概述

该策略通过组合使用双重EMA和RSI指标来识别价格趋势,并在趋势方向发生转折时及时入场。具体来说,策略使用较长周期的EMA判断大趋势方向,同时使用RSI指标判断短期的超买超卖现象。当价格在主趋势方向发生拉回时,通过RSI指标发出交易信号,根据趋势方向做多或做空。

策略原理

使用200周期的EMA判断大趋势方向。价格上穿EMA线为看涨信号,下穿EMA线为看跌信号。

RSI指标参数设置为10周期。其中RSI上穿40为超卖信号,下穿60为超买信号。

当大趋势为上升(价格高于EMA线)时,如果发生RSI指标下穿40的超卖信号,做多入场。

当大趋势为下降(价格低于EMA线)时,如果发生RSI指标上穿60的超买信号,做空入场。

止损设置为ATR指标的4倍。止盈设置为止损的2倍,实现2:1的风险回报比。

优势分析

该策略最大的优势在于同时结合趋势和反转指标,能够在趋势发生拉回时及时入场,因此可以获得较好的绩效。具体优势如下:

使用双EMA系统判断主要趋势方向,可以有效跟踪价格趋势。

RSI指标可识别短期内的超买超卖情况,辅助判定入场时机。

止损通过ATR指标设定,可根据市场波动性调整止损幅度,有利于风险控制。

严格遵循趋势交易原则,可以减少不必要的交易,降低系统性风险。

风险分析

该策略主要存在以下风险:

在趋势震荡趋弱的过程中,可能产生错误交易信号。这时需要审时度势,谨慎入场。

在极端行情中,ATR指标设定的止损可能过大或过小,需要动态调整。也可以考虑替换为其他止损方式。

交易信号产生频率可能较高,需要关注是否符合自己的交易频率偏好。

需关注RSI参数是否设定恰当,应适时进行参数优化。

优化方向

该策略主要可优化的方向如下:

可以测试增加其他趋势指标,如MACD等,辅助判断趋势方向。

可以测试其他反转指标,如KDJ、布林带等与RSI进行组合,寻找更佳的交易信号。

可以引入机器学习算法,通过自适应调整参数,实现动态止损和止盈。

可以结合情绪指标、消息面等更多因素进行判断,提高系统的整体稳健性。

总结

该策略总体来说是一个非常典型的结合趋势跟踪和反转指标的短线策略。通过使用双EMA判断大趋势,同时利用RSI指标的反转特征捕捉趋势中的Pullback机会入场。从原理上讲,该策略将不同指标的优点结合在了一起, FORM了很好的互补效应。如果后期通过参数优化、模型融合等手段进行改进,该策略的效果还具有很大的提升空间。

