概述

基于EMA200的移动止盈移动止损策略是一个以EMA200为基准,结合移动止损和移动止盈机制的交易策略。该策略通过EMA200判断整体趋势方向,只在趋势方向上做多或空,同时利用ATR指标计算出合理的止损位和止盈位,实现移动止损和移动止盈。

策略原理

该策略首先计算出200周期的EMA,作为判断整体趋势的指标。只有当价格高于EMA200时才做多,价格低于EMA200时才做空,从而保证只在趋势方向操作。

在入场后,策略利用ATR指标计算出合理的止损和止盈增量,分别添加到最新高点和最新低点,形成上轨和下轨。当价格超过上轨时,对多单止盈;当价格跌破下轨时,对空单止损。随着价格的运行,止损位和止盈位也会动态调整,从而实现移动止损和移动止盈的效果。

优势分析

该策略最大的优势在于,通过EMA200判断趋势,避免反向操作。同时,止损止盈位会跟随价格调整,及时止损止盈,有效控制风险。

另外,ATR止损止盈是对市场波动性的评估,能够设置合理的止损止盈位,不会过于疲软或激进。相比固定止损止盈更具有优势。

总的来说,该策略结合趋势和止损止盈,既追求利润最大化,也控制风险,是一个非常平衡的策略。

风险分析

该策略的主要风险在于,EMA200未必能完全准确判断趋势,价格有可能产生假突破。如果不慎在非趋势方向上入场,可能造成较大亏损。

另外,ATR止损止盈虽然有一定的科学依据和优势,但也可能出现超过正常波动范围的情况。此时就可能被秒出场,无法获利。

为减小这些风险,可考虑结合其他指标确认趋势和波动性,例如布林线、RSI等,避免错误信号。另外也可以适当宽松止损范围,但不能过于宽松。

策略优化

该策略可以从以下几个方面进行优化:

EMA周期可调整为100或150周期,寻找更稳定的趋势判断标准。

ATR参数可优化,找到更合理的市场波动性代表值。

可加入布林线等其他指标辅助判断趋势和波动。

停损止盈可调整为ATR的整数倍,如2倍或3倍ATR,让止损更加灵活。

可添加重新入场机制,即止损后价格重新进入趋势再次入场。

通过测试不同参数,选择更优参数;加入其他指标判断;优化止损机制等方法,可以显著提高策略的稳定性和盈利能力。

总结

基于EMA200的移动止盈移动止损策略,通过EMA判断整体趋势,ATR计算合理的止损止盈来控制风险,是一种平衡的交易策略。该策略有判断趋势、移动止损止盈、风险控制的优势,但也存在一定的假突破风险。通过参数优化,加入其他指标判断,可以进一步提高策略效果。

