概述

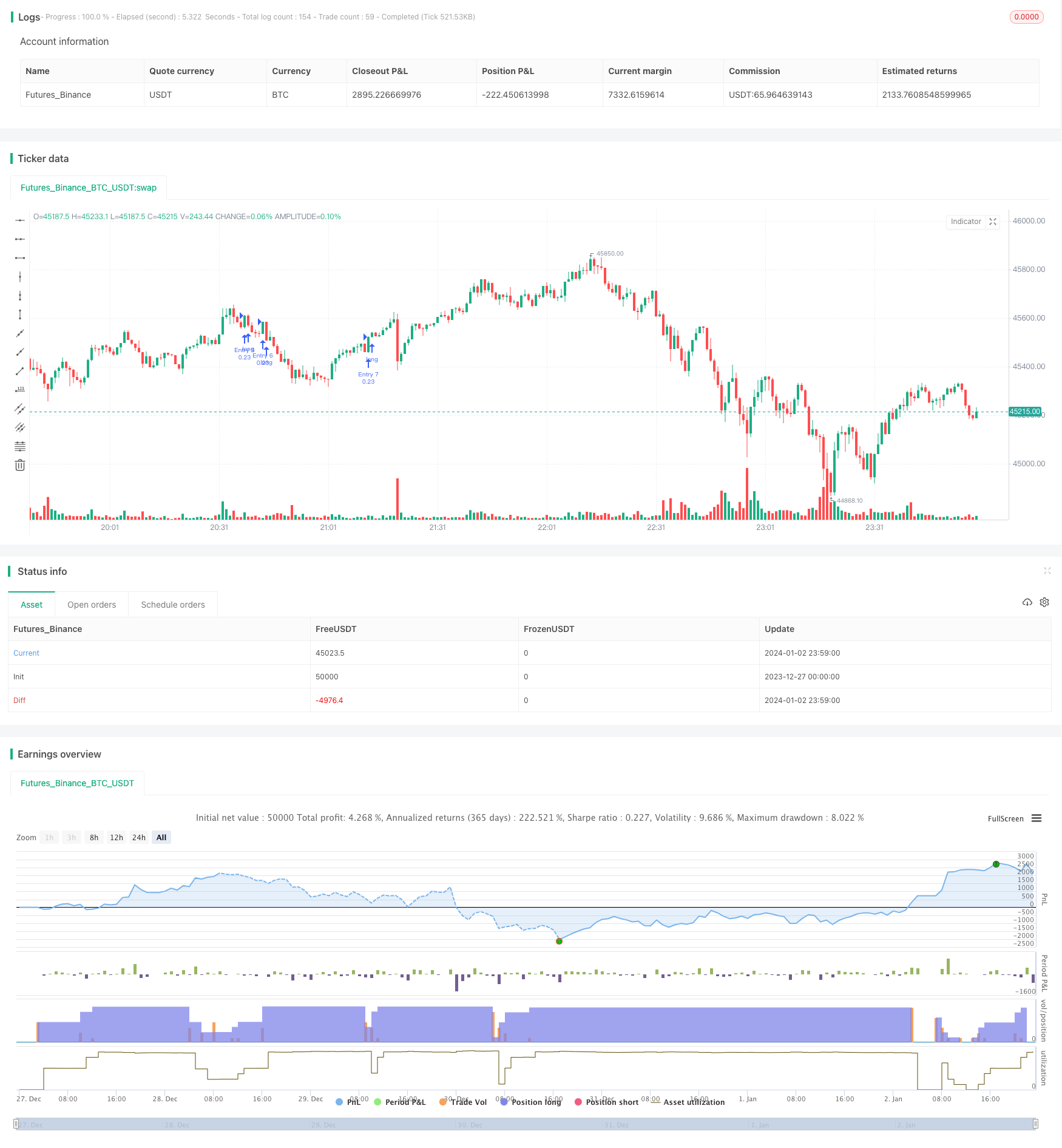

该策略基于均线的多时间框架级差,追踪中长线趋势,采用级差仓位追涨模式,实现资金的指数增长。策略最大优势是能抓住中长线趋势,进行分批分阶段的追涨,从而获取超额收益。

