概述

该策略基于布林带指标设计,当价格突破布林带上轨时做多,当价格突破布林带下轨时做空,属于趋势跟踪策略。

策略原理

- 计算布林带的中轨、上轨和下轨

- 当收盘价突破上轨时,做多入场

- 当收盘价突破下轨时,做空入场

- 平仓条件:突破中轨时平掉多单,突破中轨时平掉空单

该策略通过布林带判断市场的波动区间和趋势方向,当价格突破布林带上下轨时,认为是一个趋势反转的信号,根据这个信号入场做多做空。中轨附近作为止损位置,突破中轨时退出仓位。

优势分析

- 使用布林带指标判断市场趋势和支持阻力位

- 突破布林带上下轨时机会较高

- 有清晰的入场和出场规则

风险分析

- 布林带突破假信号的风险,可能是短期的价格震荡

- 大幅度行情时,止损可能较大

风险解决方法: 1. 结合其他指标判断趋势 2. 调整参数,扩大布林带范围

优化方向

- 结合趋势指标,避免不必要的反转操作

- 动态调整布林带参数,优化参数大小

总结

该策略通过布林带指标判断价格趋势和支撑阻力位,在布林带上下轨突破点入场,止损点为布林带中轨。策略逻辑简单清晰,容易实现。可以通过调整参数或与其他指标组合来优化,在趋势行情中效果较好。

