概述

该策略运用布林带指标判断价格是否处于整合期,以及使用突破判断入场和出场。整体来说,该策略主要利用价格整合带来的剧烈行情进行获利。

策略原理

该策略首先计算20日内的收盘价的简单移动平均线作为布林带的中轨,并计算标准差的2倍作为布林带的带宽。当价格高于上轨时判定为突破上轨,当价格低于下轨时判定为突破下轨。

当价格位于布林带中轨上下时,判断为整合期。当检测到突破信号时,做多头入场。当再次突破下轨时,平仓。做空同理。

止损设定为ATR指标的2倍。

优势分析

该策略主要依赖布林带的整合与突破属性,具有以下优势:

- 利用价格整合带来的剧烈行情,潜在获利空间大

- 布林带指标直观,参数优化简单

- 随大趋势运行,避免追顶杀跌

风险分析

该策略也存在一些风险:

- 突破信号可能出现假突破,造成亏损

- 止损设置过大,单笔亏损扩大

- 布林带参数设置不当,失去指标效用

对策:

- 结合价量指标过滤假突破

- 优化止损区间,降低单笔亏损

- 测试不同布林带参数,选择最优参数

优化方向

该策略可以从以下几个方向进行优化:

- 整合判定规则可以引入更多指标,避免错误信号

- 增加趋势过滤,根据趋势方向决定做多做空

- 增加止损方式,如追踪止损等,更好控制风险

总结

该策略整体较为简单直接,通过捕捉价格整合带来的能量聚集实现较大盈利。优化空间较大,可从入场规则、止损方式等方面进行调整,在控制风险的前提下获得更稳定收益。

策略源码

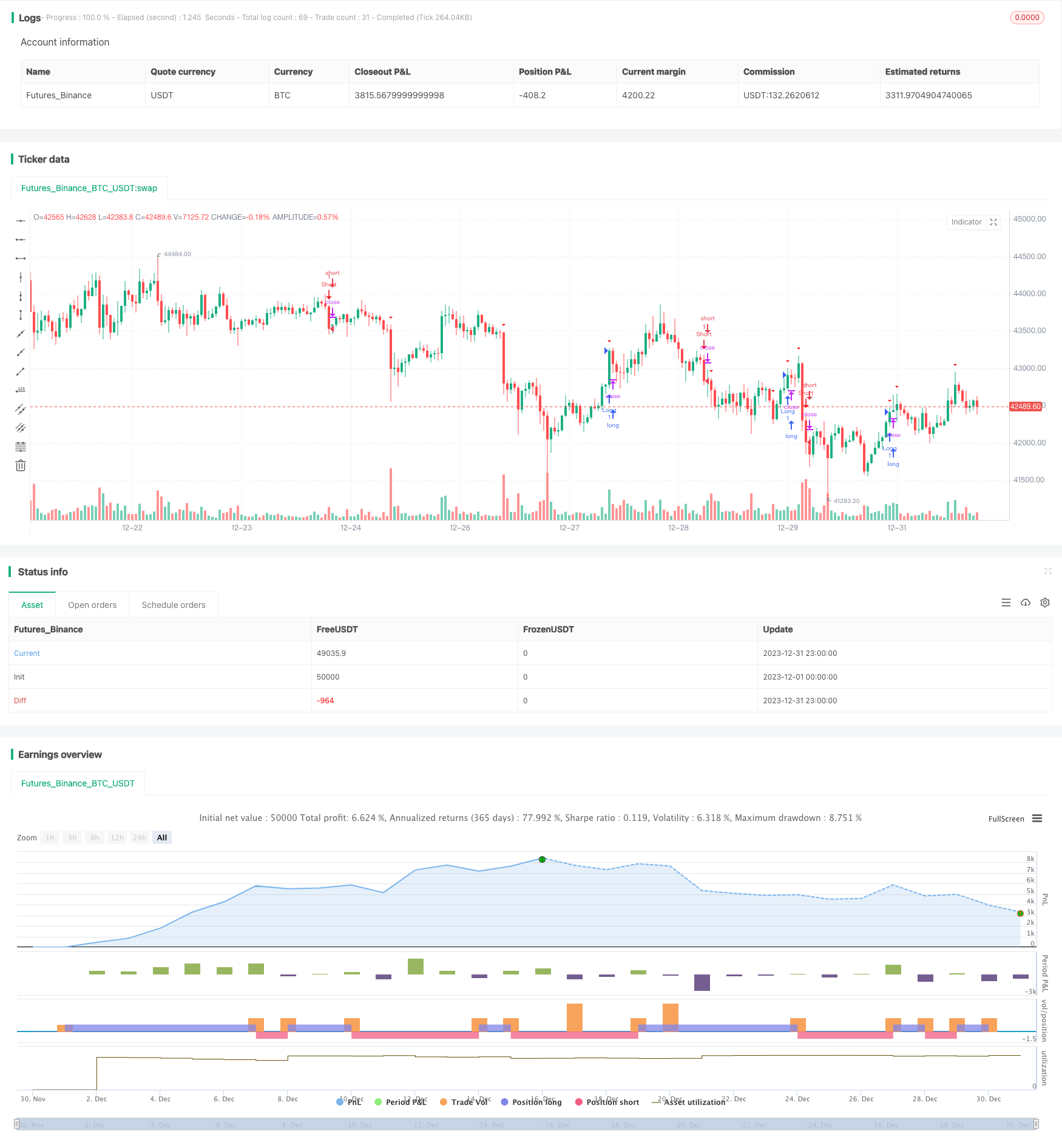

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Consolidation Breakout Strategy", shorttitle="CBS", overlay=true)

// Parameters

length = input(20, title="Bollinger Bands Length")

mult = input(2.0, title="Bollinger Bands Multiplier")

risk = input.float(1, title="Risk per Trade (%)") / 100

// Calculate Bollinger Bands

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper = basis + dev

lower = basis - dev

// Entry Conditions

consolidating = ta.crossover(close, upper) and ta.crossunder(close, lower)

// Exit Conditions

breakout = ta.crossover(close, upper) or ta.crossunder(close, lower)

// Risk Management

atrVal = ta.atr(14)

stopLoss = atrVal * input.float(2, title="Stop Loss Multiplier", minval=0.1, maxval=5)

// Entry and Exit Conditions

longEntry = breakout and close > upper

shortEntry = breakout and close < lower

if (longEntry)

strategy.entry("Long", strategy.long)

if (shortEntry)

strategy.entry("Short", strategy.short)

if (longEntry and close < basis - stopLoss)

strategy.close("Long Exit")

if (shortEntry and close > basis + stopLoss)

strategy.close("Short Exit")

// Plot Entry and Exit Points

plotshape(consolidating, style=shape.triangleup, location=location.belowbar, color=color.rgb(30, 255, 0), title="Entry Signal")

plotshape(breakout, style=shape.triangledown, location=location.abovebar, color=color.rgb(255, 0, 0), title="Exit Signal")