概述

双7日突破策略是一个非常简单的短线交易策略。它只有3个交易规则:

- 价格必须高于200日简单移动均线

- 当价格收盘低于过去7天的最低价时做多

- 当价格收盘高于过去7天的最高价时平仓

虽然规则非常简单,但该策略在一些股票和时间段中表现非常出色,甚至超过许多RSI策略。

策略原理

双7日突破策略利用价格的支撑和阻力进行交易。当价格跌破过去7天的最低价时,说明价格可能进入调整期,这时做多;当价格涨破过去7天的最高价时,说明行情可能转强,应平仓了结利润。

该策略是典型的短线交易策略。它通过7天时间窗口判断最近几天价格行情,利用超短线的突破信号进行入场。同时,它要求价格高于200日均线,避免在长期下跌行情中交易。

优势分析

双7日突破策略最大的优势就是简单易行。它只有3条规则,非常容易实施。且由于信号判断时间窗口很短,交易频率较高,适合短线操作。

另外,该策略充分利用了价格的支撑和阻力进行交易。这类突破信号往往比较可靠,胜率较高。这也是该策略表现出色的原因。

风险分析

双7日突破策略作为一个短线策略,其交易风险主要来自两方面:

- 错误信号风险。当价格出现错误突破时,该策略会产生损失。

- 大盘系统性风险。当大盘出现剧烈调整时,个股之间相关性增大,该策略可能同时持有多个股票仓位,面临较大的市场风险。

为降低这些风险,可以适当调整参数,缩短持仓时间,或结合其他指标进行过滤。当大盘波动剧烈时,应减少仓位规模。

优化方向

双7日突破策略还有进一步优化的空间:

- 可以测试不同的均线参数,寻找更合适的长期指标。

- 可以测试不同的突破周期参数,优化短期指标。

- 可以加入止损机制,进一步控制单笔损失。

- 可以结合其他指标进行过滤,提高信号准确率。

通过参数和策略结构的优化,有望进一步提升策略的稳定性和效率。

总结

双7日突破策略是一个简单高效的短线交易策略。它利用支撑阻力进行突破交易,信号生成频率高,适合短线操作。同时它要求价格高于长期均线,能有效规避长期调整的系统性风险。通过参数和模块的优化,该策略有望获取更出色的表现。

策略源码

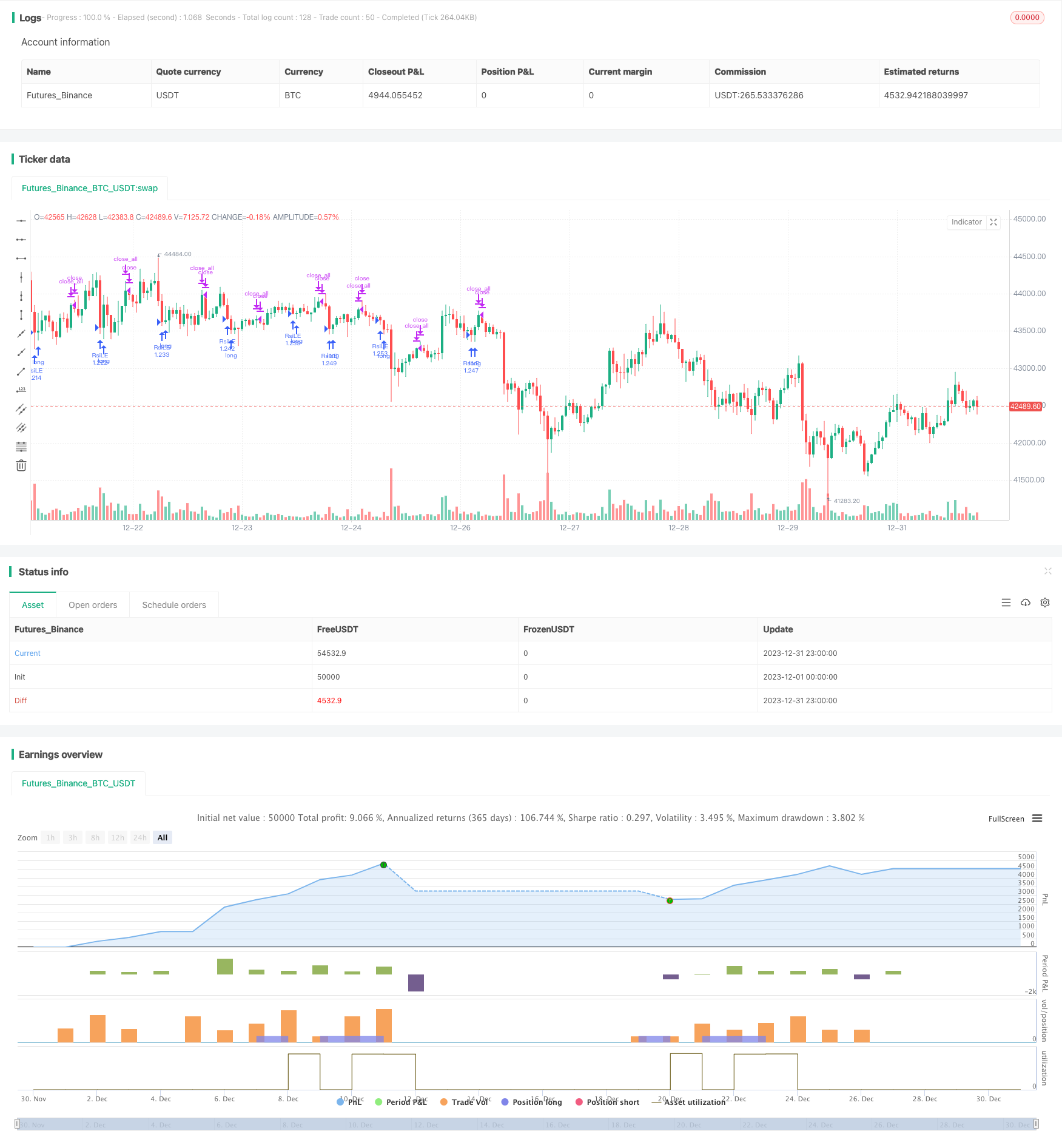

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Double 7's Strategy", overlay=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

value1=input(7, title="Quantity of day low")

value2=input(7, title="Quantity of day high")

entry=lowest(close[1],value1)

exit=highest(close[1],value2)

mma200=sma(close,200)

// Test Period

testStartYear = input(2009, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(2, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(2020, "Backtest Stop Year")

testStopMonth = input(12, "Backtest Stop Month")

testStopDay = input(30, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => true

if testPeriod()

if (close>mma200) and (close<entry)

strategy.entry("RsiLE", strategy.long , comment="Open")

if (close>exit)

strategy.close_all()