策略原理

- 基于9日均线,100日均线和200日均线构建多时间框架。

- 当短周期均线从下向上突破长周期均线时产生买入信号。

- 采用7级差仓位追涨模式,每次开新仓时判断之前的仓位是否已满,如果已经有6个仓位了,则不再增仓。

- 每个仓位设置固定止盈止损点为3%,进行风险控制。

以上就是该策略的基本交易逻辑。

策略优势

- 能够有效抓住中长线趋势,最大程度享受行情的指数级增长。

- 采用多时间周期均线进行级差,能够有效避免被短线市场噪音干扰。

- 设置固定止盈止损点,有效控制每个仓位的风险。

- 采用级差追涨模式,分批建仓,能够把握趋势机会,获得超额收益。

策略风险及解决方法

- 存在被终结的风险。如果行情出现转势,无法及时止损退出,可能面临巨额亏损。解决方法是缩短均线周期,加快止损速度。

- 存在仓位风险。如果突发事件导致亏损超过承受范围,会面临追加保证金或爆仓的风险。解决方法是适当减少初始仓位比例。

- 存在亏损过大的风险。如果行情剧烈下跌,级差追涨转为空头,可能亏损高达700%以上。解决方法是加大固定止损比例,加快止损速度。

策略优化方向

- 可以测试不同参数的均线组合,寻找更优参数。

- 可以优化建仓的仓位数。测试不同的级差仓位数,找到最优解。

- 可以测试固定止损止盈的设置。适当放大止盈范围,追求更高收益率。

总结

该策略总体来说非常适合捕捉行情中长线趋势,采用分批分阶段追涨的方式,能获得风险收益比极高的超额收益。同时也存在一定操作风险,需要通过调整参数等方法加以控制,在获利和风险之间找到平衡。总的来说,该策略非常值得实盘验证,根据实盘结果进一步调整优化。

策略源码

/*backtest

start: 2023-12-27 00:00:00

end: 2024-01-03 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Coinrule

//@version=3

strategy(shorttitle='Pyramiding Entry On Early Trends',title='Pyramiding Entry On Early Trends (by Coinrule)', overlay=false, pyramiding= 7, initial_capital = 1000, default_qty_type = strategy.percent_of_equity, default_qty_value = 20, commission_type=strategy.commission.percent, commission_value=0.1)

//Backtest dates

fromMonth = input(defval = 1, title = "From Month")

fromDay = input(defval = 10, title = "From Day")

fromYear = input(defval = 2020, title = "From Year")

thruMonth = input(defval = 1, title = "Thru Month")

thruDay = input(defval = 1, title = "Thru Day")

thruYear = input(defval = 2112, title = "Thru Year")

showDate = input(defval = true, title = "Show Date Range")

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => true // create function "within window of time"

//MA inputs and calculations

inSignal=input(9, title='MAfast')

inlong1=input(100, title='MAslow')

inlong2=input(200, title='MAlong')

MAfast= sma(close, inSignal)

MAslow= sma(close, inlong1)

MAlong= sma(close, inlong2)

Bullish = crossover(close, MAfast)

longsignal = (Bullish and MAfast > MAslow and MAslow < MAlong and window())

//set take profit

ProfitTarget_Percent = input(3)

Profit_Ticks = (close * (ProfitTarget_Percent / 100)) / syminfo.mintick

//set take profit

LossTarget_Percent = input(3)

Loss_Ticks = (close * (LossTarget_Percent / 100)) / syminfo.mintick

//Order Placing

strategy.entry("Entry 1", strategy.long, when = (strategy.opentrades == 0) and longsignal)

strategy.entry("Entry 2", strategy.long, when = (strategy.opentrades == 1) and longsignal)

strategy.entry("Entry 3", strategy.long, when = (strategy.opentrades == 2) and longsignal)

strategy.entry("Entry 4", strategy.long, when = (strategy.opentrades == 3) and longsignal)

strategy.entry("Entry 5", strategy.long, when = (strategy.opentrades == 4) and longsignal)

strategy.entry("Entry 6", strategy.long, when = (strategy.opentrades == 5) and longsignal)

strategy.entry("Entry 7", strategy.long, when = (strategy.opentrades == 6) and longsignal)

if (strategy.position_size > 0)

strategy.exit(id="Exit 1", from_entry = "Entry 1", profit = Profit_Ticks, loss = Loss_Ticks)

strategy.exit(id="Exit 2", from_entry = "Entry 2", profit = Profit_Ticks, loss = Loss_Ticks)

strategy.exit(id="Exit 3", from_entry = "Entry 3", profit = Profit_Ticks, loss = Loss_Ticks)

strategy.exit(id="Exit 4", from_entry = "Entry 4", profit = Profit_Ticks, loss = Loss_Ticks)

strategy.exit(id="Exit 5", from_entry = "Entry 5", profit = Profit_Ticks, loss = Loss_Ticks)

strategy.exit(id="Exit 6", from_entry = "Entry 6", profit = Profit_Ticks, loss = Loss_Ticks)

strategy.exit(id="Exit 7", from_entry = "Entry 7", profit = Profit_Ticks, loss = Loss_Ticks)