概述

这是一个结合使用Bill Williams的分形理论和ZZ指标的量化交易策略。该策略通过计算威廉姆斯分形来判断市场趋势,并结合ZZ指标绘制支撑阻力线,以发现潜在的突破点,从而实现趋势跟踪交易。

策略原理

该策略首先计算威廉姆斯分形,判断当前是上涨分形还是下跌分形。如果是上涨分形,则认为目前处于上涨趋势;如果是下跌分形,则认为目前处于下跌趋势。

然后根据分形点绘制ZZ指标的支撑线和阻力线。如果价格突破上涨分形对应的阻力线,则做多;如果价格突破下跌分形对应的支撑线,则做空。

通过这样的组合,可以在趋势发生转变的时候及时捕捉,实现趋势跟踪交易。

策略优势分析

这种策略结合使用了威廉姆斯分形和ZZ指标两种不同的技术分析方法,以发掘更多的交易机会。

它能够及时判断市场趋势的转变,并设置好的止损止盈条件,有助于把握主要趋势的方向。此外,ZZ指标可以过滤掉部分假突破的情况,避免不必要的损失。

总的来说,这种策略既考虑了趋势判断,也考虑了具体的入场点选择,做到了风险和收益的平衡。

策略风险分析

这种策略最大的风险在于分形判断和ZZ指标可能会发出错误的交易信号,导致不必要的亏损。例如,突破阻力线后,价格可能会很快回落,无法持续上涨。

此外,分形的计算方式可能因为时间周期设置不当而判断失误。如果时间周期太短,则会增加假突破的概率。

要降低这些风险,可以适当调整分形的计算参数,也可以通过增加过滤条件来减少错误信号。此外,可以设置较大的止损幅度,以控制单笔损失。

策略优化方向

这种策略可以通过以下几个方面来进行进一步优化:

增加动量指标过滤,例如MACD或者布林带指标,可以避免部分假突破。

优化分形参数设置,调整对高低点的计算方式,缩小时间周期,以获得更准确的趋势判断。

增加机器学习算法判断趋势准确性,利用AI判断力避免人工设置的局限性。

增加自适应止损机制,可以根据市场波动程度来调整止损幅度。

利用深度学习算法来优化整体参数设置。

总结

本策略通过威廉姆斯分形理论和ZZ指标的巧妙结合,实现了对市场趋势变化的及时判断和捕捉。它保持了较高的胜率,有望获得长期稳定的超额收益。下一步通过引入更多过滤手段和AI判断力,有望进一步提高策略的稳定性和收益率。

