概述

双均线缠论策略是一种趋势跟踪策略。它通过计算两组移动平均线构建快线组和慢线组,并结合价格与均线的关系来判断趋势方向。

当快线上穿慢线时为看多信号。当快线下穿慢线时为看空信号。本策略结合快慢均线的方向、价格突破的Candle数等条件来判断具体的入场和出场时机。

策略原理

双均线缠论策略通过计算两组移动平均线,分别代表短期和长期趋势判断标准。具体来说,策略中定义了:

- 快速均线组,包含快速下轨均线和快速上轨均线,代表短期趋势;

- 慢速均线组,包含慢速下轨均线和慢速上轨均线,代表长期趋势。

策略通过快速均线组和慢速均线组的价格关系来判断短期和长期趋势的合理性,以及具体的入场和出场时机。

入场条件如下:

- 快速上轨线向上突破慢速上轨线2根K线或以上时为多头入场。

- 快速下轨线向下突破慢速下轨线2根K线或以上时为空头入场。

出场条件如下:

- 多头持仓期间,快速均线下穿慢速均线时为多头出场。

- 空头持仓期间,快速均线上穿慢速均线时为空头出场。

此外,策略中还设置了止盈、止损、追踪止损等功能来控制风险。

优势分析

双均线缠论策略的主要优势有:

- 通过双均线判断,能有效过滤市场噪音,锁定趋势方向。

- 结合快慢均线和价格关系,判断信号的可靠性较高。

- 策略规则简单清晰,容易理解实现,适合量化交易。

- 内置止盈、止损、追踪止损等风险控制手段,可以有效控制交易风险。

风险分析

双均线缠论策略也存在一定的风险,主要体现在:

- 在震荡行情中,可能产生虚假信号,从而引发不必要的交易。

- 均线系统对突发事件(如重大利空/利好消息面市)反应迟缓,可能带来较大亏损。

- 追踪止损在特定行情下可能被突破,从而扩大亏损。

为控制上述风险,可通过优化移动均线参数,或结合其他指标进行过滤等方法进行改进。

优化方向

双均线缠论策略可从以下几个维度进行优化:

- 优化移动平均线参数,调整均线周期,适应不同周期行情。

- 增加其他指标Filter,形成多指标组合策略,提高信号的准确性。

- 优化止损、止盈设置,设置回撤阈值,控制最大亏损。 4.引入机器学习模型预测趋势,辅助判断入场timing。

总结

双均线缠论策略整体来说是一个非常实用的趋势跟踪策略。它判断规则简单,逻辑清晰,通过双均线系统控制风险,理论依据坚实。下一步可从参数优化、风险控制等多方面进行改进,使策略的收益性、稳定性进一步提升。

