概述

本策略主要基于Stochastic Momentum Index(SMI)和相对强弱指数(RSI)这两大指标。此外还加入了颜色过滤器和K线实体过滤器作为辅助判断条件。依据SMI和RSI指标的多空信号,结合过滤条件发出交易信号。该策略可以有效发现市场中的短线交易机会。

策略原理

本策略核心依赖 SMI 和 RSI 两个指标进行判断。其中 SMI 主要判断股票是否超买超卖,RSI 则判断股票的相对强弱。当两者同时给出买入信号时,进行买入操作。具体逻辑如下:

- SMI 超卖(低于下限),视为买入信号

- RSI 低于阈值,视为买入信号

- 当 SMI 超卖和 RSI 同时低于对应的阈值时,发出买入信号

- 空头信号判断逻辑类似

此外,本策略还设置了双signals模式。该模式要求SMI和RSI必须同时发出信号才进行交易。这可以有效减少假信号。

另外,本策略还加入颜色过滤器和K线实体过滤器。这两个过滤器要求K线实体较大,并且最后一个K线的收盘价高于开盘价。这可以进一步避免交易假突破。

策略优势

- 利用SMI判断是否超买超卖,RSI判断相对强弱,双重确认可以减少假信号

- 设置双信号模式,可以大幅减少无效交易

- 颜色过滤器和K线实体过滤器可有效过滤假突破

- 策略运行逻辑清晰简单

- 大部分参数都可自定义设置

策略风险及优化

- SMI和RSI作为单独指标使用时,可能会产生较多假信号,需谨慎看待

- 双信号模式下,如果参数设定不当,可能错过较好的交易机会

- 可测试不同周期参数下策略收益情况,寻找最佳参数组合

- 可通过模拟或回测评估具体阈值参数的设定

- 可考虑结合更多过滤器优化策略

总结

本策略整合了SMI和RSI两个指标的信号,通过双重确认发出交易指令。同时设置颜色过滤器和K线实体过滤器可过滤假突破。该策略运行逻辑简单清晰,大部分参数可自定义设置。通过参数调整可获得更好的策略收益表现。