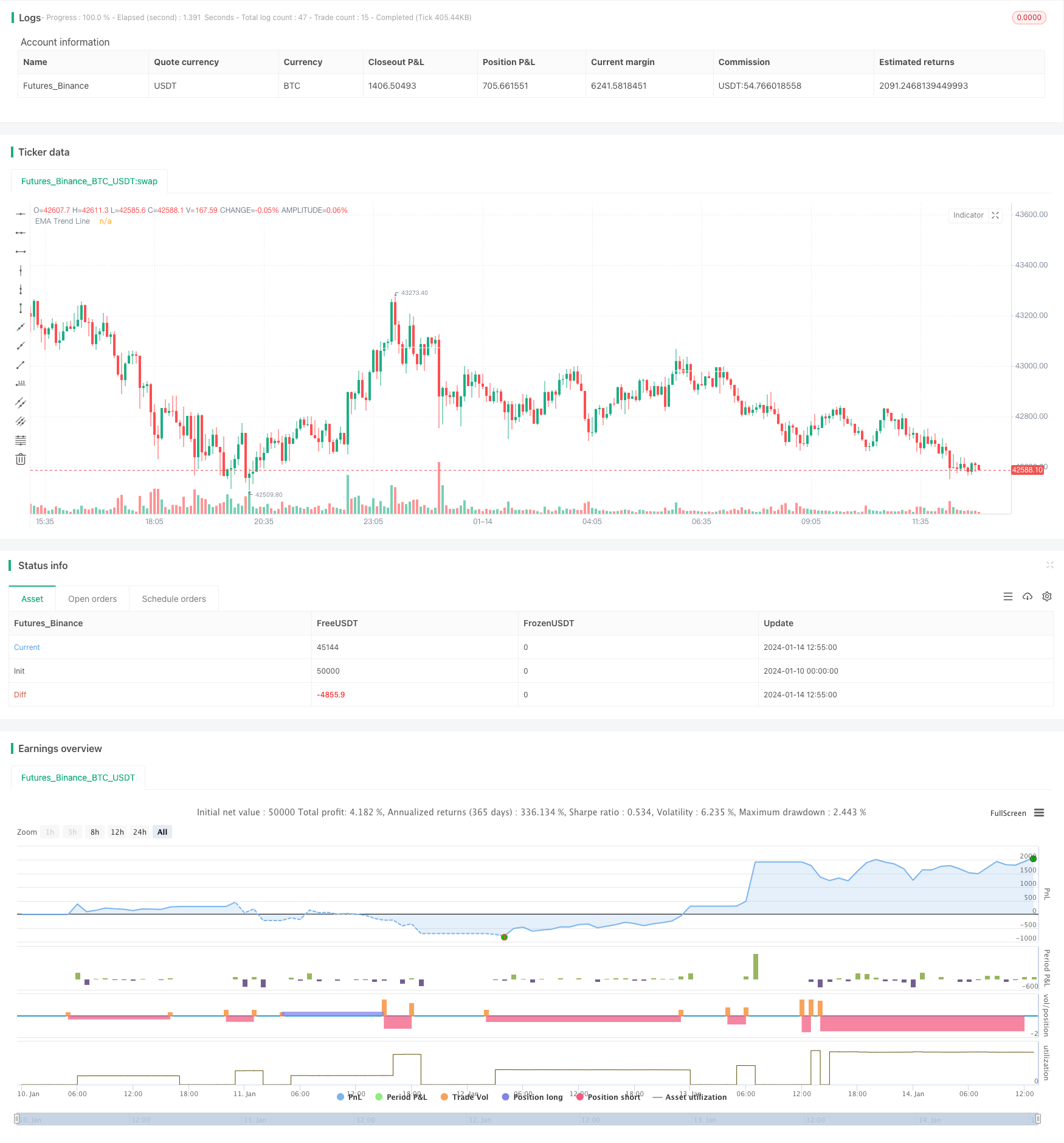

/*backtest

start: 2024-01-10 00:00:00

end: 2024-01-14 13:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kevinmck100

// @description

// This strategy is intended to be used as a base template for building new strategies.

//

// It incorporates the following features:

//

// - Risk management: Configurable X% loss per stop loss

// Configurable R:R ratio

//

// - Trade entry: Calculated position size based on risk tolerance

//

// - Trade exit: Stop Loss currently configurable ATR multiplier but can be replaced based on strategy

// Take Profit calculated from Stop Loss using R:R ratio

//

// - Backtesting: Configurable backtesting range by date

//

// - Trade drawings: TP/SL boxes drawn for all trades. Can be turned on and off

// Trade exit information labels. Can be turned on and off

// NOTE: Trade drawings will only be applicable when using overlay strategies

//

// - Debugging: Includes section with useful debugging techniques

//

// Strategy conditions:

//

// - Trade entry: LONG: C1: Price is above EMA line

// C2: RSI is crossing out of oversold area

// SHORT: C1: Price is below EMA line

// C2: RSI is crossing out of overbought area

//

// - Trade exit: Stop Loss: Stop Loss ATR multiplier is hit

// Take Profit: R:R multiplier * Stop Loss is hit

//

// The idea is to use RSI to catch pullbacks within the main trend. Note that

// this strategy is intended to be a simple base strategy for building upon.

