概述

本策略通过计算不同类型的均线(简单移动平均线SMA、指数移动平均线EMA、Hull移动平均线HMA和量加权移动平均线VWMA)并寻找其交叉点,来判断行情趋势并进行趋势跟随。当较短期均线从下方上穿较长期均线时生成买入信号;当较短期均线从上方下穿较长期均线时生成卖出信号。

策略原理

本策略主要通过比较两条不同均线之间的关系来判断行情走势。具体来说,通过输入参数设置两条均线的类型和长度。其中第一条均线长度较长,代表了长期趋势;第二条均线长度较短,代表了当前短期趋势。

当短期均线从下方穿过长期均线时,代表短期趋势变强,行情进入上涨趋势,因此在这个交叉点发出买入信号。反之,当短期均线从上方穿过长期均线时,代表短期趋势变弱,行情进入下跌趋势,因此在这个交叉点发出卖出信号。

通过这样的均线交叉判断来跟随市场趋势进行交易。

策略优势

- 利用均线交叉判断主要趋势,是一种经典且实用的技术指标

- 支持多种不同类型的均线组合,灵活性高

- 策略逻辑简单清晰,容易理解实现,适合量化交易的自动化

- 可配置参数灵活,适用于不同市场环境

风险分析

- 均线具有滞后性,交叉信号发出时,价格运动可能已经发生或者接近反转点,存在一定的滞后误报风险

- 趋势判断可能发生误判,从而导致不必要的亏损

- 需要合理配置均线参数,不同的参数可能导致结果差异很大

风险解决方法:

- 适当缩短均线周期,提升对市场变化的敏感性

- 结合其他指标进行验证,避免误判

- 参数优化方法:遍历、机器学习、遗传算法等

- 适当控制仓位规模和止损点

策略优化方向

- 增加其他指标过滤器,结合多个指标判断,提高决策准确性

- 根据市场环境自动调整均线参数

- 结合机器学习算法自动寻优参数

- 优化止损策略

总结

本策略基于均线交叉判断主要趋势的经典思路,通过不同均线的组合灵活应用。策略逻辑简单,容易实现,适合自动化交易。总体来说,本策略具有一定的实用性,但也存在一些改进优化的空间。通过参数优化、增加其他过滤器判断等方法,可以不断提升策略表现。

