概述

这是一个利用RSI指标判断趋势并设置止损止盈的量化交易策略。该策略结合 RSI 指标判断市场趋势方向,以及设置动态止损止盈来锁定利润,最大程度减少风险。

策略原理

该策略主要通过 RSI 指标判断市场趋势方向来决定做多做空。当 RSI 指标上穿低位线时判断为市场处于上升趋势,做多;当 RSI 指标下穿高位线时判断为市场处于下降趋势,做空。

同时,策略通过追踪每单的开仓价格,设定浮动止损止盈。对做多单设定开仓价格的一定比例作为止损线,做空单则设定开仓价格的一定比例作为止盈线。当价格触碰止损止盈线时,策略会自动平仓止损或止盈。

策略优势

- 利用 RSI 指标判断市场趋势方向,避免交易盘整区间;

- 设定浮动止损止盈,能够灵活锁定利润,有效控制风险;

- RSI 参数和止损止盈比例都可以通过外部输入进行调整优化。

策略风险

- RSI 指标存在一定滞后,可能错过短期趋势转换点;

- 止损止盈线过于靠近可能被突破清仓。

优化方向

- 可以测试不同周期的 RSI 指标判断效果;

- 可以测试不同的参数组合寻找最佳止损止盈比例;

- 可以加入附加指标判断过滤信号。

总结

该策略整体来说是一个利用 RSI 指标追踪趋势,并配套浮动止损止盈的量化交易策略。相比单一指标交易策略,该策略在控制风险方面做得较好,可以有效锁定利润。通过参数优化和加入辅助指标判断可以进一步提高策略表现。

