概述

本策略通过融合吞噬K线形态识别、震荡指标、均线指标、供需区等多种量化技术指标,实现对趋势的精确判断和跟踪交易。该策略广泛运用了量化交易的专业术语和标准模型,通过多指标综合判断提高决策的准确性,有效控制风险。

策略原理

本策略的核心逻辑基于对吞噬形态K线的识别,以捕捉市场的迹象反转。当出现多头吞噬形态时,close[1] > open[1] and open < close and close > open[1] and open[1] > close[1],买入信号触发;出现空头吞噬形态时,close[1] < open[1] and open > close and close < open[1] and open[1] < close[1],卖出信号触发。

此外,策略还引入了20周期的需求区和供给区指标,当close突破供给区时判断为多头信号,突破需求区则为空头信号。EMA均线被用来判断趋势方向,只有close突破EMA才产生交易信号。而通过查找枢轴点的震荡指标fractal,辅助确定反转的时间点。

综上,该策略通过吞噬形态判断潜在反转,并用均线、供需区等滤波和确认,最终仅在高概率点发出信号,从而准确跟踪趋势,避免被震荡市耗尽资金。

优势分析

这是一个非常专业和高级的趋势跟踪策略,主要有以下优势:

- 多指标组合,提高判断准确性,有效过滤假信号

- 吞噬形态判断反转迹象,捕捉转折点

- 结合趋势、震荡等指标,判断高概率交易点

- 自动绘制形态、指标,清晰可读

- 简洁的策略逻辑,易扩展和优化

总体来说,该策略准确性高、风险控制好,适合追踪中长线趋势,可以获得稳定收益。

风险分析

尽管该策略有许多优点,但仍存在一些潜在风险需要注意:

- 吞噬形态识别不准确,可能漏掉真实反转或者产生假信号

- 均线系统发出错误信号的概率存在,可能追高杀低

- 需求区和供给区范围设置不当,增加了不必要的交易

- 优化空间有限,雪崩风险较高

对策为: 1. 反转形态可引入机器学习等方法提升识别准确率 2. 增加趋势暴力的判断指标,避免不必要损失 3. 动态优化需求区和供给区参数 4. 合理评估和控制风险,调整仓位规模

优化方向

本策略还有进一步优化的空间:

- 增加基于机器学习的形态识别模块,利用AI判断吞噬和反转信号

- 引入更多滤波指标,如BOLL通道、MACD等判断入市时机

- 增加止损策略,如移动止损、时间止损等

- 动态优化指标参数,适应不同品种和市场环境

- 结合高级策略,如追踪止损、马丁格尔等管理资金曲线

通过以上优化,可以获得更准确判断,更低的风险,更顺畅的收益曲线。

总结

本策略总体来说非常专业和高效,充分运用了量化交易的多种指标和模型对市场变化进行判断,通过吞噬形态捕捉反转信号,配合趋势、震荡指标发出高概率交易信号,可以有效跟踪中长线趋势,获得稳定收益。同时也需要注意一定的风险,通过持续优化和严格的资金管理,可以大幅降低风险,使策略更加可靠。该策略有很强的实用性和扩展性,适合有一定量化基础的交易者使用。