策略源码

/*backtest

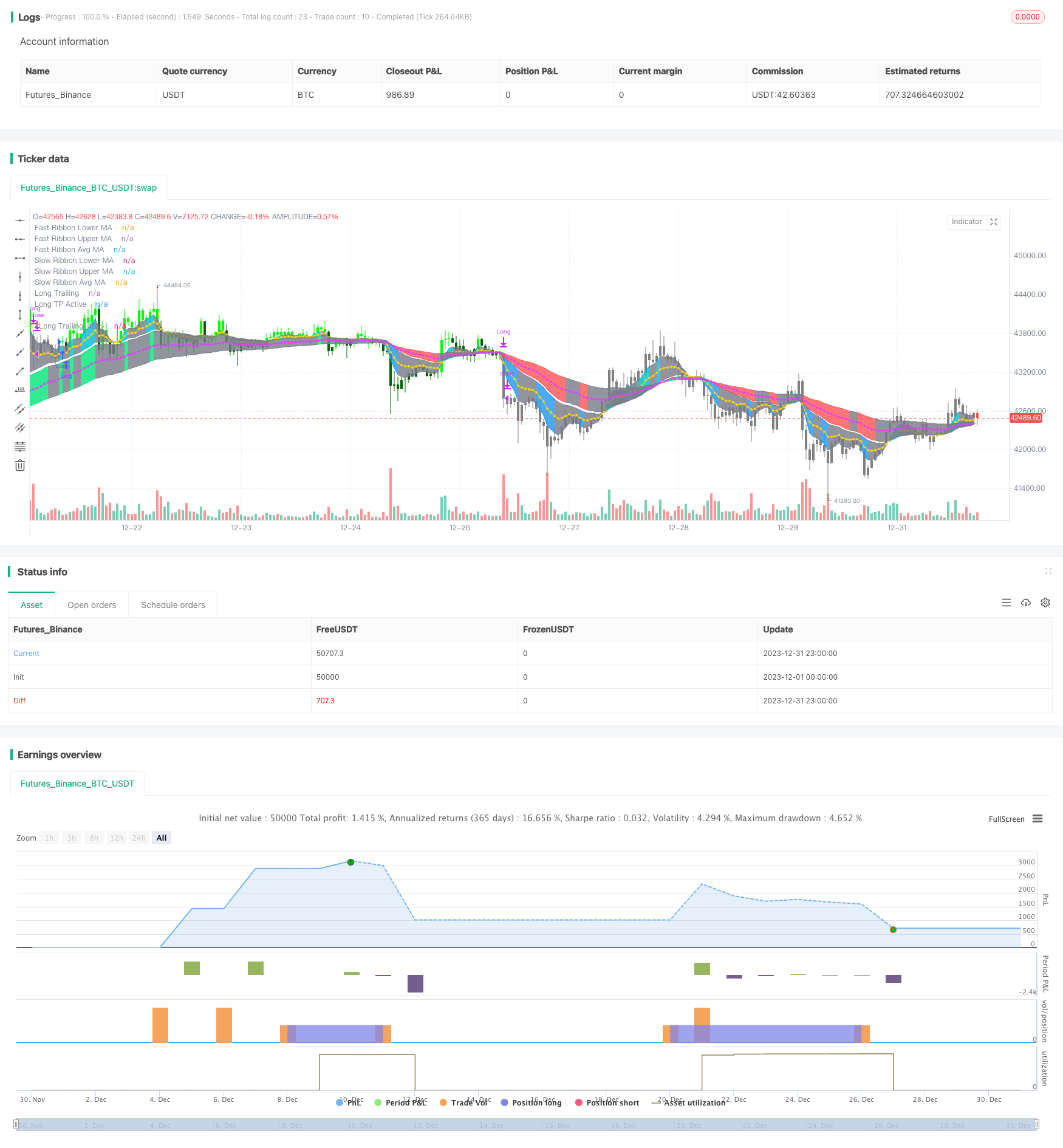

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title="[Autoview][BackTest]Dual MA Ribbons R0.12 by JustUncleL", shorttitle="[BT]DualRibbons R0.12", overlay=true )

//study(title="[Autoview][Alerts]Dual MA Ribbons R0.12 by JustUncleL", shorttitle="[AL]DualRibbons R0.12", overlay=true)

//

// Author: JustUncleL

// Revision: R0.12 Beta

// Date: 30-Apr-2018

//

// Description:

// ============

// This is an implementaion of a strategy based on two MA Ribbonn, a Fast Ribbon

// and a Slow Ribbon.

// The strategy revolves around a pair of scripts: One to generate alerts signals for

// Autoview and one for Backtesting, to tune your settings.

// The risk management options are performed within the script to set SL(StopLoss),

// TP(TargetProfit), TSL(Trailing Stop Loss) and TTP (Trailing Target Profit).

// The only requirement for Autoview is to Buy and Sell as directed by this script,

// no complicated syntax is required.

//

// The Dual Ribbons are designed to capture the inferred behaviour of traders and

// investors by using two groups of averages:

// > Traders MA Ribbon:

// Lower MA and Upper MA (Aqua=Uptrend, Blue=downtrend, Gray=Neutral), with

// centre line Avg MA (Orange dotted line).

// > Investors MAs Ribbon:

// Lower MA and Upper MA (Green=Uptrend, Red=downtrend, Gray=Neutral), with

// centre line Avg MA (Fuchsia dotted line).

