概述

本策略基于双EMA指标构建,目的是识别价格趋势,实现趋势追踪。策略首先计算中长线EMA和短期EMA,然后通过二者的黄金交叉实现多头入场,死叉实现空头入场。同时,策略还引入 highest/lowest 筛选,进一步过滤假信号。

策略原理

本策略的核心指标为双EMA,包括一短一长的EMA。具体来说,策略中定义了以下变量:

ema1: 中长线EMA周期,默认为34天 ema2: 短期EMA周期,默认为13天

ema_sr: 基于收盘价计算的中长线EMA highest_ema: ema_sr的最高价EMA,周期为ema2 lowest_ema: ema_sr的最低价EMA,周期为ema2

ema_ysl: 用于产生交易信号的EMA,根据ema_sr与highest/lowest_ema的大小关系计算

crosses检测ema_sl和ema_ysl的黄金交叉和死叉,进而实现趋势跟踪。

通过双EMA组合,可以更准确地判断价格趋势。中长线EMA过滤掉短期噪音,而短期EMA又可以及时跟踪中期趋势的转折。highest/lowestEMA的引入,可以进一步过滤假信号,从而减少不必要的交易。

优势分析

本策略最大的优势在于趋势识别准确。双EMA指标本身就优于单一EMA和SMA等其他指标,识别趋势转折的能力更强。而highest/lowest_ema的应用,可以有效过滤掉短期回撤造成的假信号,这对于趋势跟踪策略很关键。

另外,本策略参数较为简单,容易调整和优化。用户只需要关注两个EMA参数,非常直观。这也使得策略容易理解和使用。

风险分析

本策略的主要风险在于不能识别趋势反转。当价格形成长期调整或者重大转折时,双EMA组合的滞后性可能导致错过最佳入场时机。这时,仓位可能过重,从而带来较大亏损。

此外,EMA本身对突发事件也没有响应能力。重大黑天鹅事件发生时,策略同样可能遭受损失。

为缓解上述风险,我们建议适当缩短中长线EMA的长度,或者引入MACD等指标应对突发事件。同时,也可以设置止损来控制最大损失。

优化方向

本策略还有进一步优化的空间。具体来说,主要的优化方向有以下三点:

测试更多的EMA参数组合,寻找最佳参数;

增加成交量的判断,避免在价格震荡时发出错误信号;