策略源码

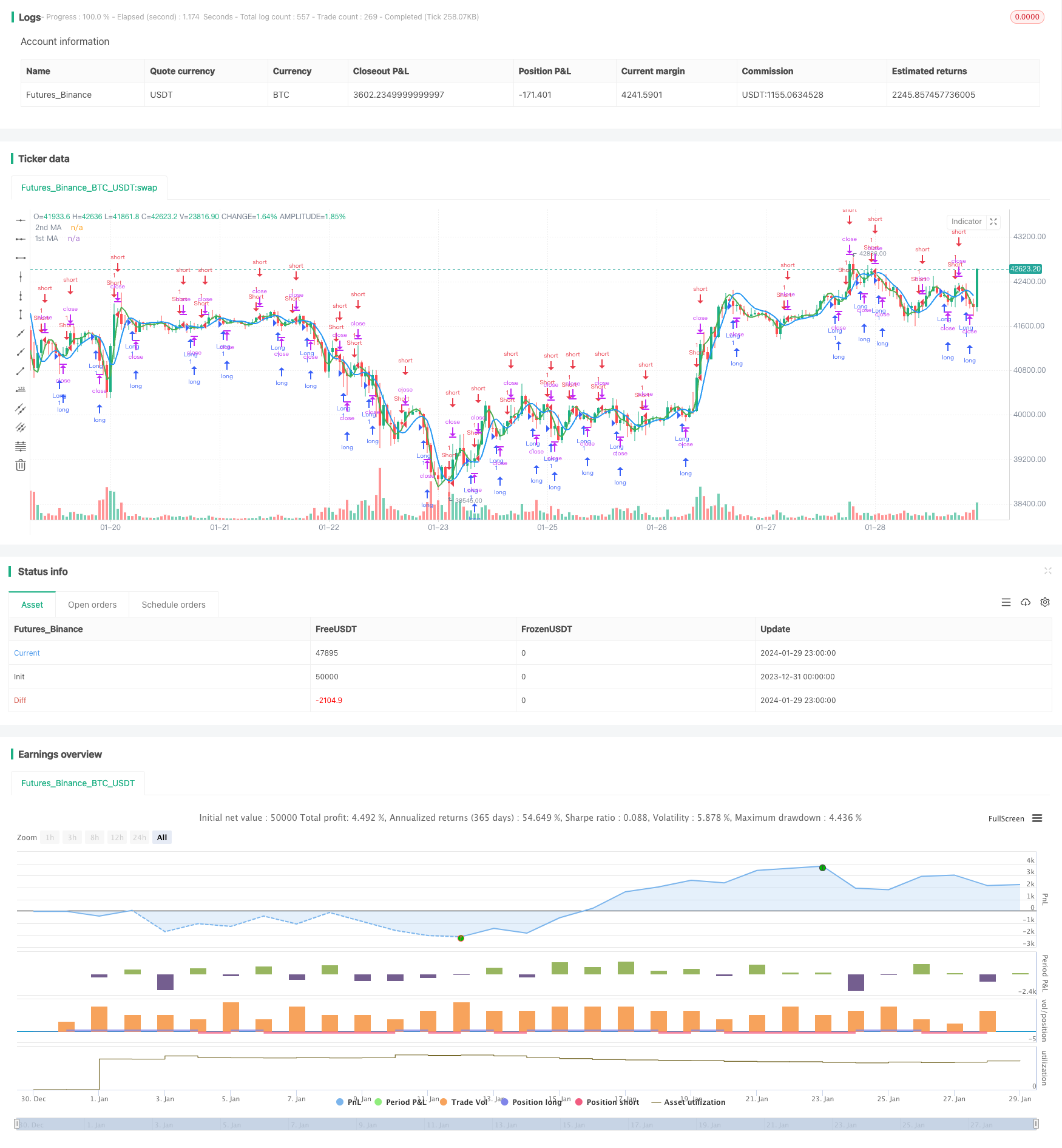

/*backtest

start: 2023-12-31 00:00:00

end: 2024-01-30 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

//study(title="MA Crossover Strategy", overlay = true)

strategy("MA Crossover Strategy", overlay=true)

src = input(close, title="Source")

price = request.security(syminfo.tickerid, timeframe.period, src)

ma1 = input(25, title="1st MA Length")

type1 = input("HMA", "1st MA Type", options=["SMA", "EMA", "HMA", "VWMA"])

ma2 = input(7, title="2nd MA Length")

type2 = input("HMA", "2nd MA Type", options=["SMA", "EMA", "HMA", "VWMA"])

f_hma(_src, _length)=>

_return = wma((2*wma(_src, _length/2))-wma(_src, _length), round(sqrt(_length)))

price1 = if (type1 == "SMA")

sma(price, ma1)

else

if (type1 == "EMA")

ema(price, ma1)

else

if (type1 == "VWMA")

vwma(price, ma1)

else

f_hma(price, ma1)

price2 = if (type2 == "SMA")

sma(price, ma2)

else

if (type2 == "EMA")

ema(price, ma2)

else

if (type2 == "VWMA")

vwma(price, ma2)

else

f_hma(price, ma2)

//plot(series=price, style=line, title="Price", color=black, linewidth=1, transp=0)

plot(series=price1, style=line, title="1st MA", color=blue, linewidth=2, transp=0)

plot(series=price2, style=line, title="2nd MA", color=green, linewidth=2, transp=0)

longCondition = crossover(price1, price2)

if (longCondition)

strategy.entry("Long", strategy.long)

shortCondition = crossunder(price1, price2)

if (shortCondition)

strategy.entry("Short", strategy.short)