概述

该策略是一种适用于加密货币市场的简单移动平均线(SMA)交叉策略。它利用快速、中速和慢速三组SMA来识别潜在的入市和出场信号。当快速SMA上穿中速SMA时,产生买入信号;当快速SMA下穿中速SMA时,产生卖出信号。

策略原理

参数设置

策略允许交易者设置以下关键参数:

- 价格数据源:收盘价或其他价格

- 是否考虑不完整K线

- SMA预测方法:平移预测或线性回归预测

- 快速SMA长度:默认7

- 中速SMA长度:默认30

- 慢速SMA长度:默认50

- 账户资金

- 每笔交易风险比例

SMA计算

根据用户设置的SMA长度,分别计算出快速SMA、中速SMA和慢速SMA。

交易信号

当快速SMA上穿中速SMA时,产生买入信号;当快速SMA下穿中速SMA时,产生卖出信号。

风险和仓位管理

策略结合账户资金和每笔交易承受的风险比例,计算出每笔交易的名义本金。再结合ATR来计算止损幅度,最终确定每笔交易的具体仓位。

优势分析

- 使用多组SMA识别趋势,判断力更强

- SMA预测方法可选,适应性更强

- 交易信号简单清晰,容易实施

- 整合风险和仓位管理,更科学

风险分析

- SMA本身滞后性会错过价格反转点

- 仅考虑技术指标,没有结合基本面

- 未考虑突发事件的影响

可以通过适当缩短SMA周期、辅助其他指标等方式来优化。

优化方向

- 结合其他指标过滤误信号

- 加入基本面判断

- 优化SMA周期参数

- 优化风险和仓位计算参数

总结

本策略整合了SMA交叉判断、风险管理和仓位优化多项功能,是一种适合加密市场的趋势跟踪策略。交易者可以根据自己的交易风格、市场环境等因素调整参数,实施优化。

策略源码

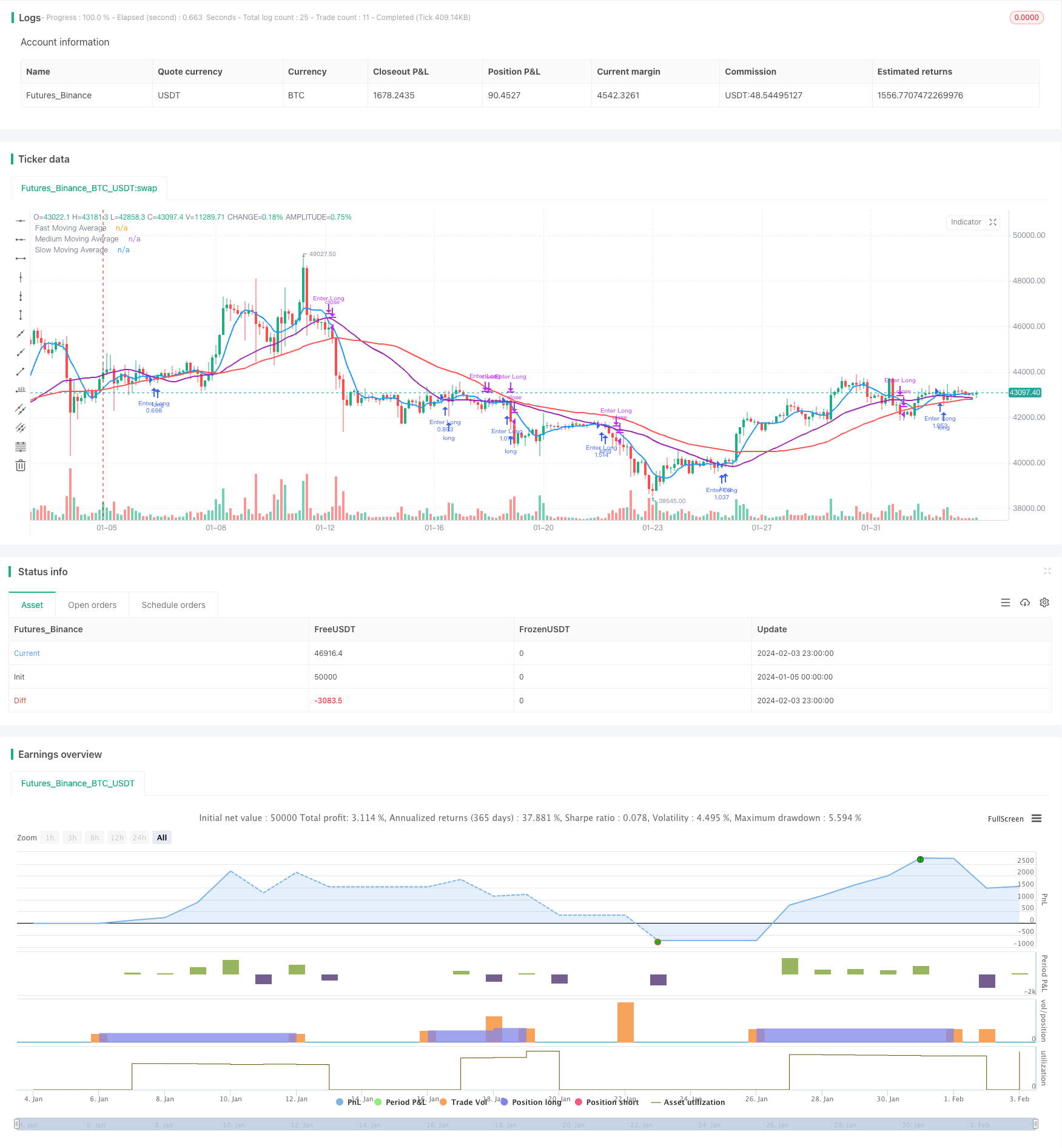

/*backtest

start: 2024-01-05 00:00:00

end: 2024-02-04 00:00:00

period: 3h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Onchain Edge Trend SMA Strategy", overlay=true, default_qty_type=strategy.percent_of_equity, default_qty_value=10)

// Configuration Parameters

priceSource = input(close, title="Price Source")

includeIncompleteBars = input(true, title="Consider Incomplete Bars")

maForecastMethod = input(defval="flat", options=["flat", "linreg"], title="Moving Average Prediction Method")

linearRegressionLength = input(3, title="Linear Regression Length")

