概述

唐奇安波动通道交易策略通过计算一定周期内的最高价和最低价的通道来判断当前价格趋势,并结合突破通道进行long和short交易。该策略适用于高波动的股票和数字货币交易。

策略原理

该策略通过计算last(history)周期内的最高价pcmax和最低价pcmin构建通道。通道上轨和下轨计算方法为:

上轨yh = pcmax - (pcmax - pcmin) * (100 - percentDev)/100

下轨yl = pcmin + (pcmax - pcmin) * percentDev/100

其中percentDev默认为13。

当价格突破上轨时,产生long信号;当价格突破下轨时,产生short信号。

具体交易信号的产生判断方法如下:

boundup = high > yh 判断是否突破上轨

bounddn = low < yl 判断是否突破下轨

upsign = sma(bounddn, 2) == 1 通过bounddn的均线判断持续突破下轨

dnsign = sma(boundup, 2) == 1 通过boundup的均线判断持续突破上轨

exitup = dnsign 突破上轨产生平仓信号

exitdn = upsign 突破下轨产生平仓信号

if upsign 突破下轨产生做多信号

if dnsign 突破上轨产生做空信号

该策略同时设定了起止交易时间,避免不必要的隔夜仓位。

策略优势

使用唐奇安通道判断趋势,回测效果较好

同时设定做多和做空信号,可以双向交易

通过均线过滤判断信号,避免错误交易

设定止损方式可选,可控制风险

设定起止交易时间,避免隔夜仓位风险

策略风险

唐奇安通道对参数history和percentDev敏感,需要优化参数以适应不同品种

震荡行情中可能产生错误信号

没有考虑订单管理因素,实盘中可能会对盈利造成影响

没有考虑仓位管理因素,实盘中可能存在仓位过大的风险

没有考虑资金管理因素,实盘中需要合理设置交易资金

策略优化方向

优化参数history和percentDev,使之更好适应不同品种

增加过滤器,避免震荡行情中的错误信号

加入仓位管理模块,控制单笔仓位占用资金比例

加入资金管理模块,限制总仓位占用资金比例

加入订单管理功能,优化下单方式

总结

唐奇安波动通道交易策略通过通道突破来判断趋势和交易信号,回测效果较好,同时具备双向交易能力。但该策略也存在一些风险,需要对参数、过滤器、仓位管理、资金管理、订单管理等方面进行优化,才能在实盘中稳定盈利。总体来说,该策略为一种较为传统的趋势跟随策略,经过优化改进后,可以成为一种可靠的量化交易策略。