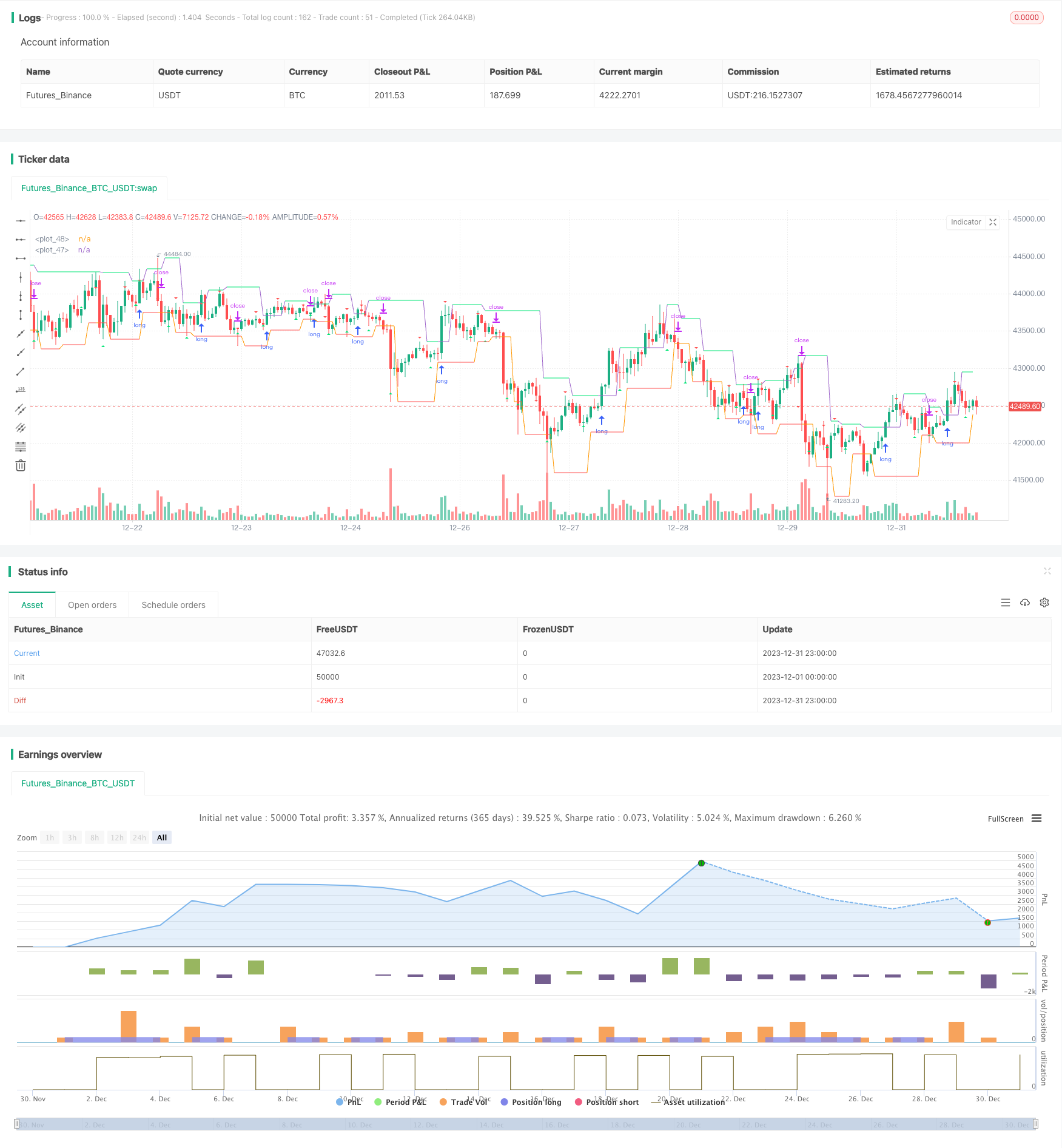

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title = "robotrading ZZ-8 fractals", shorttitle = "ZZ-8", overlay = true, default_qty_type = strategy.percent_of_equity, initial_capital = 100, default_qty_value = 100, commission_value = 0.1)

//Settings

needlong = input(true, defval = true, title = "Long")

needshort = input(false, defval = true, title = "Short")

filterBW = input(false, title="filter Bill Williams Fractals")

showll = input(true, title = "Show levels")

showff = input(true, title = "Show fractals (repaint!)")

showdd = input(true, title = "Show dots (repaint!)")

showbg = input(false, title = "Show background")

showlb = input(false, title = "Show drawdown")

startTime = input(defval = timestamp("01 Jan 2000 00:00 +0000"), title = "Start Time", type = input.time, inline = "time1")

finalTime = input(defval = timestamp("31 Dec 2099 23:59 +0000"), title = "Final Time", type = input.time, inline = "time1")

//Variables

loss = 0.0

maxloss = 0.0

equity = 0.0

truetime = true

//Fractals

isRegularFractal(mode) =>

ret = mode == 1 ? high[4] < high[3] and high[3] < high[2] and high[2] > high[1] and high[1] > high[0] : mode == -1 ? low[4] > low[3] and low[3] > low[2] and low[2] < low[1] and low[1] < low[0] : false

isBWFractal(mode) =>

ret = mode == 1 ? high[4] < high[2] and high[3] <= high[2] and high[2] >= high[1] and high[2] > high[0] : mode == -1 ? low[4] > low[2] and low[3] >= low[2] and low[2] <= low[1] and low[2] < low[0] : false

filteredtopf = filterBW ? isRegularFractal(1) : isBWFractal(1)

filteredbotf = filterBW ? isRegularFractal(-1) : isBWFractal(-1)

//Triangles

plotshape(filteredtopf and showff, title='Filtered Top Fractals', style=shape.triangledown, location=location.abovebar, color= color.red, offset=-2)

plotshape(filteredbotf and showff, title='Filtered Bottom Fractals', style=shape.triangleup, location=location.belowbar, color= color.lime, offset=-2)

//Levels

hh = 0.0

ll = 0.0

hh := filteredtopf ? high[2] : hh[1]

ll := filteredbotf ? low[2] : ll[1]

//Trend

trend = 0

trend := high >= hh[1] ? 1 : low <= ll[1] ? -1 : trend[1]

//Lines

hcol = showll and hh == hh[1] and close < hh ? color.lime : na

lcol = showll and ll == ll[1] and close > ll ? color.red : na

plot(hh, color = hcol)

plot(ll, color = lcol)

//Dots

// var line hline = na

// if hh != hh[1] and showdd

// hline := line.new(bar_index - 0, hh[0], bar_index - 2, hh[0], xloc = xloc.bar_index, extend = extend.none, style = line.style_dotted, color = color.lime, width = 1)

// var line lline = na

// if ll != ll[1] and showdd

// lline := line.new(bar_index - 0, ll[0] - syminfo.mintick, bar_index - 2, ll[0] - syminfo.mintick, xloc = xloc.bar_index, extend = extend.none, style = line.style_dotted, color = color.red, width = 1)

//Background

bgcol = showbg == false ? na : trend == 1 ? color.lime : trend == -1 ? color.red : na

bgcolor(bgcol, transp = 80)

//Orders

if hh > 0 and needlong

strategy.entry("Long", strategy.long, na, stop = hh, when = needlong and truetime)

strategy.exit("Exit Long", "Long", stop = ll, when = needshort == false)

if ll > 0 and startTime

strategy.entry("Short", strategy.short, na, stop = ll, when = needshort and truetime)

strategy.exit("Exit Short", "Short", stop = hh, when = needlong == false)

if time > finalTime

strategy.close_all()

strategy.cancel("Long")

strategy.cancel("Short")

if showlb

//Drawdown

max = 0.0

max := max(strategy.equity, nz(max[1]))

dd = (strategy.equity / max - 1) * 100

min = 100.0

min := min(dd, nz(min[1]))

//Max loss size

equity := strategy.position_size != strategy.position_size[1] ? strategy.equity : equity[1]

loss := equity < equity[1] ? ((equity / equity[1]) - 1) * 100 : 0

maxloss := min(nz(maxloss[1]), loss)

//Label

min := round(min * 100) / 100

maxloss := round(maxloss * 100) / 100

labeltext = "Drawdown: " + tostring(min) + "%" + "\nMax.loss " + tostring(maxloss) + "%"

var label la = na

label.delete(la)

tc = min > -100 ? color.white : color.red

osx = timenow + round(change(time)*50)

osy = highest(100)

la := label.new(x = osx, y = osy, text = labeltext, xloc = xloc.bar_time, yloc = yloc.price, color = color.black, style = label.style_labelup, textcolor = tc)