概述

该策略通过在下跌趋势中判断突出的交易量定位短期底部,在超卖条件下进行买入操作,属于积极的短线交易策略。

策略原理

当交易量超过基于SMA的平均量2倍标准差时认为是突出交易量,同时RSI低于30时认为是超卖状态。当两者条件同时满足时,判断为短期底部并立即做多。做多后一定时间后(如10根K线)会平仓离场。

所以该策略的逻辑只有下面几步:

- 计算最近20根K线的交易量SMA作为基准量

- 计算最近20根K线交易量的2倍标准差作为突出量的判断标准

- 计算最近20根K线的RSI判断是否超卖

- 当交易量超过基准量+2倍标准差且RSI低于30时,判断为短期底部

- 在短期底部时立即做多

- 10根K线后自动平仓

优势分析

该策略具有以下优势:

- 逻辑简单,容易理解和优化

- 利用了交易量突出的特点判断短期转折点

- RSI指标确保只在超卖区做多,避免追顶

- 自动止损,最大化回避尾部风险

总的来说,策略充分利用了量能突破判断短期趋势反转的特点,同时严格控制了风险,是一种可靠性较高的积极做多策略。

风险分析

该策略主要存在以下风险:

- 交易量和RSI所构成的交易信号可能出现假突破的情况,导致错误做多亏损;

- 固定的止损时间设置可能在市场大幅反转时无法止损或止损过早;

- parameter优化不到位可能导致信号频繁或过少。

针对以上风险,可以从以下几个方面进行优化:

- 增加其他指标过滤,避免假突破的信号;

- 设置动态跟踪止损,而不是固定Root K线止损;

- 全面测试并优化参数,确保参数稳健。

优化方向

该策略可以从以下几个方面进行进一步优化:

- 增加机器学习模型判断量能突破的可靠性,避免假信号

- 增加自适应止损机制,而不是简单的固定根K线设置

- 针对突出量参数进行多维数据集优化

- 增加机器学习筛选超卖信号的准确性

- 结合情绪面分析增加策略的阿尔法

通过引入更多先进的技术指标、机器学习和情绪面分析,可以显著提高策略的稳定性、阿尔法和 Sharpe 比率。

总结

该策略整体来说是一个非常简单直接、逻辑清晰的短线突破策略。通过合理应用交易量指标判断短期趋势反转点,同时严格控制风险,可以获得不错的效果。但是仍然存在一定的假信号风险和参数健壮性风险。这些问题都可以通过引入更多先进技术进行逐步改进和优化,使策略的效果更加显著。

策略源码

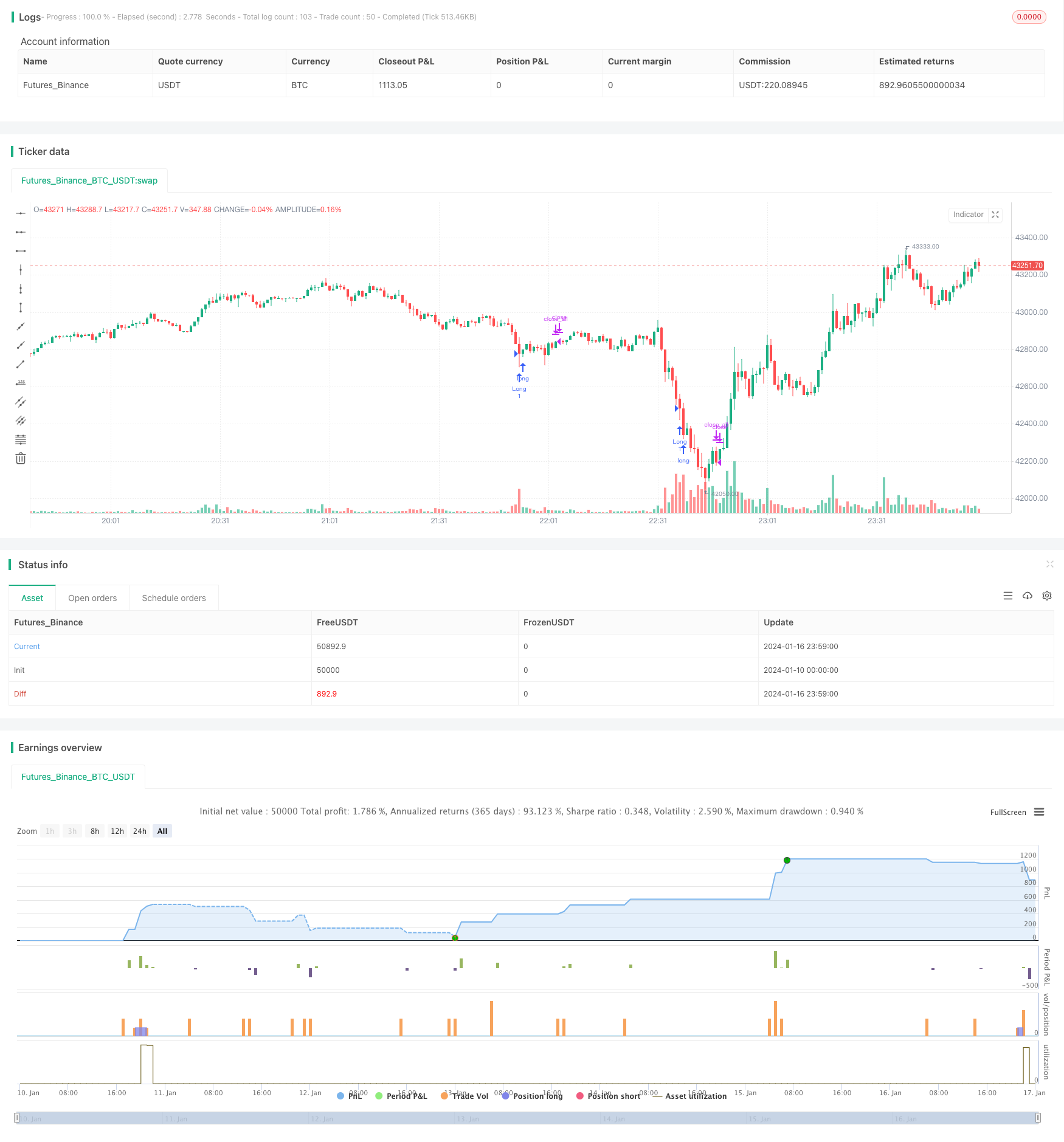

/*backtest

start: 2024-01-10 00:00:00

end: 2024-01-17 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © footlz

//@version=4

strategy("Bottom catch strategy", overlay=true)

v_len = input(20, title="Volume SMA Length")

mult = input(2)

rsi_len = input(20, title="RSI Length")

oversold = input(30, title="Oversold")

close_time = input(10, title="Close After")

v = volume

basis = sma(v, v_len)

dev = mult * stdev(v, v_len)

upper_volume = basis + dev

rsi = rsi(close, rsi_len)

long = v > upper_volume and rsi < oversold

strategy.entry("Long", true, when=long)

passed_time = 0.0

if strategy.position_size != 0

passed_time := 1

else

passed_time := 0

if strategy.position_size != 0 and strategy.position_size[1] != 0

passed_time := passed_time[1] + 1

if passed_time >= close_time

strategy.close_all()

// If want to enable plot, change overlay=false.

v_color = close >= close[1] ? color.new(#3eb370, 0) : color.new(#e9546b, 0)

// plot(v, title="volume", color=v_color, style=plot.style_columns)

// plot(upper_volume, title="Threshold", color=color.aqua)