// It was not designed to be traded in its current form.

//@version=5

INITIAL_CAPITAL = 1000

DEFAULT_COMMISSION = 0.02

MAX_DRAWINGS = 500

IS_OVERLAY = true

strategy("Risk Management Strategy Template", "Strategy Template", overlay = IS_OVERLAY, initial_capital = INITIAL_CAPITAL, currency = currency.NONE, max_labels_count = MAX_DRAWINGS, max_boxes_count = MAX_DRAWINGS, max_lines_count = MAX_DRAWINGS, default_qty_type = strategy.cash, commission_type = strategy.commission.percent, commission_value = DEFAULT_COMMISSION)

// =============================================================================

// INPUTS

// =============================================================================

// ------------------------ Replacable section - Start -------------------------

// ------------------

// Indicator Settings

// ------------------

emaLength = input.int (200, "EMA Length ", group = "Indicators: Settings", inline = "IS1", minval = 1, tooltip = "EMA line to identify trend direction. Above EMA trend line is bullish. Below EMA trend line is bearish")

rsiLength = input.int (10, "RSI Length ", group = "Indicators: Settings", inline = "IS2", minval = 1)

// ----------------------

// Trade Entry Conditions

// ----------------------

rsiOverbought = input.int (60, "RSI Overbought ", group = "Strategy: Conditions", inline = "SC1", minval = 50, maxval = 100, tooltip = "RSI overbought level used to identify pullbacks within the main trend. RSI crossing BELOW this level triggers a SHORT when in a DOWN trend")

rsiOversold = input.int (40, "RSI Oversold ", group = "Strategy: Conditions", inline = "SC2", minval = 0, maxval = 50, tooltip = "RSI overbought level used to identify pullbacks within the main trend. RSI crossing ABOVE this level triggers a LONG when in an UP trend")

// ---------------------

// Trade Exit Conditions

// ---------------------

atrLength = input.int (14, "Stop Loss ATR Length ", group = "Strategy: Exit Conditions", inline = "EC1", minval = 0, tooltip = "Length of ATR used to calculate Stop Loss.")

slAtrMultiplier = input.float(4, "Stop Loss ATR Multiplier ", group = "Strategy: Exit Conditions", inline = "EC2", minval = 0, step = 0.1, tooltip = "Size of StopLoss is determined by multiplication of ATR value. Take Profit is derived from this also by multiplying the StopLoss value by the Risk:Reward multiplier.")

// ------------------------- Replacable section - End --------------------------

// ---------------

// Risk Management

// ---------------

riskReward = input.float(2, "Risk : Reward 1 :", group = "Strategy: Risk Management", inline = "RM1", minval = 0, step = 0.1, tooltip = "Previous high or low (long/short dependant) is used to determine TP level. 'Risk : Reward' ratio is then used to calculate SL based of previous high/low level.\n\nIn short, the higher the R:R ratio, the smaller the SL since TP target is fixed by previous high/low price data.")

accountRiskPercent = input.float(1, "Portfolio Risk % ", group = "Strategy: Risk Management", inline = "RM1", minval = 0, step = 0.1, tooltip = "Percentage of portfolio you lose if trade hits SL.\n\nYou then stand to gain\n Portfolio Risk % * Risk : Reward\nif trade hits TP.")