策略源码

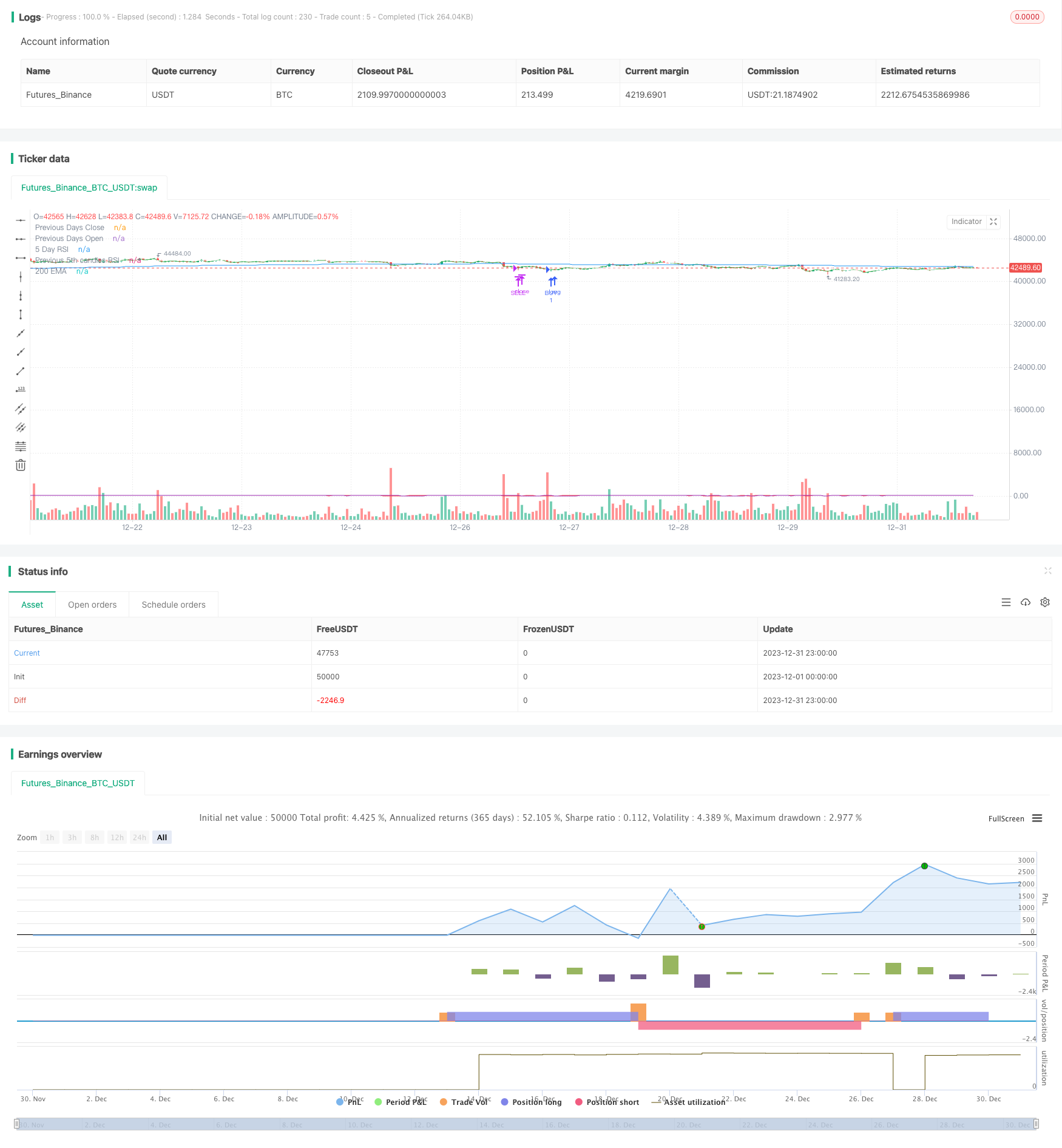

/*backtest

start: 2023-12-01 00:00:00

end: 2023-12-31 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// ©chewyScripts.

//@version=5

strategy("96er RSI+200EMA Strategy + Alerts", overlay=true, shorttitle = "The old 96er - RSI5 + 200 EMA")

//,use_bar_magnifier=false

// This works best on a small account $100, with 50% of equity and up to 10 max open trades.

// 96% Profitable, turns $100 into $350 in 1 month. very few losses. super happy with it.

// So far it triples the account on a 1m chart in 1 month back testing on the SEI-USD pair.

// I did not test on FX pairs or other instruments.

// had some issues with the inputs not working so had to hard code some, also the lastClose var sometimes breaks and starts following every candle, not sure why.

in_r1 = input.int(8,"5 day input or RSI1", group = "Signals")

in_lowerRSI = input.int(28,"RSI Lower", group = "Signals")

in_upperRSI = input.int(72,"RSI Upper ", group = "Signals")

in_emaperiod = input.int(200,"EMA Period", group = "Signals")

in_daysback = input.int(1,"Look back days for close/open", group = "Signals")

in_openOrders = input.int(5,"max open orders",tooltip = "Be careful, to high and you will get margin called!! 5 is probably the highest you should go", group = "Order Controls")

in_buybreakout = input.int(40,"Buy breakout range", group = "Order Controls")

in_buyTP = input.float(1.1500,"Buy TP: 1+TP %, .05 seems to work well.", group = "TPSL")

in_sellTP = input.float(0.9750, "Sell TP: 1-TP%. .025 seems to work well. ", group = "TPSL")

in_useAlerts = input.bool(false,"Turns on Buy/Sell Alerts",group = "Alerts")

in_useCustomAlertMSG = input.bool(false,"Use default Buy/Sell or the messages below",group = "Alerts")

in_alertBuySignalTxt = input("Buy","Buy signal API/TXT message template", tooltip = "Review the UserGuid on JSON varibles in alerts", group = "Alerts")

in_alertSellSignalTxt = input("Sell","Sell signal API/TXT message template", tooltip = "Review the UserGuid on JSON varibles in alerts", group = "Alerts")

simple int rsi5 = in_r1

// 3 rsi strategy , when all of them are overbought we sell, and vice versa

rsi7 = ta.rsi(close,rsi5)