// > Anchor time frame (0=current). This is the time frame that the MAs are

// calculated for. This way 60m MA Ribbons can be viewed on a 15 min chart to establish

// tighter Stop Loss conditions.

//

// Trade Management options:

// -------------------------

// - Option to specify Backtest start and end time.

// - Trailing Stop, with Activate Level (as % of price) and Trailing Stop (as % of price)

// - Target Profit Level, (as % of price)

// - Stop Loss Level, (as % of price)

// - BUY green triandles and SELL dark red triangles

// - Trade Order closed colour coded Label:

// > Dark Red = Stop Loss Hit

// > Green = Target Profit Hit

// > Purple = Trailing Stop Hit

// > Orange = Opposite (Sell) Order Close

//

// Trade Management Indication:

// ----------------------------

// - Trailing Stop Activate Price = Blue dotted line

// - Trailing Stop Price = Fuschia solid stepping line

// - Target Profit Price = Lime '+' line

// - Stop Loss Price = Red '+' line

//

// Dealing With Renko Charts:

// --------------------------

// - If you choose to use Renko charts, make sure you have enabled the "IS This a RENKO Chart"

// option, (I have not so far found a way to Detect the type of chart that is running).

// - If you want non-repainting Renko charts you MUST use TRADITIONAL Renko Bricks. This

// type of brick is fixed and will not change size.

// - Also use Renko bricks with WICKS DISABLED. Wicks are not part of Renko, the whole

// idea of using Renko bricks is not to see the wick noise.

// - Set you chart Time Frame to the lowest possible one that will build enough bricks

// to give a reasonable history, start at 1min TimeFrame. Renko bricks are not dependent

// on time, they represent a movement in price. But the chart candlestick data is used

// to create the bricks, so lower TF gives more accurate Brick creation.

// - You want to size your bricks to 2/1000 of the pair price, so for ETHBTC the price is say 0.0805

// then your Renko Brick size should be about 2*0.0805/1000 = 0.0002 (round up).

// - You may find there is some slippage in value, but this can be accounted for in the Backtes

// by setting your commission a bit higher, for Binance for example I use 0.2

//

// References:

// ===========

// - MA Ribbon R#.# by JustUncleL

// - "How to automate this strategy for free using a chrome extension" by CryptoRox

//

// Revisions:

// ==========

// R0.12 - Beta 2 Version

//

//

//

// -----------------------------------------------------------------------------

// Copyright 2018 JustUncleL

//

// This program is free software: you can redistribute it and/or modify

// it under the terms of the GNU General Public License as published by

// the Free Software Foundation, either version 3 of the License, or

// any later version.

//

// This program is distributed in the hope that it will be useful,

// but WITHOUT ANY WARRANTY; without even the implied warranty of

// MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

// GNU General Public License for more details.

//

// The GNU General Public License can be found here

// <http://www.gnu.org/licenses/>.

//

// -----------------------------------------------------------------------------

//

//

// Use Alternate Anchor TF for MAs

uRenko = input(true, title="IS This a RENKO Chart")

//

anchor = input(0,minval=0,maxval=1440,title="Alternate TimeFrame Multiplier (0=none)")

//

src = close //input(close, title="EMA Source")

showRibbons = input(true,title="Show Coloured MA Ribbons")

showAvgs = input(true,title="Show Ribbon Median MA Lines")

//

// Fast Ribbon MAs

// Lower MA - type, length

typeF1 = input(defval="EMA", title="FAST MA Ribbon Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenF1 = input(defval=5, title="FAST Ribbon Lower MA Length", minval=1)

gammaF1 = 0.33 //input(defval=0.33,title="Fast MA - Gamma for LAGMA")

// Upper MA - type, length

typeF11 = typeF1 //input(defval="WMA", title="FAST Ribbon Upper MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenF11 = input(defval=25, title="FAST Ribbon Upper Length", minval=2)

gammaF11 = 0.77 //input(defval=0.77,title="Slow MA - Gamma for LAGMA")

// Slow Ribbon MAs

// Lower MA - type, length

typeS1 = input(defval="EMA", title="SLOW MA Ribbon Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenS1 = input(defval=28, title="SLOW Ribbon Lower MA Length", minval=1)

gammaS1 = 0.33 //input(defval=0.33,title="Fast MA - Gamma for LAGMA")