// ----------

// Date Range

// ----------

startYear = input.int (2022, "Start Date ", group = 'Strategy: Date Range', inline = 'DR1', minval = 1900, maxval = 2100)

startMonth = input.int (1, "", group = 'Strategy: Date Range', inline = 'DR1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

startDate = input.int (1, "", group = 'Strategy: Date Range', inline = 'DR1', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

endYear = input.int (2100, "End Date ", group = 'Strategy: Date Range', inline = 'DR2', minval = 1900, maxval = 2100)

endMonth = input.int (1, "", group = 'Strategy: Date Range', inline = 'DR2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12])

endDate = input.int (1, "", group = 'Strategy: Date Range', inline = 'DR2', options = [1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31])

// ----------------

// Drawing Settings

// ----------------

showTpSlBoxes = input.bool(false, "Show TP / SL Boxes", group = "Strategy: Drawings", inline = "D1", tooltip = "Show or hide TP and SL position boxes.\n\nNote: TradingView limits the maximum number of boxes that can be displayed to 500 so they may not appear for all price data under test.")

showLabels = input.bool(false, "Show Trade Exit Labels", group = "Strategy: Drawings", inline = "D2", tooltip = "Useful labels to identify Profit/Loss and cumulative portfolio capital after each trade closes.\n\nAlso note that TradingView limits the max number of 'boxes' that can be displayed on a chart (max 500). This means when you lookback far enough on the chart you will not see the TP/SL boxes. However you can check this option to identify where trades exited.")

// =============================================================================

// INDICATORS

// =============================================================================

// ------------------------ Replacable section - Start -------------------------

// ---

// EMA

// ---

ema = ta.ema(close, emaLength)

plot(ema, "EMA Trend Line", color.white)

// ---

// RSI

// ---

rsi = ta.rsi(close, rsiLength)

// ------------------------- Replacable section - End --------------------------

// =============================================================================

// STRATEGY LOGIC

// =============================================================================

// ---------

// FUNCTIONS

// ---------

percentAsPoints(pcnt) =>

math.round(pcnt / 100 * close / syminfo.mintick)

calcStopLossPrice(pointsOffset, isLong) =>

priceOffset = pointsOffset * syminfo.mintick

if isLong

close - priceOffset

else

close + priceOffset

calcProfitTrgtPrice(pointsOffset, isLong) =>

calcStopLossPrice(-pointsOffset, isLong)

printLabel(barIndex, msg) => label.new(barIndex, close, msg)

printTpSlHitBox(left, right, slHit, tpHit, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = slHit ? color.new(color.red, 60) : color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = tpHit ? color.new(color.green, 60) : color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTpSlNotHitBox(left, right, entryPrice, slPrice, tpPrice) =>

if showTpSlBoxes

box.new (left = left, top = entryPrice, right = right, bottom = slPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

box.new (left = left, top = entryPrice, right = right, bottom = tpPrice, bgcolor = color.new(color.gray, 90), border_width = 0)

line.new(x1 = left, y1 = entryPrice, x2 = right, y2 = entryPrice, color = color.new(color.yellow, 20))

line.new(x1 = left, y1 = slPrice, x2 = right, y2 = slPrice, color = color.new(color.red, 20))

line.new(x1 = left, y1 = tpPrice, x2 = right, y2 = tpPrice, color = color.new(color.green, 20))

printTradeExitLabel(x, y, posSize, entryPrice, pnl) =>

if showLabels

labelStr = "Position Size: " + str.tostring(math.abs(posSize), "#.##") + "\nPNL: " + str.tostring(pnl, "#.##") + "\nCapital: " + str.tostring(strategy.equity, "#.##") + "\nEntry Price: " + str.tostring(entryPrice, "#.##")

label.new(x = x, y = y, text = labelStr, color = pnl > 0 ? color.new(color.green, 60) : color.new(color.red, 60), textcolor = color.white, style = label.style_label_down)

// ----------

// CONDITIONS

// ----------

inDateRange = time >= timestamp(syminfo.timezone, startYear, startMonth, startDate, 0, 0) and time < timestamp(syminfo.timezone, endYear, endMonth, endDate, 0, 0)

// ------------------------ Replacable section - Start -------------------------

// Condition 1: Price above EMA indicates bullish trend, price below EMA indicates bearish trend

bullEma = close > ema

bearEma = close < ema

// Condition 2: RSI crossing back from overbought/oversold indicates pullback within trend

bullRsi = ta.crossover (rsi, rsiOversold)

bearRsi = ta.crossunder (rsi, rsiOverbought)