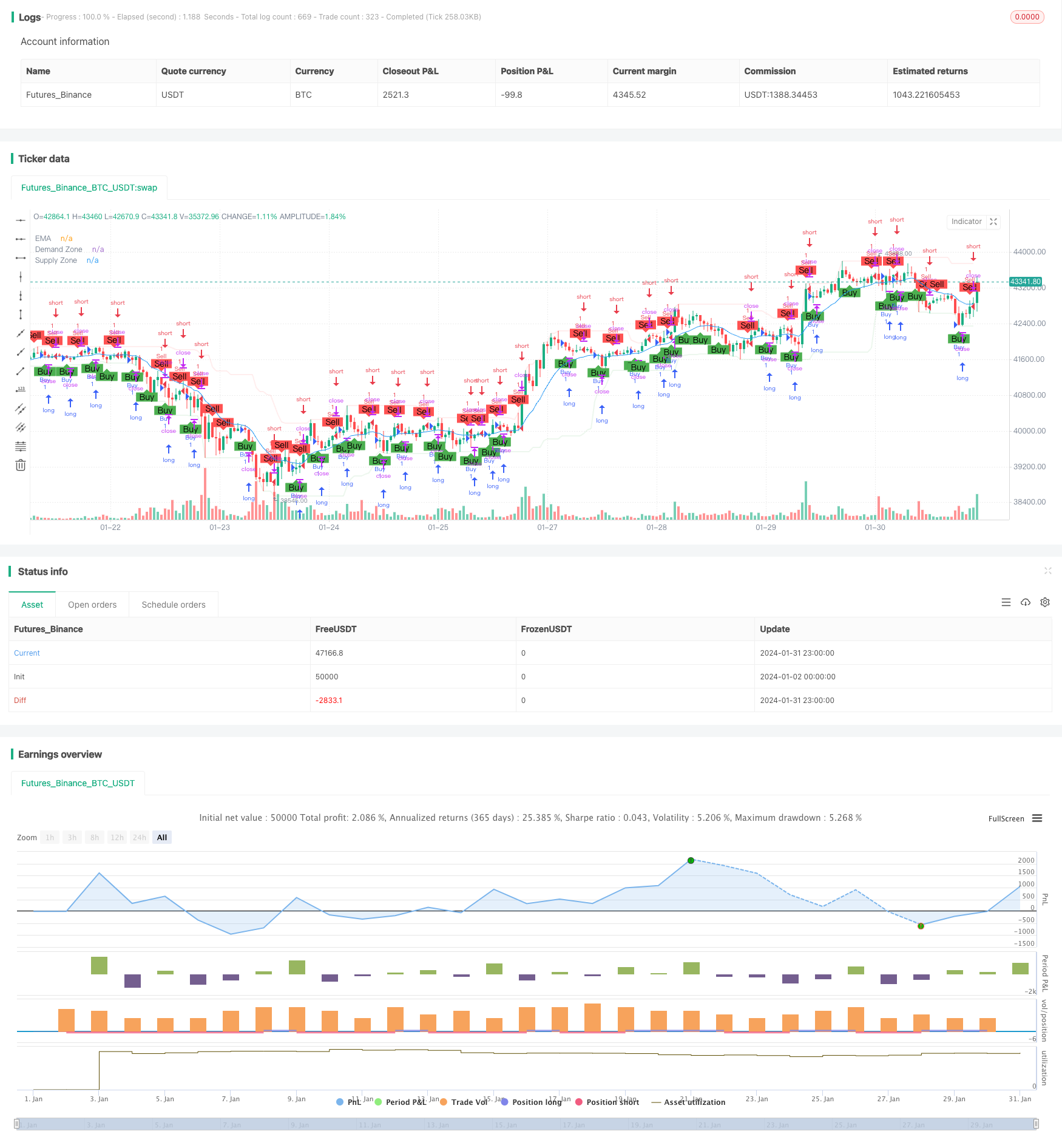

/*backtest

start: 2024-01-02 00:00:00

end: 2024-02-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Engulfing Candles with Fractals, Moving Average, Demand & Supply", overlay=true)

// Input parameters

emaLength = input(14, title="EMA Length")

demandSupplyLength = input(20, title="Demand & Supply Length")

// Calculate EMA

emaValue = ta.ema(close, emaLength)

// Calculate Demand and Supply Zones

demandZone = ta.lowest(low, demandSupplyLength)

supplyZone = ta.highest(high, demandSupplyLength)

// Plot Demand and Supply Zones

plot(demandZone, color=color.new(color.green, 90), linewidth=2, title="Demand Zone")

plot(supplyZone, color=color.new(color.red, 90), linewidth=2, title="Supply Zone")

// Determine Engulfing Candles

bullishEngulfing = close[1] > open[1] and open < close and close > open[1] and open[1] > close[1]

bearishEngulfing = close[1] < open[1] and open > close and close < open[1] and open[1] < close[1]

// Plot Engulfing Candle Bars

bgcolor(bullishEngulfing ? color.new(color.green, 90) : na)

bgcolor(bearishEngulfing ? color.new(color.red, 90) : na)

// Plot Moving Average

plot(emaValue, color=color.blue, title="EMA")

// Fractal Indicator

fractalUp = ta.pivothigh(high, 2, 2)

fractalDown = ta.pivotlow(low, 2, 2)

// Plot Buy and Sell Fractals

plotshape(series=fractalUp, title="Buy Fractal", location=location.belowbar, color=color.green, style=shape.labelup, text="Buy")

plotshape(series=fractalDown, title="Sell Fractal", location=location.abovebar, color=color.red, style=shape.labeldown, text="Sell")

// Strategy logic

buySignal = bullishEngulfing and close > emaValue and close > supplyZone

sellSignal = bearishEngulfing and close < emaValue and close < demandZone

// Execute strategy

if (fractalUp)

strategy.entry("Buy", strategy.long)

if (fractalDown)

strategy.entry("Sell", strategy.short)

// Plot strategy entry points on the chart

plotshape(series=buySignal ? 1 : na, title="Buy Signal", color=color.green, style=shape.triangleup, location=location.belowbar, size=size.small)

plotshape(series=sellSignal ? 1 : na, title="Sell Signal", color=color.red, style=shape.triangledown, location=location.abovebar, size=size.small)