// Upper MA - type, length

typeS16 = typeS1 //input(defval="WMA", title="SLOW Ribbon Upper MA Type: ", options=["SMA", "EMA", "WMA", "VWMA", "SMMA", "DEMA", "TEMA", "LAGMA", "HullMA", "ZEMA", "TMA", "SSMA"])

lenS16 = input(defval=72, title="SLOW Ribbon Upper Length", minval=2)

gammaS16 = 0.77 //input(defval=0.77,title="Slow MA - Gamma for LAGMA")

// - Constants

gold = #FFD700

// - FUNCTIONS

// - variant(type, src, len, gamma)

// Returns MA input selection variant, default to SMA if blank or typo.

// SuperSmoother filter

// © 2013 John F. Ehlers

variant_supersmoother(src,len) =>

a1 = exp(-1.414*3.14159 / len)

b1 = 2*a1*cos(1.414*3.14159 / len)

c2 = b1

c3 = (-a1)*a1

c1 = 1 - c2 - c3

v9 = 0.0

v9 := c1*(src + nz(src[1])) / 2 + c2*nz(v9[1]) + c3*nz(v9[2])

v9

variant_smoothed(src,len) =>

v5 = 0.0

v5 := na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len

v5

variant_zerolagema(src,len) =>

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v10 = ema1+(ema1-ema2)

v10

variant_doubleema(src,len) =>

v2 = ema(src, len)

v6 = 2 * v2 - ema(v2, len)

v6

variant_tripleema(src,len) =>

v2 = ema(src, len)

v7 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v7

//calc Laguerre

variant_lag(p,g) =>

L0 = 0.0

L1 = 0.0

L2 = 0.0

L3 = 0.0

L0 := (1 - g)*p+g*nz(L0[1])

L1 := -g*L0+nz(L0[1])+g*nz(L1[1])

L2 := -g*L1+nz(L1[1])+g*nz(L2[1])

L3 := -g*L2+nz(L2[1])+g*nz(L3[1])

f = (L0 + 2*L1 + 2*L2 + L3)/6

f

// return variant, defaults to SMA

variant(type, src, len, g) =>

type=="EMA" ? ema(src,len) :

type=="WMA" ? wma(src,len):

type=="VWMA" ? vwma(src,len) :

type=="SMMA" ? variant_smoothed(src,len) :

type=="DEMA" ? variant_doubleema(src,len):

type=="TEMA" ? variant_tripleema(src,len):

type=="LAGMA" ? variant_lag(src,g) :

type=="HullMA"? wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) :

type=="SSMA" ? variant_supersmoother(src,len) :

type=="ZEMA" ? variant_zerolagema(src,len) :

type=="TMA" ? sma(sma(src,len),len) :

sma(src,len)

// - /variant

// If have anchor specified, calculate the base multiplier.

//mult = isintraday ? anchor==0 or interval<=0 or interval>=anchor or anchor>1440? 1 : round(anchor/interval) : 1

//mult := isdwm? 1 : mult // Only available Daily or less

mult = anchor>0 ? anchor : 1

//

high_ = uRenko? max(close,open) : high

low_ = uRenko? min(close,open) : low

//adjust MA lengths with Anchor Multiplier

//Fast MA Ribbon

emaF1 = variant(typeF1, src, lenF1*mult, gammaF1)

emaF11 = variant(typeF11, src, lenF11*mult,gammaF11)

emafast = (emaF1+emaF11)/2 // Average of Upper and Lower MAs

//

//Slow MA Ribbon

emaS1 = variant(typeS1,src, lenS1*mult,gammaS1)

emaS16 = variant(typeS16, src, lenS16*mult, gammaS16)

emaslow = (emaS1+emaS16)/2 // Average of Upper and Lower MAs

//

// Count crossover candles

xup = 0

xdn = 0

fup = 0

fdn = 0

sup = 0

sdn = 0

//

xup := (emafast-emaslow)>0 and (emafast-emaslow)>(emafast[1]-emaslow[1]) ? nz(xup[1])+1 : 0

