概述

Noro平移均线止损策略是一种趋势跟踪策略。它通过计算3日简单移动平均线,并在其上方和下方加上一个比例作为开仓线和止损线。同时设置了止盈位。这样可以在趋势开始时打开头寸,在趋势反转时止损出场。

策略原理

该策略的核心是计算3日简单移动平均线ma。然后在ma上方加上一个百分比lo作为开仓线long,当价格上穿long时做多;在ma下方减去一个百分比sl作为止损线stop,当价格下破stop时止损。同时设置了止盈线take,当价格达到止盈线时止盈。

具体计算规则如下:

- 计算3日简单移动平均线ma

- 开仓线long = ma + ma * lo%

- 止盈线take = 当前持仓均价 + 当前持仓均价 * tp%

- 止损线stop = 当前持仓均价 - 当前持仓均价 * sl%

这样就构建起了一个以ma为基准,通过可配置的百分比来设置开仓线、止盈线和止损线的趋势跟踪策略。

优势分析

这种策略最大的优势在于可以自动跟踪趋势运行。通过做多看涨,做空看跌,无需判断面上形态就可以捕捉中间趋势。再配合止盈止损设置,可以在趋势结束时自动止损,避免回撤过大。

另一个优势是参数可以灵活调整。通过调整开仓线、止盈线和止损线的百分比参数,可以自由控制仓位规模和止损空间。

风险分析

该策略最大的风险在于容易形成巨大的滑点。因为其是离场线交易,当价格急速下跌时很容易造成超出止损价格很远才成交的情况。这将会让投资者损失惨重。

另一个风险是参数设置不当可能导致过于频繁出入场,增加交易频率和手续费的负担。

优化方向

该策略可以从以下几个方面进行优化:

- 改为使用限价单止损,避免巨大滑点的风险

- 增加仓位数设置,可以平滑调仓,降低交易频率

- 增加趋势判断指标,避免非趋势市场的误操作

- 优化参数设置,找到最优参数组合

总结

Noro平移均线止损策略是一个简单实用的趋势跟踪策略。它可以自动跟踪趋势运行,配合止盈止损设置有效控制风险。该策略最大的风险在于可能造成较大滑点,以及参数设置不当导致过于频繁交易。通过改进止损方式、优化参数设置等手段,可以将该策略优化得更加实用。

