概述

该策略是基于布林带的金叉死叉进行做多做空的策略。当价格突破布林带上轨时,做空;当价格突破布林带下轨时,做多。在持仓期间,会进行加仓以及止损追踪。

策略原理

该策略使用布林带的上中下3条轨迹。布林带中轨是n天的移动平均线,上轨是中轨+k倍的n天标准差,下轨是中轨-k倍的n天标准差。n一般为20,k一般为2。

当价格从下向上突破下轨时,表明价格开始上涨,此时做多;当价格从上向下突破上轨时,表明价格开始下跌,此时做空。

在做多做空后,会继续进行加仓。加仓的条件是在已持仓的基础上,如果价格再次触碰均线,会再次开仓做多或做空。

所有持仓的止损追踪也会实时更新。止损线会根据当前持仓的平均价格与布林带价格的差值来设定。

优势分析

该策略具有以下优势:

- 使用布林带指标,能够捕捉价格的突破,精确做多做空

- 采用金叉死叉方式,进行规则化的入场

- 持仓后会加仓,可以获得更大利润

- 实时更新止损,避免止损被冲击

风险分析

该策略也存在一些风险:

- 布林带作为指标,对市场波动较为敏感,可能会被套利

- 加仓方式增加了风险敞口,亏损会被放大

- 止损线并不绝对,还是存在被套的可能

针对这些风险,可以从以下几个方面进行优化:

- 调整布林带的参数,适应不同周期

- 优化加仓的幅度和频率

- 增加中轨作为进一步止损线

优化方向

该策略可以从以下几个方面进行优化:

- 优化布林带的参数,适应更多市场环境

- 优化加仓逻辑,平衡风险和收益

- 增加止损线,如中轨止损等

- 增加止盈策略,更主动止盈

- 结合其他指标过滤入场时机

- 优化资金管理,控制单笔风险

总结

本策略整体来说是一种典型的趋势追踪策略。它能够顺势而为,在趋势出现时获取利润。同时,也具有一定的风险,需要进一步优化和改进,适应更多市场情况,减少假突破带来的风险。