xdn := (emafast-emaslow)<0 and (emafast-emaslow)<(emafast[1]-emaslow[1]) ? nz(xdn[1])+1 : 0

fup := (emaF1-emaF11)>0 and (emaF1-emaF11)>(emaF1[1]-emaF11[1]) ? nz(fup[1])+1 : 0

fdn := (emaF1-emaF11)<0 and (emaF1-emaF11)<(emaF1[1]-emaF11[1]) ? nz(fdn[1])+1 : 0

sup := (emaS1-emaS16)>0 and (emaS1-emaS16)>(emaS1[1]-emaS16[1]) ? nz(sup[1])+1 : 0

sdn := (emaS1-emaS16)<0 and (emaS1-emaS16)<(emaS1[1]-emaS16[1]) ? nz(sdn[1])+1 : 0

//Fast EMA Final Color Rules

colFinal = fup>=2 ? aqua : fdn>=2 ? blue : gray

//Slow EMA Final Color Rules

colFinal2 = sup>=2 ? lime : sdn>=2 ? red : gray

//Fast EMA Plots

p1=plot(showRibbons?emaF1:na, title="Fast Ribbon Lower MA", style=line, linewidth=1, color=colFinal,transp=10)

p2=plot(showRibbons?emaF11:na, title="Fast Ribbon Upper MA", style=line, linewidth=1, color=colFinal,transp=10)

plot(showAvgs?emafast:na, title="Fast Ribbon Avg MA", style=circles,join=true, linewidth=1, color=gold,transp=10)

//

fill(p1,p2,color=colFinal, transp=90)

//Slow EMA Plots

p3=plot(showRibbons?emaS1:na, title="Slow Ribbon Lower MA", style=line, linewidth=1, color=colFinal2,transp=10)

p4=plot(showRibbons?emaS16:na, title="Slow Ribbon Upper MA", style=line, linewidth=1, color=colFinal2,transp=10)

plot(showAvgs?emaslow:na, title="Slow Ribbon Avg MA", style=circles,join=true, linewidth=1, color=fuchsia,transp=10)

//

fill(p3,p4, color=colFinal2, transp=90)

// Generate Buy Sell signals,

buy = 0

sell=0

//

buy := xup>=2 and sup>=2 and fup>=2 ? nz(buy[1])>0?buy[1]+1:1 : 0

sell := xdn>=2 and sdn>=2 and fdn>=2 ? nz(sell[1])>0?sell[1]+1 :1 : 0

//

//////////////////////////////////////////////////

//* Put Entry and special Exit conditions here *//

//////////////////////////////////////////////////

//////////////////////////////////////////////////////////////////////////////////////////

//*** This Trade Management Section of code is a modified version of that found in ***//

//*** "How to automate this strategy for free using a chrome extension" by CryptoRox ***//

//*** Modifications made by JustUncleL. ***//

//////////////////////////////////////////////////////////////////////////////////////////

//

///////////////////////////////////////////////

//* Backtesting Period Selector | Component *//

///////////////////////////////////////////////

//* https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

//* https://www.tradingview.com/u/pbergden/ *//

//* Modifications made by JustUncleL*//

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(1, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(1, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => true

///////////////////////////////////////////////

//* Place Entry and Special Exit Logic here *//

///////////////////////////////////////////////

AQUA = #00FFFFFF

BLUE = #0000FFFF

RED = #FF0000FF

LIME = #00FF00FF

GRAY = #808080FF

DARKRED = #8B0000FF

DARKGREEN = #006400FF

// Keep current state until opposite signal detected.

bsState = 0, bsState := nz(bsState[1])

bsState := buy==1 and bsState<=0? 1 :

sell==1 and bsState>=0? -1 :

bsState

//Entry Conditions, when state changes direction.

longLogic = change(bsState) and bsState==1 and (barstate.isconfirmed or barstate.ishistory)

shortLogic = change(bsState) and bsState==-1 and (barstate.isconfirmed or barstate.ishistory)