[lastOpen, lastClose] = request.security(syminfo.tickerid, "D", [open,close], lookahead = barmerge.lookahead_on)

rsi3 = ta.rsi(close[5],rsi5)

ma = ta.ema(close,in_emaperiod)

plot(rsi7,"5 Day RSI",color.red)

plot(lastClose,"Previous Days Close",color.green)

plot(lastOpen,"Previous Days Open",color.white)

plot(rsi3,"Previous 5th candles RSI",color.purple)

plot(ma,"200 EMA",color.blue)

//sell = ta.crossunder(rsi7,70) and ta.crossunder(rsi14,70) and ta.crossunder(rsi21,70)

//buy = ta.crossover(rsi7,in_lowerRSI) and close < ma and rsi3 <= in_upperRSI and strategy.opentrades < in_openOrders

//sell = ta.crossunder(rsi7,in_upperRSI) and close > ma and rsi3 >= in_lowerRSI3 and strategy.opentrades < in_openOrders

//buy condition

buy = ta.crossover(rsi7,in_lowerRSI) and close < ma and close < lastClose and strategy.opentrades < in_openOrders

// sell condition

sell = ta.crossunder(rsi7,in_upperRSI) and close > ma and close > lastClose and strategy.opentrades < in_openOrders

var lastBuy = close

var lastSell = close

//var buyLabel = label.new(na,na,yloc = yloc.belowbar, style = label.style_none, textcolor = color.green, size = size.normal)

//var sellLabel = label.new(na,na,yloc = yloc.abovebar, style = label.style_none, textcolor = color.red, size = size.normal)

if (buy)

strategy.entry("BUY", strategy.long,alert_message = "Buy @"+str.tostring(close))

lastBuy := close

//buyLabel := label.new(na,na,yloc = yloc.belowbar, style = label.style_none, textcolor = color.green, size = size.normal)

//label.set_x(buyLabel,bar_index)

//label.set_y(buyLabel,low)

//label.set_text(buyLabel,"Buy!!@ " +str.tostring(lastBuy) + "\n TP: " + str.tostring(lastBuy*in_buyTP) + "\n↑")

if(not in_useAlerts)

alert("Buy")

//label.delete(buyLabel)

if ((close >= lastBuy*in_buyTP ) or (rsi7 > in_buybreakout) and close >= lastClose and (close >= lastClose*in_buyTP or close >= lastBuy*in_buyTP ) )

//label.new(bar_index,na,"TP!!@ " +str.tostring(close), yloc = yloc.abovebar, style = label.style_none, textcolor = color.green, size = size.normal)

strategy.close("BUY", "BUY Exit",alert_message = "Buy Exit: TP @" +str.tostring(close) + " OR TP: " + str.tostring(lastBuy*in_buyTP))

if(not in_useAlerts)

alert("Buy Exit")

if (sell)

strategy.entry("SELL", strategy.short, alert_message = "Sell @ " + str.tostring(close))

lastSell := close

//sellLabel := label.new(na,na,yloc = yloc.abovebar, style = label.style_none, textcolor = color.red, size = size.normal)

//label.set_x(sellLabel,bar_index)

//label.set_y(sellLabel,high)

//label.set_text(sellLabel,"Sell!!@ " +str.tostring(lastSell) + "\n TP: " + str.tostring(lastSell*in_sellTP) + "\n🠇")

if(not in_useAlerts)

alert("Sell")

//label.delete(sellLabel)

if ( close < ma and (close <= lastSell*in_sellTP ) or (close < lastClose*in_sellTP) )

//label.new(bar_index,na,"TP!!@ " +str.tostring(close), yloc = yloc.belowbar, style = label.style_none, textcolor = color.red, size = size.normal)

strategy.close("SELL", "Sell Exit", alert_message = "Sell Exit TP @" +str.tostring(close) + " OR TP: " + str.tostring(lastSell*in_sellTP))

if(not in_useAlerts)

alert("Sell Exit")

alertcondition(buy and in_useAlerts,"Buy Alert","test")