// Combine all entry conditions

goLong = inDateRange and bullEma and bullRsi

goShort = inDateRange and bearEma and bearRsi

// ------------------------- Replacable section - End --------------------------

// Trade entry and exit variables

var tradeEntryBar = bar_index

var profitPoints = 0.

var lossPoints = 0.

var slPrice = 0.

var tpPrice = 0.

var inLong = false

var inShort = false

// Entry decisions

openLong = (goLong and not inLong)

openShort = (goShort and not inShort)

flippingSides = (goLong and inShort) or (goShort and inLong)

enteringTrade = openLong or openShort

inTrade = inLong or inShort

// ------------------------ Replacable section - Start -------------------------

// Exit calculations

atr = ta.atr(atrLength)

slAmount = atr * slAtrMultiplier

slPercent = math.abs((1 - (close - slAmount) / close) * 100)

tpPercent = slPercent * riskReward

// ------------------------- Replacable section - End --------------------------

// Risk calculations

riskAmt = strategy.equity * accountRiskPercent / 100

entryQty = math.abs(riskAmt / slPercent * 100) / close

if openLong

if strategy.position_size < 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Long", strategy.long, qty = entryQty, alert_message = "Long Entry")

enteringTrade := true

inLong := true

inShort := false

if openShort

if strategy.position_size > 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

printTradeExitLabel(bar_index + 1, math.max(tpPrice, slPrice), strategy.position_size, strategy.position_avg_price, strategy.openprofit)

strategy.entry("Short", strategy.short, qty = entryQty, alert_message = "Short Entry")

enteringTrade := true

inShort := true

inLong := false

if enteringTrade

profitPoints := percentAsPoints(tpPercent)

lossPoints := percentAsPoints(slPercent)

slPrice := calcStopLossPrice(lossPoints, openLong)

tpPrice := calcProfitTrgtPrice(profitPoints, openLong)

tradeEntryBar := bar_index

strategy.exit("TP/SL", profit = profitPoints, loss = lossPoints, comment_profit = "TP Hit", comment_loss = "SL Hit", alert_profit = "TP Hit Alert", alert_loss = "SL Hit Alert")

// =============================================================================

// DRAWINGS

// =============================================================================

// -----------

// TP/SL Boxes

// -----------

slHit = (inShort and high >= slPrice) or (inLong and low <= slPrice)

tpHit = (inLong and high >= tpPrice) or (inShort and low <= tpPrice)

exitTriggered = slHit or tpHit

entryPrice = strategy.closedtrades.entry_price (strategy.closedtrades - 1)

pnl = strategy.closedtrades.profit (strategy.closedtrades - 1)

posSize = strategy.closedtrades.size (strategy.closedtrades - 1)

// Print boxes for trades closed at profit or loss

if (inTrade and exitTriggered)

inShort := false

inLong := false

printTpSlHitBox(tradeEntryBar + 1, bar_index, slHit, tpHit, entryPrice, slPrice, tpPrice)

printTradeExitLabel(bar_index, math.max(tpPrice, slPrice), posSize, entryPrice, pnl)

// Print TP/SL box for current open trade

if barstate.islastconfirmedhistory and strategy.position_size != 0

printTpSlNotHitBox(tradeEntryBar + 1, bar_index + 1, strategy.position_avg_price, slPrice, tpPrice)

// =============================================================================

// DEBUGGING

// =============================================================================

// Data window plots

plotchar(slPrice, "Stop Loss Price", "")

plotchar(tpPrice, "Take Profit Price", "")

// Label plots

plotDebugLabels = false

if plotDebugLabels

if bar_index == tradeEntryBar

printLabel(bar_index, "Position size: " + str.tostring(entryQty * close, "#.##"))