结合趋势线、通道等工具,更准确判断趋势转折点。

通过参数优化、增加过滤条件等手段,有望进一步提升策略的稳定性和盈利能力。这需要量化测试人员持续进行回测与优化。

总结

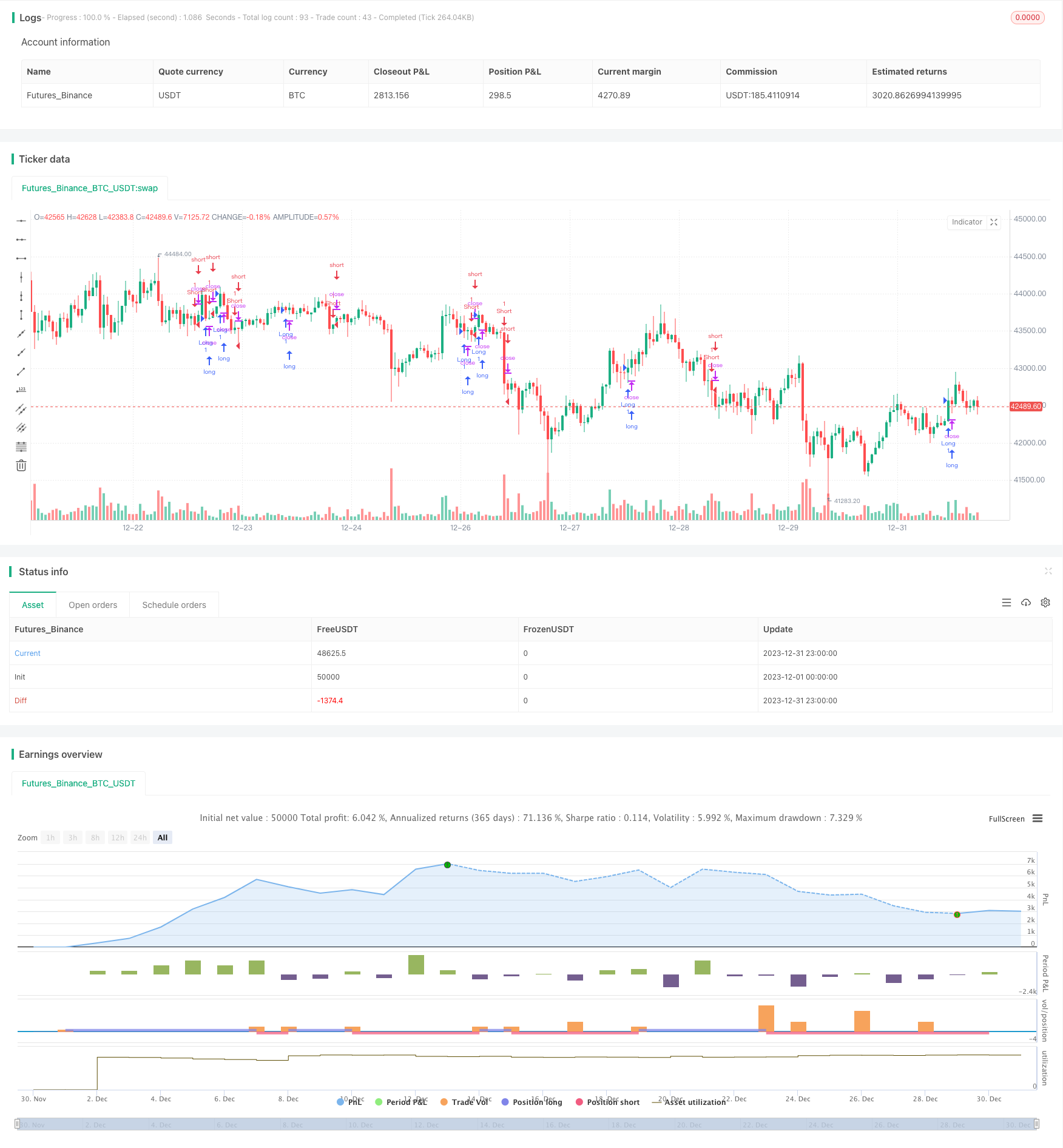

本策略整体来说识别趋势的能力较强,通过双EMA组合过滤噪音,并有效平滑价格曲线。Highest/lowest EMA的引入也增强了信号的可靠性。从回测结果来看,策略可以获得较好的稳定收益。

但是策略本身较为滞后,无法及时识别趋势反转。这是本策略面临的主要风险,也是未来优化的重点方向。我们期待通过参数调整、信号过滤等手段,进一步增强策略的鲁棒性,使其能够在更多市场环境下获得稳定收益。

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

// Modified from kivancfr3762's A2MK script

strategy("EMA STRATEGY", overlay=true)

ema2=input(13, "EMA2 Length")

ema1=input(34, "EMA1 Length")

ema_sr = ema((max(close[1], high) + min(close[1], low)) / 2, ema1)

highest_ema = ema(highest(ema_sr, 3), ema2)

lowest_ema = ema(lowest(ema_sr, 3), ema2)

k1 = ema_sr > highest_ema

k2 = ema_sr < lowest_ema

ema_ysl = iff(k1, lowest_ema, highest_ema)

longCondition = crossover(ema_ysl, ema_sr)

if (longCondition)

strategy.entry("Short", strategy.short)

shortCondition = crossunder(ema_ysl, ema_sr)

if (shortCondition)

strategy.entry("Long", strategy.long)