概述

该策略的主要思想是结合零滞后叠加移动平均线(ZLSMA)指标判断趋势方向,以及悬臂线出口(CE)指标来寻找更精确的入场和出场时机。ZLSMA是一种趋势指标,可较早判断趋势的变化。CE通过计算ATR来动态调整出场点位,可有效控制止损。该策略主要适合中短线操作。

策略原理

ZLSMA部分:

- 使用线性回归方法分别计算长度为130周期的LMA线。

- 然后将两条LMA线叠加,得出赋值给eq的差值。

- 最后,通过原先的LMA线加上eq差值,构成零滞后叠加移动平均线ZLSMA。

- 使用线性回归方法分别计算长度为130周期的LMA线。

CE部分:

- 计算ATR指标,并乘以系数(默认2)来确定离最近高点或低点的动态距离。

- 当收盘价超过最近的多头止损线或空头止损线时,相应调整该止损线。

- 根据收盘价相对于止损线的位置变化判断做多做空方向。

入场时机:

- ZLSMA判断趋势方向,CE发出信号时入场。

- ZLSMA判断趋势方向,CE发出信号时入场。

出场止损:

- 长线设有固定止损和止盈。

- 短线以CE的动态出口替代固定止损。

优势分析

- ZLSMA可较早判断趋势,避免假突破。

- CE可根据市场波动程度灵活调整出口点位。

- 策略风险收益比可自定义。

- 长短线运用止损止盈方法不同,可同时控制风险。

风险分析

- 参数设置不当可能增加输率或扩大止损范围。

- 若行情反转迅速,仍有止损被突破的风险。

优化方向

- 可以测试不同市场及时间周期的参数优化。

- 可考虑根据波动率或特定周期调整止盈止损参数。

- 可尝试与其它指标或模型组合,提高获利率。

总结

该策略主要运用零滞后叠加移动平均线判断趋势方向,结合悬臂线出口指标寻找更精确的入场出场时机。策略优势在于可自定义止损止盈比例,以及悬臂线出口的动态调整可根据市场情况控制风险。下一步可尝试参数优化及策略组合,以进一步提高稳定性和获利率。