// Exit on Sell signal

longExitC = 0

shortExitC = 0

longExitC := (emafast<emaslow and close<emaslow)

and (barstate.isconfirmed or barstate.ishistory) ? nz(longExitC[1])+1 : 0

shortExitC := (emafast>emaslow and close>emaslow)

and (barstate.isconfirmed or barstate.ishistory) ? nz(shortExitC[1])+1 : 0

// Exit condition for no SL.

longExit = change(longExitC) and longExitC==1

shortExit = change(shortExitC) and shortExitC==1

//////////////////////////

//* Strategy Component *//

//////////////////////////

fastExit = input(false,title="Use Opposite Trade as a Close Signal")

clrBars = input(true,title="Colour Candles to Trade Order state")

orderType = input("LongsOnly",title="What type of Orders", options=["Longs+Shorts","LongsOnly","ShortsOnly","Flip"])

//

isLong = (orderType != "ShortsOnly")

isShort = (orderType != "LongsOnly")

//

long = longLogic

short = shortLogic

if orderType=="Flip"

long := shortLogic

short := longLogic

////////////////////////////////

//======[ Signal Count ]======//

////////////////////////////////

sectionLongs = 0

sectionLongs := nz(sectionLongs[1])

sectionShorts = 0

sectionShorts := nz(sectionShorts[1])

if long and isLong

sectionLongs := sectionLongs + 1

sectionShorts := 0

if short and isShort

sectionLongs := 0

sectionShorts := sectionShorts + 1

longCondition = (long and isLong)

shortCondition = (short and isShort)

////////////////////////////////

//======[ Entry Prices ]======//

////////////////////////////////

last_open_longCondition = na

last_open_shortCondition = na

last_open_longCondition := longCondition ? close : nz(last_open_longCondition[1])

last_open_shortCondition := shortCondition ? close : nz(last_open_shortCondition[1])

///////////////////////////////////////////////

//======[ Position Check (long/short) ]======//

///////////////////////////////////////////////

last_longCondition = na

last_shortCondition = na

last_longCondition := longCondition ? time : nz(last_longCondition[1])

last_shortCondition := shortCondition ? time : nz(last_shortCondition[1])

in_longCondition = last_longCondition > last_shortCondition

in_shortCondition = last_shortCondition > last_longCondition

/////////////////////////////////

//======[ Trailing Stop ]======//

/////////////////////////////////

isTS = input(true, "Trailing Stop")

ts = input(3.0, "Trailing Stop (%)", minval=0,step=0.1, type=float) /100

last_high = na

last_low = na

last_high_short = na

last_low_long = na

last_high := not in_longCondition ? na : in_longCondition and (na(last_high[1]) or high_ > nz(last_high[1])) ? high_ : nz(last_high[1])

last_high_short := not in_shortCondition ? na : in_shortCondition and (na(last_high[1]) or high_ > nz(last_high[1])) ? high_ : nz(last_high[1])

last_low := not in_shortCondition ? na : in_shortCondition and (na(last_low[1]) or low_ < nz(last_low[1])) ? low_ : nz(last_low[1])

last_low_long := not in_longCondition ? na : in_longCondition and (na(last_low[1]) or low_ < nz(last_low[1])) ? low_ : nz(last_low[1])

long_ts = isTS and not na(last_high) and (low_ <= last_high - last_high * ts) //and (last_high >= last_open_longCondition + last_open_longCondition * tsi)

short_ts = isTS and not na(last_low) and (high_ >= last_low + last_low * ts) //and (last_low <= last_open_shortCondition - last_open_shortCondition * tsi)

///////////////////////////////

//======[ Take Profit ]======//

///////////////////////////////

isTP = input(true, "Take Profit")

tp = input(3.0, "Take Profit (%)",minval=0,step=0.1,type=float) / 100

ttp = input(1.0, "Trailing Profit (%)",minval=0,step=0.1,type=float) / 100

ttp := ttp>tp ? tp : ttp

long_tp = isTP and (last_high >= last_open_longCondition + last_open_longCondition * tp) and (low_ <= last_high - last_high * ttp)

short_tp = isTP and (last_low <= last_open_shortCondition - last_open_shortCondition * tp) and (high_ >= last_low + last_low * ttp)