fastMALength = input(7, title="Fast Moving Average Length")

mediumMALength = input(30, title="Medium Moving Average Length")

slowMALength = input(50, title="Slow Moving Average Length")

tradingCapital = input(100000, title="Trading Capital")

tradeRisk = input(1, title="Trade Risk (%)")

// Calculation of Moving Averages

calculateMA(source, period) => sma(source, period)

predictMA(source, forecastLength, regressionLength) =>

maForecastMethod == "flat" ? source : linreg(source, regressionLength, forecastLength)

offset = includeIncompleteBars ? 0 : 1

actualSource = priceSource[offset]

fastMA = calculateMA(actualSource, fastMALength)

mediumMA = calculateMA(actualSource, mediumMALength)

slowMA = calculateMA(actualSource, slowMALength)

// Trading Logic

enterLong = crossover(fastMA, mediumMA)

exitLong = crossunder(fastMA, mediumMA)

// Risk and Position Sizing

riskCapital = tradingCapital * tradeRisk / 100

lossThreshold = atr(14) * 2

tradeSize = riskCapital / lossThreshold

if (enterLong)

strategy.entry("Enter Long", strategy.long, qty=tradeSize)

if (exitLong)

strategy.close("Enter Long")

// Display Moving Averages

plot(fastMA, color=color.blue, linewidth=2, title="Fast Moving Average")

plot(mediumMA, color=color.purple, linewidth=2, title="Medium Moving Average")

plot(slowMA, color=color.red, linewidth=2, title="Slow Moving Average")