策略源码

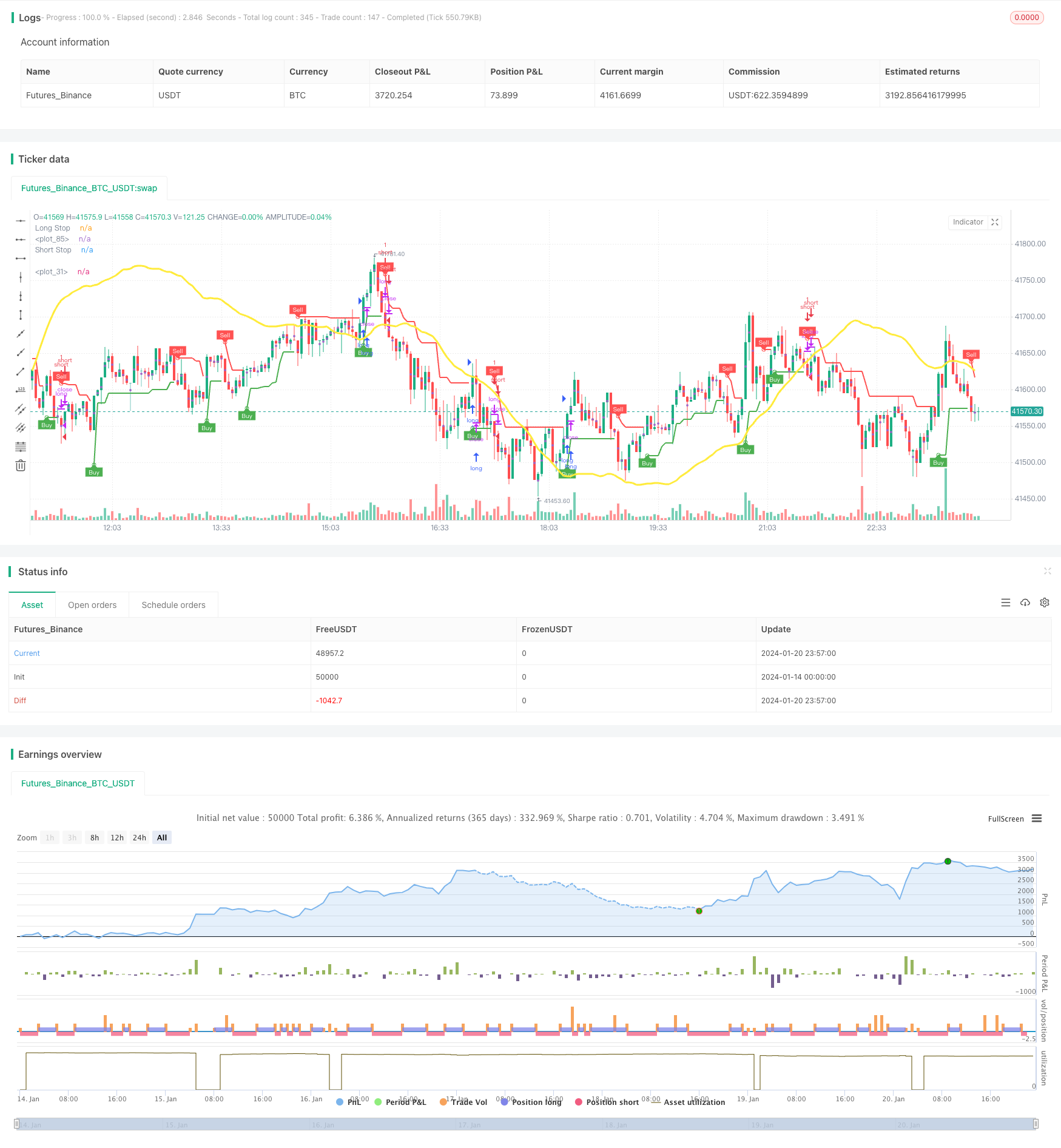

/*backtest

start: 2024-01-14 00:00:00

end: 2024-01-21 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © GGkurg

//@version=5

strategy(title = "ZLSMA + Chandelier Exit", shorttitle="ZLSMA + CE", overlay=true)

var GRP1 = "take profit / stop loss"

TP = input(title='long TP%', defval=2.0, inline = "1", group = GRP1)

SL = input(title='long SL%', defval=2.0, inline = "1", group = GRP1)

TP2 = input(title='short TP', defval=2.0, inline = "2", group = GRP1)

SL2 = input(title='short SL', defval=2.0, inline = "2", group = GRP1)

//-------------------------------------------------calculations

takeProfitPrice = strategy.position_avg_price * (1+(TP/100))

stopLossPrice = strategy.position_avg_price * (1-(SL/100))

takeProfitPrice2 = strategy.position_avg_price * (1-(TP2/100))

stopLossPrice2 = strategy.position_avg_price * (1+(SL2/100))

//---------------------------------------ZLSMA - Zero Lag LSMA

var GRP2 = "ZLSMA settings"

length1 = input(title='Length', defval=130, inline = "1", group = GRP2)

offset1 = input(title='Offset', defval=0, inline = "2", group = GRP2)

src = input(close, title='Source', inline = "3", group = GRP2)

lsma = ta.linreg(src, length1, offset1)

lsma2 = ta.linreg(lsma, length1, offset1)

eq = lsma - lsma2

zlsma = lsma + eq

plot(zlsma, color=color.new(color.yellow, 0), linewidth=3)