/////////////////////////////

//======[ Stop Loss ]======//

/////////////////////////////

isSL = input(false, "Stop Loss")

sl = input(3.0, "Stop Loss (%)", minval=0,step=0.1, type=float) / 100

long_sl = isSL and (low_ <= last_open_longCondition - last_open_longCondition * sl)

short_sl = isSL and (high_ >= last_open_shortCondition + last_open_shortCondition * sl)

////////////////////////////////////

//======[ Stop on Opposite ]======//

////////////////////////////////////

//NOTE Short exit signal is non-repainting, no need to force it, if Pyramiding keep going

long_sos = (fastExit or (not isTS and not isSL)) and longExit

short_sos = (fastExit or (not isTS and not isSL)) and shortExit

/////////////////////////////////

//======[ Close Signals ]======//

/////////////////////////////////

// Create a single close for all the different closing conditions, all conditions here are non-repainting

longClose = isLong and (long_tp or long_sl or long_ts or long_sos) and not longCondition

shortClose = isShort and (short_tp or short_sl or short_ts or short_sos) and not shortCondition

in_closeLong = longClose

in_closeLong := not isLong? false : longClose ? true : longCondition? false : in_closeLong[1]

in_closeShort = shortClose

in_closeShort := not isShort? false : shortClose ? true : shortCondition? false : in_closeShort[1]

///////////////////////////////

//======[ Plot Colors ]======//

///////////////////////////////

longCloseCol = na

shortCloseCol = na

longCloseCol := long_tp ? green : long_sl ? maroon : long_ts ? purple : long_sos ? orange :longCloseCol[1]

shortCloseCol := short_tp ? green : short_sl ? maroon : short_ts ? purple : short_sos ? orange : shortCloseCol[1]

//

tpColor = isTP and in_longCondition ? lime : isTP and in_shortCondition ? lime : na

slColor = isSL and in_longCondition ? red : isSL and in_shortCondition ? red : na

//////////////////////////////////

//======[ Strategy Plots ]======//

//////////////////////////////////

plot(isTS and in_longCondition and isLong and not in_closeLong?

last_high - last_high * ts : na, "Long Trailing", fuchsia, style=2, linewidth=2,offset=1)

plot(isTP and in_longCondition and isLong and not in_closeLong and last_high < last_open_longCondition + last_open_longCondition * tp ?

last_open_longCondition + last_open_longCondition * tp : na, "Long TP Active", tpColor, style=3,join=false, linewidth=2,offset=1)

plot(isTP and in_longCondition and isLong and not in_closeLong and last_high >= last_open_longCondition + last_open_longCondition * tp ?

last_high - last_high * ttp : na, "Long Trailing", black, style=2, linewidth=2,offset=1)

plot(isSL and in_longCondition and isLong and not in_closeLong and last_low_long > last_open_longCondition - last_open_longCondition * sl ?

last_open_longCondition - last_open_longCondition * sl : na, "Long SL", slColor, style=3,join=false, linewidth=2,offset=1)

//

plot(isTS and in_shortCondition and isShort and not in_closeShort?

last_low + last_low * ts : na, "Short Trailing", fuchsia, style=2, linewidth=2,offset=1)

plot(isTP and in_shortCondition and isShort and not in_closeShort and last_low > last_open_shortCondition - last_open_shortCondition * tp ?

last_open_shortCondition - last_open_shortCondition * tp : na, "Short TP Active", tpColor, style=3,join=false, linewidth=2,offset=1)

plot(isTP and in_shortCondition and isShort and not in_closeShort and last_low <= last_open_shortCondition - last_open_shortCondition * tp ?

last_low + last_low * ttp : na, "Short Trailing", black, style=2, linewidth=2,offset=1)

plot(isSL and in_shortCondition and isShort and not in_closeShort and last_high_short < last_open_shortCondition + last_open_shortCondition * sl ?

last_open_shortCondition + last_open_shortCondition * sl : na, "Short SL", slColor, style=3,join=false, linewidth=2,offset=1)