策略源码

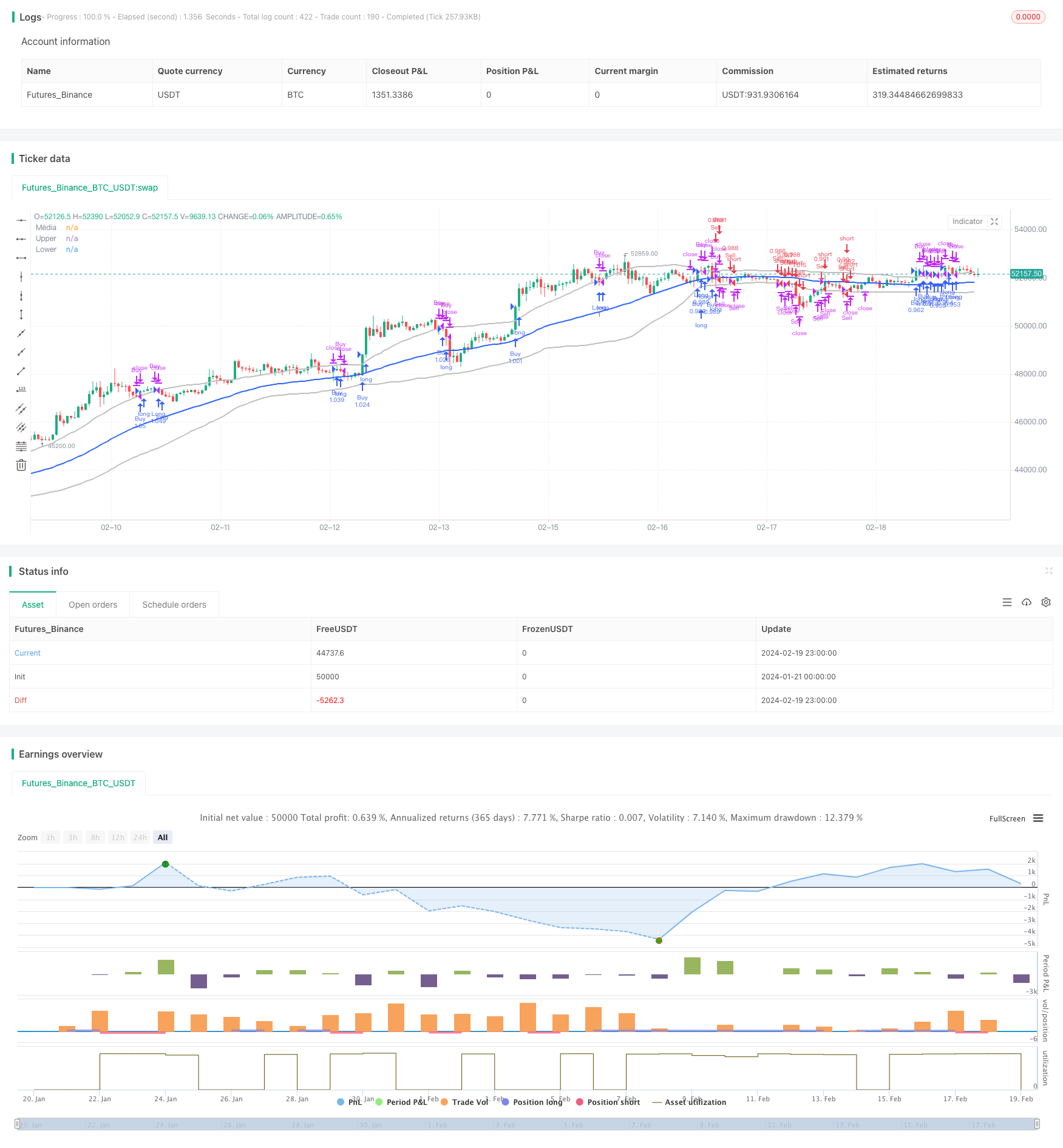

/*backtest

start: 2024-01-21 00:00:00

end: 2024-02-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("FFFDBTC", overlay=true,initial_capital = 100,commission_type =strategy.commission.percent,commission_value= 0.15,default_qty_value = 100,default_qty_type = strategy.percent_of_equity)

// === INPUT BACKTEST RANGE ===

FromMonth = input.int(defval=1, title="From Month", minval=1, maxval=12)

FromDay = input.int(defval=1, title="From Day", minval=1, maxval=31)

FromYear = input.int(defval=1972, title="From Year", minval=1972)

ToMonth = input.int(defval=1, title="To Month", minval=1, maxval=12)

ToDay = input.int(defval=1, title="To Day", minval=1, maxval=31)

ToYear = input.int(defval=9999, title="To Year", minval=2010)

// === FUNCTION EXAMPLE ===

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => true

// Definindo tamanho da posição

position_size = strategy.equity

// Definir parâmetros das Bandas de Bollinger

length = input.int(51, "Comprimento")

mult = input.float(1.1, "Multiplicador")

// Calcular as Bandas de Bollinger

basis = ta.sma(close, length)

dev = mult * ta.stdev(close, length)

upper = basis + dev

lower = basis - dev

// Definir condições de entrada e saída

entrada_na_venda = low < lower

saida_da_venda = high > lower and strategy.position_size < 0

entrada_na_compra = high > upper

saida_da_compra = low < upper and strategy.position_size > 0

shortCondition = close[1] < lower[1] and close > lower and close < basis

longCondition = close[1] > upper[1] and close < upper and close > basis

// Entrar na posição longa se a condição longCondition for verdadeira

if ((entrada_na_compra) and window() )

strategy.entry("Buy", strategy.long)

//saida da compra

if (saida_da_compra)

strategy.close("Buy")

//entrada na venda

if ((entrada_na_venda) and window() )

strategy.entry("Sell", strategy.short)

//saida da venda

if (saida_da_venda)

strategy.close("Sell")

if ((longCondition) and window())

strategy.entry("Long", strategy.long)

// Entrar na posição curta se a condição shortCondition for verdadeira

if ((shortCondition) and window())

strategy.entry("Short", strategy.short)

// Definir a saída da posição

strategy.exit("Exit_Long", "Long", stop=ta.sma(close, length), when = close >= basis)

strategy.exit("Exit_Short", "Short", stop=ta.sma(close, length), when = close <= basis)

// Desenhar as Bandas de Bollinger no gráfico

plot(basis, "Média", color=#2962FF, linewidth=2)

plot(upper, "Upper", color=#BEBEBE, linewidth=2)

plot(lower, "Lower", color=#BEBEBE, linewidth=2)