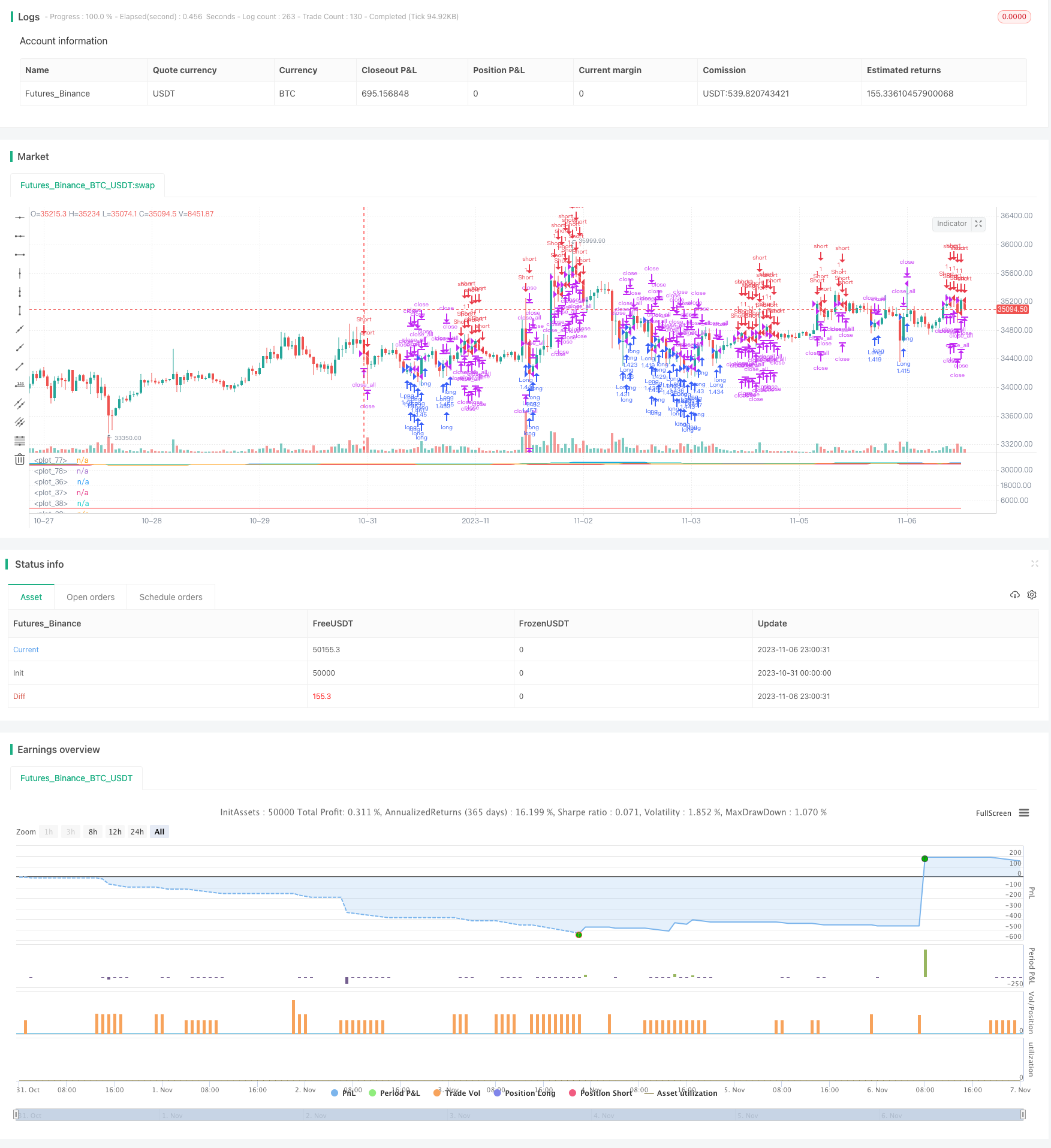

/*backtest

start: 2023-10-31 00:00:00

end: 2023-11-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

////////////////////////////////////////////////////////////

// Copyright by AlexInc v1.0 02/07/2018 @aav_1980

// PriceChannel strategy

// If you find this script helpful, you can also help me by sending donation to

// BTC 16d9vgFvCmXpLf8FiKY6zsy6pauaCyFnzS

// LTC LQ5emyqNRjdRMqHPHEqREgryUJqmvYhffM

////////////////////////////////////////////////////////////

//@version=3

strategy("AlexInc PriceChannel Str", overlay=false)

history = input(20)

percentDev = input(13)

capital = input(100)

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

usestoploss = input(true, defval = true, title = "Stop Loss")

stoplossmult = input(3.8, defval = 3.8, minval = 1, maxval = 10, title = "Stop loss multiplicator")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

bodymin = min( open, close)

bodymax = max(open, close)

pcmax = highest(bodymax, history)

pcmin = lowest(bodymin, history)

yh = ((pcmax - pcmin) / 100 * (100 - percentDev)) + pcmin

yl = ((pcmax - pcmin) / 100 * percentDev) + pcmin

plot(pcmax)

plot(pcmin)

plot(yh)

plot(yl)

//1

bounddn = low < yl ? 1 : 0

boundup = high > yh ? 1 : 0

upsign = sma(bounddn, 2) == 1

dnsign = sma(boundup, 2) == 1

//2

//upsign = crossover(bodymin, yl)

//dnsign = crossunder(bodymax , yh)

exitup = dnsign

exitdn = upsign

lot = strategy.equity / close * capital / 100

xATR = atr(history)

nLoss = usestoploss ? stoplossmult * xATR : na

stop_level_long = 0.0

stop_level_long := nz(stop_level_long[1])

stop_level_short = 0.0

stop_level_short := nz(stop_level_short[1])

pos = strategy.position_size

if pos >0 and pos[1] <= 0 //crossover(pos, 0.5)

stop_level_long = strategy.position_avg_price - nLoss

if pos < 0 and pos[1] >= 0 //crossunder(pos, -0.5)

stop_level_short = strategy.position_avg_price + nLoss

if pos == 0

stop_level_long = bodymin - nLoss

stop_level_short = bodymax + nLoss

//plot(bodymax + nLoss, color=red)

//plot(bodymin - nLoss, color=red)

plot(stop_level_long, color=red)

plot(stop_level_short, color=red)

if upsign

strategy.entry("Long", strategy.long, needlong == false ? 0 : lot)

if dnsign

strategy.entry("Short", strategy.short, needshort == false ? 0 : na)

if true

strategy.close_all()

//if strategy.position_size != 0

// strategy.exit("Exit Long", from_entry = "Long", stop = stop_level_long)

// strategy.exit("Exit Short", from_entry = "Short", stop = stop_level_short)