概述

该策略集成了多种技术指标和交易概念,可用于自动生成买入和卖出信号。主要特点是结合趋势分析指标实现优化止损,同时利用均线交叉产生交易信号。

策略原理

技术指标

定制UTSTC指标:基于平均真实波幅实现了一个自适应追踪止损指标,可根据市场波动性调整止损范围。

STC指标:快速简单移动平均线和慢速简单移动平均线的差值,用于判断市场趋势方向和潜在反转点。

简单移动平均线(SMA)和指数移动平均线(EMA):计算不同周期的移动平均线并绘画,提供额外的趋势判断信息。

交易信号

买入信号:当收盘价上穿UTSTC指标并且STC指标处于看涨状态时产生。

卖出信号:当收盘价下穿UTSTC指标并且STC指标处于看跌状态时产生。

策略优势

整合多种指标判断市场趋势,可提高信号准确率。

UTSTC指标根据真实波幅自动调整止损范围,可有效控制每单亏损。

利用均线交叉产生简单有效的交易信号。

不同参数设置组合可以适应更多市场环境。

策略风险

STC等趋势判断指标存在滞后,可能错过短期反转机会。

均线交叉信号可能产生假信号。

需要仔细评估各个参数设置,不当组合可能降低盈利或增加亏损。

止损范围过大可能增加亏损风险,过小可能过早止损。

优化方向

测试不同长度周期的STC指标参数,寻找对策略影响最小的设置。

尝试结合其他指标过滤假信号,如KDJ、MACD等。

根据回测结果调整止损参数,找到最优参数组合。

评估不同持仓时间设置,寻找最优持仓周期。

总结

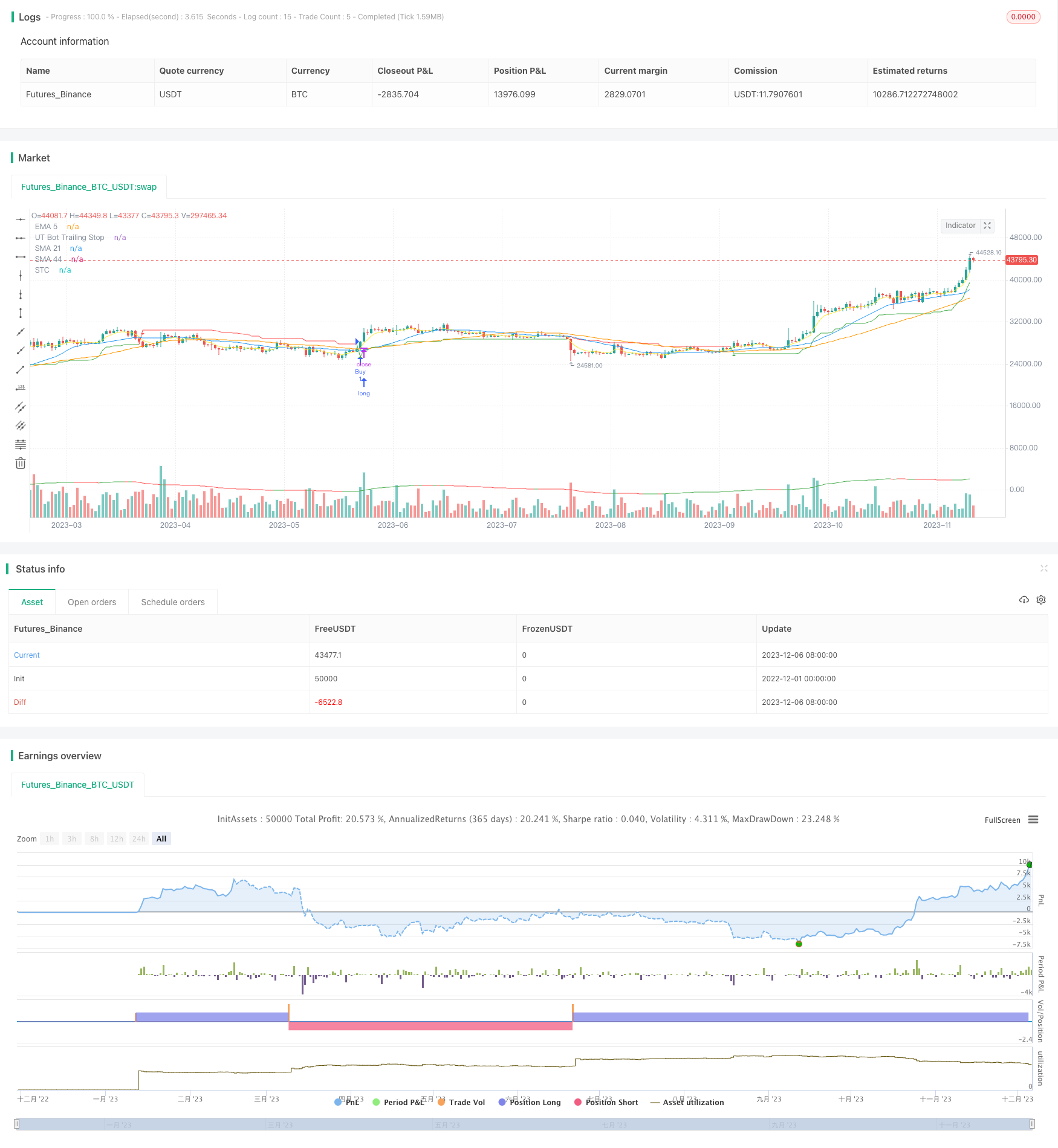

该策略整合趋势判断、自动止损管理和交易信号判断多个模块,形成一个较为全面的量化交易方案。通过参数调优和功能扩展,可望获得稳定的收益。但任何策略都无法完全规避亏损,需要谨慎验证效果并做好风险控制。

