.position_avg_price * (1 - takeTick)

longTake = strategy.position_avg_price * (1 + takeTick)

plot(strategy.position_size > 0 and enablesl ? longStop : na, style=plot.style_linebr, color=color.red, linewidth=1, title="Long Fixed SL")

plot(strategy.position_size < 0 and enablesl ? shortStop : na, style=plot.style_linebr, color=color.red, linewidth=1, title="Short Fixed SL")

plot(strategy.position_size > 0 and enabletp ? longTake : na, style=plot.style_linebr, color=color.green, linewidth=1, title="Long Take Profit")

plot(strategy.position_size < 0 and enabletp ? shortTake : na, style=plot.style_linebr, color=color.green, linewidth=1, title="Short Take Profit")

// Alert messages

message_enterlong = input("", title="Long Entry message")

message_entershort = input("", title="Short Entry message")

message_closelong = input("", title="Close Long message")

message_closeshort = input("", title="Close Short message")

// Strategy Execution

if (xRSI > overbought and close > ema and time_cond and timetobuy and rsinormal and useemafilter)

strategy.entry("Long", strategy.long, alert_message = message_enterlong)

if (xRSI < oversold and close < ema and time_cond and timetobuy and rsinormal and useemafilter)

strategy.entry("Short", strategy.short, alert_message = message_entershort)

if (xRSI < oversold and close > ema and time_cond and timetobuy and rsiflipped and useemafilter)

strategy.entry("Long", strategy.long, alert_message = message_enterlong)

if (xRSI > overbought and close < ema and time_cond and timetobuy and rsiflipped and useemafilter)

strategy.entry("Short", strategy.short, alert_message = message_entershort)

if (xRSI > overbought and time_cond and timetobuy and rsinormal and noemafilter)

strategy.entry("Long", strategy.long, alert_message = message_enterlong)

if (xRSI < oversold and time_cond and timetobuy and rsinormal and noemafilter)

strategy.entry("Short", strategy.short, alert_message = message_entershort)

if (xRSI < oversold and time_cond and timetobuy and rsiflipped and noemafilter)

strategy.entry("Long", strategy.long, alert_message = message_enterlong)

if (xRSI > overbought and time_cond and timetobuy and rsiflipped and noemafilter)

strategy.entry("Short", strategy.short, alert_message = message_entershort)

if strategy.position_size > 0 and timetoclose and enableclose

strategy.close_all(alert_message = message_closelong)

if strategy.position_size < 0 and timetoclose and enableclose

strategy.close_all(alert_message = message_closeshort)

if strategy.position_size > 0 and enablesl and time_cond

strategy.exit(id="Close Long", stop=longStop, limit=longTake, alert_message = message_closelong)

if strategy.position_size < 0 and enablesl and time_cond

strategy.exit(id="Close Short", stop=shortStop, limit=shortTake, alert_message = message_closeshort)

if strategy.position_size > 0 and enabletp and time_cond

strategy.exit(id="Close Long", stop=longStop, limit=longTake, alert_message = message_closelong)

if strategy.position_size < 0 and enabletp and time_cond

strategy.exit(id="Close Short", stop=shortStop, limit=shortTake, alert_message = message_closeshort)