策略源码

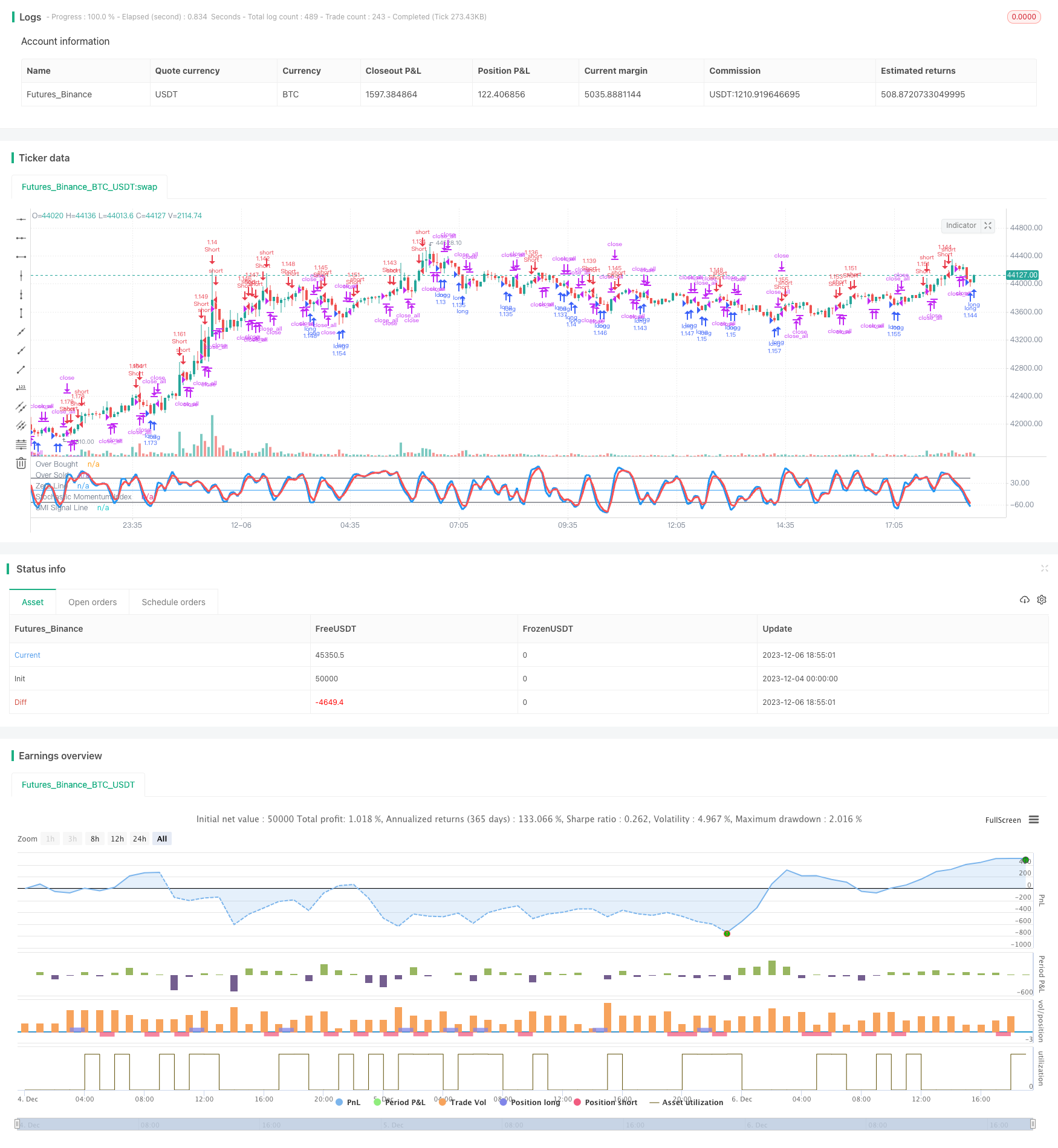

/*backtest

start: 2023-12-04 00:00:00

end: 2023-12-06 19:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=2

strategy(title = "Noro's Stochastic Strategy v1.3", shorttitle = "Stochastic str 1.3", overlay = false, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

usemar = input(false, defval = false, title = "Use Martingale")

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Capital, %")

usesmi = input(true, defval = true, title = "Use SMI Strategy")

usersi = input(true, defval = true, title = "Use RSI Strategy")

usecol = input(true, defval = true, title = "Use Color-Filter")

usebod = input(true, defval = true, title = "Use Body-Filter")

a = input(2, defval = 2, minval = 2, maxval = 50, title = "SMI Percent K Length")

b = input(2, defval = 2, minval = 2, maxval = 50, title = "SMI Percent D Length")

limitsmi = input(50, defval = 50, minval = 1, maxval = 100, title = "SMI Limit")

periodrsi = input(2, defval = 2, minval = 2, maxval = 50, title = "RSI Period")

limitrsi = input(10, defval = 10, minval = 1, maxval = 50, title = "RSI Limit")

double = input(false, defval = false, title = "SMI+RSI Mode")

showbg = input(false, defval = false, title = "Show background")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

//Fast RSI

fastup = rma(max(change(close), 0), periodrsi)

fastdown = rma(-min(change(close), 0), periodrsi)

fastrsi = fastdown == 0 ? 100 : fastup == 0 ? 0 : 100 - (100 / (1 + fastup / fastdown))

//Stochastic Momentum Index

ll = lowest (low, a)

hh = highest (high, a)

diff = hh - ll

rdiff = close - (hh+ll)/2

//avgrel = ema(ema(rdiff,b),b)

//avgdiff = ema(ema(diff,b),b)

avgrel = sma(sma(rdiff,b),b)

avgdiff = sma(sma(diff,b),b)

SMI = avgdiff != 0 ? (avgrel/(avgdiff/2)*100) : 0

SMIsignal = ema(SMI,b)

//Lines

plot(SMI, color = blue, linewidth = 3, title = "Stochastic Momentum Index")

plot(SMIsignal, color = red, linewidth = 3, title = "SMI Signal Line")

plot(limitsmi, color = black, title = "Over Bought")

plot(-1 * limitsmi, color = black, title = "Over Sold")

plot(0, color = blue, title = "Zero Line")

//Color-Filter

gb = close > open or usecol == false

rb = close < open or usecol == false

//Body Filter

nbody = abs(close - open)

abody = sma(nbody, 10)

body = nbody > abody / 3 or usebod == false

//Signals

up1 = SMI < -1 * limitsmi and rb and body and usesmi

dn1 = SMI > limitsmi and gb and body and usesmi

up2 = fastrsi < limitrsi and rb and body and usersi

dn2 = fastrsi > 100 - limitrsi and gb and body and usersi

exit = ((strategy.position_size > 0 and close > open) or (strategy.position_size < 0 and close < open)) and body

//Background

redb = (SMI > limitsmi and usesmi) or (fastrsi > 100 - limitrsi and usersi)

limeb = (SMI < -1 * limitsmi and usesmi) or (fastrsi < limitrsi and usersi)

col = showbg == false ? na : redb ? red : limeb ? lime : na

bgcolor(col, transp = 50)

//Trading

profit = exit ? ((strategy.position_size > 0 and close > strategy.position_avg_price) or (strategy.position_size < 0 and close < strategy.position_avg_price)) ? 1 : -1 : profit[1]

mult = usemar ? exit ? profit == -1 ? mult[1] * 2 : 1 : mult[1] : 1

lot = strategy.position_size == 0 ? strategy.equity / close * capital / 100 * mult : lot[1]

signalup = ((up1 or up2) and double == false) or (up1 and up2 and double)

if signalup

if strategy.position_size < 0

strategy.close_all()

strategy.entry("long", strategy.long, needlong == false ? 0 : lot, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

signaldn = ((dn1 or dn2) and double == false) or (dn1 and dn2 and double)

if signaldn

if strategy.position_size > 0

strategy.close_all()

strategy.entry("Short", strategy.short, needshort == false ? 0 : lot, when=(time > timestamp(fromyear, frommonth, fromday, 00, 00) and time < timestamp(toyear, tomonth, today, 23, 59)))

if time > timestamp(toyear, tomonth, today, 23, 59) or exit

strategy.close_all()