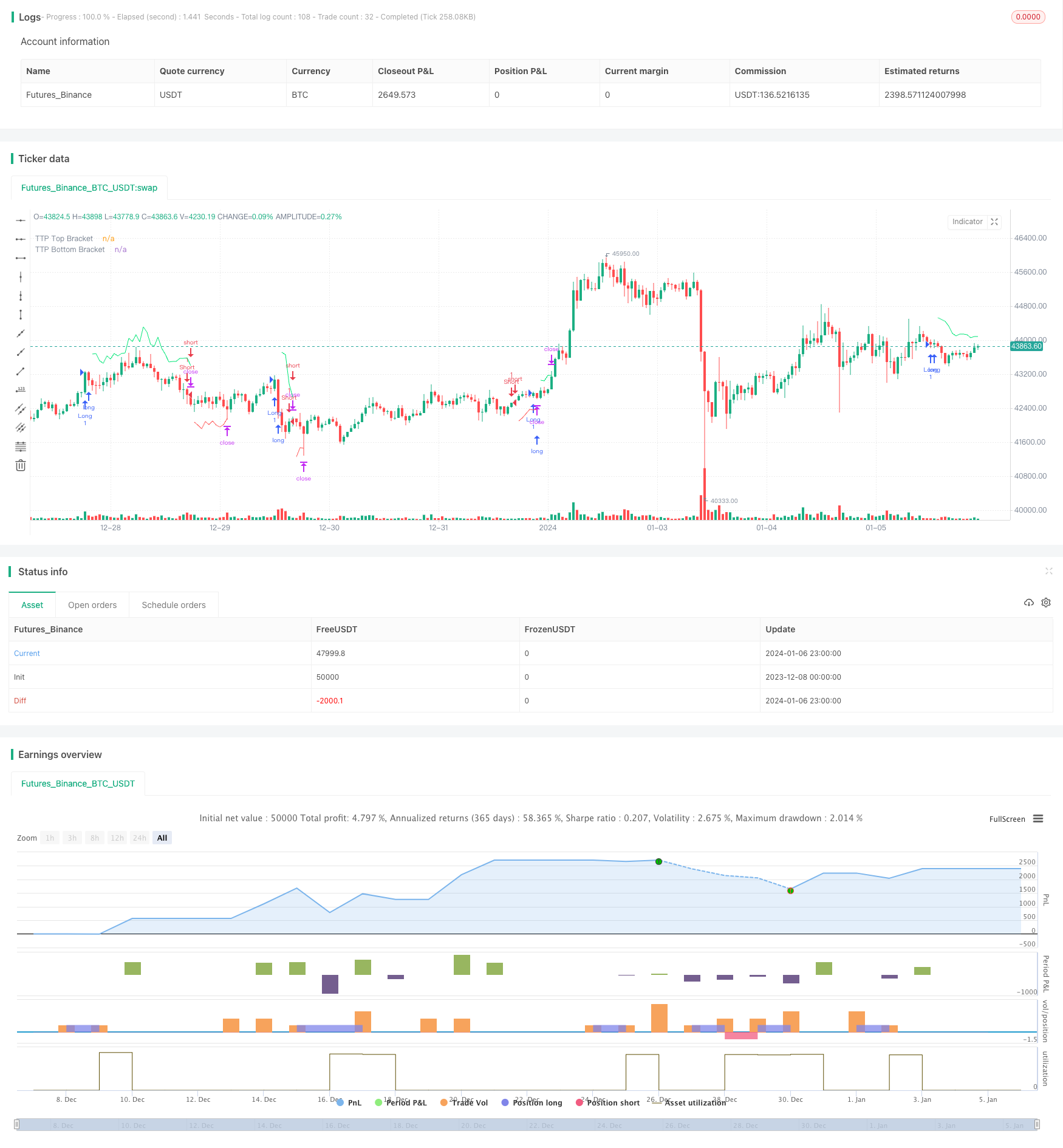

/*backtest

start: 2023-12-08 00:00:00

end: 2024-01-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © ozgurhan

//@version=5

strategy("EMA 200 Based Trailing Take Profit", overlay=true, margin_long=100, margin_short=100, default_qty_value=1, initial_capital=100)

// EMA 200 tanımı

ema200 = ta.ema(close, 200)

// Orijinal long ve short koşulları

longConditionOriginal = ta.crossover(ta.sma(close, 14), ta.sma(close, 28))

shortConditionOriginal = ta.crossunder(ta.sma(close, 14), ta.sma(close, 28))

// EMA 200'ün üzerinde ve altında long ve short koşulları

longCondition = longConditionOriginal and close > ema200

shortCondition = shortConditionOriginal and close < ema200

if longCondition

strategy.entry("Long", strategy.long, comment="Long", alert_message="Long")

if shortCondition

strategy.entry("Short", strategy.short, comment="Short", alert_message="Short")

atr_length=input.int(7, title="ATR Length")

atr_multiplier = input.float(1.5, title="ATR Multiplier")

atr_multiplied = atr_multiplier * ta.atr(atr_length)

ttp_top_bracket = strategy.position_size > 0 ? high[1] + atr_multiplied : na

ttp_bottom_bracket = strategy.position_size < 0 ? low[1] - atr_multiplied : na

plot(ttp_top_bracket, title="TTP Top Bracket", color=color.lime, style=plot.style_linebr, offset=1)

plot(ttp_bottom_bracket, title="TTP Bottom Bracket", color=color.red, style=plot.style_linebr, offset=1)

strategy.exit("Close Long", from_entry="Long", limit=ttp_top_bracket, alert_message="Close Long")

strategy.exit("Close Short", from_entry="Short", limit=ttp_bottom_bracket, alert_message="Close Short")