策略源码

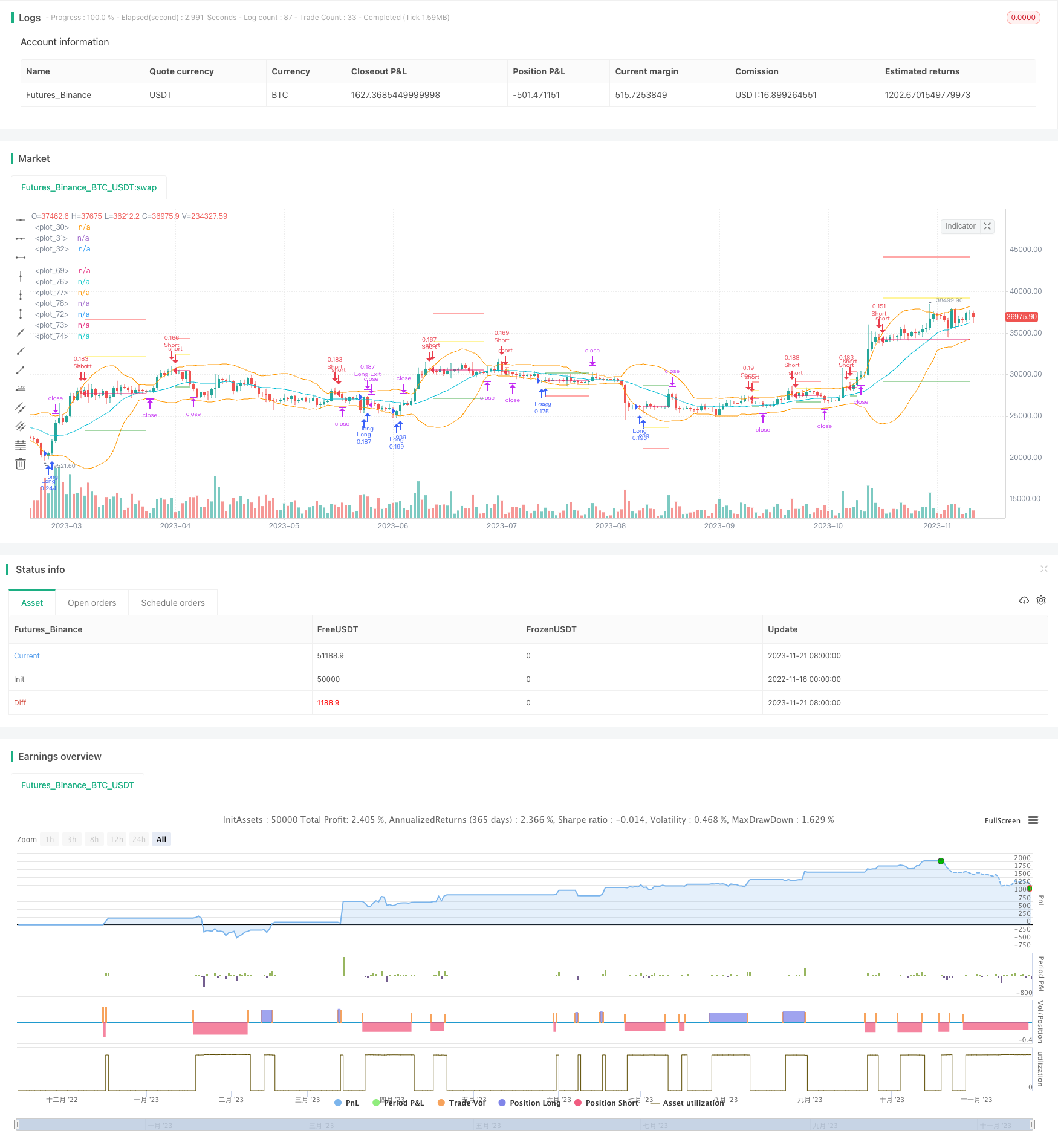

/*backtest

start: 2022-11-16 00:00:00

end: 2023-11-22 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title='Bollinger Band strategy with split, limit, stop', shorttitle='bb strategy', overlay=true,commission_type = strategy.commission.percent, commission_value = 0.01, default_qty_type = strategy.percent_of_equity, default_qty_value = 10, pyramiding = 4)

//Summary: Going Long or Short when Entering after Breaking the Bollinger Bands\

//At this time, the stop-loss, profit-taking price, and pyramiding standard\

// are determined from the difference between the position average price and the band price.

//After entering the position, if the price crosses the mid-band line, the stop loss is adjusted to the mid-band line.

//each trade, entry position size = 10% of total cash

//max pyramiding is 4

//commission = 0.01%

in_period = true

bb_length = input.int(20)

bb_mult = input.int(2)

[middle, upper, lower] = ta.bb(close,bb_length, bb_mult)

plot(middle, color=color.aqua)

plot(upper, color=color.orange)

plot(lower, color=color.orange)

long_cond = ta.crossover(close,lower)

short_cond = ta.crossunder(close,upper)

var saved_ph = 0.0

if strategy.opentrades>0 and strategy.opentrades[1]==0 and strategy.position_size > 0

saved_ph := upper[1]

var saved_pl = 0.0

if strategy.opentrades>0 and strategy.opentrades[1]==0 and strategy.position_size < 0

saved_pl := lower[1]

avg = strategy.position_avg_price

long_diff = saved_ph-avg

short_diff = saved_pl-avg

long_stoploss = avg - 1*long_diff

short_stoploss = avg - 1*short_diff

long_avgdown = avg - 0.5*long_diff

short_avgup = avg - 0.5*short_diff

long_profit_price = avg + 0.5*long_diff

short_profit_price = avg + 0.5*short_diff

var label _label = na

if in_period

if long_cond and strategy.opentrades==0

strategy.entry("Long",strategy.long)

if long_cond and strategy.opentrades >0 and (close[1]<long_avgdown or close[2]<long_avgdown)

strategy.entry("Long",strategy.long)

if short_cond and strategy.opentrades==0

strategy.entry("Short", strategy.short)

if short_cond and strategy.opentrades>0 and (close[1]>short_avgup or close[2]>short_avgup)

strategy.entry("Short",strategy.short)

plot(avg, style=plot.style_linebr)

plot(strategy.position_size > 0? long_profit_price: na,color=color.green, style=plot.style_linebr)

plot(strategy.position_size > 0? long_avgdown: na,color=color.yellow, style=plot.style_linebr)

plot(strategy.position_size > 0? long_stoploss: na,color=color.red, style=plot.style_linebr)

plot(strategy.position_size < 0? short_profit_price: na,color=color.green, style=plot.style_linebr)

plot(strategy.position_size < 0? short_avgup: na,color=color.yellow, style=plot.style_linebr)

plot(strategy.position_size < 0? short_stoploss: na,color=color.red, style=plot.style_linebr)

if strategy.position_size > 0

if ta.crossover(close, middle)

strategy.exit("Long Exit", "Long", limit=long_profit_price, stop=middle)

else

strategy.exit("Long Exit", "Long", limit=long_profit_price, stop=long_stoploss)

if strategy.position_size < 0

if ta.crossunder(close, middle)

strategy.exit("Short Exit", "Short", limit=short_profit_price, stop=middle)

else

strategy.exit("Short Exit", "Short", limit=short_profit_price, stop=short_stoploss)