策略源码

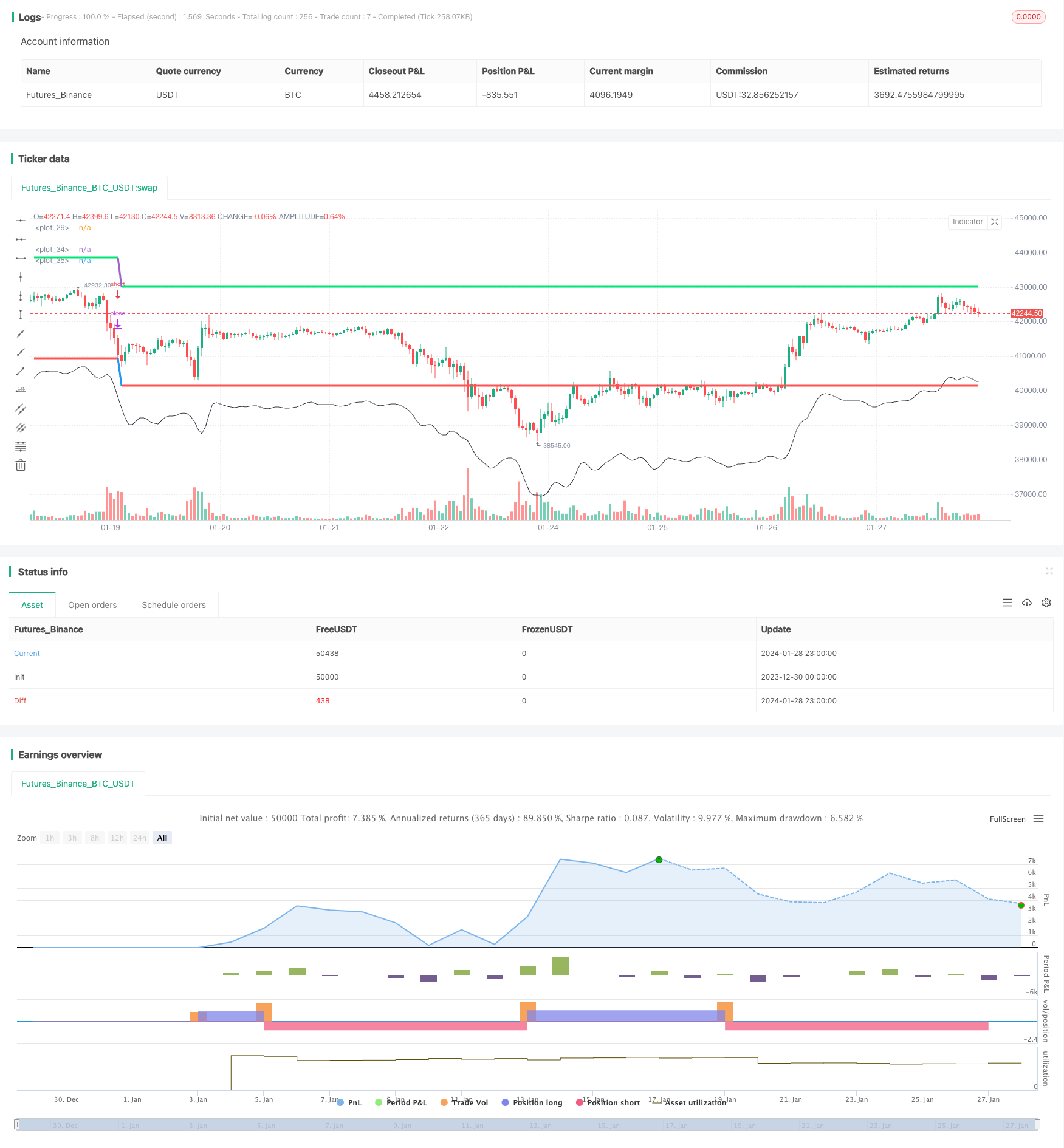

/*backtest

start: 2023-12-30 00:00:00

end: 2024-01-29 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//2019

//Noro

//@version=4

strategy("Stop-loss", overlay = true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100, pyramiding = 0)

//Settings

lo = input(-5.0, title = "Long-line, %")

tp = input(5.0, title = "Take-profit")

sl = input(2.0, title = "Stop-loss")

//SMA

ma = sma(ohlc4, 3)

long = ma + ((ma / 100) * lo)

//Orders

avg = strategy.position_avg_price

if ma > 0

strategy.entry("Long", strategy.long, limit = long)

strategy.entry("Take", strategy.short, 0, limit = avg + ((avg / 100) * tp))

strategy.entry("Stop", strategy.short, 0, stop = avg - ((avg / 100) * sl))

//Cancel order

if strategy.position_size == 0

strategy.cancel("Take")

strategy.cancel("Stop")

//Lines

plot(long, offset = 1, color = color.black, transp = 0)

take = avg != 0 ? avg + ((avg / 100) * tp) : long + ((long / 100) * tp)

stop = avg != 0 ? avg - ((avg / 100) * sl) : long - ((long / 100) * sl)

takelinecolor = avg == avg[1] and avg != 0 ? color.lime : na

stoplinecolor = avg == avg[1] and avg != 0 ? color.red : na

plot(take, offset = 1, color = takelinecolor, linewidth = 3, transp = 0)

plot(stop, offset = 1, color = stoplinecolor, linewidth = 3, transp = 0)