概述

本策略通过结合相对强弱指标(RSI)和布林线通道来识别交易机会,属于量化交易中的均值回复策略。当RSI低于设定阈值时买入,当价格上穿布林线通道中轨时平仓,没有做空机会。

策略原理

使用RSI指标判断市场是否处于超卖状态。RSI低于30时,被视为超卖信号。

使用布林线通道判断价格是否开始反弹上行。当价格从布林线下轨反弹上穿布林线中轨时,做多方向结束。

结合RSI超卖信号和布林线出圈信号,可以设定买入点位。当两种信号同时触发时买入,等待价格上穿布林线中轨时平仓套现。

优势分析

该策略结合均值反转型指标RSI和通道指标布林线,可以更准确定位买入时机。

RSI指标可以过滤掉许多假突破的情况,减少不必要的交易。

布林线通道作为止损指标,可以控制单笔交易的风险。

风险分析

RSI指标可能发出错误信号,导致错过买入机会。

布林线通道参数设置不当可能导致止损过于宽松或严格。

交易品种选择不当,如交易小市值股票时流动性风险较大。

优化方向

可以测试不同参数组合,如RSI周期、布林线通道周期和倍数,寻找最优参数。

可以结合其他指标如KD、MACD等,设定更严格的买入条件以过滤信号。

可以根据不同交易品种设定止损幅度,如设置波动率止损。

总结

本策略首先利用RSI低位买入,再利用布林线通道高位止损的思路,属于均值回复交易策略。相比单一使用RSI或布林线等指标,本策略可以更准确定位买入卖出点位,从而获得更好的策略效果。下一步可以通过参数优化、信号过滤、止损策略等进一步完善。

策略源码

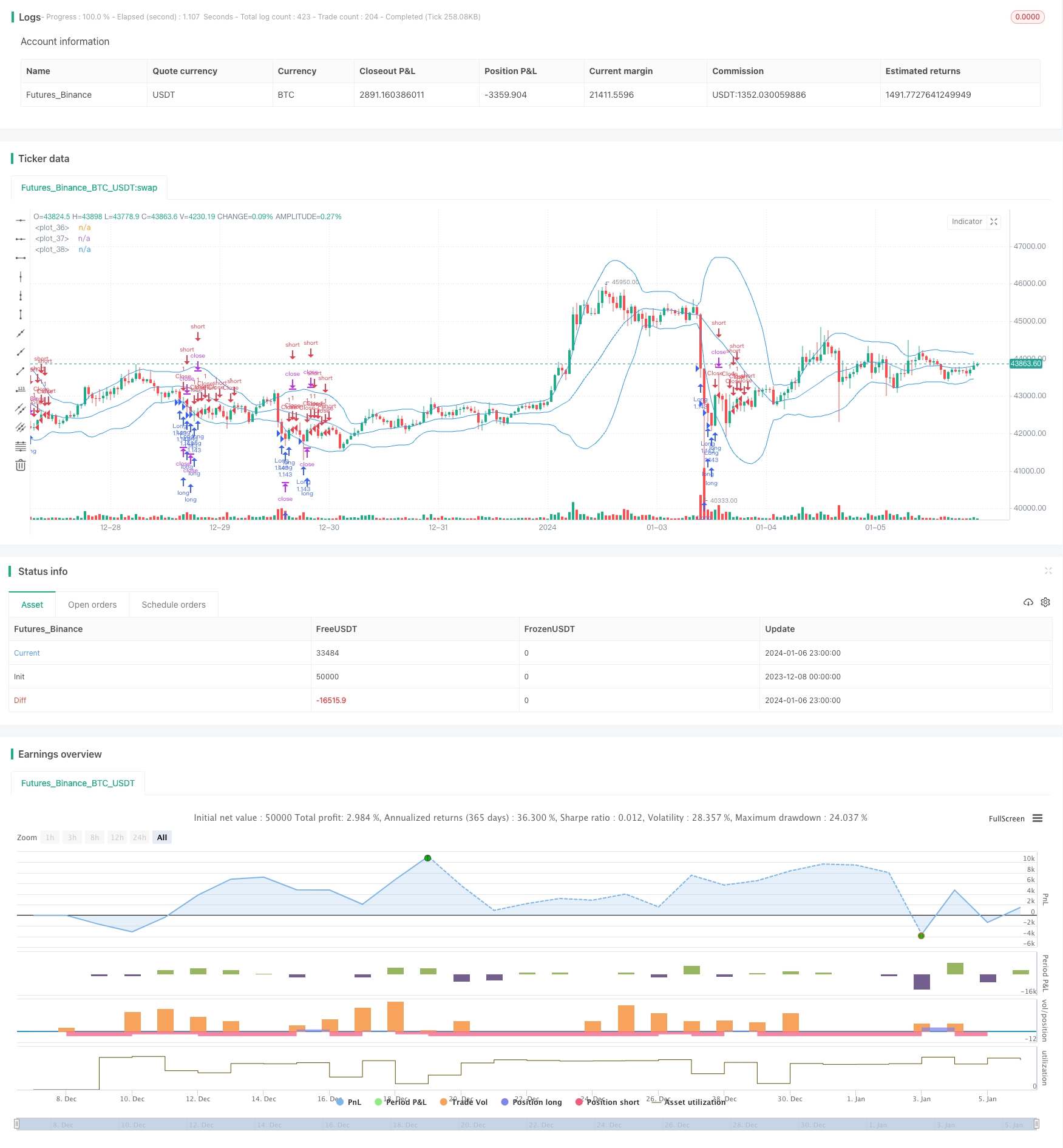

/*backtest

start: 2023-12-08 00:00:00

end: 2024-01-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//Noro

//2018

//@version=3

strategy(title = "Noro's BB + RSI Strategy v1.0", shorttitle = "BB+RSI str 1.0", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 5)

//Settings

capital = input(100, defval = 100, minval = 1, maxval = 10000, title = "Lot, %")

rsiuse = input(true, defval = true, title = "Use RSI")

bbuse = input(true, defval = true, title = "Use BB")

showbb = input(true, defval = true, title = "Show BB Overlay")

bbperiod = input(20, defval = 20, minval = 2, maxval = 1000, title = "BB period")

bbsource = input(ohlc4, title = "BB source")

bbmult = input(2, defval = 2, minval = 1, maxval = 100, title = "BB Mult")

rsiperiod = input(7, defval = 7, minval = 2, maxval = 1000, title = "RSI period")

rsisource = input(close, title = "RSI source")

rsilimit = input(30, defval = 30, minval = 1, maxval = 49, title = "RSI Limit")

fromyear = input(1900, defval = 1900, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From Day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To Day")

//RSI

rsi = rsi(rsisource, rsiperiod)

//BB

basis = sma(bbsource, bbperiod)

dev = bbmult * stdev(bbsource, bbperiod)

upper = basis + dev

lower = basis - dev

//Overlay

col = showbb ? blue : na

plot(upper, color = col)

plot(basis, color = col)

plot(lower, color = col)

//Signals

up = (rsi < rsilimit or rsiuse == false) and (low < lower or bbuse == false)

cl = close > open

//Trading

lot = 0.0

lot := strategy.position_size == 0 ? strategy.equity / close * capital / 100 : lot[1]

if up

strategy.entry("Long", strategy.long, lot)

if cl

strategy.entry("Close", strategy.short, 0)

if time > timestamp(toyear, tomonth, today, 23, 59)

strategy.close_all()