策略源码

/*backtest

start: 2022-12-01 00:00:00

end: 2023-12-07 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("OB+LQ+UTSTC+SMA+EMA-NORA-MIP21-Jashore-Bangladesh-OneMinuteTF", shorttitle="OB+LS+UTSTC-MIP21-Jashore-Bangladesh-OneMinuteTF", overlay=true)

// Order Block + Liquidity Swings [NORA] Settings

pivot_length = input(14, title="Pivot Lookback")

bull_ext_last = input(3, title="Bullish OB Extension")

bear_ext_last = input(3, title="Bearish OB Extension")

swing_length = input(5, title="Swing Length")

area = input("Wick Extremity", title="Swing Area", options=["Wick Extremity", "Full Range"])

min_profit = input(0.5, title="Minimum Profit Target")

max_loss = input(0.5, title="Maximum Loss Stop")

// Variables

var float bull_ob_price = na

var float bear_ob_price = na

var float swing_high = na

var float swing_low = na

// Calculate Order Block Prices

var float low_lowest = na

var float high_highest = na

if bar_index >= pivot_length

low_lowest := lowest(low, pivot_length)

high_highest := highest(high, pivot_length)

bull_ob_price := low_lowest

bear_ob_price := high_highest

// Calculate Swing High/Low Prices

var float low_lowest_swing = na

var float high_highest_swing = na

if area == "Wick Extremity"

low_lowest_swing := lowest(low, swing_length)

high_highest_swing := highest(high, swing_length)

else

low_lowest_swing := lowest(high - low, swing_length)

high_highest_swing := highest(high - low, swing_length)

swing_low := low_lowest_swing

swing_high := high_highest_swing

// Trading Logic for Order Block + Liquidity Swings

buy_liquidity = crossover(close, bull_ob_price) and close > swing_low

sell_liquidity = crossunder(close, bear_ob_price) and close < swing_high

// Plot Buy/Sell Signals for Order Block + Liquidity Swings

plotshape(series=buy_liquidity, style=shape.labelup, location=location.belowbar, color=color.rgb(39, 166, 175), size=size.small, title="Bullish LQ")

plotshape(series=sell_liquidity, style=shape.labeldown, location=location.abovebar, color=color.rgb(248, 95, 215), size=size.small, title="Bearish LQ")

// UTSTC-SMA-EMA-NORA-New Settings

keyvalue = input(3, title="UT Bot Key Value", step=0.5)

atrperiod = input(10, title="UT Bot ATR Period")

src = close

xATR = atr(atrperiod)

nLoss = keyvalue * xATR

xATRTrailingStop = 0.0

xATRTrailingStop := iff(src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0), max(nz(xATRTrailingStop[1]), src - nLoss),

iff(src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0), min(nz(xATRTrailingStop[1]), src + nLoss),

iff(src > nz(xATRTrailingStop[1], 0), src - nLoss, src + nLoss)))

pos = 0

pos := iff(src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0), 1,

iff(src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0), -1, nz(pos[1], 0)))

xcolor = pos == -1 ? color.red: pos == 1 ? color.green : color.blue

plot(xATRTrailingStop, color=xcolor, title="UT Bot Trailing Stop")

// STC Settings

stc_length = input(12, title="STC Length")

fastLength = input(26, title="STC Fast Length")

slowLength = input(50, title="STC Slow Length")

fastMA = ema(close, fastLength)

slowMA = ema(close, slowLength)

STC = fastMA - slowMA

STCColor = STC > STC[1] ? color.green : color.red

plot(STC, color=STCColor, title="STC")

// Add SMAs

sma21 = sma(close, 21)

sma44 = sma(close, 44)

plot(sma21, color=color.blue, title="SMA 21")

plot(sma44, color=color.orange, title="SMA 44")

// Add EMA

ema5 = ema(close, 5)

plot(ema5, color=color.yellow, title="EMA 5")

// Combined Strategy

buySignal = crossover(src, xATRTrailingStop) and STC < 25 and STCColor == color.green

sellSignal = crossunder(src, xATRTrailingStop) and STC > 75 and STCColor == color.red

// Plot Buy and Sell signals as triangles

plotshape(series=buySignal, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=sellSignal, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

strategy.entry("Buy", strategy.long, when=buySignal)

strategy.entry("Sell", strategy.short, when=sellSignal)