概述

Hilo激活器买卖信号策略是一种基于Hilo激活器指标的量化交易策略。它使用Hilo指标动态生成关键的价格阈值,并在收盘价突破这些价格水平时产生买入和卖出信号。该策略支持自动实际交易,能够基于规则建立多头和空头头寸。

策略原理

该策略使用自定义变量设置Hilo激活器指标的周期长度、平移大小和是否使用指数移动平均线。Hilo指标包含代表做多和做空决策的关键价格线。当收盘价上穿Hilo线时,产生买入信号;当收盘价下穿Hilo线时,产生卖出信号。为了清晰可视化信号,该策略使用绿色三角标记买入信号,使用红色三角标记卖出信号。

优势分析

Hilo激活器买卖信号策略具有如下优势:

- 使用Hilo指标识别关键支撑与压力位,可以捕捉价格反转机会

- 参数可调整,可以针对不同市场和交易品种进行优化

- 结合可视化信号设计,直观简洁

- 支持自动交易实施策略

风险分析

该策略也存在一些风险:

- Hilo指标存在滞后,可能错过部分价格移动

- 需要适当调整参数,避免产生过多无效信号

- 自动交易风险需要评估和控制

优化方向

该策略可以从以下几个方面进行优化:

- 结合其他指标过滤无效信号,提高信号质量

- 增加止损机制,控制单笔损失

- 优化参数设置,适应更广泛的市场情况

- 利用机器学习方法动态优化参数

总结

Hilo激活器买卖信号策略为量化交易提供了一个简单可靠的基础框架。该策略运用Hilo指标判定关键价格,在突破这些价格时产生交易信号。该策略可视化设计优良,参数可调整,支持自动化交易。通过进一步的测试和优化,可以使其适应更多不同的品种和交易环境,从而获得更稳定的超额收益。

策略源码

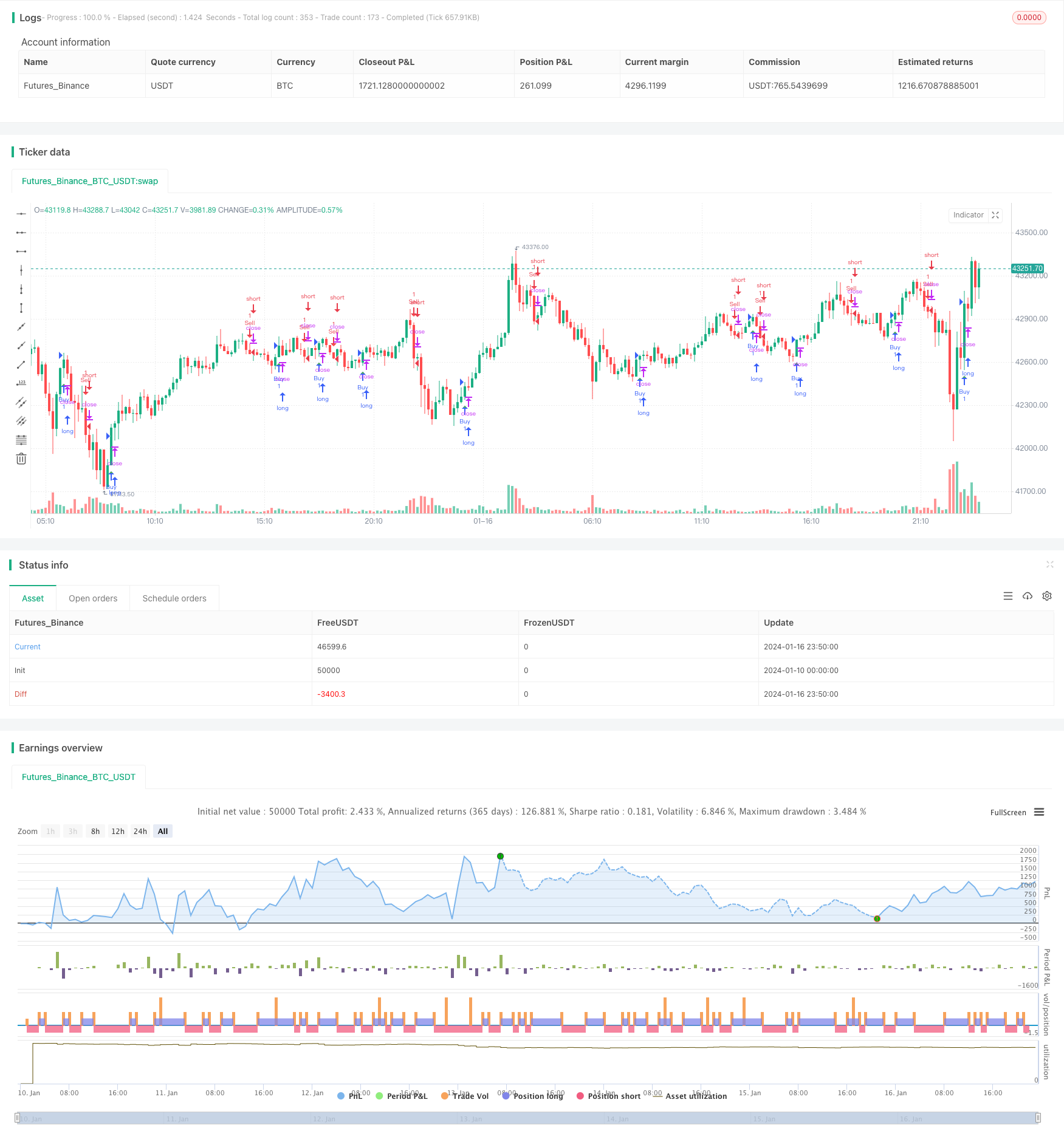

/*backtest

start: 2024-01-10 00:00:00

end: 2024-01-17 00:00:00

period: 10m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Hilo Activator com Sinais de Compra e Venda", overlay=true)

// Entradas personalizadas

period = input(8, title="Período")

shift = input(1, title="Deslocamento")

exp = input(false, title="Média Móvel Exponencial")

max = exp ? ema(high[shift], period) : sma(high[shift], period)

min = exp ? ema(low[shift], period) : sma(low[shift], period)

pos = close > max ? -1 : close < min ? 1 : 0

pos := pos == 0 ? na(pos[1]) ? 0 : pos[1] : pos

hilo = pos == 1 ? max : min

// Condições para sinais de compra e venda

buySignal = crossover(close, hilo)

sellSignal = crossunder(close, hilo)

plotshape(buySignal, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(sellSignal, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)

// plotbar(hilo,hilo,hilo,hilo,color=pos==1?color.red:color.green)

strategy.entry("Buy", strategy.long, when = buySignal)

strategy.entry("Sell", strategy.short, when = sellSignal)