//---------------------------------------ZLSMA conditisions

//---------long

longc1 = close > zlsma

longclose1 = close < zlsma

//---------short

shortc1 = close < zlsma

shortclose1 = close > zlsma

//---------------------------------------Chandelier Exit

var string calcGroup = 'Chandelier exit settings'

length = input.int(title='ATR Period', defval=1, group=calcGroup)

mult = input.float(title='ATR Multiplier', step=0.1, defval=2.0, group=calcGroup)

useClose = input.bool(title='Use Close Price for Extremums', defval=true, group=calcGroup)

var string visualGroup = 'Visuals'

showLabels = input.bool(title='Show Buy/Sell Labels', defval=true, group=visualGroup)

highlightState = input.bool(title='Highlight State', defval=true, group=visualGroup)

var string alertGroup = 'Alerts'

awaitBarConfirmation = input.bool(title="Await Bar Confirmation", defval=true, group=alertGroup)

atr = mult * ta.atr(length)

longStop = (useClose ? ta.highest(close, length) : ta.highest(length)) - atr

longStopPrev = nz(longStop[1], longStop)

longStop := close[1] > longStopPrev ? math.max(longStop, longStopPrev) : longStop

shortStop = (useClose ? ta.lowest(close, length) : ta.lowest(length)) + atr

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := close[1] < shortStopPrev ? math.min(shortStop, shortStopPrev) : shortStop

var int dir = 1

dir := close > shortStopPrev ? 1 : close < longStopPrev ? -1 : dir

var color longColor = color.green

var color shortColor = color.red

var color longFillColor = color.new(color.green, 90)

var color shortFillColor = color.new(color.red, 90)

var color textColor = color.new(color.white, 0)

longStopPlot = plot(dir == 1 ? longStop : na, title='Long Stop', style=plot.style_linebr, linewidth=2, color=color.new(longColor, 0))

buySignal = dir == 1 and dir[1] == -1

plotshape(buySignal ? longStop : na, title='Long Stop Start', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(longColor, 0))

plotshape(buySignal and showLabels ? longStop : na, title='Buy Label', text='Buy', location=location.absolute, style=shape.labelup, size=size.tiny, color=color.new(longColor, 0), textcolor=textColor)

shortStopPlot = plot(dir == 1 ? na : shortStop, title='Short Stop', style=plot.style_linebr, linewidth=2, color=color.new(shortColor, 0))

sellSignal = dir == -1 and dir[1] == 1

plotshape(sellSignal ? shortStop : na, title='Short Stop Start', location=location.absolute, style=shape.circle, size=size.tiny, color=color.new(shortColor, 0))

plotshape(sellSignal and showLabels ? shortStop : na, title='Sell Label', text='Sell', location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.new(shortColor, 0), textcolor=textColor)

midPricePlot = plot(ohlc4, title='', style=plot.style_circles, linewidth=0, display=display.none, editable=false)

longStateFillColor = highlightState ? dir == 1 ? longFillColor : na : na

shortStateFillColor = highlightState ? dir == -1 ? shortFillColor : na : na

fill(midPricePlot, longStopPlot, title='Long State Filling', color=longStateFillColor)

fill(midPricePlot, shortStopPlot, title='Short State Filling', color=shortStateFillColor)

await = awaitBarConfirmation ? barstate.isconfirmed : true

alertcondition(dir != dir[1] and await, title='Alert: CE Direction Change', message='Chandelier Exit has changed direction!')

alertcondition(buySignal and await, title='Alert: CE Buy', message='Chandelier Exit Buy!')

alertcondition(sellSignal and await, title='Alert: CE Sell', message='Chandelier Exit Sell!')

//---------------------------------------Chandelier Exit conditisions

//---------long

longc2 = buySignal

longclose2 = sellSignal

//---------short

shortc2 = sellSignal

shortclose2 = buySignal

//---------------------------------------Long entry and exit

if longc1 and longc2

strategy.entry("long", strategy.long)

if strategy.position_avg_price > 0

strategy.exit("close long", "long", limit = takeProfitPrice, stop = stopLossPrice, alert_message = "close all orders")

if longclose1 and longclose2 and strategy.opentrades == 1

strategy.close("long","ema long cross", alert_message = "close all orders")

//---------------------------------------Short entry and exit

if shortc1 and shortc2

strategy.entry("short", strategy.short)

if strategy.position_avg_price > 0

strategy.exit("close short", "short", limit = takeProfitPrice2, stop = stopLossPrice2, alert_message = "close all orders")

if shortclose1 and shortclose2 and strategy.opentrades == 1

strategy.close("close short","short", alert_message = "close all orders")