//

bclr = not clrBars ? na : in_closeLong and in_closeShort ? GRAY :

in_longCondition and not in_closeLong and isLong ? close<last_open_longCondition? DARKGREEN : LIME :

in_shortCondition and not in_closeShort and isShort ? close>last_open_shortCondition? DARKRED : RED : GRAY

barcolor(bclr,title="Trade State Bar Colouring")

///////////////////////////////

//======[ Alert Plots ]======//

///////////////////////////////

//plotshape(longCondition?close:na, title="Long", color=green, textcolor=green, transp=0,

// style=shape.triangleup, location=location.belowbar, size=size.small,text="LONG",offset=0)

//plotshape(longClose and not in_closeLong[1]?close:na, title="Long Close", color=longCloseCol, textcolor=white, transp=0,

// style=shape.labeldown, location=location.abovebar, size=size.small,text="Long\nClose",offset=0)

//plotshape(shortCondition?close:na, title="Short", color=red, textcolor=red, transp=0,

// style=shape.triangledown, location=location.abovebar, size=size.small,text="SHORT",offset=0)

//plotshape(shortClose and not in_closeShort[1]?close:na, title="Short Close", color=shortCloseCol, textcolor=white, transp=0,

// style=shape.labelup, location=location.belowbar, size=size.small,text="Short\nClose",offset=0)

// Autoview alert syntax - This assumes you are trading coins BUY and SELL on Binance Exchange

// WARNING*** Only use Autoview to automate a strategy after you've sufficiently backtested and forward tested the strategy.

// You can learn more about the syntax here:

// http://autoview.with.pink/#syntax and you can watch this video here: https://www.youtube.com/watch?v=epN5Tjinuxw

// For the opens you will want to trigger BUY orders on LONGS (eg ETHBTC) with alert option "Once Per Bar Close"

// and SELL orders on SHORTS (eg BTCUSDT)

// b=buy q=0.001 e=binance s=ethbtc t=market ( LONG )

// or b=sell q=0.001 e=binance s=btcusdt t=market ( SHORT )

//alertcondition(longCondition, "Open Long", "LONG")

//alertcondition(shortCondition, "Open Short", "SHORT")

// For the closes you will want to trigger these alerts on condition with alert option "Once Per Bar"

// (NOTE: with Renko you can only use "Once Per Bar Close" option)

// b=sell q=99% e=binance s=ethbtc t=market ( CLOSE LONGS )

// or b=buy q=99% e=binance s=btcusdt t=market ( CLOSE SHORTS )

// This gets it as it happens and typically results in a better exit live than in the backtest.

// It works really well for counteracting some market slippage

//alertcondition(longClose and not in_closeLong[1], "Close Longs", "CLOSE LONGS")

//alertcondition(shortClose and not in_closeShort[1], "Close Shorts", "CLOSE SHORTS")

////////////////////////////////////////////

//======[ Strategy Entry and Exits ]======//

////////////////////////////////////////////

if testPeriod() and isLong

strategy.entry("Long", 1, when=longCondition)

strategy.close("Long", when=longClose and not in_closeLong[1])

if testPeriod() and isShort

strategy.entry("Short", 0, when=shortCondition)

strategy.close("Short", when=shortClose and not in_closeShort[1])

// --- Debugs

//plotchar(longExit,location=location.bottom)

//plotchar(longCondition,location=location.bottom)

//plotchar(in_longCondition,location=location.bottom)

//plotchar(longClose,location=location.bottom)

//plotchar(in_closeLong,location=location.bottom)

// --- /Debugs

///////////////////////////////////

//======[ Reset Variables ]======//

///////////////////////////////////

if longClose or not in_longCondition or not isLong

last_high := na

last_high_short := na

sectionLongs := 0

if longClose and isLong and not in_closeLong[1] and bsState==1

bsState := 0

if shortClose or not in_shortCondition or not isShort

last_low := na

last_low_long := na

sectionShorts := 0

if shortClose and isShort and not in_closeShort[1] and bsState==-1

bsState := 0

//plotchar(bsState,location=location.bottom)

// EOF